Get the free Certificate of Incorporation

Get, Create, Make and Sign certificate of incorporation

How to edit certificate of incorporation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certificate of incorporation

How to fill out certificate of incorporation

Who needs certificate of incorporation?

Understanding the Certificate of Incorporation Form

Understanding the certificate of incorporation

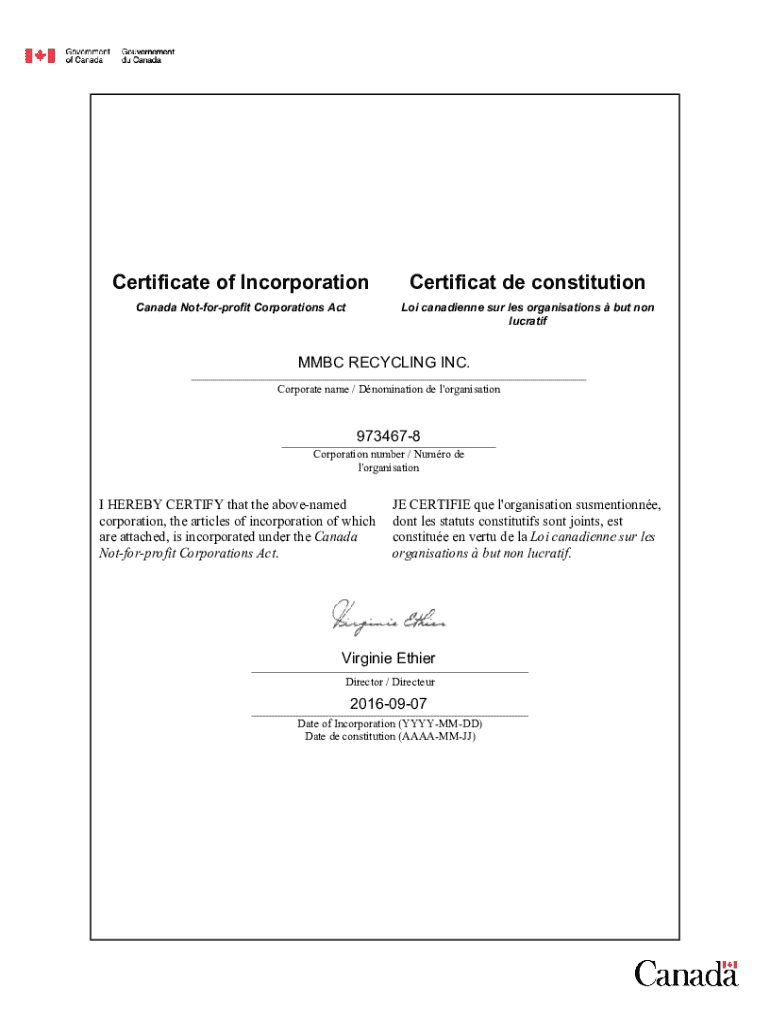

A certificate of incorporation form is a crucial document that legally establishes a corporation within a specific jurisdiction. This document serves as the foundation for corporate existence, outlining essential details such as the business's name, purpose, and structure. By filing this certificate, the business gains legal recognition, allowing it to operate, conduct transactions, and enter into contracts under its corporate identity.

The importance of this document cannot be overstated, as it provides liability protection for the owners, also known as shareholders, safeguarding their personal assets from any debts or legal actions against the corporation. Corporations, including for-profit and nonprofit entities, are required to file this document to be recognized by state laws and enjoy the associated benefits.

Who needs to file a certificate of incorporation?

The requirement to file a certificate of incorporation is primarily relevant for startups and new businesses seeking to establish a formal structure. Without proper incorporation, a business operates as a sole proprietorship or partnership, exposing its owners to personal liability. Filing this certificate allows these entities to separate their personal and business liabilities, offering legal protection.

