Get the free Return of Organization Exempt From Income Tax

Get, Create, Make and Sign return of organization exempt

Editing return of organization exempt online

Uncompromising security for your PDF editing and eSignature needs

How to fill out return of organization exempt

How to fill out return of organization exempt

Who needs return of organization exempt?

Return of Organization Exempt from Income Tax - How-to Guide

Understanding Form 990: What You Need to Know

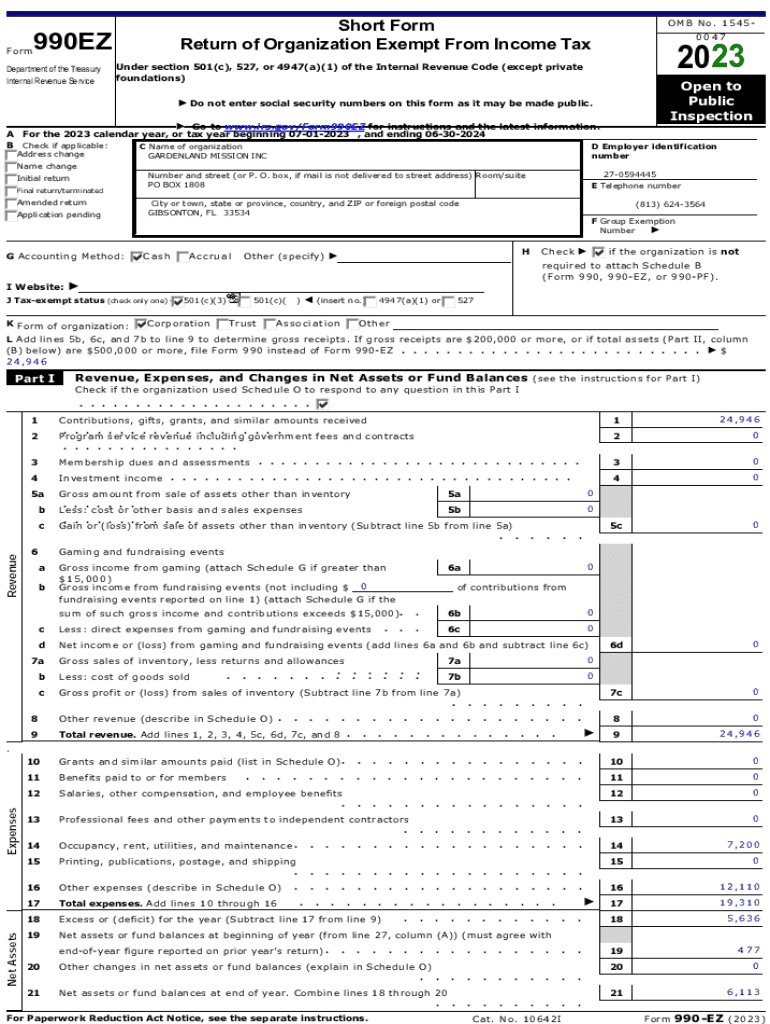

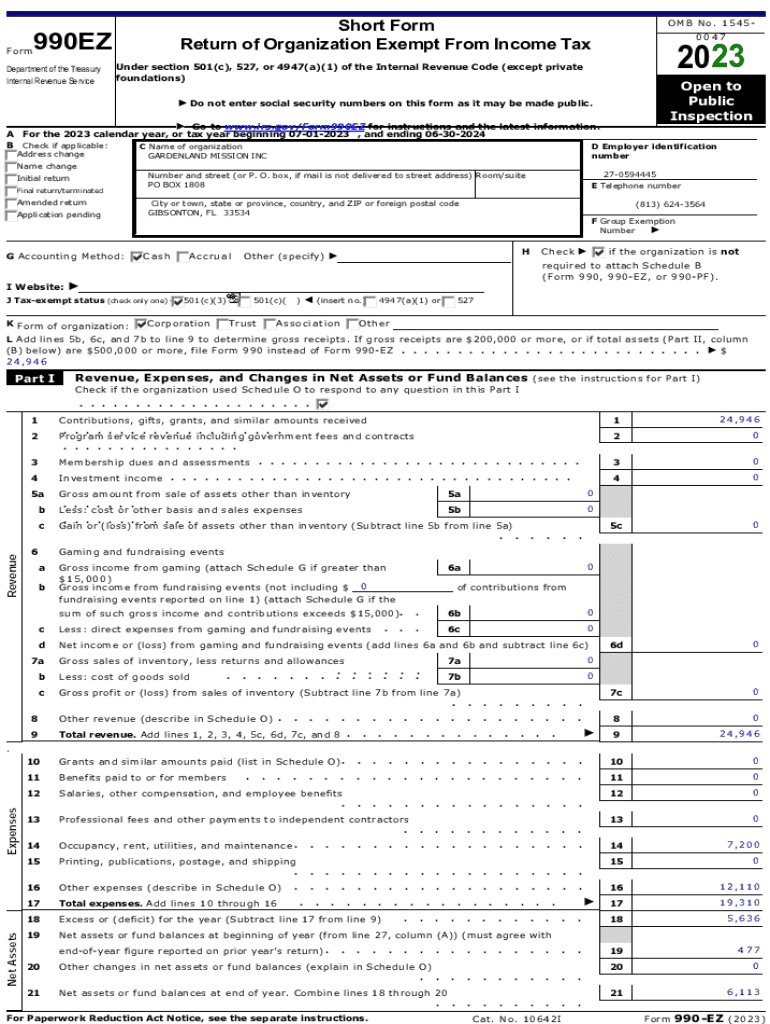

Form 990 serves as the annual information return designed specifically for tax-exempt organizations in the United States. This form provides the IRS and the public with essential information about a non-profit's mission, programs, and finances. Form 990 is crucial for compliance with IRS requirements and serves as a cornerstone for tax-exempt status.

