Get the free Return of Organization Exempt From Income Tax - Form 990

Get, Create, Make and Sign return of organization exempt

Editing return of organization exempt online

Uncompromising security for your PDF editing and eSignature needs

How to fill out return of organization exempt

How to fill out return of organization exempt

Who needs return of organization exempt?

Return of Organization Exempt Form: A Comprehensive Guide

Understanding the return of organization exempt form

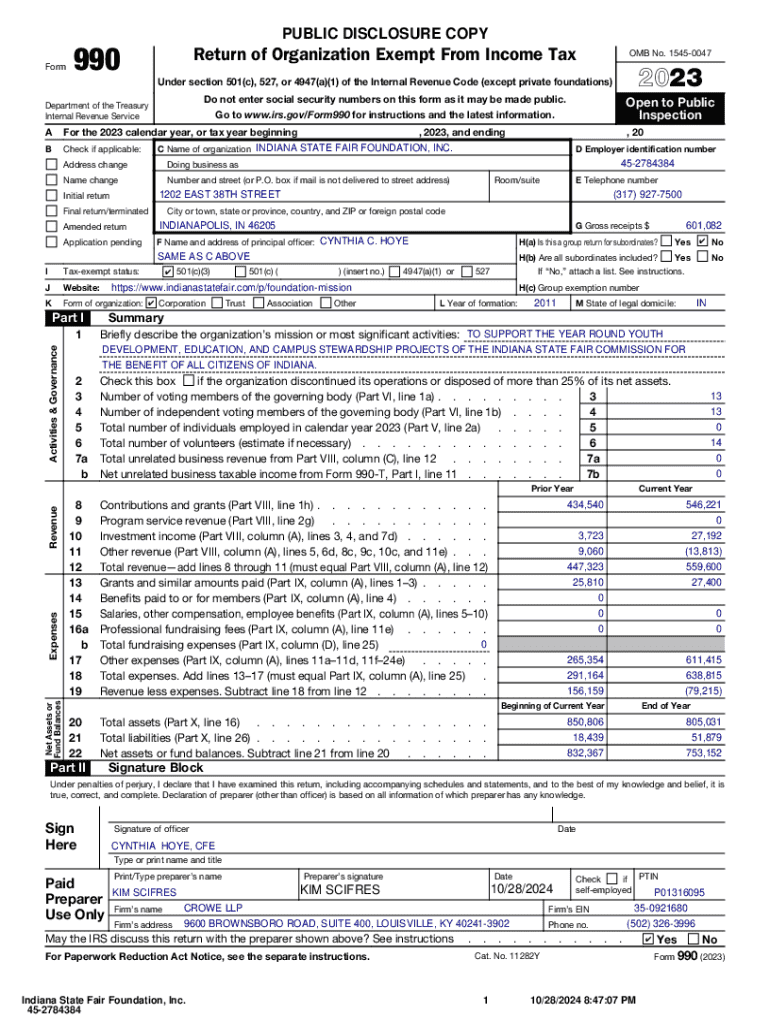

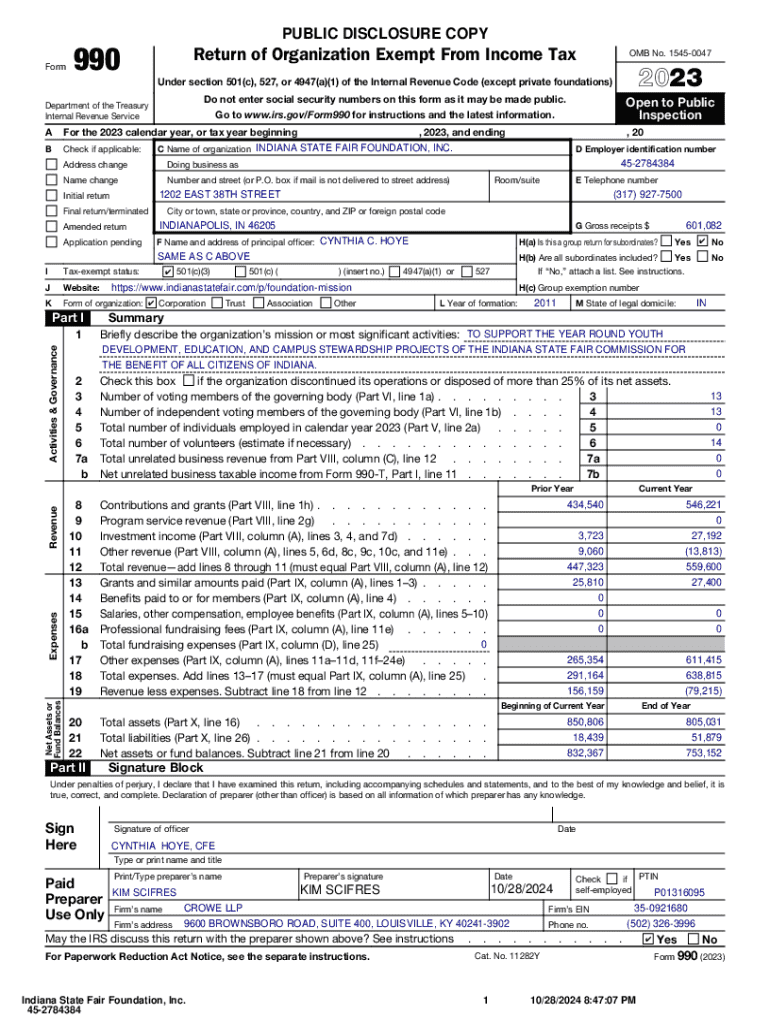

The Return of Organization Exempt Form, known as Form 990, serves as the primary tax compliance document for tax-exempt organizations in the United States. This form provides the IRS and the public with important information about an organization’s financial activities, governance, and operations, ensuring transparency and accountability among nonprofit entities.

Types of exempt organizations

Organizations can fall under various classifications depending on their mission and operations, with 501(c)(3) and 501(c)(4) being among the most recognized. These classifications have distinct filing requirements and implications for tax treatment.

IRS guidelines and filing requirements

Understanding who must file and the specific IRS guidelines is crucial for compliance. Organizations with yearly gross receipts exceeding a certain threshold must file Form 990, while smaller organizations may qualify for easier filing options.

Preparing for the return process

Preparation is key to successful completion of the Return of Organization Exempt Form. Gathering the necessary documentation beforehand can minimize errors and streamline the filing process.

Choosing the correct form

The choice of which form to file often hinges on the organization’s size, revenue, and complexity of operations. Understanding the distinctions between Form 990, 990-EZ, and 990-N can facilitate compliance.

Step-by-step guide to completing the form