In addition, existing businesses planning to expand into new states must also file this document to comply with local business laws. Understanding whether you're establishing a nonprofit or for-profit corporation is essential, as the requirements can vary significantly depending on the business structure chosen.

When is the optimal time to file?

For startups, the optimal time to file the certificate of incorporation form is ideally before commencing any business activities. Registering early not only establishes a legal entity but also allows for obtaining necessary permits and licenses under the corporation's name. Various factors can influence the timeline, including business planning stages, financial readiness, and the urgency of entering the market.

State-specific deadlines can also impact when you should file. Some states have expedited processes that may shorten or extend typical timelines. Therefore, understanding your chosen state's regulations is crucial in determining the most suitable filing time.

Key information required to file

Filing a certificate of incorporation requires specific information to ensure compliance with state laws. Firstly, you must provide your business name and confirm its availability in the state. Then, clearly articulate the business's purpose—this should outline the core objectives your corporation aims to achieve. Information regarding the registered agent, a designated individual or entity responsible for receiving legal documents, is also critical.

Moreover, you need to specify the share structure, detailing the number of shares the corporation is authorized to issue and their categorization (such as common or preferred shares). Finally, note the duration of the business; some corporations choose a perpetual existence, while others may specify a set duration. Gathering this information beforehand streamlines the filing process.

Costs and fees involved in filing

The cost of filing a certificate of incorporation varies by state and is influenced by several factors. Typically, the base state filing fees range from $50 to $500, depending on the state of incorporation. However, in addition to these fees, businesses must consider potential extra costs such as expedited filing services that some states offer for an additional fee. For startups, it's essential to allocate to your financial planning for these costs upfront to avoid unexpected surprises during the incorporation process.

Consultation with a legal professional can also incur costs, but this investment can provide invaluable advice to ensure compliance and accuracy in your application. Comparing state filing fees in your chosen location can aid in budget planning while determining how much additional funds may be necessary for the overall incorporation process.

Choosing the right state for incorporation

Selecting the proper state for incorporation can significantly impact your business operations and tax obligations. Popular states such as Delaware, Nevada, and Wyoming are often chosen due to their favorable corporate laws and tax benefits. Delaware, for instance, offers a well-established legal framework and does not impose state income tax on corporations that operate outside of Delaware, making it an attractive option for many business owners.

Each state presents unique benefits and drawbacks, such as varying filing fees and regulatory environments. Tax considerations, including sales and income taxes, should influence your decision-making process. Engaging in research about these factors can help ensure that you choose the state that aligns best with your corporation’s long-term goals.

Navigating the filing process

Navigating the filing process for your certificate of incorporation can feel overwhelming, but a structured approach can simplify it significantly. Start with gathering all required information, such as your business structure, name, purpose, and registered agent details. After compiling this information, complete your certificate of incorporation form, making sure to review state-specific requirements.

Once the form is filled out, submit it to the appropriate state agency—usually the Secretary of State’s office—along with the necessary filing fees. After submission, wait for confirmation and review from the state. Understanding common mistakes, like providing inaccurate information or failing to sign the document, can help avoid delays.

Do you need legal assistance?

Legal assistance can be a significant asset during the filing of your certificate of incorporation. Hiring a lawyer provides experts who can interpret state regulations, draft documents accurately, and streamline the overall process. However, it’s essential to weigh the costs versus the benefits, as legal fees can add up quickly.

In instances of complex corporate structures or areas of concern about tax implications, consulting with a legal professional may be prudent. Recognizing when you need legal help can save your business time and reduce the likelihood of filing errors which may lead to costly penalties.

Additional elements of the certificate of incorporation

The articles of incorporation generally encompass multiple essential elements that form the backbone of your certificate of incorporation. Article I pertains to the business name which must be distinctive and align with state requirements. Article II discusses the duration of the business, specifying whether it is intended to exist perpetually or for a limited time.

