Get the free Business Personal Property Rendition

Get, Create, Make and Sign business personal property rendition

Editing business personal property rendition online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business personal property rendition

How to fill out business personal property rendition

Who needs business personal property rendition?

Business Personal Property Rendition Form - A Comprehensive Guide

Understanding the business personal property rendition form

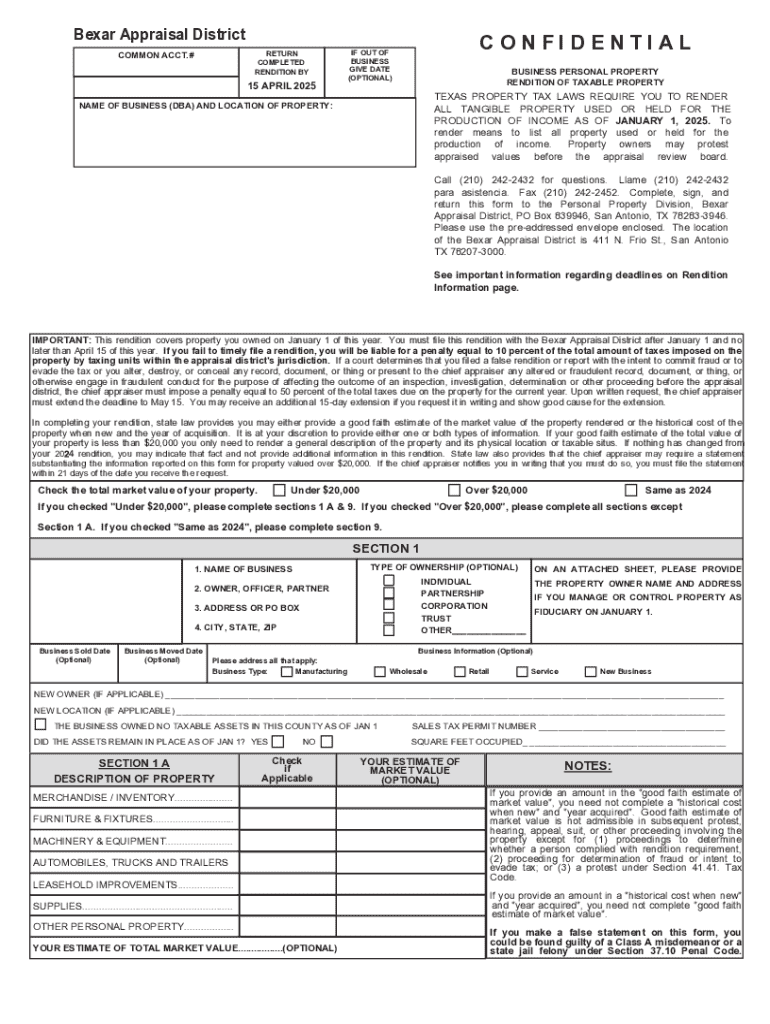

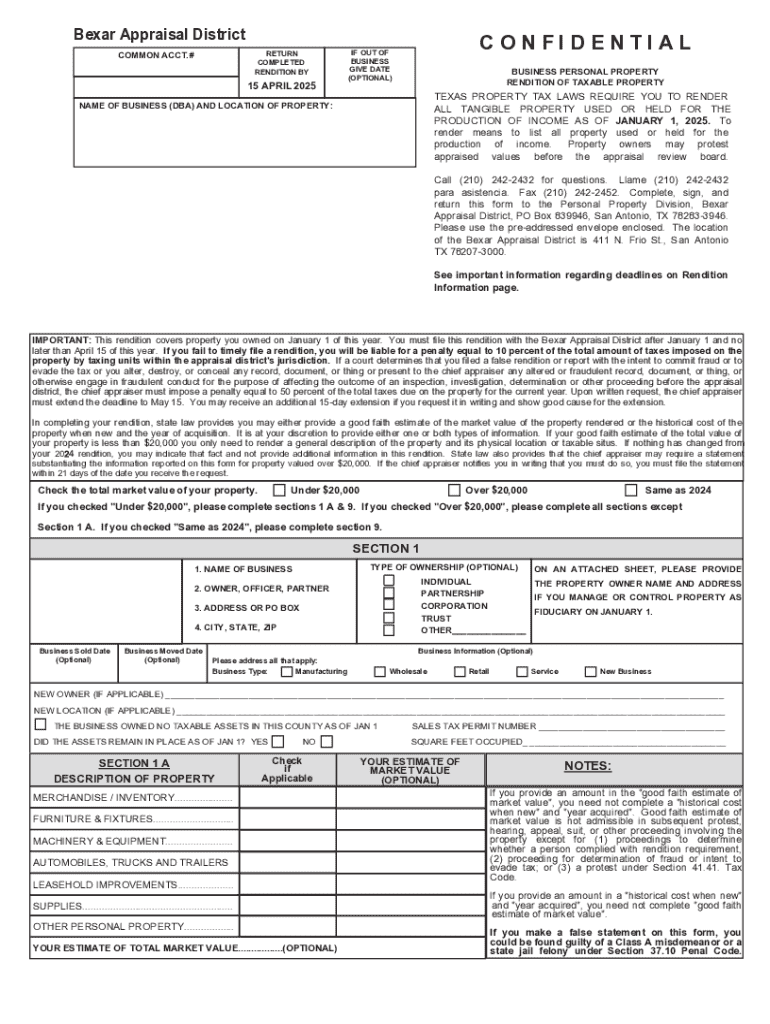

A Business Personal Property Rendition Form is a crucial document used by businesses to report the personal property they own to the local tax assessor's office. This form outlines the value of assets such as equipment, machinery, and supplies, which are not classified as real estate but are vital for business operations. Filing this form accurately ensures that businesses pay fair property taxes based on their asset holdings rather than getting over- or under-assessed.

