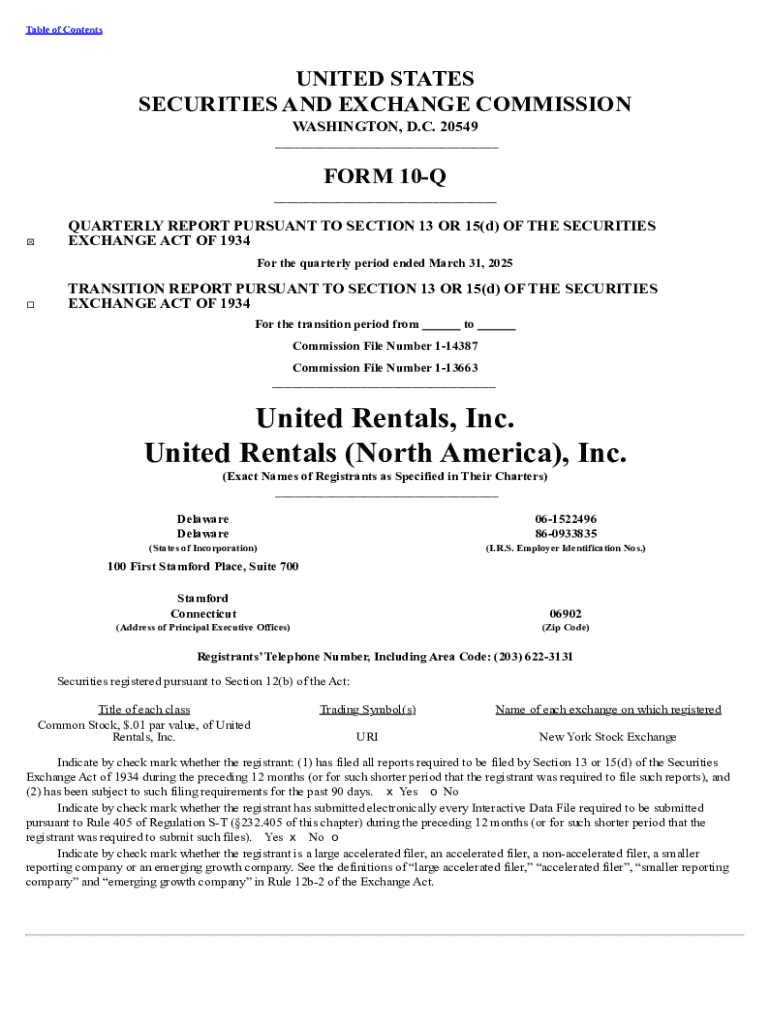

Get the free Form 10-q

Get, Create, Make and Sign form 10-q

Editing form 10-q online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-q

How to fill out form 10-q

Who needs form 10-q?

Understanding Form 10-Q: A Complete Guide for Investors and Businesses

What is a Form 10-Q?

A Form 10-Q is a comprehensive quarterly report that publicly traded companies in the United States must file with the U.S. Securities and Exchange Commission (SEC). This form serves to provide shareholders and the investing public with an updated view of a company's financial performance and condition, operating results, and any significant events that occurred during the quarter. The purpose of the Form 10-Q is to ensure transparency and informative disclosures, helping stakeholders make informed investment decisions.

For investors and stakeholders, the Form 10-Q is particularly important as it offers a snapshot of a company’s operations, performance metrics, and potential risk factors over the preceding quarter. Unlike the more comprehensive Form 10-K, which is filed annually, the Form 10-Q covers only the period of the quarter, making it a crucial tool for tracking a company’s quarterly trajectory.

This form distinctly differs from other SEC filings such as the Form 8-K, which is used to report unscheduled events or corporate changes, and the annual Form 10-K, which includes detailed audited financial statements.

Essential components of Form 10-Q

Form 10-Q is structured to facilitate the clear presentation of financial information. Understanding its essential components can help investors navigate through the document effectively. The required sections of a 10-Q include:

The financial statements within the 10-Q usually include the income statement, balance sheet, and cash flow statement, providing key performance indicators for the quarter. The MD&A offers insights into management's perspective on performance, strategies, and future prospects, while market risk disclosures detail potential external factors impacting the company's business.

