Get the free Non-tax Filer Income — Independent Student

Get, Create, Make and Sign non-tax filer income independent

How to edit non-tax filer income independent online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non-tax filer income independent

How to fill out non-tax filer income independent

Who needs non-tax filer income independent?

Understanding the Non-Tax Filer Income Independent Form

Understanding the Non-Tax Filer Income Independent Form

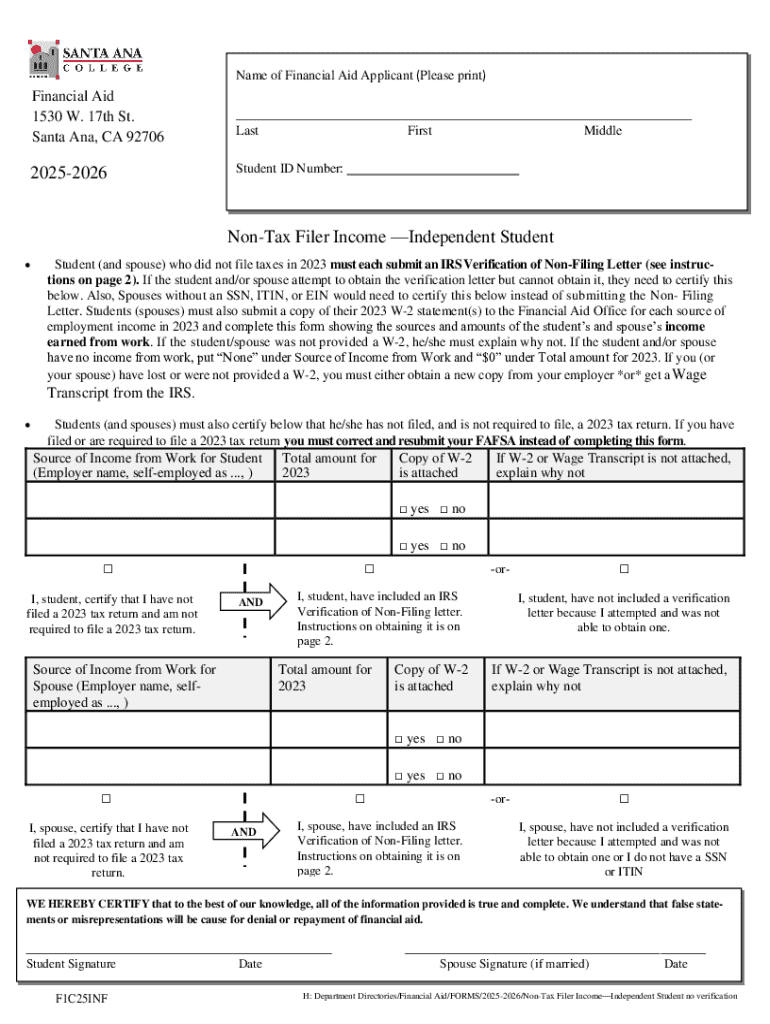

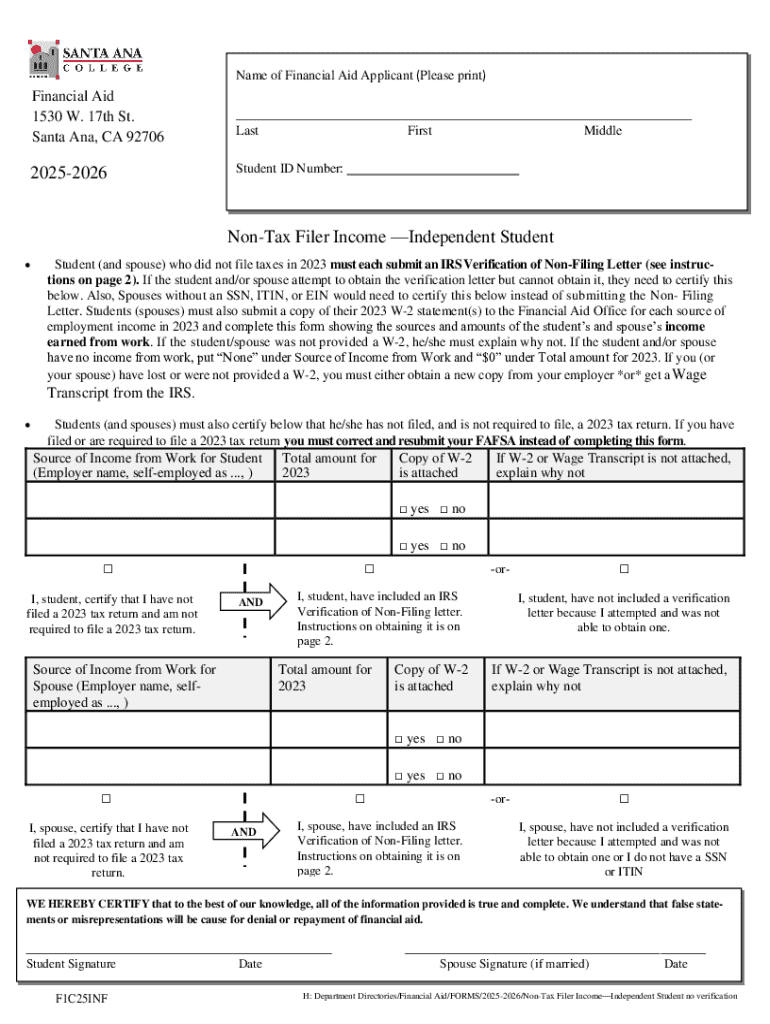

The Non-Tax Filer Income Independent Form is a crucial document for individuals who do not file taxes but still need to document their income for various purposes. This form is often required for financial aid applications, loan processing, and other situations where proof of income is necessary. By providing an accurate representation of their financial situation, non-tax filers can ensure that they receive adequate support and opportunities.

