Get the free Form Sc 13g/a

Get, Create, Make and Sign form sc 13ga

Editing form sc 13ga online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form sc 13ga

How to fill out form sc 13ga

Who needs form sc 13ga?

A comprehensive guide to form SC 13G/A: Navigating securities regulation with ease

Understanding the SC 13G/A form

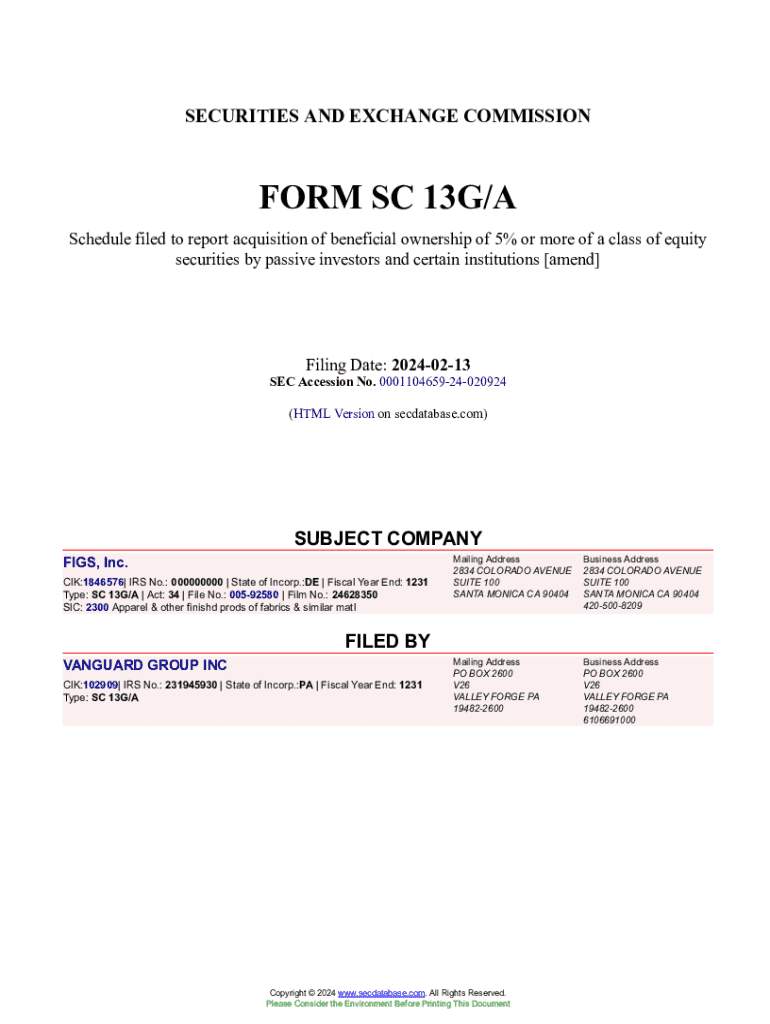

The SC 13G/A form is an essential document required by the Securities and Exchange Commission (SEC) for the reporting of securities owned by institutional investors and other large shareholders. This form is used to amend previously filed SC 13G forms, hence the designation 'A' for amendment. The purpose of this document is to provide updated information about an entity's holdings, adjustments in ownership, or changes in the purpose of investment.

Understanding the significance of the SC 13G/A within the realm of securities regulation helps promote transparency and ensures that investors and the market have access to pertinent information regarding significant ownership stakes in publicly traded companies. This form provides investors with insights into who holds substantial shares and may influence company decisions.

Who needs to file the SC 13G/A?

Filing the SC 13G/A is pivotal for specific types of investors, particularly passive investors and institutions. Passive investors, who typically do not seek to influence the company’s management practices or policies, need to report their ownership details through this form. Conversely, institutional investors, such as mutual funds or pension funds, often have substantial stakes in public companies and must adhere to these filing requirements to comply with regulatory standards.

Common scenarios that necessitate an SC 13G/A filing include situations where a firm's ownership in a company increases beyond 5%—this threshold prompts mandatory reporting. Additionally, if there are any changes in the purposes underlying the ownership, such as a shift from passive to active investing, an amendment is required to reflect these changes accurately.

Components of the SC 13G/A form

The SC 13G/A form consists of several essential sections, each designed to collect necessary information related to the securities and the filer. The cover page provides basic identifying information about the entity filing the amendment. This includes the name of the entity, its address, and the date of the filing.

The subsequent items provide detailed disclosures, such as the identity of the persons or entities filing (Item 1), specifics about the securities owned (Item 2), and the purpose of any transactions involved (Item 3). Understanding these components is crucial for accurate completion of the form and ensuring compliance with SEC requirements.

