Get the free onlinewarrants

Get, Create, Make and Sign onlinewarrants form

Editing onlinewarrants form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out onlinewarrants form

How to fill out warrants payroll expense for

Who needs warrants payroll expense for?

Understanding Warrants Payroll Expense for Form

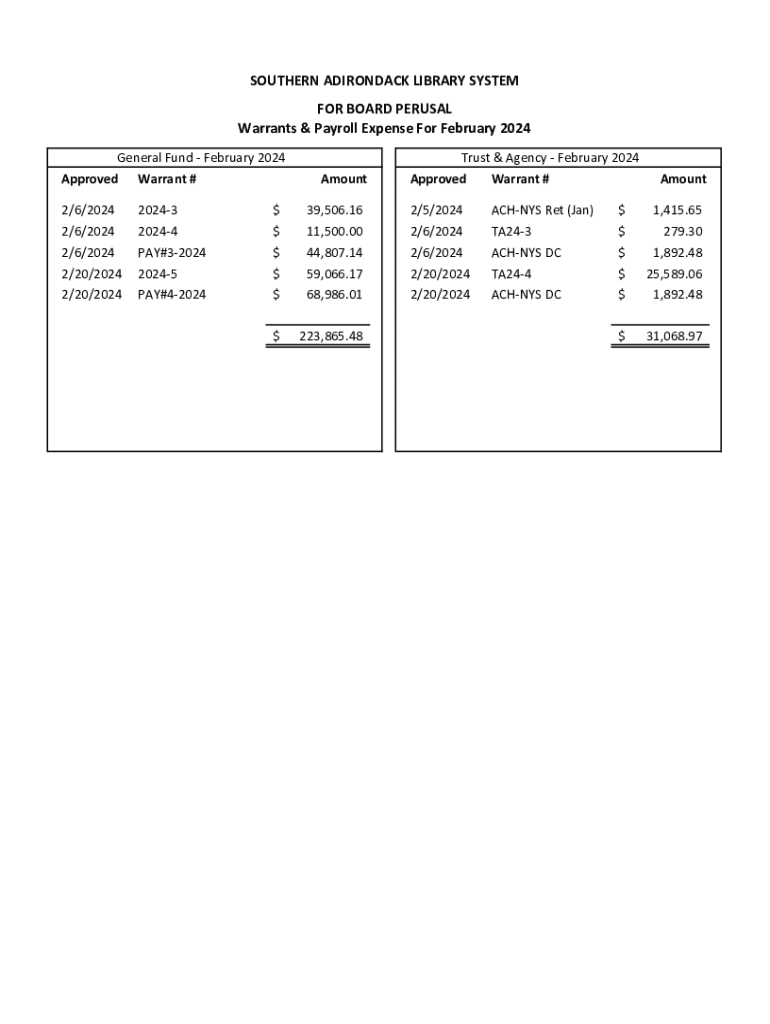

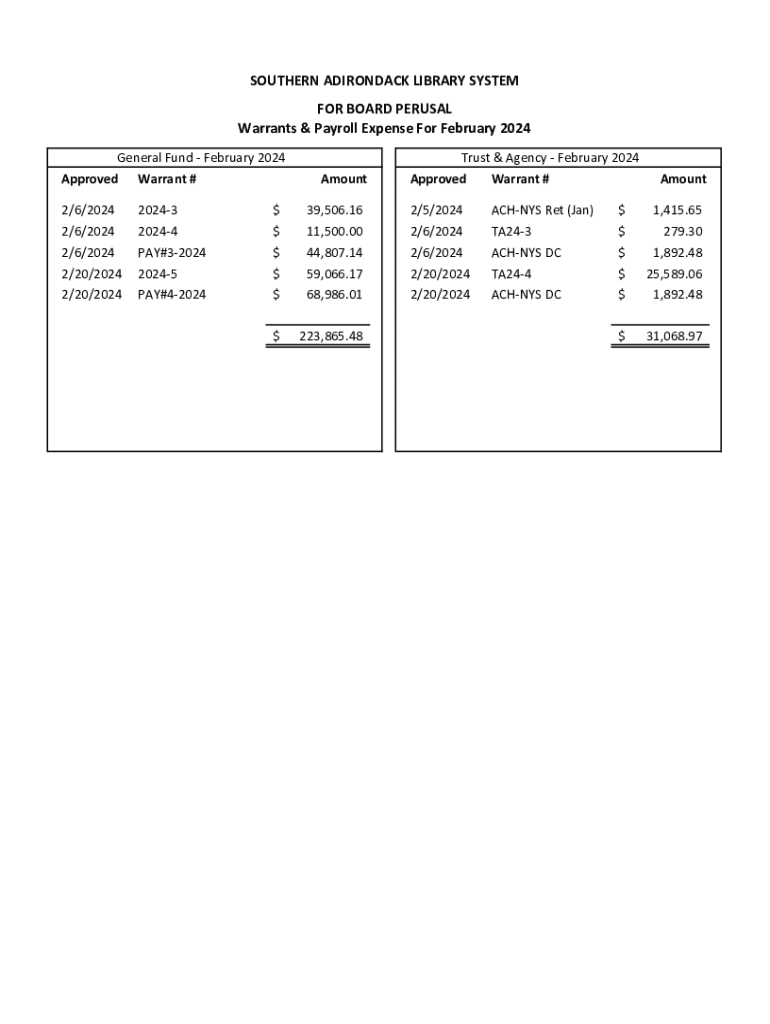

Understanding payroll warrants

A payroll warrant acts as an official document that authorizes the disbursement of funds to employees as part of their wages. These documents play a crucial role in the payroll processing cycle, ensuring that employees receive their compensation accurately and on time. Payroll warrants are particularly important for organizations that manage multiple employees across various pay periods, providing a structured method to track payments.

