Get the free Beneficiary Change Form

Get, Create, Make and Sign beneficiary change form

How to edit beneficiary change form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficiary change form

How to fill out beneficiary change form

Who needs beneficiary change form?

Comprehensive Guide to the Beneficiary Change Form

Understanding the beneficiary change form

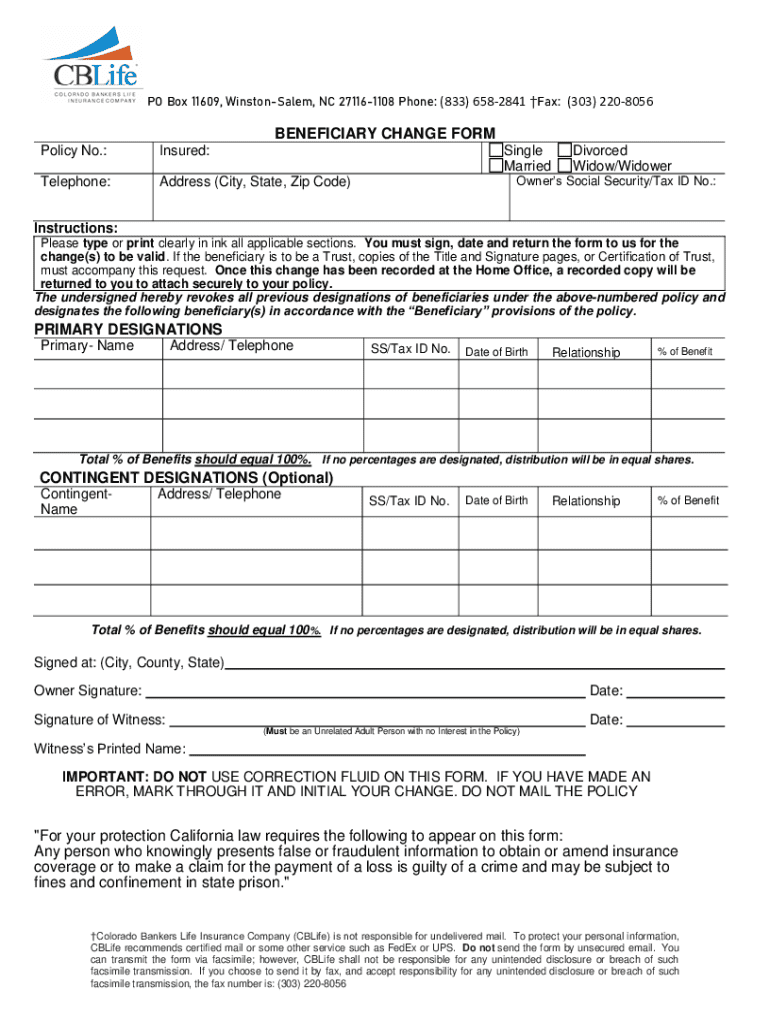

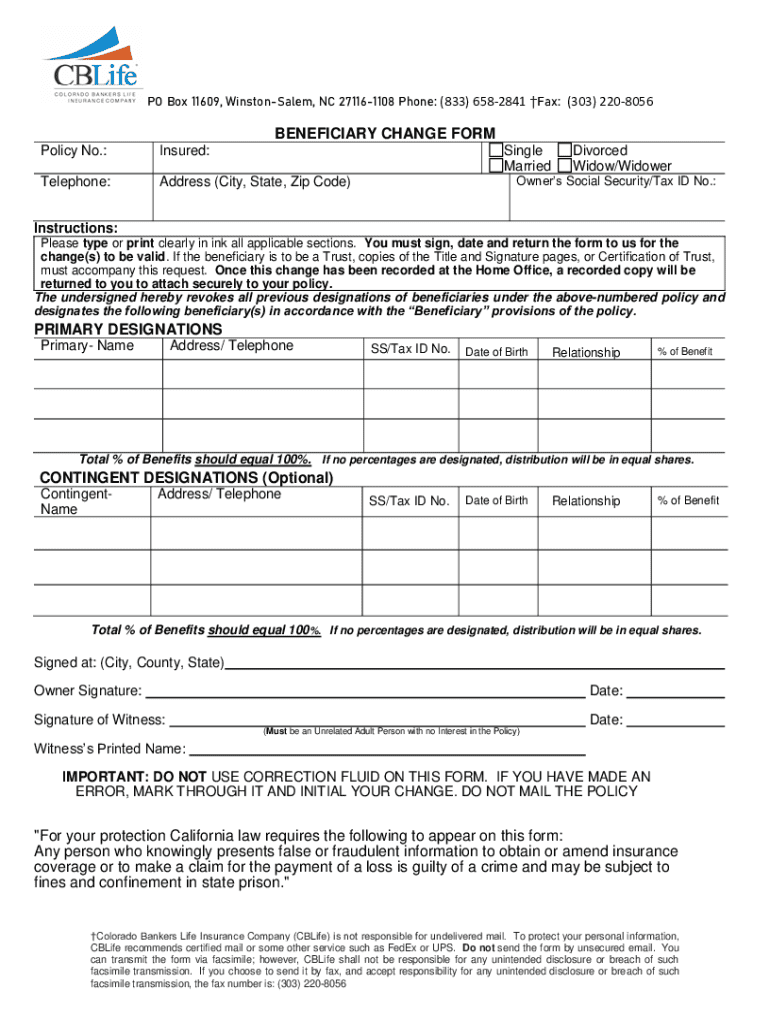

A beneficiary change form is a vital document that allows individuals to update or alter the designated beneficiaries of a financial product such as a life insurance policy, retirement account, or trust. Keeping beneficiary information current is essential as it ensures that assets are distributed according to the policyholder's wishes upon their passing. Neglecting to maintain accurate beneficiary details can lead to unintended outcomes, conflicting claims, or delays in asset distribution.