The importance of Form 990 extends beyond mere compliance. It acts as a vital transparency tool, promoting public trust by allowing stakeholders, including donors and volunteers, to access key insights into an organization’s operations. As such, it represents both a legal obligation and an opportunity for organizations to communicate their value effectively.

Who Needs to File Form 990?

Determining if your organization needs to file Form 990 hinges on its classification and financial activities. Generally, most tax-exempt entities, including charities, foundations, and educational institutions, are required to file this return. However, certain exceptions exist, notably for smaller organizations with annual gross receipts under $50,000, which can file the simpler Form 990-N (e-Postcard).

Additionally, understanding the different variants of Form 990 is key to compliant filing. The primary versions include:

Gathering the Required Information and Documentation

Successfully completing Form 990 requires meticulous preparation and documentation. Organizations should begin by compiling necessary information, which includes basic organizational details such as the legal name, address, and mission statement. Financial records, including revenue, expenses, and balance sheets, are also paramount to demonstrate fiscal health.

Moreover, detailed program service accomplishments must be recorded to showcase organizational impact. To facilitate the process, it is crucial to gather key documents that support these figures. This documentation typically includes:

Step-by-Step Guide to Completing Form 990

Filling out Form 990 might seem daunting, but a systematic approach can streamline the process. Here’s a step-by-step guide to ensure accurate completion:

Filing options for Form 990

Organizations have various options when it comes to submitting Form 990. The traditional offline filing method requires mailing a hard copy to the IRS, which may be cumbersome and time-consuming. Alternatively, online submission through IRS e-file simplifies the process, allowing immediate processing.

For even greater efficiency, consider using electronic filing tools offered by platforms like pdfFiller. These tools can guide organizations through the form, ensuring all required fields are completed accurately. After submission, organizations should expect to receive a confirmation of receipt from the IRS, which can be tracked online to alleviate concerns about filing status.

Common mistakes and tips for a successful filing

A successful filing hinges on attention to detail; however, many organizations still encounter recurring issues when completing Form 990. One of the most frequent mistakes is providing incomplete information, which can lead to delays or even penalties. Additionally, misreporting financial data, whether intentionally or accidentally, can trigger audits or loss of tax-exempt status.

To steer clear of these pitfalls, here are some best practices to consider:

Resources for nonprofits and Form 990

Navigating the complexities of Form 990 can be daunting, but numerous resources are available to help organizations succeed. Interactive tools, such as online calculators for financial input and document management solutions offered by pdfFiller, can simplify the entire form-filling experience.

Additionally, organizations can access IRS resources directly for clarity on regulations and participate in webinars focused on non-profit compliance. For those uncertain about their capabilities, seeking professional assistance, such as audit firms that specialize in non-profits, can be invaluable.

The impact of timely filing

Filing Form 990 on time is not merely a bureaucratic requirement; it holds significant implications for tax-exempt organizations. Failing to submit within the designated timeframe can incur penalties, fines, and potentially jeopardize an organization’s tax-exempt status—an outcome that could dampen financial support and stakeholder trust.

Organizations should also be aware of options for filing extensions, ensuring they adhere to regulatory deadlines without sacrificing the quality of their submission. Awareness of these deadlines forms an integral part of organizational compliance.

Signature and record-keeping

Finalizing Form 990 necessitates management signatures to affirm the accuracy and legitimacy of the submission. This step is crucial as it holds the organization accountable for the presented information. Without appropriate signatures, forms may be considered incomplete, leading to delays.

Moreover, maintaining copies of submitted forms for future reference is vital. Best practices suggest retaining both digital and hard copies, organizing them in a manner that facilitates quick access during IRS inspections or audits. Efficient document storage solutions can aid in ensuring compliance and accountability.

Continuous improvement for future filings

Learning from each filing experience can set the foundation for continuous improvement in managing Form 990 submissions. Engaging board members and key staff in the process enhances collaboration and comprehensive understanding of the requirements.

Utilizing feedback from past filings, organizations can refine their practices to make future submissions smoother. Incorporating lessons learned from earlier mistakes allows for better preparation, ultimately fostering stronger compliance and operational transparency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify return of organization exempt without leaving Google Drive?

How can I get return of organization exempt?

How do I edit return of organization exempt on an Android device?

What is return of organization exempt?

Who is required to file return of organization exempt?

How to fill out return of organization exempt?

What is the purpose of return of organization exempt?

What information must be reported on return of organization exempt?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.