Without payroll warrants, businesses would struggle with maintaining organization and accountability in their payment systems. The accuracy of payroll warrants contributes significantly to a company’s financial integrity and employee satisfaction.

Payroll expense overview

Payroll expenses refer to the costs incurred by an organization to compensate its employees. They encompass salaries, wages, bonuses, and other forms of remuneration, including health benefits and retirement contributions. Accurate categorization of payroll expenses is essential for financial reporting and budgeting, ultimately impacting an organization’s cash flow management.

Misclassifying payroll expenses can lead to severe compliance issues and financial discrepancies. Therefore, each organization must conscientiously track and report payroll-related costs. Doing so helps maintain lawful compliance with tax regulations and provides insights into operational efficiency.

Navigating the payroll expense form

The payroll expense form is a vital tool for tracking and managing payroll costs accurately. It serves as a record for both the employer and employee, ensuring transparency in compensation practices. Utilizing digital forms offered through platforms like pdfFiller enables streamlined management of payroll records, whether they’re virtual or paper-based.

Employers benefit significantly from using an electronic payroll expense form because of improved accessibility, ease of editing, and the ability to store documents securely in the cloud. Additionally, tracking payroll expenses electronically allows for quicker updates and adjustments.

Step-by-step guide to filling out the payroll expense form

Filling out the payroll expense form may seem daunting, but following a systematic approach can simplify the process. Start by gathering all necessary employee information, including their names, Social Security numbers, and work hours. Additionally, consolidate payroll data such as amounts to be paid, deductions, and applicable tax information.

When accessing your payroll expense form, adhere to these steps for accuracy:

Consider utilizing visual aids, such as sample forms available within pdfFiller, which can guide users in navigating these sections.

Editing and submitting your payroll expense form

Once the payroll expense form is filled out, reviewing and editing it for errors is crucial. This is where tools like pdfFiller shine, allowing users to modify their documents easily, add annotations, and correct any mistakes before finalization. Additionally, pdfFiller offers electronic signature capabilities, ensuring that all approvals are efficiently collected and securely stored.

For submission, users can utilize various methods, including online forms submission or mailing hard copies. It’s essential to understand the deadlines for submitting payroll expense forms, as late submissions can lead to complications in payment processing and potential penalties.

Troubleshooting common issues

When it comes to payroll expense forms, mistakes can happen. Common errors include miscalculating totals, incorrect employee details, and missing signatures. To avoid these pitfalls, double-check every section for accuracy and use tools that offer error-checking functionalities.

If your form happens to be rejected, don’t panic. Take note of the feedback provided and follow the guidelines for resubmission. Always keep a line of communication open with payroll or HR departments to clarify any uncertainties.

Authorized roles in payroll processing

Understanding who handles payroll expense forms within an organization is crucial for ensuring efficiency and security. Typically, roles in payroll processing may include payroll managers, HR personnel, and financial analysts who are responsible for preparing, reviewing, and managing payroll documents.

It’s essential to define each role's responsibilities clearly to maintain data protection and handle sensitive payroll information appropriately. Providing training regarding secure data practices is also vital in safeguarding payroll documentation.

Related procedures and policies

Relevant organizational policies regarding payroll warrants must be thoroughly understood and adhered to. This includes compliance with labor laws, tax regulations, and company internal controls. Familiarizing oneself with these protocols is integral to ensuring seamless payroll operations.

Moreover, organizations should have established internal procedures for issuing payroll warrants. This may involve verification processes, timelines for payment processing, and documentation standards that align with their overall financial strategy.

Quick links and resources

Accessing the right resources can greatly enhance one’s payroll processing experience. With pdfFiller, users can find forms and tools to expedite their payroll expense form management. This includes direct links to templates and compliance guides, ensuring that individuals and teams have everything they need at their fingertips.

Ensure you have access to government resources that provide guidelines related to payroll compliance, thereby supporting informed decision-making and adherence to best practices.

Frequently asked questions (FAQs)

Many questions may arise in the realm of payroll expenses and warrants. Common queries include the distinction between regular and special payroll warrants, how to handle discrepancies in payroll forms, and the implications of payroll errors on tax reporting. Addressing these questions within an organization's context can enhance understanding and compliance.

Clearing up misconceptions about payroll processes can lead to smoother operations and better overall management of expenses.

Contacting support

Not every situation can be resolved independently. There are times when professional assistance becomes necessary, especially when faced with complex issues regarding payroll forms or tax regulations. Identifying the right moment to seek help is crucial.

Connecting with the OFM Help Desk or payroll support resources is vital in such instances. Ensure to provide all relevant information that can assist the service team in understanding the issue and offering prompt solutions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit onlinewarrants form straight from my smartphone?

How do I edit onlinewarrants form on an Android device?

How do I fill out onlinewarrants form on an Android device?

What is warrants payroll expense for?

Who is required to file warrants payroll expense for?

How to fill out warrants payroll expense for?

What is the purpose of warrants payroll expense for?

What information must be reported on warrants payroll expense for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.