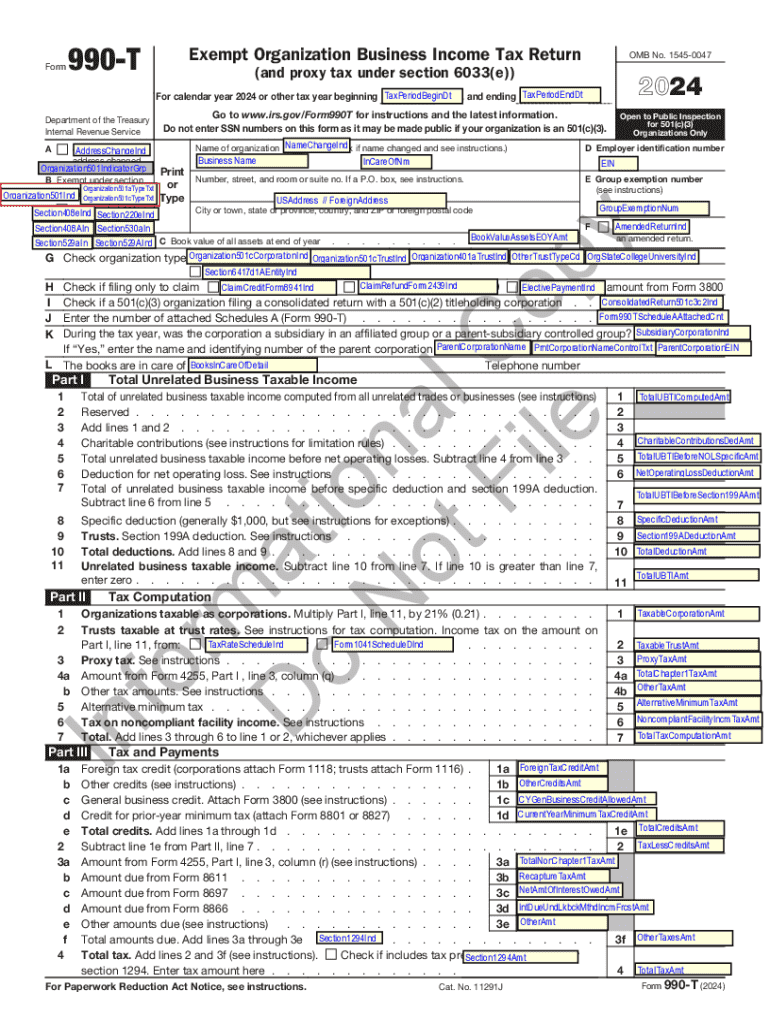

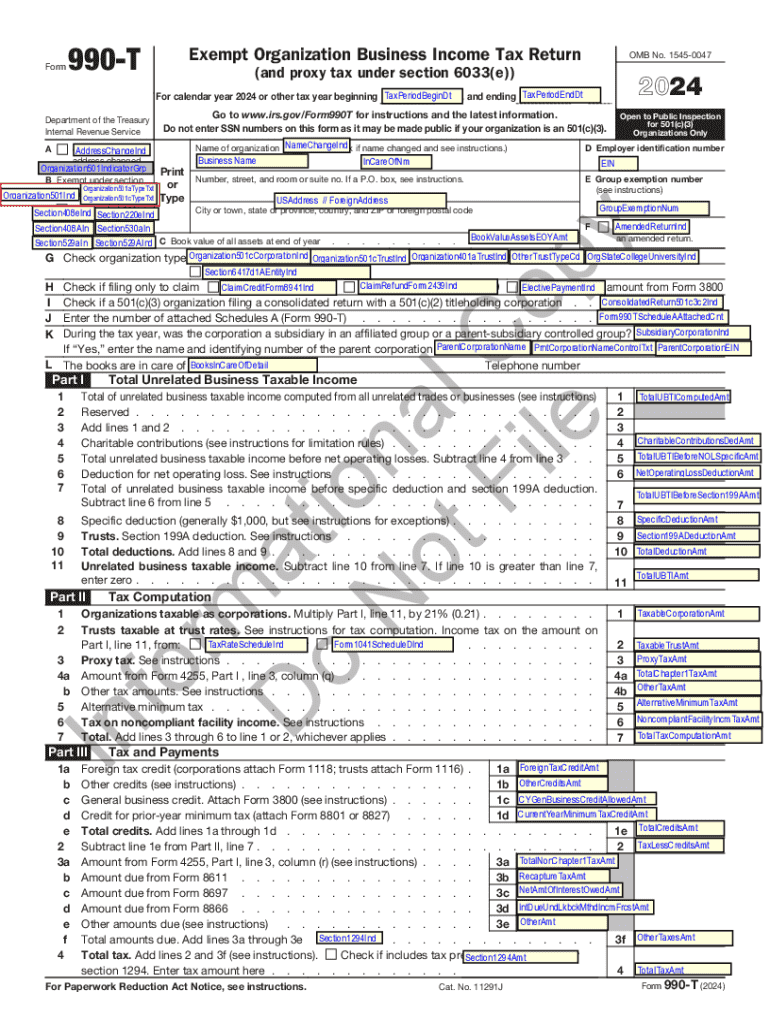

Get the free Form 990-t

Get, Create, Make and Sign form 990-t

How to edit form 990-t online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990-t

