Get the free 2025-2026 Independent Student Household Worksheet

Get, Create, Make and Sign 2025-2026 independent student household

How to edit 2025-2026 independent student household online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025-2026 independent student household

How to fill out 2025-2026 independent student household

Who needs 2025-2026 independent student household?

Comprehensive Guide to the 2 Independent Student Household Form

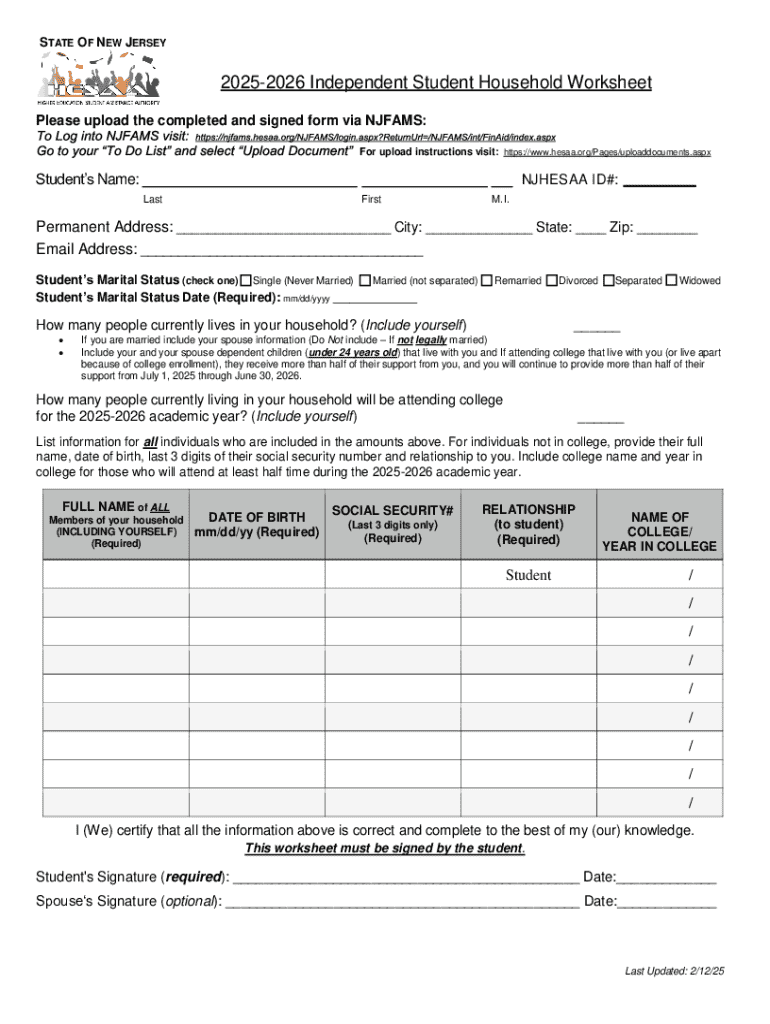

Overview of the independent student household form

The 2 Independent Student Household Form is a critical document for those pursuing financial aid in higher education. This form is designed specifically for independent students, those who are not financially dependent on their parents. It plays a vital role in determining the financial aid eligibility and the amount of aid a student may receive. As higher education costs continue to rise, understanding how to effectively complete this form is essential to securing financial support.

Who qualifies as an independent student?

Qualifying as an independent student hinges on several criteria outlined by the FAFSA guidelines. These include age considerations, marital status, military service, and dependents. Generally, students who are 24 years of age or older are automatically considered independent. Furthermore, those who have served in the military, those who are married, or those with dependents may also qualify.

To verify independent status, students must provide specific documentation. Acceptable proof can include tax returns, proof of military service, and documentation regarding dependents. Special cases such as unaccompanied homeless youth may require additional forms of verification. It’s crucial to gather and submit appropriate documents to avoid delays in the financial aid process.

Step-by-step guide to completing the independent student household form

Completing the 2 Independent Student Household Form requires careful attention to detail. Start by gathering personal identification, financial documents like tax returns and W-2 forms, and any documents necessary to verify your dependency status. Having everything organized will streamline the process.

