Get the free Form 5471

Get, Create, Make and Sign form 5471

Editing form 5471 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 5471

How to fill out form 5471

Who needs form 5471?

Comprehensive Guide to Form 5471: What You Need to Know

Understanding Form 5471

Form 5471 is an informational tax form required for U.S. citizens and residents who are officers, directors, or shareholders in certain foreign corporations. It serves to provide the Internal Revenue Service (IRS) with essential information about these foreign entities, ensuring compliance with U.S. tax laws.

The primary purpose of Form 5471 is to report financial and operational details of foreign corporations, thereby capturing tax liabilities tied to foreign investments. This necessity arises from the IRS's efforts to curb tax evasion linked to international assets.

The importance of filing this form cannot be overstated. It not only aids in avoiding potential penalties but also ensures that U.S. taxpayers meet their reporting obligations concerning foreign income. Failing to file correctly can lead to severe repercussions.

Typically, Form 5471 must be filed if certain ownership thresholds are met, primarily regarding controlled foreign corporations (CFCs). Understanding who qualifies to file this form is crucial for compliance.

Filing requirements overview

U.S. owners of foreign corporations must adhere to specific filing requirements when dealing with Form 5471. The IRS stipulates these requirements to ensure transparency and compliance regarding foreign investments. A Controlled Foreign Corporation (CFC) is defined as a foreign corporation in which U.S. shareholders own more than 50% of the total combined voting power of the stock.

There are several categories of filers for Form 5471, each with distinct requirements and obligations:

Associated penalties for non-compliance

Failing to file Form 5471 carries significant penalties. The IRS has established strict consequences for non-compliance, making it critical for taxpayers to understand the risks involved. The penalties can be substantial, amounting to thousands of dollars per form.

Late filing incurs additional fees. Specifically, if the form is not submitted on time, the fine can range from $10,000 for initial failures to more severe penalties connected to continued failures, including potential criminal charges.

To avoid penalties, taxpayers should ensure timely and accurate submissions. This diligence includes verification of all data entered on the form, as inaccuracies can lead to further complications.

The IRS does offer some relief programs for late filers, such as the Streamlined Filing Compliance Procedures, where certain taxpayers may qualify for reduced penalties if they come forward voluntarily.

Comprehensive filing instructions

Completing Form 5471 can be complex, but following a clear step-by-step guide can help facilitate the process. Start by downloading the form from the IRS website and carefully review the instructions provided with it.

When filling out the form, ensure that all personal information, including name, address, and taxpayer identification number (TIN), is accurate. Be prepared to provide detailed financial information about the foreign corporation, including its assets and income.

Common mistakes include neglecting to file required schedules or inaccurate reporting of ownership percentages. These errors can lead to increased scrutiny and penalties.

Should you need to amend a previously filed Form 5471, utilize IRS Form 1040-X. Be mindful of deadlines, including standard filing timelines, which typically coincide with the U.S. tax filing deadline, and any extensions that can be requested.

