Understanding and Completing a Short Deed of Trust Form

Understanding the short deed of trust form

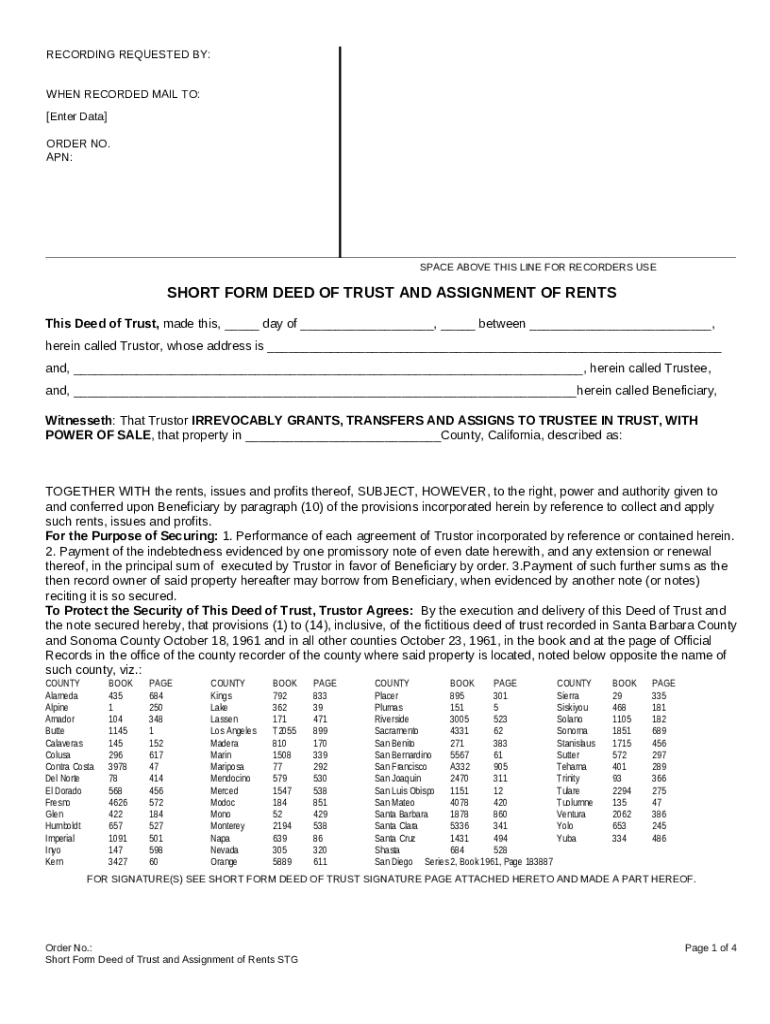

A short deed of trust is a legal document primarily used in real estate transactions. It serves as a security instrument for loans secured by real property, allowing the lender to claim the property if the borrower defaults on the loan. Unlike traditional deeds of trust, which can be lengthy and complex, the short deed of trust form is concise, focusing precisely on the vital details needed for enforceability. This streamlined approach makes it particularly attractive to individuals or teams looking for efficiency in document creation and management.

In real estate dealings, a short deed of trust is crucial as it simplifies the process of securing loans for buyers while simultaneously offering lenders an assurance of protection for their investment. By outlining the borrower’s obligations and the terms of the agreement clearly, both parties can operate with a mutual understanding of their rights and responsibilities.

Key components of a short deed of trust

A short deed of trust contains several essential elements. The first is the identification of the parties involved, which includes the borrower, beneficiary (the lender), and trustee, the entity or person that holds the legal right to the property until the loan obligation is fulfilled. Furthermore, this document provides a clear description of the property in question, including its legal description and address.

Specific clauses must be included to ensure the document's functionality. These typically encompass the loan amount and terms, detailing the obligations of the borrower regarding repayments, interest rates, and the loan duration. The default clause outlines the remedies available to the lender should the borrower fail to meet their obligations—this is critical for protecting the lender’s interest. Additionally, a governing law clause specifies which state laws will apply, adding another layer of clarity while addressing jurisdictional concerns.

Step-by-step instructions for completing the form

To obtain a short deed of trust form, users can visit platforms like pdfFiller, where comprehensive and customizable templates are readily available. Once downloaded, it's crucial to fill out each section accurately. Start with party information, entering the names, addresses, and contact details of the borrower, beneficiary, and trustee clearly.

Next, provide a detailed property description. This should include not just the address but also the legal description as identified in official records. Then, outline the loan details, including the total loan amount, interest rate, and payment schedule. To ensure clarity and avoid errors, consider reviewing your entries before finalizing the document. Common pitfalls include leaving out crucial information or not matching the borrower’s name with legal documents, which can lead to complications down the road.

