Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

Editing sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

SEC Form 4 Form: How-to Guide Long-read

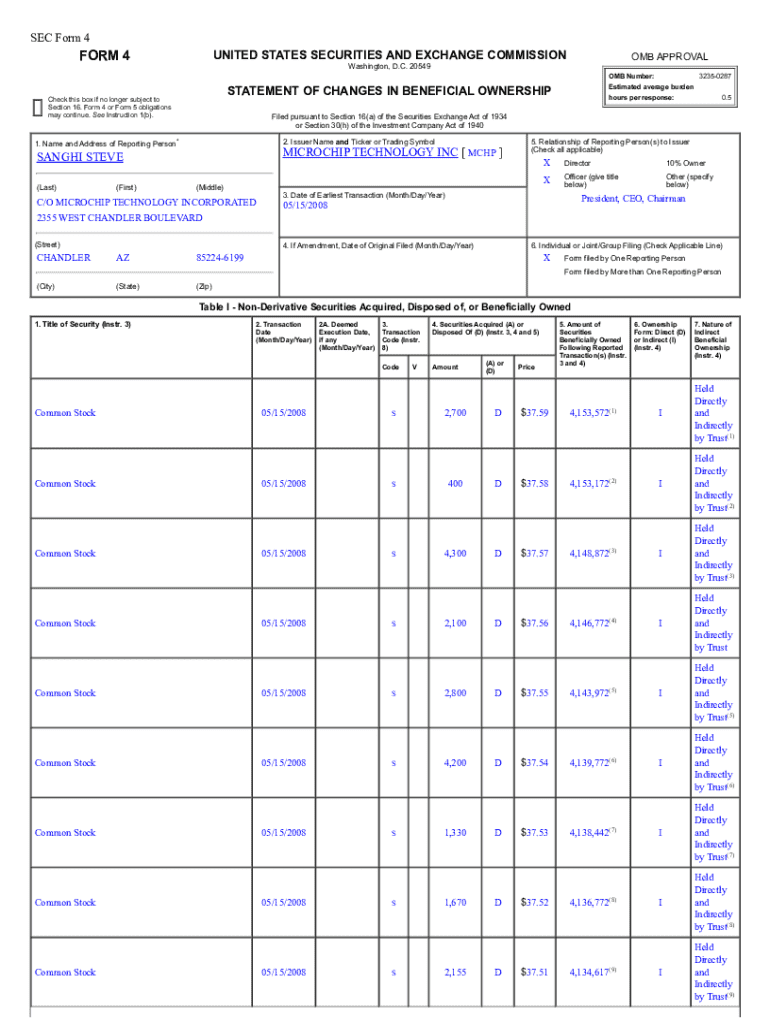

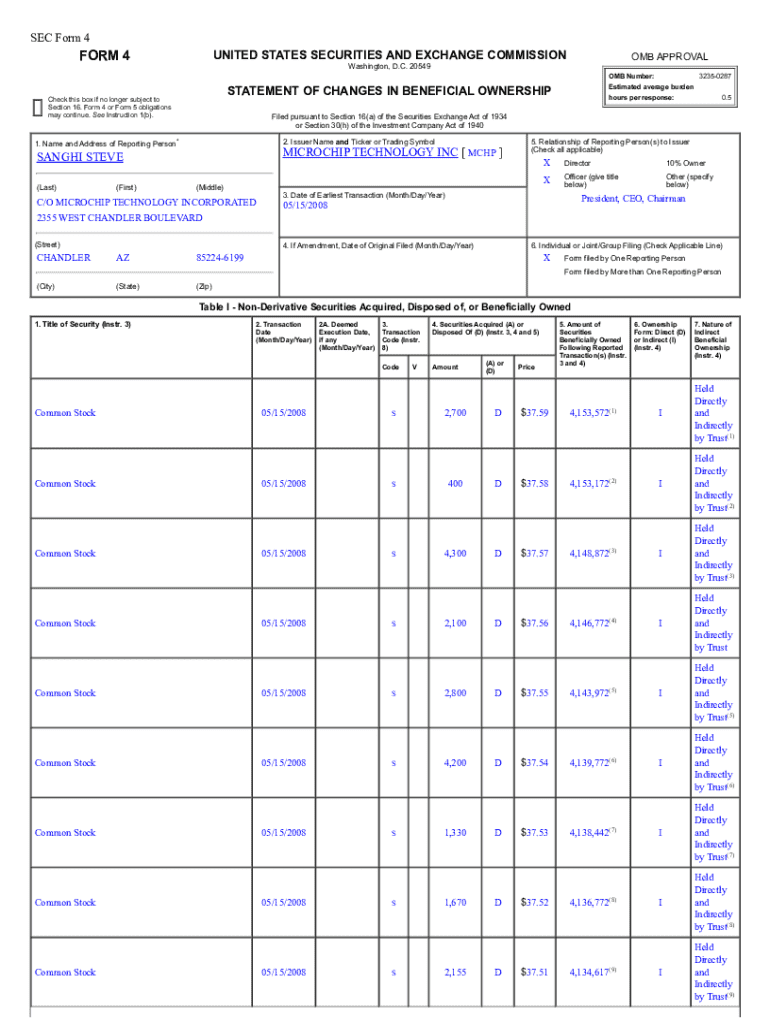

Understanding SEC Form 4

SEC Form 4 is a crucial document used by corporate insiders to report trades in their company's stock. The primary purpose of this form is to disclose insider transactions to the Securities and Exchange Commission (SEC), thereby promoting transparency in the stock market. This form serves as a significant tool for investors and analysts who track insider trading activities as it provides insights into the buying and selling behavior of key company executives.

Understanding the importance of SEC Form 4 is essential for anyone interested in the financial markets. When insiders buy or sell shares, these filings often signal their confidence or concern about the company’s future. Thus, monitoring Form 4 submissions can help investors make more informed decisions concerning their investments, aligning them with the actions and intentions of the people who know the company best.

Who files SEC Form 4?

SEC Form 4 must be filed by insiders of publicly traded companies. Insiders typically include corporate executives, directors, and major shareholders who own more than 10% of a company's stock. The requirement to file this form arises from the need to disclose significant ownership changes or transactions to ensure that the marketplace operates fairly and that all investors have access to the same material information.

These insiders have access to sensitive business information that can significantly affect stock performance. Their trades, therefore, can provide valuable signals to investors about the company's health. Legally mandated to report their transactions within a specified timeframe, insiders contribute to the overall integrity of stock trading and help prevent fraudulent practices in securities dealings.

Preparing to fill out SEC Form 4

Before filling out SEC Form 4, certain prerequisites must be in place. First and foremost, insiders should gather all necessary information, which includes personal data such as the insider's name, address, occupation, and relationship to the issuer of the company's stock. Additionally, compiling relevant ownership details and previous transactions will facilitate an accurate completion of the form.

Understanding key terms associated with SEC Form 4 is also vital in ensuring accuracy. Familiarity with concepts like beneficial ownership, which refers to individuals who hold investment power over securities although the securities are not registered in their names, will help individuals in classifying their transactions correctly.

Step-by-step instructions for completing SEC Form 4

Completing SEC Form 4 involves several key sections. The first section requires the reporting person's information, which includes personal details like their full name, relationship to the issuer, and their address. Accuracy is paramount; even minor errors can lead to significant consequences. Double-checking all information before submission will help avoid unnecessary setbacks.

In the second section, the issuer's information is entered, including the company's name and the stock's ticker symbol. Correctly identifying the issuer is crucial as it aligns the transaction with the right entity. Specifying the correct ticker symbol is essential for proper market identification. Following this, the transaction details are documented, typically indicating whether the insider bought, sold, or exercised options associated with company stock, along with the corresponding transaction codes, which inform the SEC of the nature of the transaction.

