Get the free application form for rolling over wrs pension account blackout data for discretion add comments and more msockid 05455ee20e4a63a2123b4fdc0fd762c8

Get, Create, Make and Sign application form for rolling

How to edit application form for rolling online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application form for rolling

How to fill out wrs pension account rollover

Who needs wrs pension account rollover?

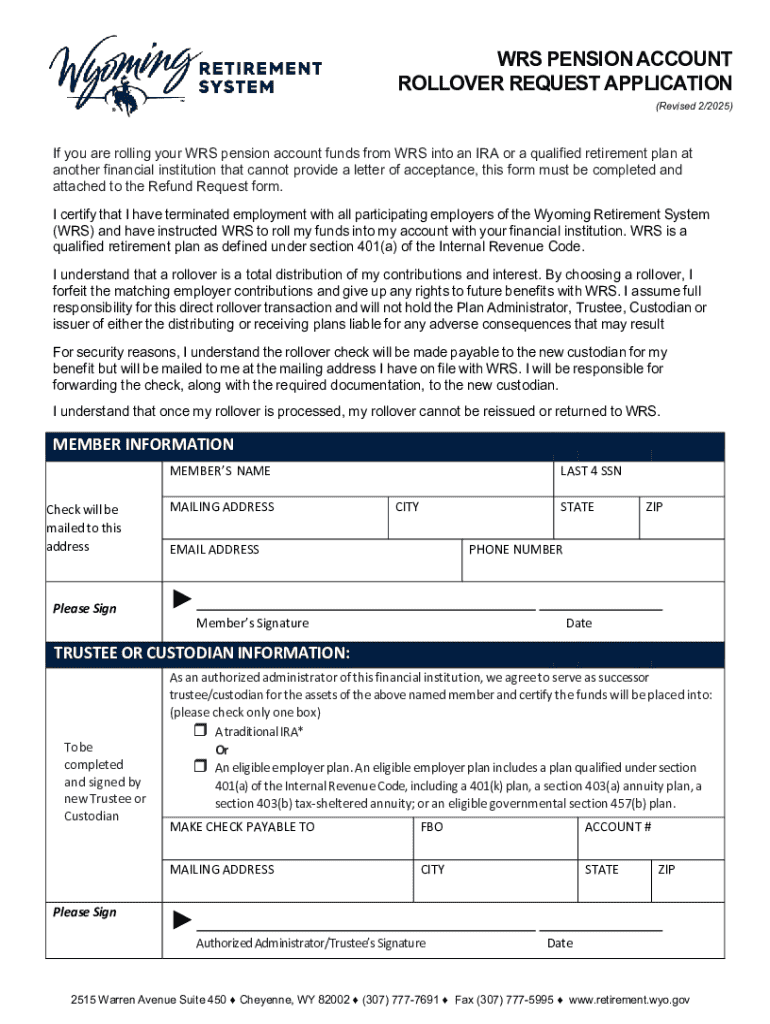

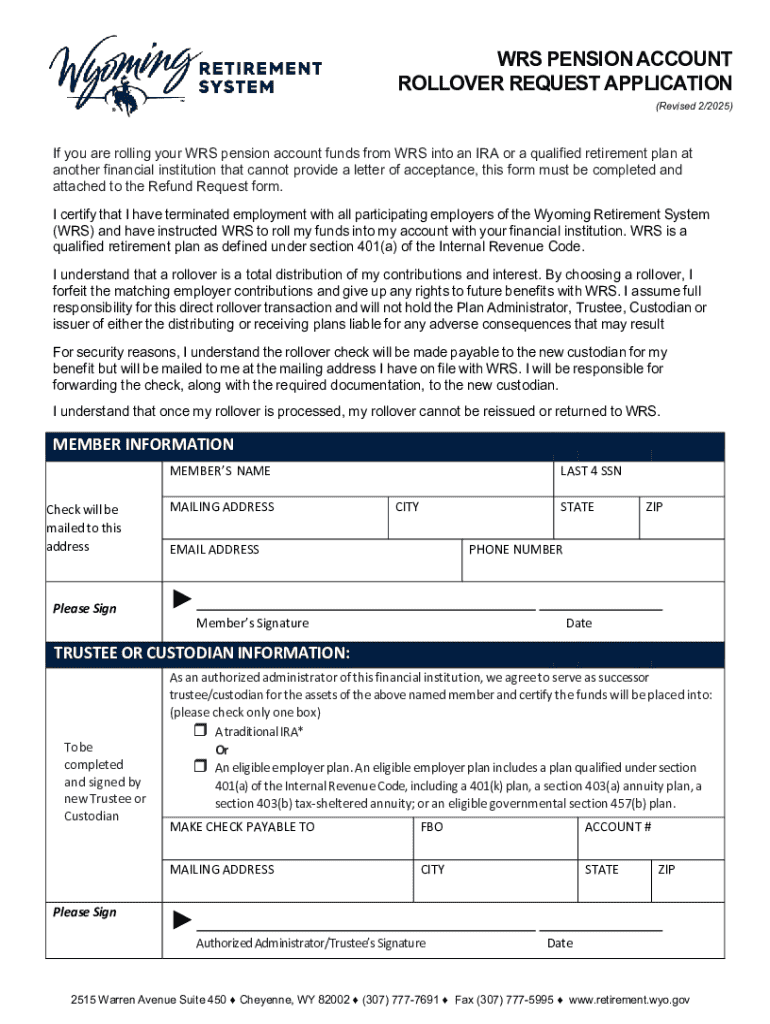

Understanding the WRS Pension Account Rollover Form

Overview of WRS pension account rollover

A WRS pension account, part of the Wisconsin Retirement System (WRS), provides retirement benefits to state employees and certain local government employees. When you're considering a financial transition, like changing jobs or retiring, you may explore various options for rolling over your WRS pension. Rollovers allow you to manage the funds within your retirement accounts more effectively, providing the opportunity to consolidate your savings into a single account for easier management.

Understanding rollover options is critical because they can significantly influence your retirement income. Before initiating a rollover, important considerations include the timeline for your plans, future employment status, and the specific rules associated with your pension plan.

Eligibility criteria for rollover

Not everyone can roll over their WRS pension. Generally, eligible individuals include those who are former employees of the state, those who have retired, or those who have separated from service and meet specific criteria. Factors influencing eligibility can include years of service and the type of pension plan you are enrolled in.

Ensure you are aware of the timeframes and deadlines for rolling over accounts. Generally, rollovers must be initiated within a specific period following retirement or job separation to avoid potential penalties, so timely action is crucial.

Step-by-step guide: Completing the WRS pension account rollover form

To assist you in the process, here’s a detailed guide on completing the WRS pension account rollover form effectively.

Tracking your rollover request

After submitting your rollover request, it’s important to monitor its progress. Many plans offer online portals where you can check the status of your request. Processing times can vary but typically take a few weeks, and you may receive notifications regarding the status directly.

Expect to receive communications about any next steps or confirmations once the rollover is finalized. Keeping track of your request ensures you can address any potential issues promptly.

Understanding tax implications

When rolling over your WRS pension, understanding the tax implications is essential. Federal withholding requirements can apply, meaning a portion of your funds may be withheld for tax purposes unless you opt for a direct rollover into another qualified plan.

