Get the free Mfaa Associate Application Form

Get, Create, Make and Sign mfaa associate application form

How to edit mfaa associate application form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mfaa associate application form

How to fill out mfaa associate application form

Who needs mfaa associate application form?

Complete Guide to the MFAA Associate Application Form

Understanding the MFAA associate application

The Mortgage & Finance Association of Australia (MFAA) serves as a vital pillar for professionals in the mortgage and finance industry. It aims to uphold industry standards and enhance the credibility of practitioners through a structured framework and supportive resources. This organization plays a crucial role in advocating for professionals and providing access to professional development opportunities.

Becoming an MFAA associate not only validates your professional status but also enables you to leverage the myriad benefits offered by the association, including networking opportunities, educational resources, and industry insights. However, before diving into the process, it’s essential to understand the eligibility criteria which typically include specific educational qualifications and relevant work experience.

Preparing to apply

Preparation is key when applying for the MFAA Associate Application. Start by gathering all necessary documentation before initiating the application process. Required documents generally include proof of identity, educational qualifications, and relevant certifications. A checklist can be helpful in ensuring that you have everything you need.

In addition, consider setting up an online account on the MFAA portal to streamline your application process. A well-organized application is crucial as incomplete submissions may delay your membership approval.

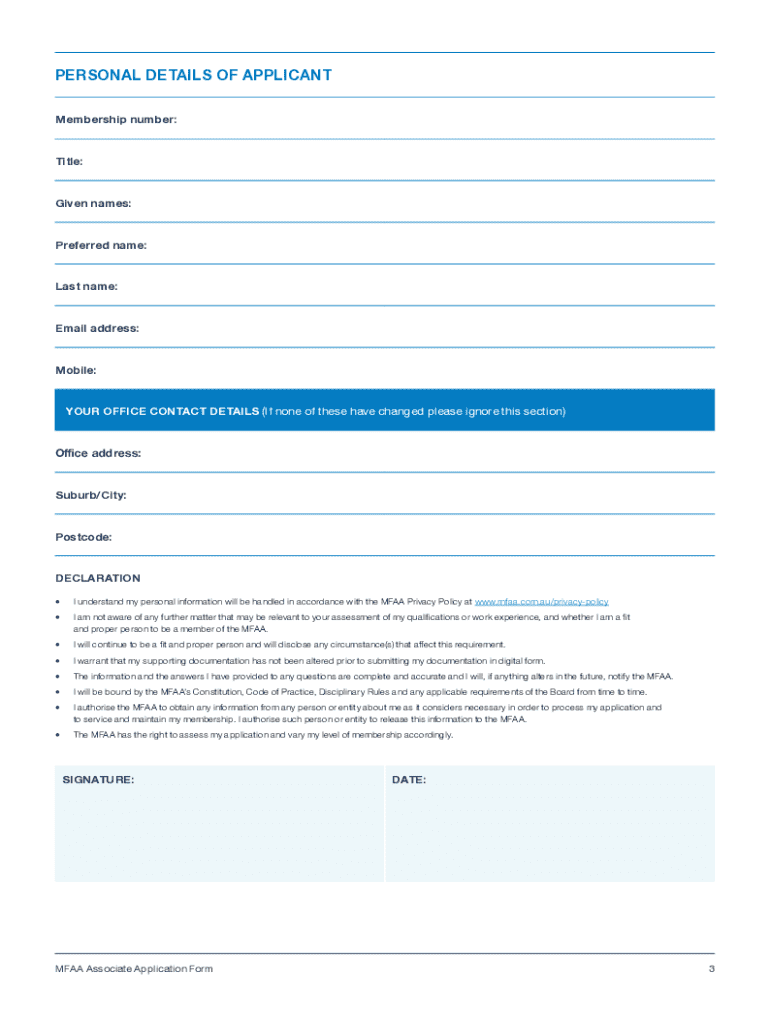

Completing the application form

Accessing and completing the MFAA associate application form is simpler than it seems. Begin by visiting the MFAA website, where you’ll find the application section. Fill in your personal information with utmost accuracy, including your name, address, and contact details.

Next, specify the membership category that applies to you—individual, company, or affiliated membership. Highlight your professional history by providing details about your employment, licenses, and certifications.

Submission process

Submitting your completed MFAA associate application form can usually be done online through the MFAA portal. Adhere to the online submission guidelines to minimize any complications. If you prefer traditional methods, check if a mail-in application process is available.

With regard to fees, applicants should be informed of costs associated with the application. Common payment methods accepted include credit card payments and direct bank transfers.

After submission: what to expect

Once submitted, applicants can expect a thorough review of their application by the MFAA committee. The processing timeline typically ranges from several days to a few weeks, depending on the volume of applications. It’s advisable to keep track of your application status through the MFAA portal, where updates are posted.

Applicants should be aware of the selection criteria for acceptance and how notifications will be communicated. Emails or portal notifications are common methods used to inform applicants of their application outcomes.

Navigating membership categories

The MFAA offers several membership categories, including individual, student, and affiliate memberships. Furthermore, businesses can apply for brokerage memberships, providing them with tailored benefits. Each category serves unique needs in the mortgage and finance sector, allowing professionals at different stages to find their fit within the organization.

Membership also brings additional benefits—members gain access to a variety of resources and tools, including industry reports, best practice guidelines, and networking opportunities designed to enhance professional development.

Additional considerations

As part of the application process, applicants may undergo mandatory police, credit, and bankruptcy checks, which help maintain industry standards and protect the integrity of the MFAA. Completing these checks is straightforward and can typically be done through service providers like Equifax.

Compliance is essential within the finance industry, and ensuring that you remain updated with the latest regulations is critical. The MFAA provides various resources and support channels to assist members in staying compliant and informed.

FAQs about the MFAA associate application

First-time applicants often have common questions regarding qualifications and documentation requirements for the MFAA associate application. Many seek clarification on specific educational prerequisites or documents needed, particularly if they are transitioning from different roles within the finance sector.

In addition to these inquiries, prospective applicants may benefit from support resources provided by MFAA, including webinars and FAQs on their website, which assist with any uncertainties you may face.

Leveraging the pdfFiller advantage for your application

Utilizing pdfFiller can significantly enhance your application experience. With its powerful features, you can easily edit and fill out the MFAA associate application form directly in PDF format without the stress of dealing with paper forms. Moreover, eSigning documents is streamlined within the platform, accelerating the application process.

Collaboration features on pdfFiller allow you to work seamlessly with team members on joint applications or refer documents to others for review. This is especially useful for those applying as companies or partnerships, enabling easy management and sharing of application documents from any location.

Final steps: becoming an MFAA associate

Once your application for the MFAA Associate Membership is approved, it's time to engage fully with the MFAA community. Attend networking events, join professional groups, and access educational resources provided by the association to grow your expertise. Continuous professional development opportunities are also available to help you stay competitive in the finance and mortgage industry.

Remaining active within the association ensures ongoing support and access to valuable resources that will enhance your career. By participating in seminars and workshops, members can keep their skills sharp and remain informed about changes within the industry.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my mfaa associate application form in Gmail?

How do I edit mfaa associate application form in Chrome?

Can I edit mfaa associate application form on an iOS device?

What is mfaa associate application form?

Who is required to file mfaa associate application form?

How to fill out mfaa associate application form?

What is the purpose of mfaa associate application form?

What information must be reported on mfaa associate application form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.