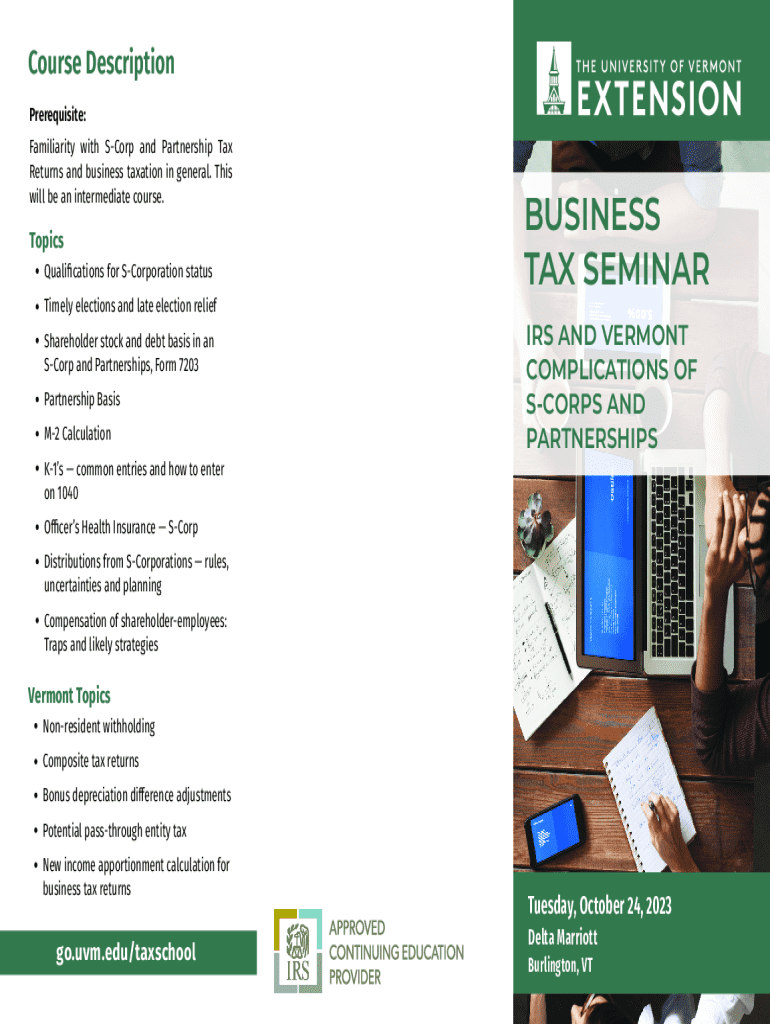

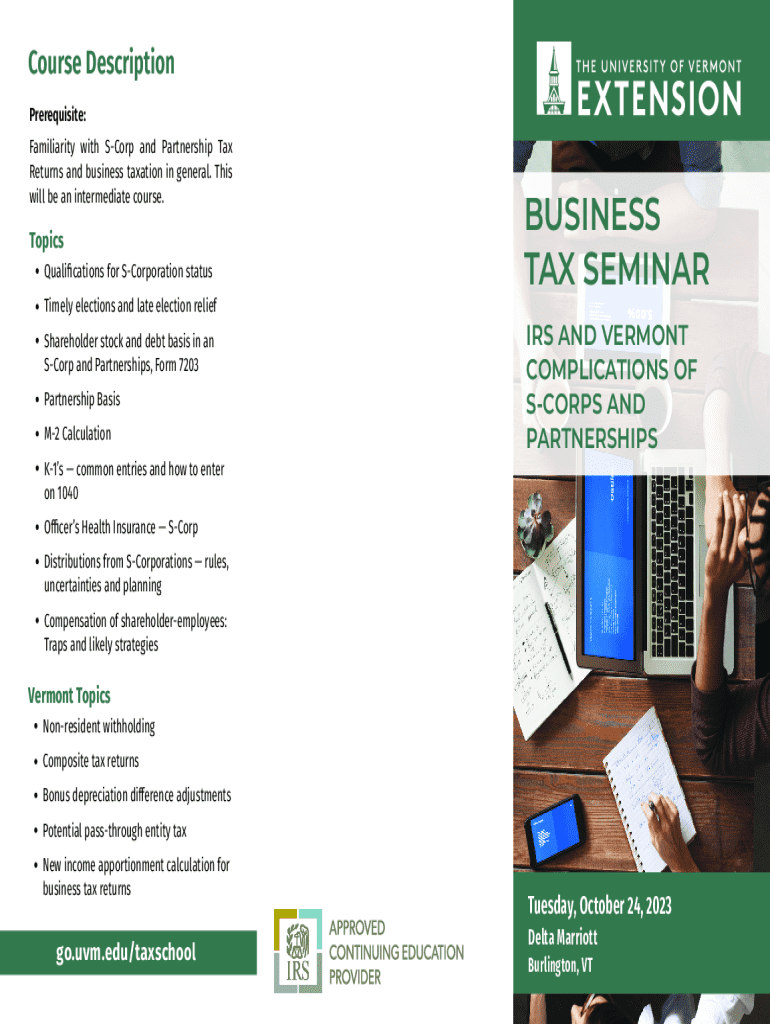

Get the free Business Tax Seminar

Get, Create, Make and Sign business tax seminar

How to edit business tax seminar online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business tax seminar

How to fill out business tax seminar

Who needs business tax seminar?

