Get the free Treasurer's Guide to Pension & Benefits

Get, Create, Make and Sign treasurers guide to pension

Editing treasurers guide to pension online

Uncompromising security for your PDF editing and eSignature needs

How to fill out treasurers guide to pension

How to fill out treasurers guide to pension

Who needs treasurers guide to pension?

Treasurer's guide to pension form

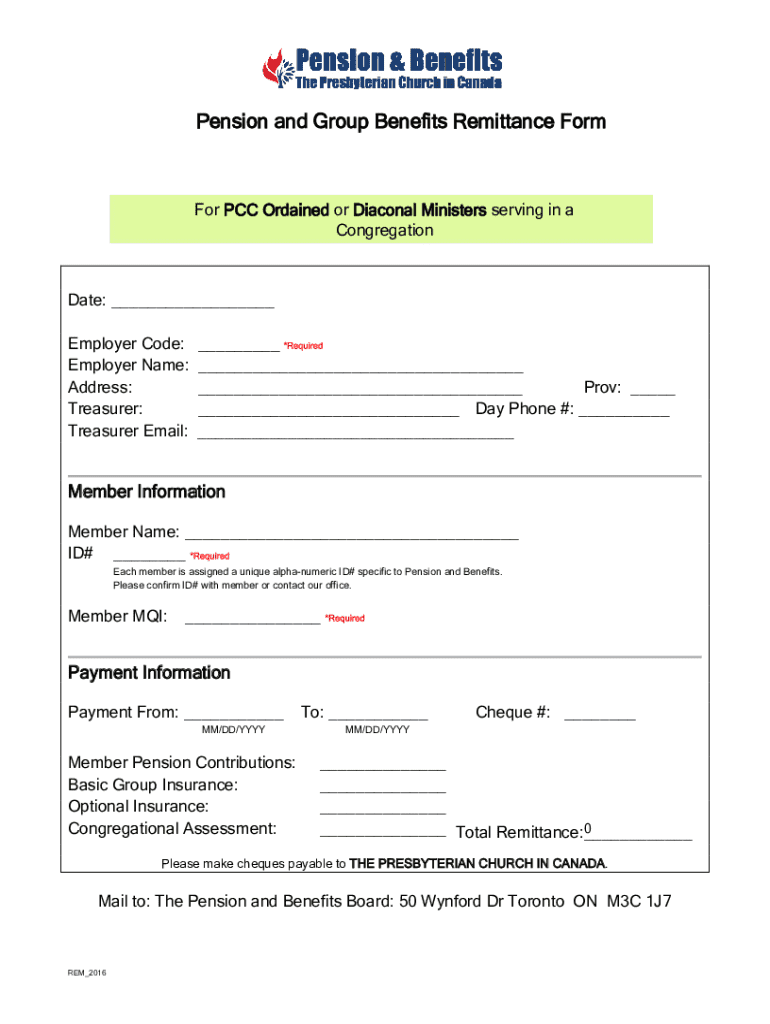

Understanding the pension form

The pension form is a crucial document in the realm of financial management, particularly for individuals preparing for retirement. This form not only facilitates the enrollment process into pension plans but also ensures that beneficiaries are designated, and claims for retirement benefits are processed efficiently. Each section within the pension form serves a significant purpose, making it vital for both the employee and the employer to understand its importance.

Key terminology often encountered includes 'beneficiary,' which refers to individuals designated to receive benefits upon the employee’s passing, and 'vested benefits,' which are the benefits that an employee is entitled to retain even after leaving a company. Understanding these terms is essential for accurate completion and long-term financial planning.

Types of pension forms

Pension forms vary widely, tailored for specific audiences and purposes. Commonly used forms typically include Employee Enrollment Forms, Beneficiary Designation Forms, and Retirement Benefit Claim Forms. Each serves distinct functions, from signing up employees for pension plans to notifying financial institutions of any changes in beneficiary details or processing retirement benefits.

Additionally, there are program-specific pension forms. Public pension plans may require different documentation compared to private plans due to varying regulations and service structures. Recognizing which form pertains to a specific pension plan is necessary to avoid submission delays or complications.

Step-by-step instructions for filling out the pension form

Completing a pension form may seem daunting, but breaking it down into steps can simplify the process. **Step 1** involves gathering all necessary information and documents such as personal identification, employment history, and beneficiary information. Ensuring that this data is accurate and up-to-date is crucial.