The primary purpose of the rendition form is to provide transparency in property assessments and help local governments collect the appropriate amount of taxes. Tax assessors use this information to determine the taxable value of business personal property, which ultimately affects the property tax owed by the business owner.

Who needs to file the business personal property rendition form?

The Business Personal Property Rendition Form must be filed by individuals and businesses that own personal property used in their operations. This includes corporations, limited liability companies (LLCs), and sole proprietors. Each type of ownership structure has specific requirements, which can influence how the assets are reported. Corporations and LLCs typically need to file every year, detailing all personal property owned as of January 1st. Sole proprietors may also be required to file, depending on their local tax regulations.

Leased equipment also falls under this category. If a business leases equipment, it is generally required to report this equipment as well, given that lease obligations typically involve long-term usage. It's essential to review local regulations to verify if this applies to your situation.

Types of assets typically reported

Businesses report several categories of personal property on the Business Personal Property Rendition Form. Each category helps determine the total value of the business’s personal assets, which in turn affects tax assessments. Common asset categories include:

Correctly categorizing and valuing these assets is pivotal for accurately reporting their worth on the form, as undervaluing could lead to penalties or higher future assessments.

Preparing to fill out the form

Before completing the Business Personal Property Rendition Form, gather all necessary information. Start by compiling detailed descriptions of each asset, including its location, condition, and estimated market value. This information should be accurate and reflect the true worth of your business's personal property as of January 1st. Moreover, review previous year’s tax assessments, as they can provide a baseline for your current filing.

Additionally, understand any implications related to sales taxes if applicable, and calculate depreciation based on your assets’ cost basis to reflect the accurate value of your property. This preparation ensures you're equipped to fill out the rendition form accurately, minimizing the risk of errors that could lead to audit flags or penalties.

Step-by-step instructions for completing the form

Completing the Business Personal Property Rendition Form may seem daunting, but by breaking it down into sections, the process can become manageable. Here’s a section-by-section guide:

Common mistakes to avoid include failing to report all assets, miscalculating valuations, or neglecting the required signature. A thorough review before submission can help prevent these errors.

Filing process for the business personal property rendition form

Once the form is completed, it’s time to file it with your local tax assessor’s office. Be aware of local deadlines, which can vary by jurisdiction. Typically, the deadline is between January 31st and April 15th, depending on the area. Missing this deadline can lead to penalties or being assessed at a higher value.

You have different options for filing: many assessor offices allow online submissions, which can expedite processing and provide immediate confirmation. Alternatively, you may opt for paper filing via postal mail. If you choose this route, ensure you get a mailing receipt or delivery confirmation to track your submission.

Understanding property tax assessments

Once submitted, your Business Personal Property Rendition Form will be reviewed for tax assessment purposes. County assessors use information from your form in conjunction with market conditions, property usage, and comparable sales data to calculate taxable value. This assessment is crucial, as it directly impacts the property tax amount owed by your business.

Taxable values can fluctuate due to changes in the market, the condition of the property, or adjustments in local regulations. Understanding how your property is assessed helps you prepare for potential increases in tax liability and ensures you're only paying what’s fair based on your asset’s true value.

Special situations and exemptions

Not all assets are treated equally under tax law, leading to some special considerations. For example, leased equipment often requires different reporting methods, and sometimes tax assessors may tax the leasing party instead of the business utilizing that property. Furthermore, software may not always fall under taxable property, depending on if it's classified as a service or a tangible item, warranting a check of local regulations for specifics.

Moreover, historical or significant assets, such as antiques or items of cultural value, could be exempt from taxation in some jurisdictions. Conducting thorough research on potential exemptions can lead to significant tax savings.

Frequently asked questions

Understanding the nuances of filing the Business Personal Property Rendition Form can lead to many inquiries. Here are some common questions that arise:

Resources and tools for managing business personal property

Employing the right tools can simplify the management of your Business Personal Property Rendition Form and other related documents. pdfFiller provides an excellent platform for editing, signing, and managing your documents online. With its user-friendly interface, you can collaborate with team members or legal experts efficiently, ensuring all necessary inputs are recorded.

Utilizing features such as automated reminders for filing deadlines and customizable templates can significantly ease the burden of document management. Additionally, ensuring accurate records and management of personal property becomes seamless with this comprehensive cloud-based solution.

Contact information for further assistance

When in doubt, looking for information or specific clarification on the Business Personal Property Rendition Form requires reaching out to the local assessor’s office. They can provide insights tailored to your specific situation, ensuring compliance with local laws and regulations.

Many local assessor’s offices also maintain social media channels or online help resources, which can serve as valuable platforms for finding additional information quickly. Consider leveraging external tax resources as well, such as local CPA firms or tax advisors, to gain further clarity and guidance on handling your business personal property.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find business personal property rendition?

How do I complete business personal property rendition online?

How do I edit business personal property rendition online?

What is business personal property rendition?

Who is required to file business personal property rendition?

How to fill out business personal property rendition?

What is the purpose of business personal property rendition?

What information must be reported on business personal property rendition?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.