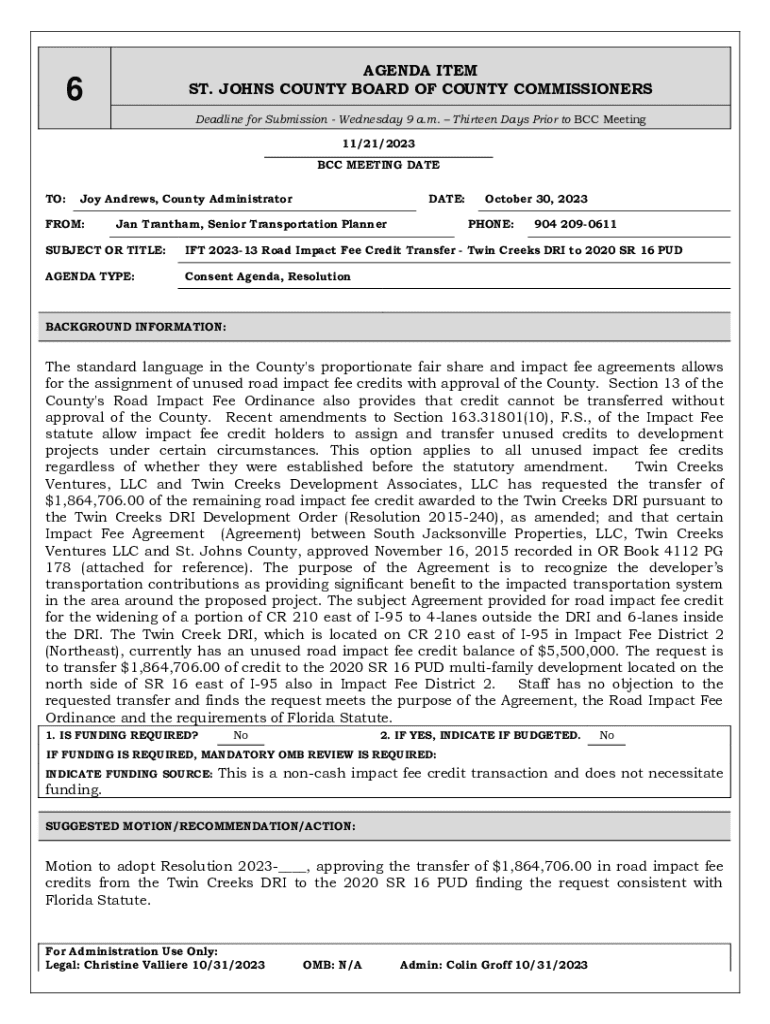

Get the free Ift 2023-13 Road Impact Fee Credit Transfer - Twin Creeks Dri to 2020 Sr 16 Pud

Get, Create, Make and Sign ift 2023-13 road impact

Editing ift 2023-13 road impact online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ift 2023-13 road impact

How to fill out ift 2023-13 road impact

Who needs ift 2023-13 road impact?