**Step 2** is about accessing the pension form. Most employers provide these forms online, and they can typically be downloaded and printed for convenience. It’s imperative to have the latest version of the form to ensure compliance with the most recent policies or guidelines.

Moving into **Step 3**, careful completion follows. Each section must be addressed, from personal details to pension preferences. Avoiding common mistakes like miswriting the Social Security Number or neglecting to mention previous employment can prevent future issues.

Finally, **Step 4** requires a thorough review of the form. A checklist for submission can aid in catching errors, ensuring all necessary signatures are secured and that the information is accurately represented.

Editing and managing your pension form

Once the pension form is completed, managing it effectively is the next step. Using tools like pdfFiller enables users to edit their pension forms online quickly. Individuals can import existing PDFs to make changes, ensuring that every detail is current without the hassle of starting from scratch.

Adding eSignatures is another functionality that enhances document processing. Collaboration features allow for teams to review changes and ensure everyone involved is on the same page. Keeping your completed forms securely stored is vital, and digital formats provide an excellent solution.

Managing revisions is also important. pdfFiller offers a history of document changes, allowing users to revert to previous versions if necessary. This feature can be invaluable during discussions about retirement plans.

Frequently asked questions about the pension form

Mistakes happen. If you realize you’ve made an error on your pension form, the first step is to assess whether you can correct it immediately or if a new form is necessary. Generally, minor errors can be crossed out and corrected as long as the corrections are initialed to confirm accuracy.

Updating information on the pension form is another common concern. Changes like name or address adjustments can typically be processed by submitting an updated form. Make sure to follow any specific guidelines provided by your employer or pension administrator.

If you don’t receive a response after submitting your form, it's wise to follow up through the appropriate channels. Keeping a record of submission dates can save time in these situations, ensuring you can reference when you sent the document.

Tools and resources for effective management of pension forms

Utilizing interactive tools available on pdfFiller can enhance the experience of managing pension forms. For example, document comparison tools help you see differences between versions, making it easier to track changes and important updates.

Templates for various pension forms are available as well, ensuring you never have to start from scratch. Additional features for form management, including cloud storage solutions, provide peace of mind by facilitating easy access from any device, while sharing options allow for smooth collaboration with others involved in pension planning.

How to submit your pension form

Understanding submission methods is crucial for the timely processing of your pension form. The online submission process is becoming increasingly common, with many employers providing portals for easy access and secure document transfer. Alternatively, if mailing is necessary, keep in mind essential dos and don’ts, like using certified mail for trackable proof of delivery.

Tracking your submission is important. If using online methods, look out for confirmation emails. For mailed submissions, note the tracking number provided by postal services to monitor delivery status. This helps ensure your form reaches its destination without delays.

Common issues and solutions

Encountering common submission issues can be frustrating. Problems like missing documents or incorrect formats might arise. Should issues occur, contacting the appropriate support for assistance is critical. Investigating FAQs on delays and processing times can offer insights into the specific nuances of the pension form submission process.

Additionally, companies often have specific timelines for processing forms. Staying informed about these timelines can help manage expectations regarding when to follow up on your submission.

Best practices for managing pension forms

Keeping accurate records related to pension forms is essential. Regularly reviewing your pension information ensures you stay informed about your benefits and can identify any changes that may affect your retirement planning. This proactive approach can be beneficial in facilitating smoother transitions as you approach retirement.

Leveraging technology for document management and security adds another layer of efficiency. Tools available on pdfFiller help maintain organization while providing secure options for storing and sharing crucial financial documents, thus simplifying the overall management process.

Other related forms and resources

In addition to the pension form, there are numerous other financial management forms available that are crucial for comprehensive retirement planning. These include forms for Social Security benefits, health insurance options, and estate planning documents. With the right resources, individuals can ensure they are well-prepared for their financial futures.

Linking to resources for further learning about pension management can elevate financial literacy. Understanding different types of accounts, benefits, and planning tools can immensely improve one’s retirement readiness. Tools for financial planning beyond pension forms also enhance long-term stability, encouraging broader financial health and security.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit treasurers guide to pension from Google Drive?

How can I send treasurers guide to pension for eSignature?

How do I fill out treasurers guide to pension on an Android device?

What is treasurers guide to pension?

Who is required to file treasurers guide to pension?

How to fill out treasurers guide to pension?

What is the purpose of treasurers guide to pension?

What information must be reported on treasurers guide to pension?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.