Step-by-step instructions for filling out the SC 13G/A form

Filling out the SC 13G/A form requires careful attention to detail. Here’s a checklist of required information you need to gather before beginning the form:

When filling out each section, follow these detailed instructions: The cover page should be filled first, including all relevant entities’ names and addresses. For Item 1, provide complete identification of the filer. Item 2 requires specific details about how many shares or types of securities are held. In Item 3, succinctly explain the purpose of the ownership, focusing on any changes in investment strategy. Be sure to adhere to formatting guidelines specified by the SEC and double-check for clarity and conciseness.

Common mistakes to avoid include omitting details, entering incorrect figures, or failing to update information in a timely fashion. These oversights can lead to compliance issues or misinterpretation of ownership stakes in the market.

Filing formats for SC 13G/A

The SC 13G/A form can be filed electronically or via paper submissions. Electronic filing is highly encouraged as it is more efficient and gives immediate confirmation of receipt. The SEC’s EDGAR (Electronic Data Gathering, Analysis, and Retrieval) system is the primary platform for submitting this form. This system allows filers to access their submitted forms and makes it easier for the public to access filed documents.

If choosing to file a paper submission instead, ensure the form is printed clearly, filled out thoroughly, and submitted to the correct address. Each filing format has specific guidelines, so familiarizing yourself with them is critical to avoiding missteps.

Important deadlines related to the SC 13G/A

Filing timelines for the SC 13G/A are crucial to maintaining compliance with SEC regulations. Initial filing deadlines usually align with the end of the calendar year; thus, if you hold more than 5% of a company’s securities by that time, your form must be filed promptly. Annual updates are typically required to reflect current holdings and any significant changes in investment positions.

Timely amendments should be filed as soon as significant events occur that necessitate changes to the information previously reported. Failure to file on time can result in penalties or regulatory scrutiny, underscoring the need for diligence in these respects.

Amendment requirements for SC 13G/A

Amending an SC 13G/A filing is necessary under certain conditions, particularly when there are changes in ownership percentages, transactions, or investment intents. Events such as acquiring additional shares, relinquishing shares, or altering the reason for holding the investment can prompt the necessity for an amendment.

The detailed process for amending involves accurately re-filing the form with updated information. It is essential to reference the prior SC 13G/A when submitting the new form to ensure coherence and clarity for the SEC reviewers.

Related forms and their exemptions

In addition to the SC 13G/A, it’s important to consider the Schedule 13D form, which serves a different purpose. While the SC 13G/A is for passive investors, Schedule 13D is used by those who have intentions to influence corporate management or policies. Thus, the thresholds and implications for these filings can significantly differ.

Identifying exemptions is also crucial. In specific cases, certain institutional investors may not be required to file an SC 13G/A due to regulatory exemptions provided under specific situations dictated by SEC guidelines. Knowing the details of these exemptions helps ensure full compliance without unnecessary filings.

Tools for streamlining the filing process

The process of filling out the SC 13G/A can be cumbersome, but utilizing tools like pdfFiller can simplify it significantly. This powerful platform allows users to fill out PDF forms efficiently, edit documents, and electronically sign them with ease. After filling out the SC 13G/A, pdfFiller offers collaborative features that enable multiple users to access and work on the document simultaneously, which is especially beneficial for institutional investors operating within teams.

Benefits of using a cloud-based solution such as pdfFiller include easy access from anywhere, secure storage, and the ability to track changes. This ensures that the most current information is always available and minimizes the risk of submitting outdated forms.

Resources and additional support

Understanding the complexities of the SC 13G/A can be daunting, but various resources are available to aid filers. Frequently Asked Questions (FAQs) on the SEC's official site provide valuable insights into common concerns and procedural questions related to the form.

Furthermore, links to SEC guidance and rulebooks are accessible for those needing additional support on filing requirements. Engaging with community and professional services can also provide tailored advice for specific situations regarding SC 13G/A filings.

Exploring case studies and examples

Real-life examples of SC 13G/A filings can provide valuable insights into how various firms manage their reporting obligations. Several institutional investors have successfully navigated the complexities of filing the SC 13G/A, showcasing the crucial process of accurately reporting their shareholdings and intentions.

Lessons learned from notable instances reflect the importance of accuracy in reporting as well as the consequences of failing to amend when necessary. These case studies serve as cautionary tales, emphasizing integrity and thoroughness in all filing processes.

Final notes on compliance and best practices

Timeliness and accuracy are crucial when it comes to filing the SC 13G/A. Ensuring that all information is correctly submitted can prevent complications or penalties by regulatory bodies. Staying informed about regulatory changes is equally important, as the securities landscape is dynamic and can shift unexpectedly.

Incorporating best practices in compliance involves establishing an internal review process to ensure checks and balances are in place before submitting any filings. Regular training and updates for personnel involved in compliance will further contribute to a culture of diligence and accuracy, fostering a proactive approach to securities regulation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form sc 13ga?

How do I complete form sc 13ga online?

How do I fill out form sc 13ga using my mobile device?

What is form sc 13ga?

Who is required to file form sc 13ga?

How to fill out form sc 13ga?

What is the purpose of form sc 13ga?

What information must be reported on form sc 13ga?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.