How to fill out form 990-t

Who needs form 990-t?

Understanding IRS Form 990-T: A Comprehensive Guide for Nonprofits

Understanding IRS Form 990-T

Form 990-T is an essential tax document specifically designed for tax-exempt organizations that engage in unrelated business activities. This form allows these organizations to report their unrelated business income (UBI) and calculate the tax owed on this income. The IRS defines unrelated business income as income from a trade or business regularly carried on that is not substantially related to the organization's exempt purpose. Understanding the specifics of Form 990-T is crucial for compliance and ensuring that nonprofits maintain their tax-exempt status.

Filing Form 990-T is more than just a regulatory requirement; it is vital for maintaining transparency and good standing with the IRS. Nonprofits that fail to report their UBI may face penalties or, worse, jeopardize their tax-exempt status. Hence, it becomes imperative for organizations to comprehend not only when to file this form but also how to accurately report their unrelated income, ensuring compliance with IRS regulations.

It's vital to distinguish between Form 990 and Form 990-T. While Form 990 serves as an annual information return for tax-exempt organizations to provide financial information about their operations, Form 990-T specifically addresses the income tax liability on unrelated business income. This distinction is crucial for nonprofits, as both forms have different filing requirements and implications for maintaining tax-exempt status.

Who must file Form 990-T?

Not all nonprofit organizations need to file Form 990-T; only those that have engaged in unrelated business activities generating income are required to file. Applicable organizations include charitable organizations, social clubs, labor unions, and other tax-exempt entities that generate revenue through activities not related to their primary exempt purpose. Understanding this requirement is vital to prevent unnecessary filing or penalties.

There are specific thresholds that organizations should be aware of regarding filing Form 990-T. If the unrelated business income exceeds $1,000 during the tax year, then the organization must file this form. Additionally, organizations that fail to report UBI can face serious consequences, including fines or loss of exempt status, making it crucial to monitor all sources of income diligently.

Filing requirements for Form 990-T

Filing Form 990-T can be done electronically, which is the preferred method for many organizations due to its efficiency and convenience. To meet the IRS requirements for e-filing, organizations must ensure that they have the necessary software authorized by the IRS. Information is submitted securely, making data handling simpler and more compliant with regulations.

Aside from the main Form 990-T, additional supporting documents and schedules also need to be completed. For instance, Schedule A is used to report organization information including gross receipts and audit details, while Schedule B reports contributions. These schedules provide essential context to the IRS regarding the organization's activities related to UBI.

Benefits of e-filing Form 990-T

E-filing Form 990-T offers a myriad of benefits that can simplify the tax preparation process for nonprofits. One of the primary advantages is the streamlined process; organizations can complete the filing in less time compared to traditional paper filing methods. With electronic submissions, nonprofits can enhance their overall efficiency while reducing the potential for errors stemming from manual data entry.

In addition to saving time, e-filing provides enhanced accuracy. Electronic submissions minimize the chance of human error and allow organizations to validate calculations through integrated software features. Furthermore, nonprofits receive instant confirmation once their submissions are received, offering peace of mind and reassurance that they have met their filing obligations in a timely manner.

How to file Form 990-T electronically

Filing Form 990-T electronically can be a straightforward process when the following steps are followed closely. First, begin with populating your organization details in the e-filing software of your choice; accuracy here is fundamental. Next, select the appropriate tax year for your filing and the specific form type you wish to submit.

Moving forward, enter the required data for Form 990-T, ensuring all necessary fields are thoroughly completed. After inputting the data, review your form summary to confirm all information is correct, then transmit your return electronically to the IRS. Upon successful submission, you will receive confirmation of receipt, which proves valuable for your records. It’s vital to keep a copy of the submitted form and any correspondence received for your future reference.

Tips for successfully completing Form 990-T

To maximize your efficiency and accuracy while completing Form 990-T, make sure to follow detailed instructions available from the IRS. Familiarize yourself with each section of this form, as understanding what information is required will help you to navigate the complexities of tax compliance more easily.