When filling out the form, begin with the Personal Information section, providing accurate data about yourself. Next, move on to Financial Information, where you’ll include details from your tax returns. Finally, include Family Information, which may require data about any dependents. Pay close attention to detail to avoid common mistakes such as misreporting income, which could impact your eligibility for financial aid.

Understanding your financial situation

An understanding of your Expected Family Contribution (EFC) is essential as an independent student. The EFC is calculated based on financial information provided in your Independent Student Household Form and reflects your family’s ability to contribute to your educational expenses. For independent students, the calculation often considers income from the previous tax year, assets, and overall household structure.

Several factors influence your EFC, including income levels, the number of family members in the household, and whether family members are also enrolled in college. Make sure that all financial information reported is accurate and comprehensive to ensure a fair assessment of your contribution capability.

Documentation and evidence required

Documentation is a cornerstone of the 2 Independent Student Household Form. Essential forms to prepare include tax transcripts, proof of living situation, and supporting documents reflecting your financial circumstances. This might include bank statements or proof of income from additional sources. Gathering these documents upfront will prevent last-minute scrambles and ensure that your form is complete.

Submitting the form can be accomplished either electronically or via mail. Electronic submission is often faster and allows for easier tracking of your application status. Be mindful of deadlines to avoid missing out on crucial financial aid opportunities. Check the official FAFSA website for specific submission dates relevant to your state and institution.

Updates and corrections

After submitting the 2 Independent Student Household Form, it’s important to know how to update your information if necessary. If there are changes in your financial situation or household composition, you may need to revise your submitted form. Common scenarios requiring updates include changes in income, marital status, or dependency status.

Updating your information is straightforward; simply follow the procedures outlined on your financial aid portal or contact your school's financial aid office for assistance. Keeping your information current will help ensure that you receive the most accurate assessment of your financial aid eligibility.

Financial aid opportunities for independent students

Independent students have access to a variety of financial aid options. These include federal grants, loans, state financial aid, and private scholarships. Federal grants such as the Pell Grant are particularly valuable as they do not require repayment. Additionally, independent students can explore opportunities for subsidized and unsubsidized federal loans.

Understanding the differences between subsidized and unsubsidized loans is essential. Subsidized loans are need-based and do not accrue interest while a student is enrolled, while unsubsidized loans begin to accrue interest right away. Make sure to evaluate your options carefully to make informed financial decisions that will benefit your college experience.

FAQs about the independent student household form

Many students have questions regarding the 2 Independent Student Household Form. Common inquiries include eligibility requirements, what documentation is necessary, and how to effectively complete the form. It’s essential to consult resources like your school’s financial aid office for personalized guidance and answers to your questions.

In addition, the FAFSA website provides a wealth of information and resources for further assistance. Utilizing these resources can alleviate confusion and help ensure that your application is completed accurately and timely.

Staying informed

Staying updated on changes to the financial aid process and regulations is vital for independent students. This ensures that you are aware of new opportunities and requirements that could affect your aid eligibility. Subscribing to financial aid newsletters and following relevant online platforms can provide valuable information regarding legislative changes and their impact on independent student funding.

Keeping abreast of these developments will empower you to make informed decisions and seek out the best financial aid options available to you.

Special considerations

Certain populations may face unique challenges in the financial aid process. For instance, veterans may have access to specific resources and funding opportunities that can supplement traditional aid. Additionally, non-traditional students, including those returning to education after a significant gap, may need to provide more detailed documentation to verify their independence.

Recent legislative changes may also affect how financial aid is distributed to independent students. Being aware of these changes can help you navigate the complexities of financial aid more effectively, ensuring you secure the funding necessary for your educational journey.

Conclusion

The 2 Independent Student Household Form is a crucial step in accessing financial aid for independent students. Accuracy and completeness are imperative when completing the form to avoid potential pitfalls that could impact eligibility. By following the guidelines outlined in this comprehensive guide, students can confidently navigate the process and take a proactive approach to their financial aid needs. Engaging with financial aid resources can also provide ongoing support throughout the academic year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2025-2026 independent student household to be eSigned by others?

How can I get 2025-2026 independent student household?

How do I complete 2025-2026 independent student household online?

What is 2026 independent student household?

Who is required to file 2026 independent student household?

How to fill out 2026 independent student household?

What is the purpose of 2026 independent student household?

What information must be reported on 2026 independent student household?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.