Comprehensive Guide to the IFT 2023-13 Road Impact Form

Overview of the IFT 2023-13 Road Impact Form

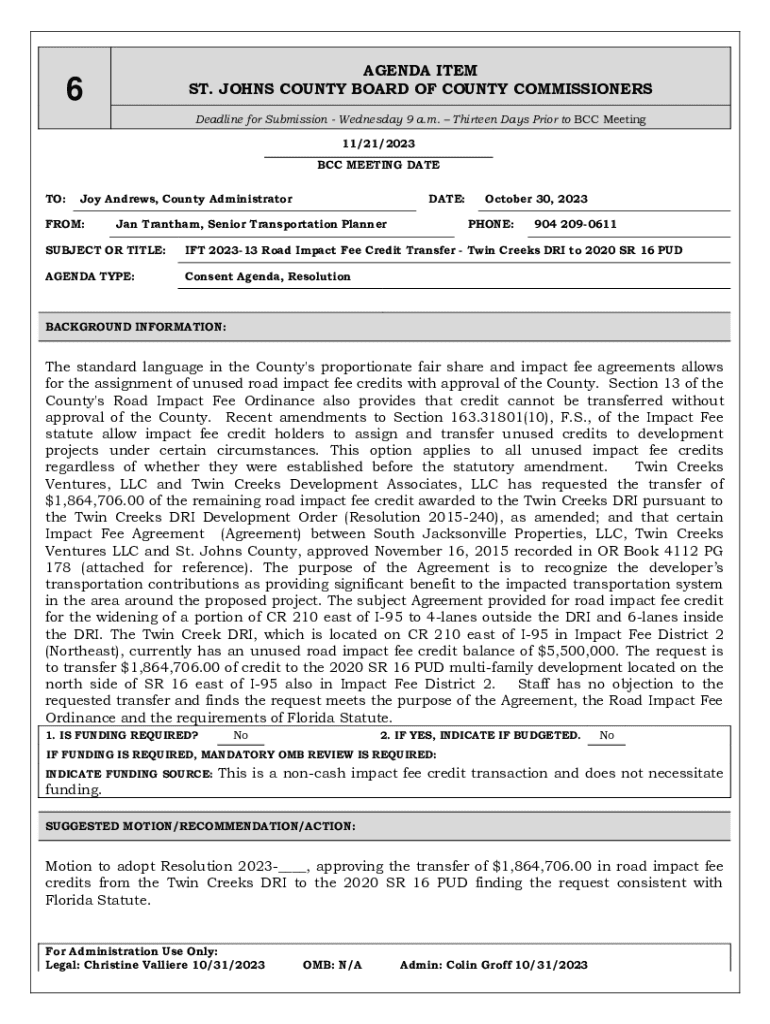

The IFT 2023-13 Road Impact Form serves a critical role in documenting and assessing the impacts of road use and development on local infrastructure and communities. This form is imperative for stakeholders such as municipalities, developers, and contractors who may influence road conditions through various projects or activities.

Before submitting this form, it's essential to consider the potential implications of the reported impacts. Understanding the full scope of your submission, including the type and severity of damages or disruptions, is crucial for ensuring that all relevant issues are addressed.

Understanding the structure of the IFT 2023-13 form

The IFT 2023-13 form is organized into several distinct sections designed to collect comprehensive information. Each section must be filled out accurately to ensure a complete assessment of the report.

Section A: Applicant Information

This section requires the applicant to provide personal details including their name, address, and any relevant affiliations. Accurate contact information is critical for follow-ups or clarifications.

Section B: Impact details

In this section, applicants must detail the specific impacts being reported. This includes outlining the nature of damages incurred and identifying whether they are physical damages to the road, disruption in traffic, or other relevant impacts.

Section : Supporting documentation

This section prompts applicants to submit necessary documents that validate their claims, such as photographs, repair estimates, or relevant correspondence. Following guidelines for acceptable evidence is crucial.

Section : Declaration and signature

The final section emphasizes the importance of signing the form, affirming that all provided information is accurate. It also outlines the penalties for submitting false information, reinforcing the need for honesty.

Step-by-step guide to completing the IFT 2023-13 form

Completing the IFT 2023-13 form can be streamlined by preparing in advance. Begin by gathering all required documents and ensuring that you meet the eligibility criteria for submission.

Filling out applicant information

Accurate details are essential here. Include your full name, address, and any organization you are representing. Double-check for any typographical errors to ensure effective communication.

Documenting impact details

Clearly articulate the nature of the impacts witnessed. Use precise language to describe the type of damage and its effects on traffic and infrastructure to prevent ambiguity.

Uploading supporting documentation

Include all necessary documents in a clear and organized manner. Utilize pdfFiller’s capabilities to digitize physical documents and ensure that your evidence maintains high quality.

Finalizing the declaration and signature

Don’t overlook this critical step. Ensure that you read through the declaration carefully before signing, confirming that all information is accurate to the best of your knowledge.

Tips for ensuring accurate submission

Submitting the IFT 2023-13 form accurately is crucial to avoid delays or issues. Being aware of common mistakes can save time and frustration.

Interactive tools available at pdfFiller

pdfFiller provides a host of document management capabilities to streamline the completion of the IFT 2023-13 form. Its cloud-based platform allows for easy access and editing from anywhere.

Utilize pdfFiller’s interactive features such as eSigning, enabling users to sign forms electronically, enhancing convenience and security.

Post-submission process

After you submit the IFT 2023-13 form, anticipate several steps. Firstly, you will receive confirmation of submission, which is important for record-keeping.

Monitoring the status of your submission can be achieved through online portals or direct communication with relevant authorities.

Frequently asked questions (FAQs)

Responses to common queries can aid in ensuring accurate submissions and addressing concerns.

Real-world examples and case studies

Numerous instances highlight successful submissions using the IFT 2023-13 form. Stakeholders who provided detailed documentation often saw quicker processing times and resolutions.

Testimonials from users on pdfFiller underline the platform's efficacy in managing important documents. Users report that comprehensive support and templates improved their experience significantly.

Additional considerations

As regulatory landscapes evolve, it's essential to stay informed about changes affecting the IFT 2023-13 form. New protocols or requirements can emerge, impacting submission processes.

Moreover, the legal implications of false reporting cannot be overstated. Engaging in dishonest practices put individuals and organizations at risk of facing significant penalties.

Resources for further learning

For those interested in delving deeper, various resources are available to expand knowledge on road impact assessments. Exploring these materials can enhance understanding and execution of the IFT 2023-13 form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find ift 2023-13 road impact?

How do I edit ift 2023-13 road impact online?

Can I create an electronic signature for the ift 2023-13 road impact in Chrome?

What is ift 2023-13 road impact?

Who is required to file ift 2023-13 road impact?

How to fill out ift 2023-13 road impact?

What is the purpose of ift 2023-13 road impact?

What information must be reported on ift 2023-13 road impact?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.