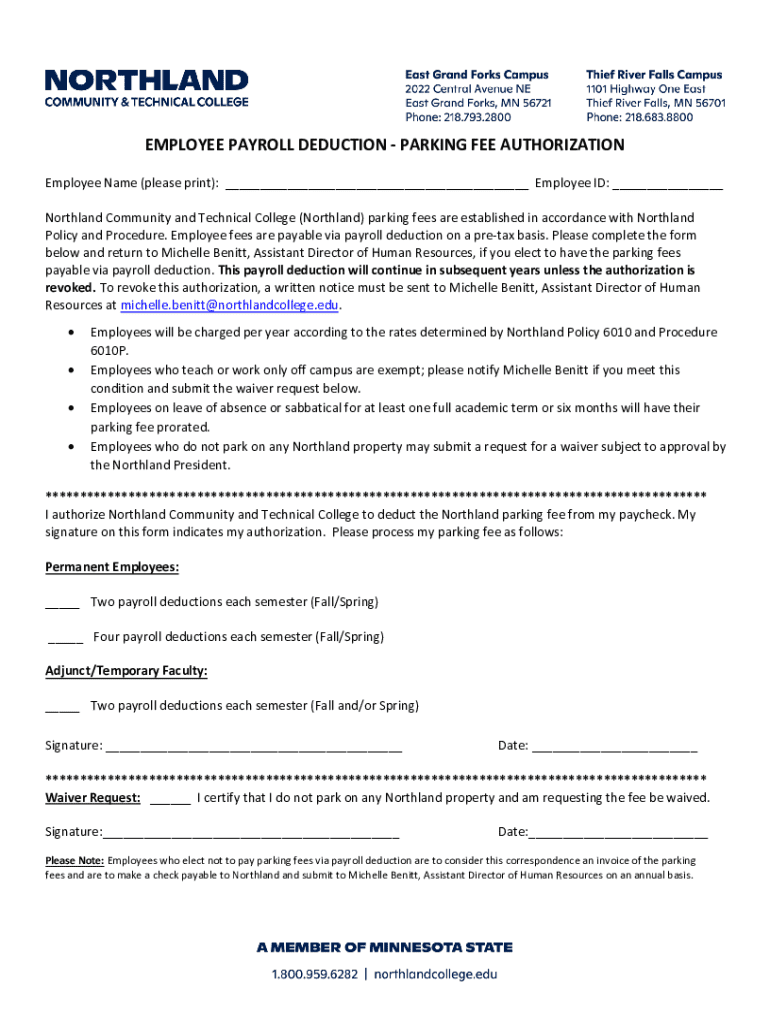

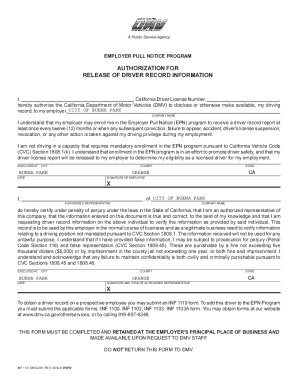

Get the free Employee Payroll Deduction - Parking Fee Authorization

Get, Create, Make and Sign employee payroll deduction

Editing employee payroll deduction online

Uncompromising security for your PDF editing and eSignature needs

How to fill out employee payroll deduction

How to fill out employee payroll deduction

Who needs employee payroll deduction?

Employee Payroll Deduction Form: A Comprehensive Guide

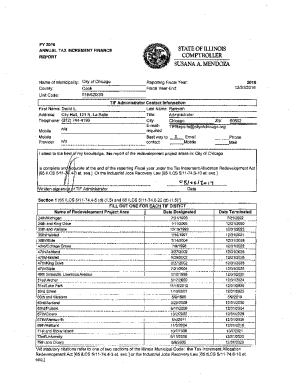

Understanding payroll deductions

Payroll deductions represent amounts withheld from an employee's gross salary to cover taxes, benefits, and other expenses. These deductions play a crucial role in an employee’s compensation structure, impacting their take-home pay and contributing to various essential programs. Understanding these deductions is critical for both employees and employers to ensure compliance with tax regulations and streamline payroll processes.

