Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Comprehensive Guide to Form 990: Filling, Managing, and Navigating Nonprofit Reporting

Overview of Form 990

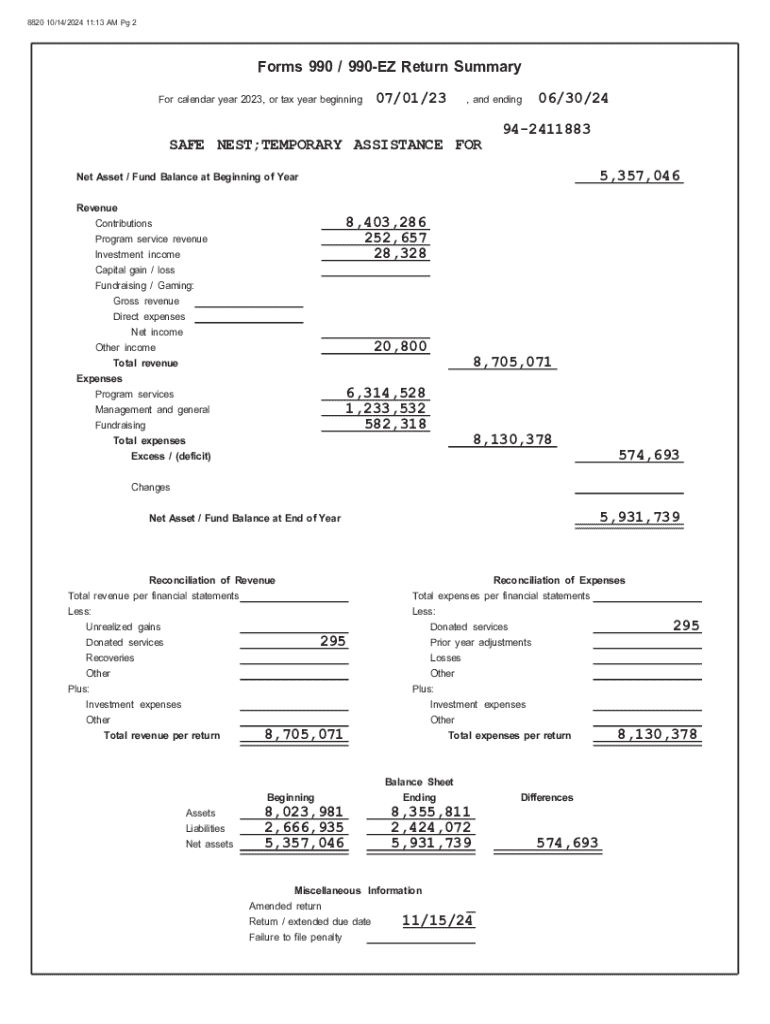

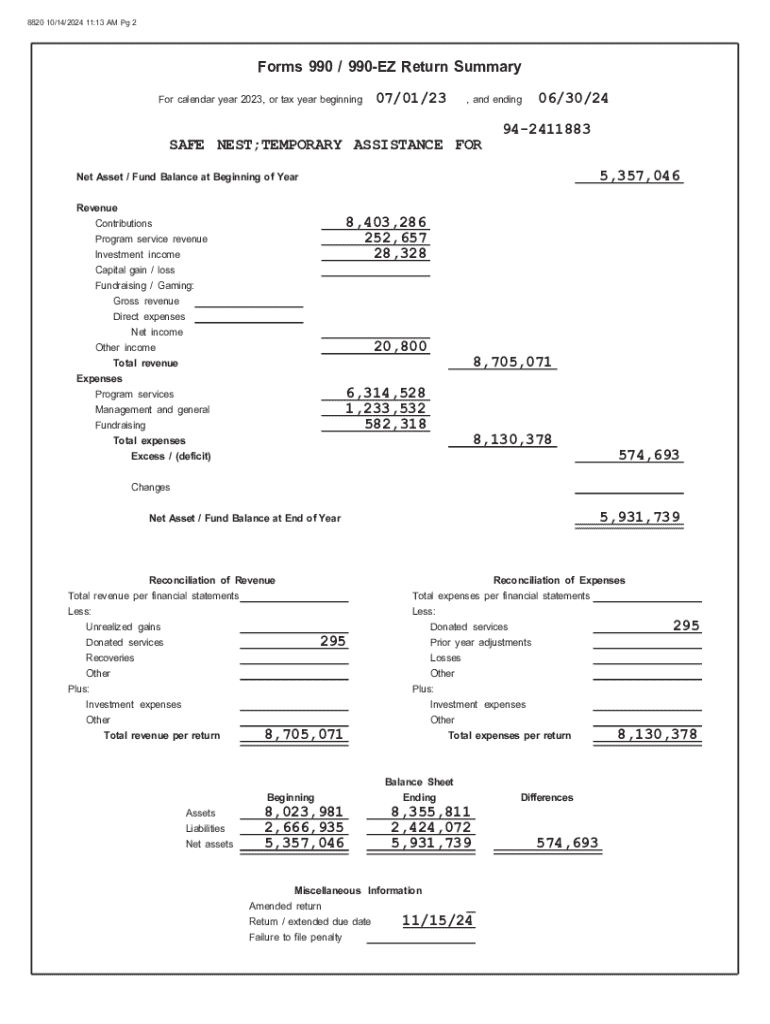

Form 990 is a crucial document in the nonprofit sector, serving as the annual information return required by the Internal Revenue Service (IRS) for most tax-exempt organizations. Its primary purpose is to provide the IRS and the public with a comprehensive overview of a nonprofit's financial activities, governance, and service accomplishments.

The importance of Form 990 lies in its role in promoting transparency and accountability for nonprofits. By making this information publicly accessible, donors, regulators, and the community can better understand an organization’s operations and financial health.

Understanding key terminology related to Form 990 is vital. Terms like 'contributions', 'net assets', and 'program services' frequently appear in the filing and are essential for accurately interpreting an organization’s financial data.

Who is required to file Form 990?

Generally, public charities and private foundations are required to file Form 990. The requirement also extends to organizations classified under different sections of the IRS code, primarily 501(c)(3) entities. However, certain organizations may be exempt from filing based on their annual gross receipts or other criteria.

Nonprofits with gross receipts below $200,000 and total assets below $500,000 can file Form 990-EZ instead of the standard Form 990. Smaller organizations with gross receipts of $50,000 or less are eligible to file the simpler Form 990-N (e-Postcard). Thus, the organizational structure and financial performance significantly influence filing requirements.

