Get the free Quarterly Schedule T

Get, Create, Make and Sign quarterly schedule t

Editing quarterly schedule t online

Uncompromising security for your PDF editing and eSignature needs

How to fill out quarterly schedule t

How to fill out quarterly schedule t

Who needs quarterly schedule t?

A Comprehensive Guide to the Quarterly Schedule T Form

Understanding the Quarterly Schedule T Form

The Quarterly Schedule T Form serves as a pivotal document in financial reporting. Designed primarily for taxpayers to report income generated over a three-month period, this form ensures that income is accurately recorded and taxes are appropriately assessed. Its purpose extends beyond simple reporting, assisting both individuals and businesses in managing their quarterly financial responsibilities.

For businesses, the Quarterly Schedule T Form is crucial in maintaining transparency, ensuring accountability, and enabling proper budgeting. For individual taxpayers, particularly freelancers or those with varying income streams, this form acts as an important tool for tax planning.

Who needs to file the Quarterly Schedule T Form?

The requirement to file the Quarterly Schedule T Form largely hinges on the type of income received. Businesses, regardless of size, must file this form to report their quarterly earnings. Individual taxpayers, particularly those who earn income through self-employment or freelance work, should also file. However, certain exemptions exist — for instance, individuals reliant on fixed salaries without secondary income probably do not need this form.

Special considerations apply to specific sectors, such as agriculture and fishing, or those with particular accounting methods, who may have different filing requirements.