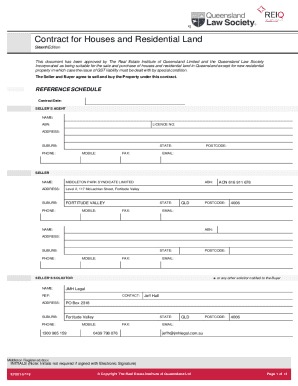

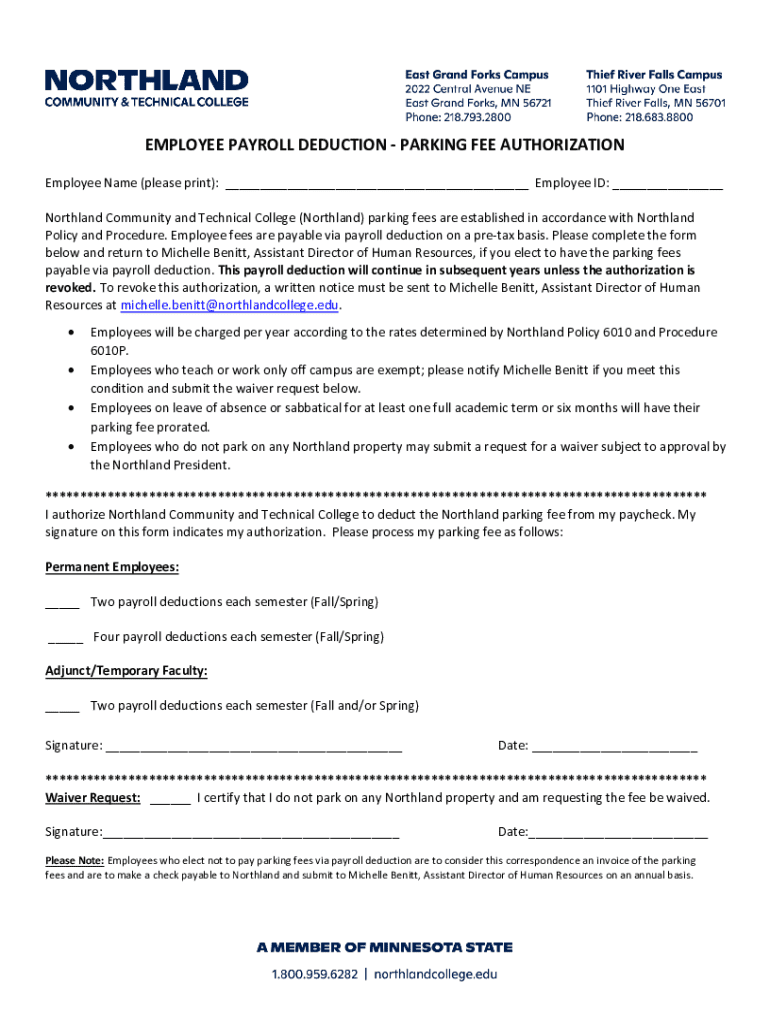

Overview of the employee payroll deduction form

The employee payroll deduction form is a crucial document used by employers to calculate and manage payroll deductions systematically. It allows employees to specify which deductions they prefer, thereby ensuring precise payroll processing. This form not only outlines the mandatory deductions required by law but also provides an avenue for employees to authorize voluntary deductions that support their personal or family financial security.

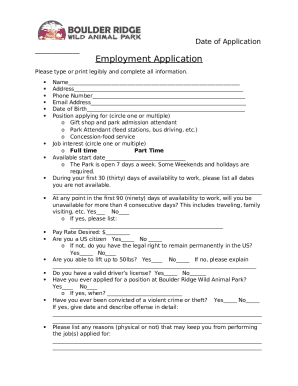

Step-by-step instructions for completing the payroll deduction form

Filling out the employee payroll deduction form correctly is vital for accurate payroll processing. Here’s how to approach it effectively:

Common mistakes to avoid when filling out the form

While completing the employee payroll deduction form, it's easy to make simple but impactful mistakes. Being aware of these can save you from future hassles:

Submitting the employee payroll deduction form

Once the form is accurately filled out, the next step is submission. Typically, forms can be submitted either electronically or in paper form, depending on your company’s policies. Ensure that you submit it to the appropriate department, usually HR or payroll.

Managing changes to payroll deductions

Just as income and employment situations change, so do financial needs. Employees must know how to update their payroll deductions to match these changes. Keeping deductions relevant to current circumstances is crucial for effective financial management.

FAQs about payroll deductions and the deduction form

Employees often have questions regarding payroll deductions. Having a clear understanding can alleviate concerns and promote confidence in financial decision-making.

Utilizing interactive tools on pdfFiller for payroll deduction management

pdfFiller provides a suite of interactive tools that simplify the handling of payroll deduction forms. By leveraging these features, employees can manage their payroll deduction forms more effectively.

Best practices for employees and employers

For employees, understanding how to choose the right deductions is pivotal in securing their financial health. It is recommended to regularly reassess your choices, considering future financial goals.

Conclusion: Staying informed and proactive with payroll deductions

Maintaining an informed stance on payroll deductions is vital for both financial wellness and compliance. Regular reviews of chosen deductions can lead to better personal finance management. With resources like pdfFiller, access to interactive tools simplifies the management of deduction forms, ensuring employees can make informed decisions with ease.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify employee payroll deduction without leaving Google Drive?

Can I edit employee payroll deduction on an Android device?

How do I complete employee payroll deduction on an Android device?

What is employee payroll deduction?

Who is required to file employee payroll deduction?

How to fill out employee payroll deduction?

What is the purpose of employee payroll deduction?

What information must be reported on employee payroll deduction?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.