Characteristics of organizations that must file include being recognized as tax-exempt by the IRS, having a specific legal structure (such as a corporation or trust), and engaging in regular charitable activities. Entities that do not meet these conditions can be exempted from Form 990 obligations.

Detailed breakdown of Form 990 sections

The structure of Form 990 is designed to provide a comprehensive view of the nonprofit’s operations. Each section of the form has its importance, requiring careful attention to detail.

Part : Summary and highlights

This section summarizes the organization’s activities and provides vital stats about its financials, including revenue and expenses. Accurately summarizing this information not only reflects the organization's achievements but also sets the tone for the rest of the form.

Part : Signature block and certifications

This part requires the signature of an authorized official who certifies that the information provided is accurate. Understanding signatory requirements is critical to ensure compliance and avoid potential legal issues.

Part : Program service accomplishments

It’s important for organizations to effectively report their impacts and achievements in this section. Highlighting program successes can enhance the organization’s credibility and attract more donations.

Part : Governance

This section delves into the governance practices and policies of the organization, which can include board composition, meeting frequency, and conflict of interest policies. Nonprofits need to ensure their governance aligns with best practices.

Part : Financial statements

This portion requires detailed reporting on revenue, expenses, and assets. The financial statements provide critical insights into the organization’s fiscal health and should be constructed with care to reflect true financial status.