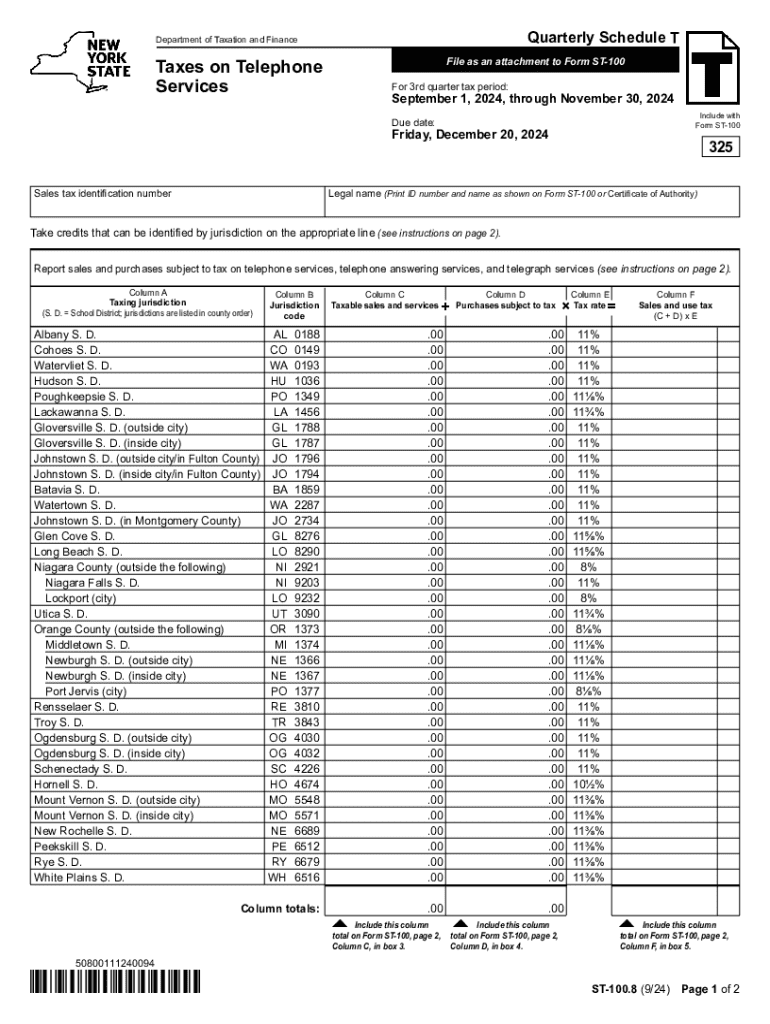

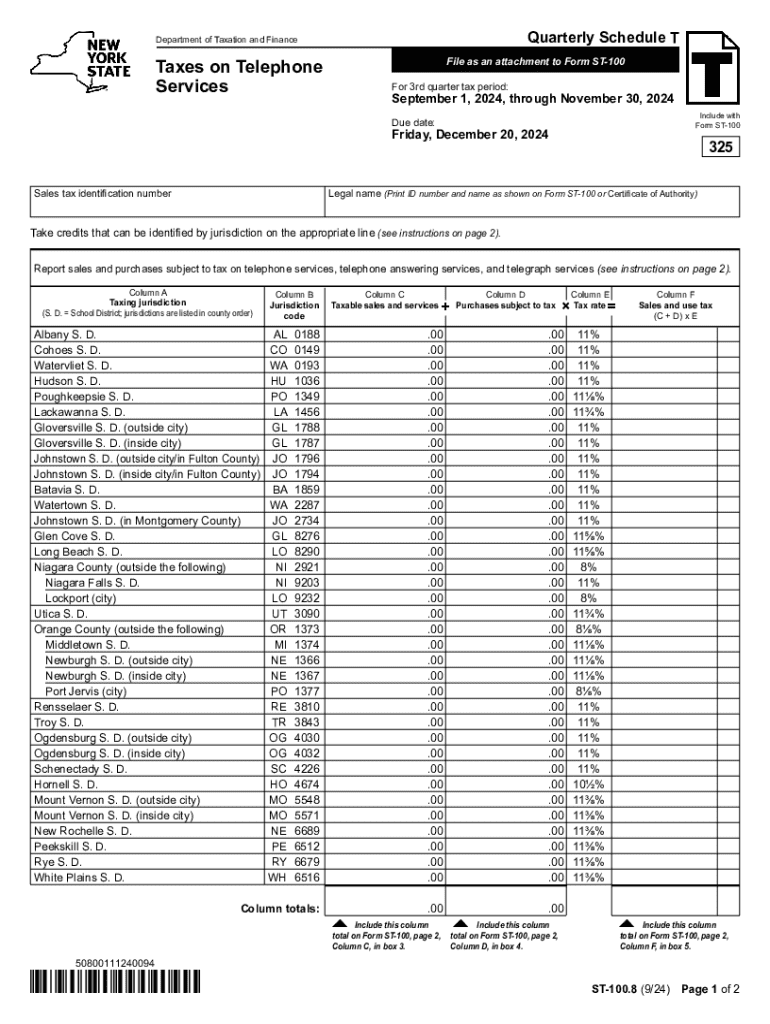

Key features of the Quarterly Schedule T Form

The Quarterly Schedule T Form features a structured layout designed for clarity and ease of use. It typically includes sections that guide the user through essential reporting areas, such as basic information, income reporting, deductions, and credits. Each section is crucial for ensuring accurate financial representation.

Key fields typically encompass taxpayer identification, total income, necessary deductions, and net tax due. Understanding the significance of each field is critical for accurate reporting. Additionally, users should be aware of any associated documents that may need submission, such as prior returns or income statements.

Moreover, certain states may impose additional requirements, making it essential to be informed of localized filing rules.

Step-by-step instructions for completing the Quarterly Schedule T Form

Preparation is key when tackling the Quarterly Schedule T Form. Before beginning the form-filling process, gather essential documents such as previous tax returns, income statements, and any receipts relevant to deductions. Having these documents at hand streamlines the filling process and minimizes errors.

When you're ready to start filling out the form, follow this section-by-section guide:

Finally, take a moment to review and double-check your submission before sending it off to avoid common pitfalls like miscalculations or missing information.

Filing options for the Quarterly Schedule T Form

Once your Quarterly Schedule T Form is complete, the next step is filing. You have two primary options: electronic filing and paper filing. Electronic filing provides a more streamlined process; modern tools like pdfFiller facilitate efficient online submissions.

Using pdfFiller, you can take advantage of features like automatic filing reminders and interactive tools that simplify the process. Alternatively, should you choose paper filing, ensure you adhere to the required mailing instructions and deadlines, as delays could lead to penalties.

Regardless of the chosen method, ensure your form is submitted in a timely manner to avoid late fees.

Managing your documents with pdfFiller

pdfFiller simplifies document management. Users can upload their Quarterly Schedule T Form to their pdfFiller account seamlessly, offering easy access whenever needed. This is especially helpful for monitoring filing history and making future submissions.

Editing and updating submissions is straightforward as well. Should any changes be required after the initial filing, pdfFiller allows for easy editing of PDFs. Furthermore, its e-signing capabilities streamline the signature process, enabling collaboration with team members or parties needing their input.

These features streamline the process, ensuring users can manage their forms effectively from a single platform.

Important dates and deadlines for filing

Awareness of the quarterly filing schedule is critical. The Quarter Schedule T Form must be filed four times each year, and each quarter has specific deadlines that users should strictly adhere to.

Typically, the deadlines fall on the last day of the month following the end of the quarter. For instance, the first quarter (January - March) filing deadline is April 30. Late submissions could result in increased penalties, compounding the financial impact of the oversight.

Understanding the consequences of late filing is equally essential. Penalties can escalate over time, alongside accruing interest rates, making timely submission a wise financial decision.

FAQ section on the Quarterly Schedule T Form

As with any tax-related form, users may have numerous questions about the Quarterly Schedule T Form. What if you're unsure whether you need to file? Or if you miss a deadline? Here are some common inquiries.

These FAQs help mitigate anxiety about the filing process, ensuring users feel informed and prepared.

Real-life scenarios and examples

Consider the example of a freelance graphic designer. Each quarter, they report varying income depending on the projects they secure. Accurate completion of the Quarterly Schedule T Form is crucial here for ensuring they track income and avoid surplus tax liabilities.

Contrast this with a corporation with steady revenue streams from multiple clients. While both scenarios require filing, how they report income will differ significantly. Understanding these nuances is key to responsible financial management.

Testimonials from users of pdfFiller often highlight the ease of use, reinforcing the tool's effectiveness in streamlining the filing process.

Moving forward: Keeping track of your filing history

Maintaining meticulous records of your Quarterly Schedule T Form submissions is crucial. pdfFiller enables users to organize and access their past filings effortlessly. This facilitates easier comparisons with previous years and enhances overall tax management strategies.

Equally important is staying informed about any changes in tax laws that could affect your quarterly filings. Tax reforms or updates in income tax regulations may alter what information is required, prompting users to adapt their filing strategies accordingly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify quarterly schedule t without leaving Google Drive?

How do I make changes in quarterly schedule t?

How do I fill out quarterly schedule t on an Android device?

What is quarterly schedule t?

Who is required to file quarterly schedule t?

How to fill out quarterly schedule t?

What is the purpose of quarterly schedule t?

What information must be reported on quarterly schedule t?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.