Article III outlines the purpose of the business, while Articles IV and V cover the powers granted to the business and registered agent details, respectively. Additionally, the share structure and management details are addressed in subsequent articles, ensuring that potential investors and state authorities have clarity regarding ownership and operational oversight. Optional articles like bylaws and indemnification clauses can also be included to enhance legal certainty.

Keeping your certificate of incorporation updated

After your business has been incorporated, it’s essential to ensure that the certificate of incorporation remains accurate and up-to-date. Changes such as alterations in business address, ownership structure, or registered agent must be reflected in your documents. Failure to amend your certificate when necessary may lead to complications with compliance and can affect the business's legal standing.

Amendments typically require filing a form with the state and may involve additional fees. It’s advisable to routinely review your certificate alongside other corporate documents to ensure full compliance with state regulations and to maintain accurate records for your business.

Resources and tools for certificate of incorporation

To facilitate the filing of a certificate of incorporation, various interactive tools are available that simplify form completion and filing. Websites such as pdfFiller provide templates tailored to various business structures, ensuring users can accurately fill out necessary information with ease. Resources like electronic signatures and document management solutions allow for a convenient approach to sealing deals while maintaining compliance.

Utilizing these tools not only expedites the incorporation process but also minimizes common errors that can arise from manual entry. Overall, having access to reliable resources can make the incorporation journey significantly smoother for up-and-coming entrepreneurs.

Exploring related legal forms and documents

In addition to the certificate of incorporation, several other essential corporate documents are crucial to maintaining compliance and operational functionality. For instance, an LLC operating agreement can significantly clarify the management structure and responsibilities within the organization. Bylaws serve to outline operational rules and regulations, ensuring all stakeholders understand the internal policies governing the corporation.

These documents are essential in safeguarding the interests of shareholders and ensuring that the corporation operates smoothly. Having all necessary legal forms in order not only enhances organizational credibility but also fosters a transparent environment for stakeholders.

FAQs about the certificate of incorporation

New incorporators often have various concerns when filing their certificates. Common inquiries include the required documentation needed for filing, timelines for approval, and understanding state-specific requirements. Clarifying misconceptions regarding legal entities, such as the belief that a DBA (Doing Business As) is sufficient for liability protection, can help new businesses navigate their incorporation paths effectively.

Additional considerations, such as whether to obtain an Employer Identification Number (EIN) simultaneously with the certificate filing, should also be highlighted. Having a clearer understanding of these aspects can help entrepreneurs make informed decisions as they incorporate, ensuring a smoother transition into the corporate world.

Personalized support and assistance

pdfFiller offers robust support for users navigating the incorporation process. With access to dedicated customer service and live support features, entrepreneurs can receive assistance tailored to their specific inquiries regarding the filing process. The platform also fosters a community where business incorporators can share their experiences and insights, creating a supportive environment for new businesses.

Utilizing these resources not only aids in addressing immediate concerns but also equips users with long-term strategies for effective document management as they grow. Engaging with a community of like-minded entrepreneurs can enhance understanding and confidence, ultimately smoothing the incorporation experience.

Engaging with pdfFiller

As a leading document management platform, pdfFiller empowers users through various innovative features designed to streamline the incorporation process. The cloud-based solutions offered enable businesses to edit, eSign, collaborate, and manage their documents effectively in one central location. This flexibility is particularly beneficial for teams working remotely or those overseeing multiple business ventures, enabling seamless collaboration from anywhere.

Exploring pdfFiller's additional services can enhance your overall document experience, providing tools that promote efficiency, clarity, and professionalism in your business operations. Diverging from traditional methods, pdfFiller sets out to redefine how businesses approach document management in a fast-paced, digital environment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit certificate of incorporation from Google Drive?

How can I edit certificate of incorporation on a smartphone?

How do I edit certificate of incorporation on an Android device?

What is certificate of incorporation?

Who is required to file certificate of incorporation?

How to fill out certificate of incorporation?

What is the purpose of certificate of incorporation?

What information must be reported on certificate of incorporation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.