Understanding and Navigating the Business Tax Seminar Form

Understanding business tax obligations

Business taxes are the charges imposed by governmental bodies on the income earned by businesses. These taxes come in various forms, including income tax, sales tax, and employment taxes, depending on the nature of the business and its operations.

Federal and state taxes vary, as each has its own regulations and rates. Sales and use taxes apply to retail businesses and are collected on the sale of goods and services. Employment taxes, including Social Security and Medicare, are mandatory for employers to withhold from their employees' earnings.

Importance of attending business tax seminars

Attending business tax seminars provides crucial education to business owners and accounting professionals alike. These seminars cover a variety of topics, from fundamental tax obligations to recent changes in tax legislation.

Moreover, these events offer exceptional networking opportunities. Engaging with other business owners and tax professionals can not only enhance knowledge but also lead to collaborations and partnerships.

Interactive Q&A sessions are particularly valuable, allowing attendees to seek expert advice on their specific tax situations. This personalized assistance can lead to effective problem-solving and smarter tax strategies.

Overview of the business tax seminar form

The business tax seminar form is a critical component for individuals and teams looking to register for tax seminars. This form serves as the entry point into a wealth of knowledge and resources that can enhance understanding of business tax obligations.

Eligibility for attending these seminars is often defined by the type of organization, its size, and in some instances, pre-existing membership in professional organizations. To facilitate the registration process, specific information is required on the form.

Filling out the business tax seminar form: Step-by-step instructions

Completing the business tax seminar form efficiently ensures your spot at these valuable events. Start by gathering all necessary documentation to facilitate a smooth submission.

Once you have your documents, begin by entering both your personal and business information accurately. This includes your name, contact details, business type, and address. Then, provide your tax identification details.

It’s also essential to select your preferred seminar dates and topics, tailoring your learning experience to your specific needs. Lastly, review all entered information for accuracy before confirming your submission.

Common mistakes to avoid

Navigating the business tax seminar form can be straightforward, but several common pitfalls may hinder your registration process. One frequent error is submitting incomplete or incorrect information, which can delay your registration or lead to disqualification.

Missing registration deadlines is another common mistake. Ensure you pay attention to the timeline surrounding the seminar to secure your spot. Additionally, participants may overlook valuable optional sessions or workshops that could enrich their experience.

Interactive tools for managing your business tax responsibilities

Utilizing interactive tools can greatly enhance your experience when managing the business tax seminar form and your overall understanding of tax obligations. A PDF editor allows you to modify the form quickly before submission, ensuring accuracy.

eSign features also streamline the registration process, making it easy to sign off on documents without the need for physical signatures. Furthermore, collaboration tools enable team registrations, allowing multiple attendees to sign up conveniently.

Frequently asked questions (FAQs)

Navigating the business tax seminar process often leads to common questions among potential attendees. One crucial query is regarding cancellation policies; if you need to cancel your seminar registration, check for specific guidelines provided on the seminar website.

Many attendees wonder whether multiple team members can register using a single form. Generally, forms allow for this convenience, but it’s best to confirm with the event organizers.

Lastly, attendees often ask how they will receive confirmation of their registration. Typically, confirmations are sent via email, along with additional details regarding the seminar.

Getting the most out of your seminar experience

Preparation is vital for maximizing your seminar experience. Prior to the event, familiarize yourself with the agenda and decide which sessions are most relevant to your business needs. Bringing along relevant resources and materials can enhance your learning experience.

Engaging with speakers and panelists can also offer more personalized insights. Prepare thoughtful questions beforehand to make the most of interactions and ensure you leave with actionable takeaways.

Post-seminar resources for continued learning

Post-seminar, it’s essential to continue your learning journey. Many seminar organizers provide access to recorded sessions and seminar materials, allowing attendees to revisit topics and gain deeper insights.

Additionally, look for further workshops and training opportunities that can enhance your understanding of taxing implications. Establish connections with tax professionals made during the seminar for ongoing support, ensuring you have access to expert advice in the future.

Testimonials and success stories

Listening to testimonials from past seminar attendees can be enlightening. Many have reported significant improvements in their business tax management strategies post-seminar.

Real-life experiences often highlight the practical benefits gained through seminars, reinforcing how education can transform tax responsibilities into manageable tasks. Expert insights and feedback add further credibility to the value of attending these educational events.

Contact and support information

For assistance with the business tax seminar form, it's essential to know how to reach out for help. Look for specific contact information provided on the seminar website.

Additionally, familiarize yourself with other support resources available for any further inquiries. Utilizing these resources effectively can ease your registration process.

Legal and compliance considerations

Staying updated on tax laws is critical for business owners. Legislative changes can influence how taxes are calculated, filed, and managed. Attending seminars keeps you informed about compliance requirements that businesses must adhere to.

Utilizing tools like pdfFiller can streamline document management while ensuring that all submissions are secure and compliant. The importance of proper documentation cannot be overstated, especially in avoiding penalties and ensuring smooth business operations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in business tax seminar without leaving Chrome?

Can I create an eSignature for the business tax seminar in Gmail?

How do I complete business tax seminar on an iOS device?

What is business tax seminar?

Who is required to file business tax seminar?

How to fill out business tax seminar?

What is the purpose of business tax seminar?

What information must be reported on business tax seminar?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.