Get the free Financial Disclosure Statement (short Form)

Get, Create, Make and Sign financial disclosure statement short

How to edit financial disclosure statement short online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial disclosure statement short

How to fill out financial disclosure statement short

Who needs financial disclosure statement short?

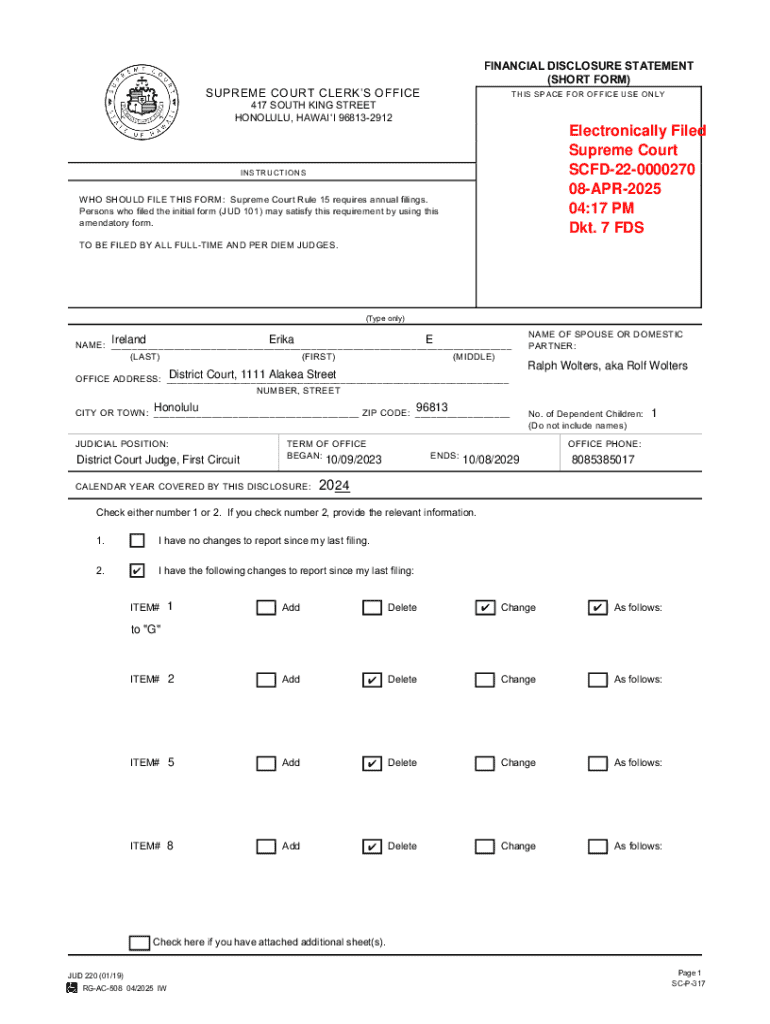

Understanding the Financial Disclosure Statement Short Form

Overview of financial disclosure statements

A financial disclosure statement short form serves as a concise document that outlines an individual's or entity's financial situation. This form is crucially utilized in various legal and financial contexts, such as divorce proceedings, loan applications, or court cases where financial transparency is necessary. It provides a snapshot of one's financial health and plays a pivotal role in ensuring all parties involved are informed about the financial aspects at hand.

The importance of a financial disclosure statement cannot be overstated. Legally, it establishes credibility and transparency, while also serving as a protective measure to avoid potential fraud or misrepresentation. In the context of financial agreements, these disclosures ensure that decisions are made with a full understanding of available resources and liabilities.

Submitting a financial disclosure statement short form usually involves specific steps to ensure compliance with local laws and regulations. Individuals may need to file this form with a court or distribute it to other parties involved in the transaction. The guidelines can vary depending on jurisdiction, hence understanding the submission process is crucial.

Understanding your financial disclosure statement

The financial disclosure statement short form requires detailed information to accurately portray one’s financial standing. Necessary details include personal identification, sources of income, a disclosure of assets, and liabilities. These elements collectively form a comprehensive picture of an individual's or organization’s financial health.