Parts -: Additional information

These sections cover a variety of information, such as executive compensation, related party transactions, and additional disclosures required under IRS regulations. Each detail is crucial for transparency.

How to complete Form 990

Filling out Form 990 can seem daunting, but breaking the process down into manageable steps can simplify it significantly.

Organizing your filing process also allows for better oversight, minimizing confusion and ensuring compliance with IRS deadlines.

Filing requirements and deadlines

Organizations must be diligent about their filing modality. They can choose between e-filing—often quicker and easier due to built-in validation checks—or traditional paper filing. Many nonprofits prefer e-filing with Form 990 due to its convenience.

Deadlines for filing Form 990 typically fall on the 15th day of the 5th month after the close of the organization’s fiscal year. For those operating on a calendar year, this places the deadline on May 15. Nonprofits should be aware of the penalties for late or incomplete filings, which can include fines.

Public inspection regulations

Form 990 is publicly accessible, meaning any interested party can review a nonprofit's filings. This drives transparency and allows for greater scrutiny of nonprofit organizations.

The implications extend beyond compliance; they foster trust and engagement with potential donors and constituents. Nonprofits should ensure their Form 990 is not only compliant but also portrays their best work.

To find and access publicly available Form 990s, stakeholders can use resources like the IRS website or guiding tools that aggregate this data for easier navigation.

Historical context and evolution of Form 990

Form 990 has evolved over the years since its introduction, with numerous updates aimed at improving transparency and efficiency in nonprofit reporting.

Recent changes include the introduction of more straightforward guidance for small organizations, adjustments to financial disclosures, and fresh emphasis on governance practices. Understanding these changes can aid organizations in adapting to new regulatory environments.

The future of Form 990 will likely continue to focus on enhanced disclosure and ease of access for stakeholders, which means nonprofits must stay up-to-date with IRS updates and requirements.

Utilizing Form 990 data for charity evaluation

Form 990 provides a wealth of data that donors and researchers can use to evaluate nonprofits. By analyzing metrics such as revenue sources, program expenses, and fundraising efficiency, stakeholders can gain insights into an organization’s operational effectiveness.

Key metrics include total expenses vs. program expenses, fundraising ratios, and revenue volatility, which enable a deeper understanding of nonprofit sustainability. Resources for accessing Form 990 data are widely available and include nonprofit data aggregators and research platforms.

Navigating compliance and best practices

Navigating the complexities of Form 990 demands adherence to best practices within the nonprofit sector, which are vital for effective reporting. Nonprofits should cultivate robust record-keeping systems and maintain transparency with stakeholders.

Preparing for IRS inquiries can be a daunting task, but proactive measures increase organizational resilience and bolster confidence among stakeholders.

Interactive tools and resources

pdfFiller provides a variety of interactive tools for nonprofits embarking on the Form 990 completion journey. With features designed for document management, users can collaboratively work on filings, easily track changes, and maintain version control.

Engaging with these resources can streamline the filing process significantly and enhance the accuracy of submitted documents.

FAQs about Form 990 and nonprofit reporting

New nonprofit administrators often have a plethora of questions regarding Form 990. Common concerns include understanding the filing process, determining what qualifies as revenue, and how to accurately report service accomplishments.

Addressing these questions is crucial to ensuring compliance and optimizing the potential of nonprofit organizations.

Support and assistance

Assistance with completing Form 990 is readily available through various channels. Many online resources, including guides and templates, cater specifically to the needs of nonprofits.

Nonprofits can connect with professionals for guidance on filling out the form accurately and in compliance with IRS standards. Additionally, pdfFiller’s customer support services provide tailored help for users navigating the complexities of Form 990.

Utilizing these resources can significantly alleviate the burden of filing, granting organizations more time to focus on their missions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form 990?

Can I create an electronic signature for signing my form 990 in Gmail?

How do I fill out form 990 on an Android device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.