Party Information: Clearly state the names and contact details.

Property Description: Include the legal description of the property.

Loan Details: Specify the amount, interest rate, and payment schedule.

Editing and customizing your short deed of trust

pdfFiller offers a suite of effective document management tools that can facilitate the editing and customizing of your short deed of trust. Users can modify text, adjust formatting, and add necessary fields or clauses in a few clicks. For instance, if additional clauses concerning repayment or security interests need to be integrated, the intuitive features of pdfFiller make these edits straightforward.

Moreover, one of the standout features is the ability to collaborate with other parties involved in the transaction. Users can easily share the document for review and input, ensuring that all parties are on the same page and that no critical detail is overlooked. This collaborative approach is invaluable for maintaining transparency and promoting mutual understanding throughout the process.

Signing and notarizing the document

Proper execution of a short deed of trust requires adherence to specific legal requirements. This includes obtaining the necessary signatures from all parties involved—the borrower, the lender, and the trustee—ensuring the document's validity. Each signature must be executed correctly and in the presence of a notary public to validate the document formally.

The notarization process typically involves the notary reviewing the document, ensuring all required sections are filled, and witnessing the signing. It adds an additional layer of legitimacy to the transaction, providing further protection to all parties involved. Having a notarized document is beneficial, as it may be required for recording purposes and can be instrumental in courts should any disputes arise regarding loan fulfillment and property claims.

Recording the deed of trust

Recording the short deed of trust is crucial for protecting both borrower and lender rights. By submitting the document to the relevant county recorder's office, the transaction is officially logged, putting the public on notice of the lender's lien on the property. This public record serves to safeguard the lender’s interest, ensuring that in the event of default, they can exercise their rights to claim the property before other creditors.

To effectively record the document, users should follow these steps: locate the appropriate county recorder’s office, prepare the necessary forms and fee payment, and submit the deed of trust for recording. After this step, expect a confirmation of recording and obtain a copy of the registered document for personal records. This confirmation is important, as it establishes the legal enforceability of the deed.

Locate the county recorder’s office where the property is situated.

Prepare for submission, including forms, fees, and any other documentation.

Submit the deed of trust and what to expect post-recording, including how you will receive confirmation.

What happens after you record the deed of trust?

Following the recording of a short deed of trust, it's essential to understand the ensuing steps and implications for both borrowers and lenders. Once recorded, borrowers will receive confirmation, which they should keep secure alongside other relevant documents. This cementing of responsibility is vital for future referencing and as evidence of the agreement.

Understanding the future implications is equally important, as both parties will be bound by the stipulations set forth in the deed. Borrowers must fulfill their payment obligations to avoid default, while lenders retain the right to pursue the property if these terms are not met. Consequently, attention to the specifics in the deed of trust ensures a clear path forward for all parties involved.

Sample short deed of trust forms

Access to customizable templates is a critical feature provided by pdfFiller, allowing users to find sample short deed of trust forms that they can tailor to fit their specific needs. These templates guide users through the process, ensuring that all necessary components are included while allowing for personalization based on unique circumstances. Examples include scenarios where the form might be utilized, such as when purchasing properties at auction or in private sales.

Using templates, individuals can easily adjust terms to match specific loan amounts, property types, and other essential clauses pertinent to their individual agreements. This availability brings forth a tailored experience in what can often be a daunting documentation process.

Additional considerations and common questions

When navigating short deeds of trust, frequently asked questions pop up. One key question pertains to the differences between a short deed of trust and a mortgage; primarily, a deed of trust involves three parties (borrower, lender, and trustee), whereas a mortgage only consists of two (borrower and lender). Another common inquiry surrounds the effects of defaulting on a deed of trust, which can lead to serious consequences such as foreclosure.

Seeking legal advice is advisable, especially when drafting or finalizing a deed of trust. Engaging with a legal professional ensures that all necessary elements are included and that the document adheres to state laws, thereby protecting all parties involved in the transaction. Understanding these intricacies can significantly mitigate risks entailed in real estate dealings.

Using pdfFiller for your short deed of trust needs

pdfFiller stands out as a robust cloud-based tool that simplifies the document creation process, particularly when dealing with short deeds of trust. With access-from-anywhere functionality, users can manage their documents securely and conveniently. The platform integrates seamlessly with various document management tools, enhancing workflow efficiency.

Beyond its features, pdfFiller provides real-world applications that many users have found invaluable. Testimonials from users highlight the ease of collaboration, editing capabilities, and the overall user-friendly design, confirming that pdfFiller not only meets but exceeds the expectations of individuals and teams seeking effective document solutions.