The importance of the non-tax filer income documentation cannot be overstated. In cases such as college financial aid, lenders may require this documentation to assess eligibility for financial assistance. Understanding the form ensures that individuals can communicate their financial status clearly, which can significantly impact funding decisions and support.

Eligibility criteria and requirements

Eligibility for filing the Non-Tax Filer Income Independent Form primarily revolves around the definition of a non-tax filer. Generally, independent individuals, such as students or individuals working part-time jobs under income thresholds, may qualify. For example, someone under the income limit set by the IRS who does not meet the minimum earnings required for tax filing but still has income must complete this form.

When determining qualifications, it’s important to understand what is characterized as an independent individual. This can include students who are financially self-sufficient or married individuals where only one spouse files taxes. A holistic understanding of necessary income documentation is also critical, which can encompass salaries, wages, self-employment revenues, and any other legitimate sources of income.

Step-by-step guide to completing the form

Completing the Non-Tax Filer Income Independent Form can seem intimidating, but by following a few simple steps, you can streamline the process. The first step involves gathering all necessary documents. This includes proof of income such as pay stubs, bank statements, and financial aid letters. It’s wise to make copies of all documentation, ensuring all records are clear and legible.

Next, you will need to fill out the form itself. Pay close attention to detail in each section and provide honest information about your income. Missing a section or making errors can lead to delays or rejections. Finally, review your completed form with a checklist to mitigate any chances of mistakes. Double-check all figures, dates, and personal information to ensure accuracy before submission.

Tools for effortless form management

pdfFiller provides a range of tools to facilitate seamless management of the Non-Tax Filer Income Independent Form. With its intuitive interface, users can easily edit PDFs, ensuring that all information is accurately reflected. Additionally, the eSignature feature allows for quick and legally binding electronic signatures, perfect for expedited submissions.

Collaboration tools on pdfFiller also enable multiple users to work on the same document simultaneously. This can be particularly helpful for teams or families who need input from multiple sources. Keeping track of changes and comments ensures that everyone involved has access to the latest information, making the process much more efficient.

Submission process

Once your Non-Tax Filer Income Independent Form is completed, understanding the submission process is essential. You can choose to submit the form electronically or via mail. Electronic submission is usually the fastest option, allowing for immediate confirmation. However, if you opt for mail, ensure that you send it via a reliable service and keep track of the submission date.

Awareness of deadlines is critical, as late submissions can have serious implications, especially for financial aid. Most institutions have strict deadlines, so plan ahead and submit as early as possible. After submission, you can expect a confirmation, whether through email or a confirmation letter, ensuring your form was received for processing.

Frequently asked questions (FAQs)

Understanding your position as a non-tax filer can raise several questions. For instance, you might wonder about your eligibility. If your income falls beneath the threshold for tax filing and you meet independent criteria, you qualify for the form. Additionally, reporting income from non-employment sources, such as rental income or investments, is crucial and must be clarified on the form as well.

If mistakes are made after submission, you can indeed amend your form. Just ensure you follow the correct procedure as stipulated by the submitting body. Providing inaccurate information can lead to serious consequences, affecting your financial aid status or loan application.

Contact information and support

If you require further assistance with the Non-Tax Filer Income Independent Form, customer support for pdfFiller is readily available. Users can reach out via email, live chat, or telephone, ensuring any questions or concerns regarding the documentation process are addressed promptly.

Service hours are generally posted on the pdfFiller website, and response times are typically swift, accommodating users across time zones. Utilizing these resources can significantly reduce the stress associated with document management, providing reliable support throughout the filing process.

Glossary of key terms

To navigate the world of financial documentation, it’s important to understand specific terminology. Terms such as 'independent student' refer to those who do not rely on parental income for support, while 'non-tax filer' designates individuals whose income does not require them to file tax returns.

Understanding these terms clarifies discussions with financial aid offices and helps in accurately filling out forms. Knowledge of financial aids, grants, and scholarships also empowers candidates to pursue alternatives where necessary.

Insightful resources related to financial documentation

Not filing taxes can have specific implications for financial aid. Educational institutions often provide alternatives or additional documentation requirements for those who can’t submit a tax return. Additionally, being aware of scholarship opportunities that cater specifically to non-tax filers can offer financial relief.

For those in unique financial circumstances, having alternative documentation options—such as proof of income—can significantly affect eligibility. Resources abound for finding additional tools and templates available on pdfFiller that can ease the process of document creation and management.

Testimonials and user experiences

User experiences highlight the real value of utilizing the Non-Tax Filer Income Independent Form. Individuals often share success stories of securing financial aid or approval for loans after explicitly and accurately representing their financial situation. Users appreciate the ease with which they can compile necessary documentation and submit forms, particularly with the help of pdfFiller.

Engagement with the platform has resulted in positive experiences, focusing on how pdfFiller’s tools simplify the entire process. Customers often express gratitude for the clarity and support provided, leading to efficient document management that meets all their needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my non-tax filer income independent in Gmail?

How do I edit non-tax filer income independent straight from my smartphone?

How do I fill out non-tax filer income independent using my mobile device?

What is non-tax filer income independent?

Who is required to file non-tax filer income independent?

How to fill out non-tax filer income independent?

What is the purpose of non-tax filer income independent?

What information must be reported on non-tax filer income independent?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.