Various life events may necessitate a beneficiary change, including marriage, divorce, birth of a child, or the death of a previously designated beneficiary. These changes reflect the individual's current relationships and intentions, making it crucial to address them in a timely manner.

Who can use the beneficiary change form?

The beneficiary change form is accessible to a wide array of individuals, including policyholders of life insurance, retirement account holders, and those managing trust accounts. Eligibility is largely retained by the individual who controls the asset or account in question. This includes not only personal accounts but also certain collective accounts for partnerships or joint ventures.

Common scenarios for using a beneficiary change form typically involve:

Preparing to complete the beneficiary change form

Before filling out the beneficiary change form, it is important to gather all necessary information to ensure a smooth process. This includes personal details such as the name, address, and relationship to the beneficiaries being designated, as well as the policy or account number linked to the form.

Additionally, different designations may be chosen, such as primary versus contingent beneficiaries. Primary beneficiaries are the first in line to receive benefits, while contingent beneficiaries act as backups should the primary beneficiaries be unable to receive the assets. Understanding these options can help clarify the intent behind your designations.

Specific versus general designations also play a role. A specific designation names an individual or group directly, while a general designation may refer to categories such as 'my children'. It’s critical to clearly specify who you wish to receive your assets to avoid confusion later.

Step-by-step guide to filling out the form

Accessing the beneficiary change form through pdfFiller is a straightforward process. Users can navigate to the correct template by logging into the platform, searching for ‘beneficiary change form,’ and selecting the appropriate template for their needs.

To fill out the form accurately, follow these detailed instructions for each section:

Accurate completion of the form is crucial. Double-checking the provided information helps avoid common mistakes, such as misspellings or incorrect beneficiary relationships, that can complicate the process later on.

Editing and customizing the beneficiary change form

Utilizing pdfFiller’s editing tools makes it easy to customize your beneficiary change form. You can add additional fields by dragging and dropping features onto the document, as well as using text boxes and annotations for clarity and important notes.

Ensure that your adjustments comply with legal requirements, particularly if there are specific state guidelines for beneficiary designations. Adhering to these guidelines protects your wishes and ensures that the document remains valid.

Signing the beneficiary change form

Once the beneficiary change form is completed, it's time to sign. Numerous options exist for signing this document, including electronic signatures, which are legally recognized in most jurisdictions. This method proves to be convenient, especially when utilizing cloud-based platforms like pdfFiller.

In some cases, adding witnesses may be required based on your state’s laws or the requirements of the financial institution involved. Once signed, the form can be submitted either electronically through pdfFiller or via traditional paper mailing.

Regardless of the submission method, it's important to keep copies for your records. This ensures that you have a documented trail of the changes made to your beneficiary designations.

Managing the beneficiary change

After submitting the beneficiary change form, it's crucial to confirm that the changes have been processed appropriately. This can be done by following up with the relevant company or agency to check if your updates are reflected in their records.

Updating your records is equally important. Store the finalized form securely, whether in physical or digital formats, as this provides a reference point for future inquiries. Regularly revisiting your beneficiary designations can be beneficial, especially after life events such as marriage, divorce, or the death of a spouse, which could affect your choices.

Resources for further assistance

Navigating beneficiary changes can be complex, and having access to reliable resources is invaluable. Frequently asked questions (FAQs) related to beneficiary changes can often provide quick answers and clarification on common issues.

For personalized help, customer support from your financial institution or the platform you are using is readily available. Additionally, seeking legal advice can help address specific concerns or scenarios regarding estate planning and beneficiary designations.

Benefits of using pdfFiller for your beneficiary change form

Utilizing pdfFiller for your beneficiary change form offers several advantages. The cloud-based access allows seamless document management wherever you are, making it convenient when updating essential forms. Real-time collaboration features enable multiple users, such as financial advisors or family members, to participate in the editing and approval process.

Furthermore, the platform ensures secure storage, allowing easy retrieval of your forms when needed, especially during sensitive times. By leveraging the innovative capabilities of pdfFiller, users can confidently manage their essential documents while remaining organized and compliant.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send beneficiary change form for eSignature?

Can I create an electronic signature for the beneficiary change form in Chrome?

How do I edit beneficiary change form straight from my smartphone?

What is beneficiary change form?

Who is required to file beneficiary change form?

How to fill out beneficiary change form?

What is the purpose of beneficiary change form?

What information must be reported on beneficiary change form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.