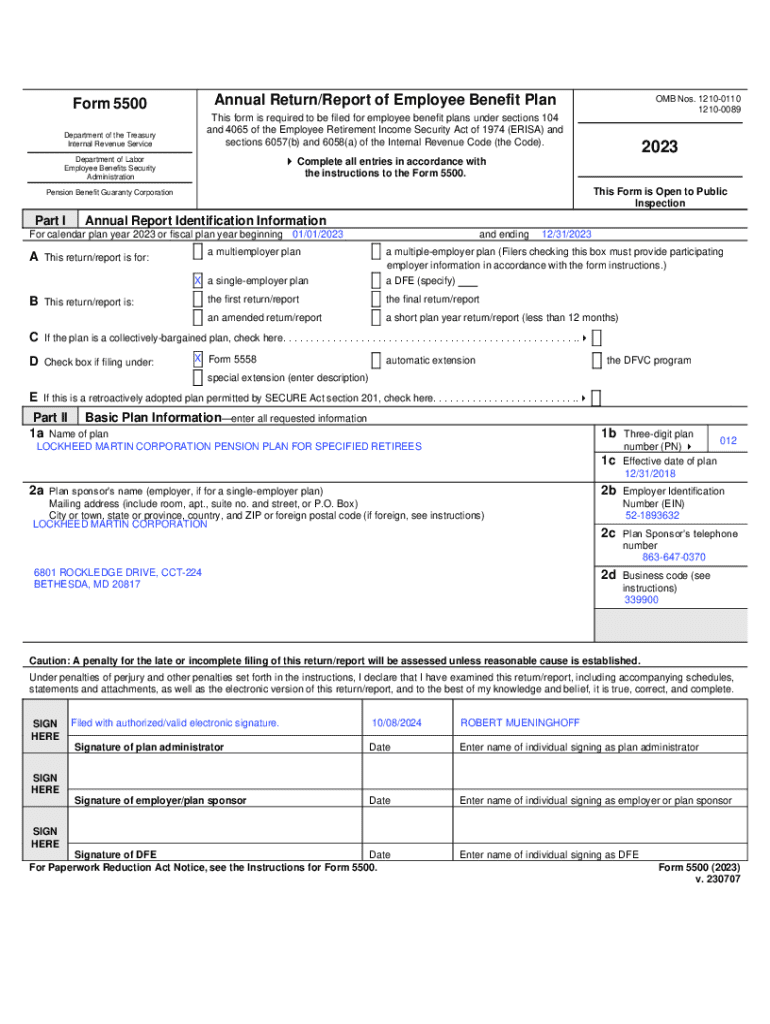

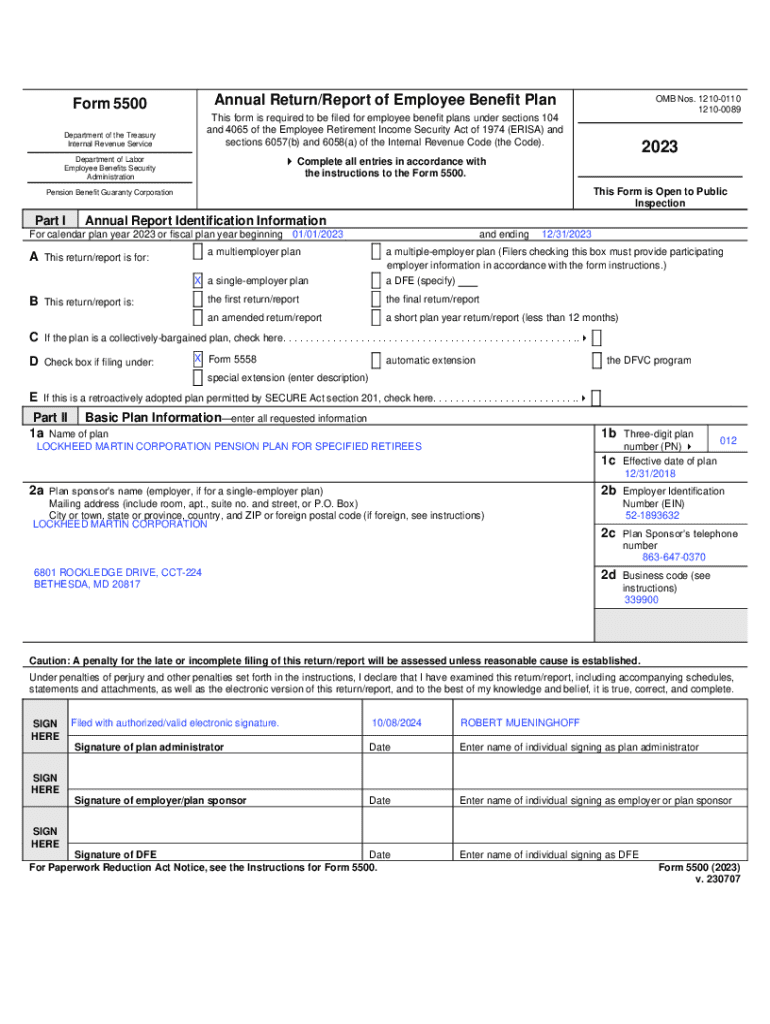

Get the free Form 5500

Get, Create, Make and Sign form 5500

How to edit form 5500 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 5500

How to fill out form 5500

Who needs form 5500?

Understanding the Form 5500: Your Comprehensive Guide

Understanding Form 5500: A Comprehensive Overview

The Form 5500 is a critical report that employee benefit plans must file annually with the Department of Labor (DOL). It serves as a primary source of information for the government to monitor compliance with laws regarding employee benefit plans. Each year, thousands of businesses entrust their financial wellness and adherence to federal regulations to this singular form.