Completing the Return of Organization Exempt Form involves several critical sections that require thorough attention. Each section captures vital organizational information necessary for compliance.

Filing modalities: How to submit your form

Successful submission of the Return of Organization Exempt Form can be done offline or online, depending on the organization's preferences and technological capabilities. Understanding both methods is pivotal.

Post-filing considerations

Once the form is filed, organizations must be aware of the subsequent steps and essential record-keeping practices. This includes understanding the IRS processing timeline and adhering to public disclosure requirements.

Common mistakes to avoid

Filing the Return of Organization Exempt Form can present challenges, and organizations must be vigilant to avoid common pitfalls that might adversely affect their status.

Resources for assistance and support

Navigating the complexities of form filing doesn't have to be daunting. Numerous resources exist to support organizations during this process. Utilizing tools can streamline submissions and alleviate stress.

Case studies and success stories

Learning from the experiences of others can provide valuable insights into best practices for filing the Return of Organization Exempt Form. Understanding both successes and failures can help organizations navigate their own filing journeys.

Frequently asked questions (FAQs)

Organizations often have numerous queries regarding the Return of Organization Exempt Form. Addressing common concerns can clarify the complexities surrounding the form and the filing process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get return of organization exempt?

How do I edit return of organization exempt online?

How do I fill out return of organization exempt on an Android device?

What is return of organization exempt?

Who is required to file return of organization exempt?

How to fill out return of organization exempt?

What is the purpose of return of organization exempt?

What information must be reported on return of organization exempt?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.