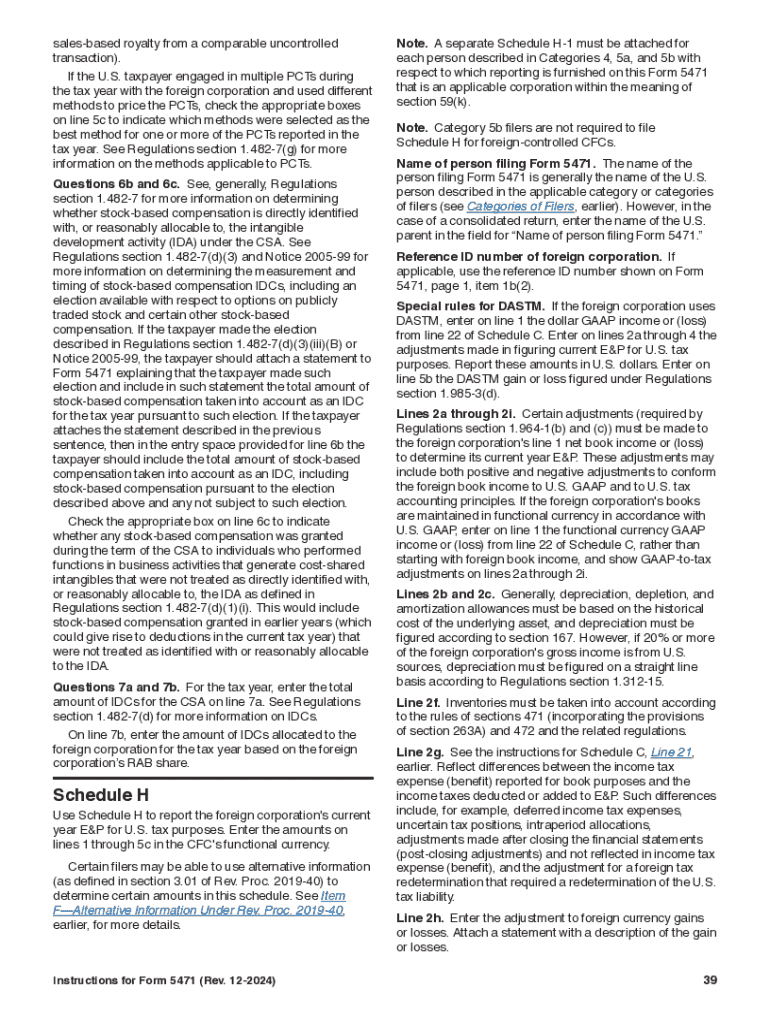

Detailed analysis of Form 5471 schedules

Form 5471 consists of various schedules that provide detailed information about the foreign corporation. Each schedule serves a specific purpose and is crucial for a comprehensive understanding of the corporation’s financial position.

Here’s a breakdown of the main schedules required with Form 5471:

It's imperative that each schedule is filled out with complete accuracy and that supporting documentation is maintained. Review specific instructions for each schedule carefully to ensure compliance.

Advanced considerations

In recent years, tax reform has introduced concepts like GILTI (Global Intangible Low-Taxed Income) and Subpart F income, which are relevant to Form 5471. Understanding these elements is vital for U.S. persons with foreign investments, as they influence tax liabilities associated with foreign corporations.

It's also essential to note the differences between Form 5471 and Form 5472. While both involve foreign entities, Form 5472 primarily pertains to foreign corporations engaged in transactions with U.S. persons, whereas Form 5471 focuses on U.S. taxpayers with foreign corporations.

Furthermore, tax implications can vary significantly for U.S. residents with foreign investments. It’s crucial to consult with a tax professional to gain a thorough understanding of individual obligations and strategies.

FAQs on Form 5471

A frequently asked question among potential filers is: Why is Form 5471 required? The answer lies in federal tax compliance and the prevention of tax evasion involving foreign income. By ensuring transparency in international transactions, the IRS can accurately assess tax obligations.

Another common query involves the benefits of filing Form 5471. Aside from avoiding penalties, timely and accurate filing can prevent audits and contribute to better financial management of international interests.

Some misconceptions about Form 5471 include the belief that only businesses operating abroad need to file. In reality, owning shares in a foreign corporation triggers filing obligations, irrespective of whether the business is actively conducting operations.

For further assistance and resources concerning Form 5471, taxpayers can consult the IRS website or seek help from tax professionals specializing in international taxation.

Client success stories and testimonials

Many individuals and businesses have successfully navigated the complexities of Form 5471 with the support of robust document management tools. Enhancing their filing process, clients have shared testimonials highlighting the seamless experience with document editing and collaboration.

One success story comes from a small business owner who utilized pdfFiller to streamline their Form 5471 filing, ensuring compliance without the stress and headache typically associated with tax forms. The platform's editing and e-signature functionalities empowered timely submissions.

Related forms and comparisons

When dealing with foreign income and investments, individuals may encounter other forms such as Form 8938 and FBAR. Understanding the distinctions between these forms is crucial, especially regarding filing obligations and penalties linked to non-compliance.

While Form 8938 focuses on the reporting of specified foreign financial assets, FBAR targets foreign bank account disclosures. A clear understanding of when to use each form can streamline compliance and reduce the risk of penalties.

Lastly, differentiating between forms W-8 and W-9 is essential for U.S. taxpayers engaged in transactions with foreign entities. Using the correct form can ensure proper tax withholding and compliance with U.S. tax regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get form 5471?

Can I sign the form 5471 electronically in Chrome?

How do I edit form 5471 on an iOS device?

What is form 5471?

Who is required to file form 5471?

How to fill out form 5471?

What is the purpose of form 5471?

What information must be reported on form 5471?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.