Filing Form 5500 is not just a bureaucratic requirement; it is vital for maintaining transparency and accountability within organizations' benefit plans. By doing so, companies demonstrate their commitment to their employees’ rights and protections. Ultimately, failure to file correctly or on time can lead to stringent penalties.

Types of Form 5500

Understanding which type of Form 5500 to use is critical for compliance and accuracy. The standard form, Form 5500, is for large corporations with plans covering 100 or more participants. Smaller plans may qualify to use the streamlined Form 5500-SF (Short Form). On the other hand, owners of one-participant plans can file the Form 5500-EZ.

When determining which form to file, consider the number of participants in your plan and whether it meets certain requirements, such as the need for an independent audit.

Filing requirements and due dates

Filings are required for most types of employer-sponsored employee benefit plans. This includes retirement plans, health plans, and other welfare benefit plans. If a business offers any of these, it is essential to file the Form 5500 accurately and on time to avoid penalties.

The standard due date for filing the Form 5500 is the last day of the seventh month after the end of the plan year. If the plan year ends on December 31, for instance, the filing is due by July 31 of the following year. Extensions can be obtained by filing Form 5558. However, it’s crucial to know whether your plan is exempt from filing in some cases, as certain small plans and governmental plans may not need to comply.

Preparing to file Form 5500

Before diving into the filing process, gathering essential documentation is imperative. This includes details about the employee benefit plan, participant counts, and financial statements. The consolidation of data from different departments will create a comprehensive overview necessary for accurate reporting.

Understanding wrap plans is crucial, especially when the employee benefit plan is bundled with other types. A wrap plan combines various benefits into a single document, simplifying the reporting process. Ensure you have access to plan documents, trust agreements, and participant information to complete your Form 5500 filing accurately.

The filing process: step-by-step guide

Filing Form 5500 may seem daunting, but breaking it down into manageable steps can simplify the process significantly. Begin by verifying whether your organization is obligated to file. Once confirmed, create an online account with the DOL, if you haven’t already. This account provides direct access to electronic filing tools.

Next, it’s time to fill out the form using online tools available through platforms like pdfFiller that make the process easier and more user-friendly. Don’t forget to proofread your details to ensure accuracy before submission. Finally, ensure that your submission is completed before the filing deadline to avoid late penalties.

Common errors and troubleshooting

When filing Form 5500, several common errors might impede compliance. For instance, inaccuracies regarding reported participant numbers can lead to incorrect form submissions, affecting plan audits and compliance checks. Missing or incorrect financial data is another frequent hurdle, which highlights the necessity of organizing detailed financial records beforehand.

If a submission is rejected, it is vital to act swiftly. Inspect the rejection notice for specific issues highlighted and amend the form accordingly. Ensure that your corrections are submitted promptly to avoid penalties as a result of delays.

Delinquent filings: Understanding your options

If you find yourself facing a delinquent Form 5500, don’t panic. The Delinquent Filer Voluntary Compliance Program (DFVCP) provides a pathway to rectify previous oversights without incurring exorbitant penalties. By filing the overdue form through this program, organizations can often qualify for reduced penalties that could save them a significant amount of money.

To initiate the process, gather all necessary documentation and submit the form along with a written request for DFVCP participation. Ensure you retain copies of all submissions for your records. Be mindful: The earlier you file the delinquent forms, the lesser the penalties may be.

Managing and amending your filing

If post-filing reviews yield errors or omissions, it's possible to amend a submitted Form 5500. Understanding how to navigate through the process of amendments will ensure that your plans remain compliant. A simple mistake can lead to significant implications, making it essential to rectify filings as soon as discrepancies are found.

To amend your filing, you’ll need to submit the appropriate version of Form 5500, ensuring you clearly mark it as an amendment. Keep in mind that certain audits may be triggered by inconsistencies, so being proactive in checking the status of your filing can save you from potential disputes.

Special circumstances

There may be unique scenarios where special considerations must be taken during filing. For example, plans with zero participants are still required to file a Form 5500, albeit with minimal reporting requirements. Ensuring that you include all necessary details—even if they are sparse—can prevent complications.

Termination of plans also requires specific filings, as there are implications on how benefit distributions are managed and reported. Additionally, addressing concerns related to fraud or frozen plans is paramount; taking proactive measures is essential for safeguarding against potential legal consequences.

Staying informed and updated

Regulations surrounding Form 5500 can change, and staying updated is crucial for compliance. Regularly checking with the DOL updates or utilizing resources from reliable third parties can help maintain accurate practices. Online platforms like pdfFiller offer tools that are continually updated to reflect the latest requirements, making the filing process less daunting.

Further, participating in workshops and online webinars can enhance understanding and foster transparency when it comes to regulatory changes. Additionally, addressing common FAQs can often clarify concerns and alleviate confusion surrounding Form 5500 filings.

Conclusion: Empowering your Form 5500 journey with pdfFiller

Successfully managing your Form 5500 filing becomes feasible with the right resources and tools. pdfFiller offers a robust platform that allows users to edit PDFs, eSign documents, and collaborate effortlessly from anywhere. This cloud-based solution ensures that you’re never hindered by geographic limitations, enabling swift responses to compliance needs.

By leveraging pdfFiller’s capabilities, businesses can streamline their filing processes, improve accuracy, and foster collaboration within teams. Enhance your document management approach while simplifying the complexities associated with Form 5500 filings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 5500 to be eSigned by others?

How do I fill out form 5500 using my mobile device?

Can I edit form 5500 on an iOS device?

What is form 5500?

Who is required to file form 5500?

How to fill out form 5500?

What is the purpose of form 5500?

What information must be reported on form 5500?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.