To manage your tax obligations effectively, consider consulting with a tax advisor who understands retirement plans. Improper rollovers can lead to penalties, so it’s vital to familiarize yourself with the rules governing your pension plan.

Options for receiving funds

When rolling over your WRS pension, you’ll generally have options for how to receive your funds. Options include direct deposit to your new retirement account or receiving a paper check. Each method has different implications regarding speed and taxation, so choose the method that best aligns with your financial strategy.

Best practices for managing your pension funds post-rollover include reviewing your investment options regularly and staying informed about market conditions.

Frequently asked questions

Many individuals have questions about the rollover process, especially if they encounter challenges.

Related resources

Utilizing interactive tools for estimating pension benefits can provide additional insights into your retirement planning strategy. Additionally, reading articles on retirement planning with WRS pensions will deepen your understanding and help you make informed decisions.

For personalized consultations and further assistance, contact the WRS help desk or your financial advisor.

Community insights and experiences

Hearing about others' experiences with the WRS pension account rollover can be beneficial. Testimonies from individuals who have successfully completed the process can provide useful insights into what to expect. Expert opinions about maximizing your pension during retirement may also guide your decisions.

Additionally, leveraging PDF solutions for document management, such as those offered by pdfFiller, can streamline your paperwork and ensure accuracy.

Positioning the WRS pension account rollover with pdfFiller

pdfFiller supports users through the entire rollover process by offering tools to edit PDFs, eSign documents, and collaborate with others. Featuring a cloud-based platform allows for seamless document management while giving users the flexibility to access their forms from anywhere. Such convenience is crucial when working on time-sensitive financial documents.

The ability to track submissions and access previous forms enhances the user experience, making pdfFiller an invaluable partner in navigating the complexities of your WRS pension account rollover.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get application form for rolling?

How do I make edits in application form for rolling without leaving Chrome?

How do I complete application form for rolling on an iOS device?

What is wrs pension account rollover?

Who is required to file wrs pension account rollover?

How to fill out wrs pension account rollover?

What is the purpose of wrs pension account rollover?

What information must be reported on wrs pension account rollover?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.