Filing requirements for Form 10-Q

Not all companies are required to file a Form 10-Q. Generally, only publicly traded companies must submit this form. The frequency for filing is quarterly, specifically covering the first three quarters of a company's fiscal year. The requirements and deadlines vary based on the company’s classification:

It’s essential for companies to meet their filing deadlines to avoid penalties and maintain their reputation among investors. Common pitfalls in filing include incomplete financial information, failing to address significant changes, or submitting the form late, which can lead to scrutiny from regulators.

Understanding the timing of filings

Timeliness is crucial for Form 10-Q submissions. Each quarter has defined key dates, typically aligning with the end of the company’s fiscal period. For companies operating on a calendar year, the key dates for fiscal quarters are often:

Late filings can imply mismanagement or financial distress, adversely affecting investor confidence and stock prices. Companies may request an extension for filing; however, repeated delays can harm reputations.

How to find and access Form 10-Qs

Filing access is made easy through several resources. The SEC’s EDGAR database is the primary repository where all public filings can be searched by company name, date, or filing type. This allows investors to peruse 10-Qs from various companies efficiently.

In addition to the SEC database, companies typically publish their Form 10-Qs on their investor relations websites, making them accessible directly to shareholders. Various financial news websites and databases also track and provide links to these filings, aiding investors in their research.

Utilizing pdfFiller for Form 10-Q

Using a cloud-based document management tool like pdfFiller can simplify the process of completing and filing Form 10-Q. pdfFiller empowers users with extensive capabilities to edit PDFs, obtain electronic signatures, and collaborate seamlessly within teams, ensuring accurate and timely filings.

Successful case studies have shown how companies streamline the filing process using pdfFiller. These businesses report enhanced accuracy and timelines through easy access to collaborative features.

Key highlights and insights from recent 10-Q filings

Recent Form 10-Q filings have shed light on market trends, particularly in sectors heavily impacted by current economic conditions. Observing trends such as reductions in revenue forecasts or increased operational costs has become noticeably frequent. Investors actively monitor these filings to gauge companies’ strategies in response to market dynamics.

An analysis of recent 10-Q submissions indicates that companies are increasingly including detailed risk factors linked to possible supply chain disruptions and labor shortages, signifying a shift towards proactive management practices. Such insights can help investors recalibrate their expectations based on updated company narratives.

Common challenges and solutions in completing Form 10-Q

Completing a Form 10-Q can present several challenges, particularly regarding the accuracy and completeness of financial disclosures. Companies often navigate complex regulatory requirements that may inadvertently lead to errors. To mitigate these challenges, firms should engage stakeholders early in the filing process to gather essential information.

Through proper project management and leveraging technology, companies can surmount these issues, significantly enhancing their filing accuracy and efficiency.

Future of 10-Q filings

The future of Form 10-Q filings is likely to be shaped by evolving regulations aimed at enhancing transparency and compliance. As the SEC adapts to changing market conditions, companies may face increased scrutiny on the content and clarity of their disclosures.

Moreover, the integration of technology in filings is expected to grow. The use of advanced data management tools, such as pdfFiller, will simplify the document management process, ensuring organizations can adapt seamlessly to regulatory changes while retaining the quality of their submissions.

FAQs about Form 10-Q

Several misconceptions about Form 10-Q exist that can lead to confusion among filers. One common question is whether all public companies are mandated to file this form. While only publicly traded companies need to submit Form 10-Qs, private companies are not subject to these requirements.

Another frequent inquiry is related to the penalties for late filings. The SEC may impose fines for non-compliance, which encourages timeliness and thoroughness in disclosures. Journalists, analysts, and investors actively follow these filings, further emphasizing the need for accuracy and adherence to deadlines.

Contact an expert

Filing Form 10-Q can be complex, and reaching out for personalized guidance may be necessary. pdfFiller offers robust support resources that provide assistance through every phase of the document preparation and submission process. Their knowledgeable support team can help you navigate through specific challenges that you may encounter while completing your Form 10-Q.

Whether you’re managing a small business or part of a larger corporate finance team, understanding and utilizing Form 10-Q thoroughly will enhance your ability to maintain compliance and investor trust.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 10-q directly from Gmail?

How do I complete form 10-q on an iOS device?

How do I complete form 10-q on an Android device?

What is form 10-q?

Who is required to file form 10-q?

How to fill out form 10-q?

What is the purpose of form 10-q?

What information must be reported on form 10-q?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.