Another key tip is to avoid common mistakes often seen with Form 990-T filings. Simple errors, such as misreporting unrelated business income, can lead to discrepancies that may trigger IRS audits. Using pdfFiller's tools to optimize your form can also be beneficial; the platform’s PDF editing features allow you to enhance your documents, while collaboration tools enable team inputs to review information more effectively.

Frequently asked questions about Form 990-T

Understanding frequently asked questions about Form 990-T can help demystify some of the complexities surrounding this form. For instance, many nonprofits wonder about the penalties for late filing. The IRS typically imposes a penalty for failing to file timely, which may result in a fine based on the organization's gross receipts.

Another common question pertains to whether Form 990-T can be filed under a Social Security Number (SSN). Generally, it cannot; it must be in the name of the organization. Organizations should also be aware of the due date for Form 990-T filings, which is usually the 15th day of the 5th month following the end of the organization’s tax year. Extensions can be applied for, but it's crucial to file for these extensions ahead of the due date.

Support and resources for Form 990-T filing

Navigating the complexities of Form 990-T filing is often easier with access to the right support and resources. pdfFiller offers comprehensive customer support to assist organizations through the filing process. Whether you have specific questions or need general guidance on filling out the form, pdfFiller's dedicated support team is equipped to help.

In addition to customer support, the robust knowledge base available through pdfFiller provides access to guides and frequently asked questions, further enhancing your understanding of the filing process. Interactive tools help simplify the filing, making the entire experience less daunting for nonprofits looking to comply with IRS requirements.

Understanding potential issues and mistakes

Common issues can arise during the Form 990-T filing process, particularly related to missing or inaccurate information. Forms can get rejected for reasons such as inconsistencies in the reported income or failure to include required schedules. Understanding common reasons for Form 990-T rejections can help organizations avoid these pitfalls and ensure a smoother filing process.

In the event that your form is rejected, there are steps to rectify the issue promptly. Organizations should carefully review any feedback provided by the IRS and address the specific concerns raised. Furthermore, if essential information is omitted, it's crucial to act quickly to resolve the omission and resubmit the form as soon as possible to maintain compliance.

Maximizing efficiency with pdfFiller

Utilizing pdfFiller can significantly enhance the efficiency of managing Form 990-T and other vital documents. As a cloud-based document management platform, pdfFiller allows organizations to create, edit, store, and eSign their forms with considerable ease. Cloud-based solutions reduce physical paperwork and facilitate remote access, which is particularly beneficial for teams working across various locations.

Additionally, the collaborative features offered by pdfFiller simplify the handling of Form 990-T among team members. With real-time editing capabilities and shared access, team inputs can enhance the quality and accuracy of submissions. E-signing options further streamline the approval process, enabling swift decision-making and ensuring that all necessary documents are signed and submitted promptly.

Tools for tax professionals handling Form 990-T

pdfFiller provides comprehensive tools tailored for tax professionals who work with nonprofits and Form 990-T. The platform accommodates client management effectively, allowing tax professionals to maintain organized records while ensuring accurate reporting on behalf of their clients. The streamlined reporting features within pdfFiller are specifically designed to enhance efficiency, enabling tax professionals to file multiple forms without redundant data entry.

Additionally, Tax990 commitment guarantees accuracy in processing and filing Form 990-T. By utilizing these features, tax professionals can significantly reduce compliance risks and further assist their clients in maintaining their tax-exempt status.

Recent updates and changes to Form 990-T

Keeping abreast of recent updates and changes related to Form 990-T is essential for compliance. The IRS regularly releases announcements that can impact how organizations file their tax returns. Staying informed about these changes ensures that organizations are prepared for any new requirements or adjustments in filing procedures, which can ultimately lead to avoiding potential penalties or missteps.

It’s also important to review yearly updates, as these revisions can dictate necessary adjustments in reporting or filing processes. These updates can influence filing deadlines, reporting requirements, and the potential impact on an organization’s tax status.

Helpful videos and tutorials

For organizations looking to deepen their understanding of Form 990-T, interactive tutorials and videos can provide invaluable insights. pdfFiller offers walkthroughs on how to complete Form 990-T effectively, guiding users through each field and offering tips for accurate and timely filing.

E-filing tips and tricks for nonprofits are also available via instructional videos, which can further assist organizations in comprehensively navigating the complexities of the tax filing landscape. Leveraging these resources ensures that all members involved in the filing process are equipped with the knowledge needed to maintain compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form 990-t in Gmail?

How do I complete form 990-t online?

How do I edit form 990-t in Chrome?

What is form 990-t?

Who is required to file form 990-t?

How to fill out form 990-t?

What is the purpose of form 990-t?

What information must be reported on form 990-t?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.