Submitting SEC Form 4

After completing the form, the next step is submitting it to the SEC. The most efficient method is through the SEC’s EDGAR system, which allows for electronic filing, making it swift and straightforward. Insiders can also submit paper forms, although this method is less common due to delays associated with mailing and processing.

It's crucial to adhere to the filing deadlines, as insiders are required to submit Form 4 within two business days of the transaction. Missing this deadline could lead to penalties, including fines and increased scrutiny from regulatory bodies. Thus, understanding the timeline and acting promptly is essential.

Understanding the impact of SEC Form 4

The disclosures made in SEC Form 4 can significantly affect stock prices. Market participants closely watch these filings; thus, when an insider buys shares, it can indicate optimism about a company’s future, often leading to a rise in stock prices. Conversely, selling by insiders may trigger concerns, prompting negative market reactions. This correlation between Form 4 filings and market behavior emphasizes the importance of monitoring these transactions for any investor.

Investors can also analyze various metrics related to SEC Form 4 filings. For instance, calculating the buy-to-sell ratio provides insights into insider sentiment. Consistently high purchase ratios may signify stronger confidence in a company's future performance, while an increase in sales could indicate underlying issues. Understanding these patterns can empower investors to make data-driven investment choices.

Interactive tools for managing SEC Form 4

When it comes to managing SEC Form 4, utilizing interactive tools is invaluable. pdfFiller offers robust features for editing and signing PDFs, streamlining the process of filing and managing forms. Users can modify Form 4 templates easily and use electronic signatures to expedite submissions. This level of convenience is crucial for insiders who regularly need to file SEC reports promptly.

Moreover, collaborative features allow team members to share and review documents securely. pdfFiller enables e-signing and hosting of sensitive documents in the cloud efficiently, enhancing both security and accessibility. This means insiders can manage their SEC filings anywhere, with all necessary tools at their fingertips.

Real-world examples and case studies

Studying case studies of significant insider trading events adds depth to the understanding of SEC Form 4. One notable example is the high-profile trades made by executives during pivotal mergers or acquisitions. Closely analyzing such events can reveal patterns of behavior that affect broader market sentiments. For instance, when a CEO of a tech firm buys large shares ahead of an earnings report, the market often reacts strongly to this insider buying, indicating trust in favorable results.

Moreover, successful insiders are often diligent in preparation and filing of their Form 4. Their methods vary but usually include careful tracking of their transactions and proactive filing to adhere to deadlines. By studying their practices, other insiders can gain practical insights into how to effectively manage their filings, ensuring compliance and demonstrating transparency.

Best practices for filing SEC Form 4

For those looking to effectively file SEC Form 4, adhering to best practices can greatly enhance accuracy and efficiency. Consistency is key; insiders should regularly review their filing obligations and stay up to date with any changes in regulations. Developing a reliable system for tracking ownership changes and transactions will streamline the process, making it less cumbersome during filing periods.

In addition, seeking resources and assistance when necessary cannot be overstated. Legal experts familiar with securities laws and regulations can provide invaluable guidance, ensuring proper compliance and helping insiders navigate the complexities of SEC filings. Moreover, leveraging online tools like pdfFiller can simplify the process and minimize errors.

Frequently asked questions about SEC Form 4

Despite its importance, there are common misconceptions surrounding SEC Form 4. One prevalent myth is that only major executives file this document, when in fact, anyone who meets the insider definition must comply regardless of their position. Another common question revolves around the timeline for filing; many believe Form 4 can be filed at their convenience, while legal requirements dictate strict deadlines.

Key takeaways for potential filers include understanding their obligations and maintaining prompt and accurate records of transactions. This proactive approach not only ensures compliance but also contributes positively to market transparency. It is vital for insiders to engage constantly with their reporting requirements and leverage available resources to refine their filing processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my sec form 4 in Gmail?

How can I modify sec form 4 without leaving Google Drive?

Can I edit sec form 4 on an iOS device?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.