Personal identification includes basic information such as name, address, and social security number. For the income section, all sources must be disclosed, whether regular wages, rental income, or bonuses. Assets can encompass real estate, savings accounts, and investments, while liabilities cover debts such as mortgages or credit card balances. Transparency in these sections is crucial; inaccuracies or omissions can lead to legal consequences or financial penalties.

Additionally, failing to submit accurate information can have serious consequences, such as penalties in court or even criminal charges in extreme cases. It’s essential to take this process seriously and ensure all information provided is truthful and complete.

Step-by-step guide to filling out the financial disclosure statement short form

Successfully completing the financial disclosure statement short form involves several key steps. The first step is to gather all necessary documentation, which can include tax returns, bank statements, records of debts, and lists of assets.

Once your documents are compiled, start by completing the personal identification section, ensuring all names, addresses, and identifying information are accurate. Next, detail your income thoroughly, calculating total earnings from all sources. It's important to be precise here, as misreporting income can lead to significant repercussions. When disclosing assets, include all valuable items, estimating their worth accurately using current market values. Lastly, identify and report all liabilities, including credit card debts and loan obligations, to give a clear picture of what you owe.

Common questions about financial disclosure statement short form

As individuals navigate the complexities of a financial disclosure statement short form, many questions often arise. One common concern is whether both parties must submit this form. Typically, yes, both parties in legal matters like divorce are required to file a financial disclosure statement to ensure that all relevant financial information is shared.

Another frequent inquiry is about electronic submission—many jurisdictions allow for electronic filing. However, it's essential to check specific local guidelines. If financial circumstances change significantly after submission, individuals should promptly update their forms as this reflects on their honesty and integrity within legal agreements. Confidentiality is a primary concern; in most cases, sensitive information is protected, adhering to privacy standards. Lastly, inaccuracies found after submission can be problematic; they may lead to penalties or reputational damage. Therefore, utmost diligence is necessary while filling out this form.

Best practices for completing your financial disclosure statement

To ensure that your financial disclosure statement short form is completed accurately, several best practices should be followed. Firstly, double-check all figures and information provided—whether it relates to assets, income, or liabilities—to avoid discrepancies that could complicate the review process. One way to enhance accuracy is by utilizing reliable financial tracking tools or software that can help aggregate data clearly.

Understanding terminology is equally important. Knowing what constitutes a liability or asset can prevent misinterpretation. This means being clear about what qualifies as income from all sources too, ensuring that you report any irregular or non-standard income. Utilizing resources such as financial advisors or document management tools like pdfFiller can provide valuable assistance throughout this process, enabling individuals to create, edit, and manage their financial documents effectively.

Managing your financial disclosure statement after submission

After submitting your financial disclosure statement short form, understanding what to expect during the review process is crucial. Typically, the receiving party or court will examine the details provided and may request additional documentation or clarification if necessary. Staying organized and prepared to respond promptly will expedite any follow-up queries.

Keeping your financial disclosure updated is essential, especially if you undergo significant changes in your income, asset portfolio, or liabilities. Regular reviews of your financial situation can aid in this process. Utilizing tools like pdfFiller for ongoing document management allows for seamless updates of your disclosure statement, enabling easy editing, eSigning, and collaboration with other involved parties to ensure that your financial information remains accurate and current.

Special circumstances and variances in financial disclosure

Certain unique situations can arise regarding the financial disclosure statement short form that may require additional considerations. For instance, irregular income streams, such as commission-based earnings or freelance work, might necessitate a more nuanced approach in reporting income. Clear documentation of these fiscal flows, including averages over time, can provide clarity.

Shared assets complicate matters as well; individuals must accurately disclose any jointly-owned property or investments. Understanding and reporting variances from standard reporting guidelines is important, as local laws may have different requirements. Moreover, changes in residency, dependents, or noteworthy financial transactions must be reported promptly to maintain the integrity of your disclosure. By adhering to these practices, individuals can ensure thorough transparency and compliance in their financial disclosures.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send financial disclosure statement short for eSignature?

Can I sign the financial disclosure statement short electronically in Chrome?

How do I edit financial disclosure statement short on an Android device?

What is financial disclosure statement short?

Who is required to file financial disclosure statement short?

How to fill out financial disclosure statement short?

What is the purpose of financial disclosure statement short?

What information must be reported on financial disclosure statement short?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.