Get the free Insurance Transfer Form

Get, Create, Make and Sign insurance transfer form

How to edit insurance transfer form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out insurance transfer form

How to fill out insurance transfer form

Who needs insurance transfer form?

The comprehensive guide to insurance transfer forms

Understanding the insurance transfer form

An insurance transfer form is a formal document used to request the transfer of an existing insurance policy from one provider to another or to update the policyholder's information. This form plays a crucial role in ensuring that both the policyholder and the insurance companies have a clear, documented understanding of the changes being made. It is particularly important for maintaining uninterrupted coverage and avoiding miscommunications between the involved parties.

Situations that require an insurance transfer include changes in residence, switching to a different insurance provider, or merging policies due to marriage or familial changes. The need for an insurance transfer can arise in various scenarios, highlighting the importance of having a readily accessible and well-understood transfer form.

Preparing for the transfer

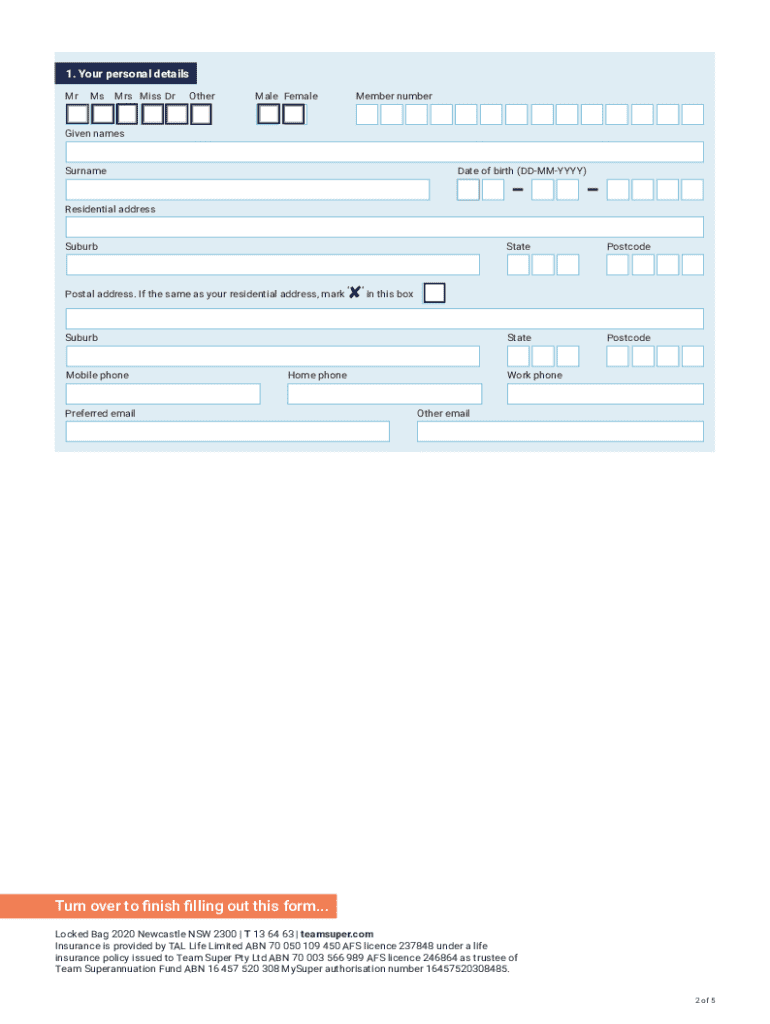

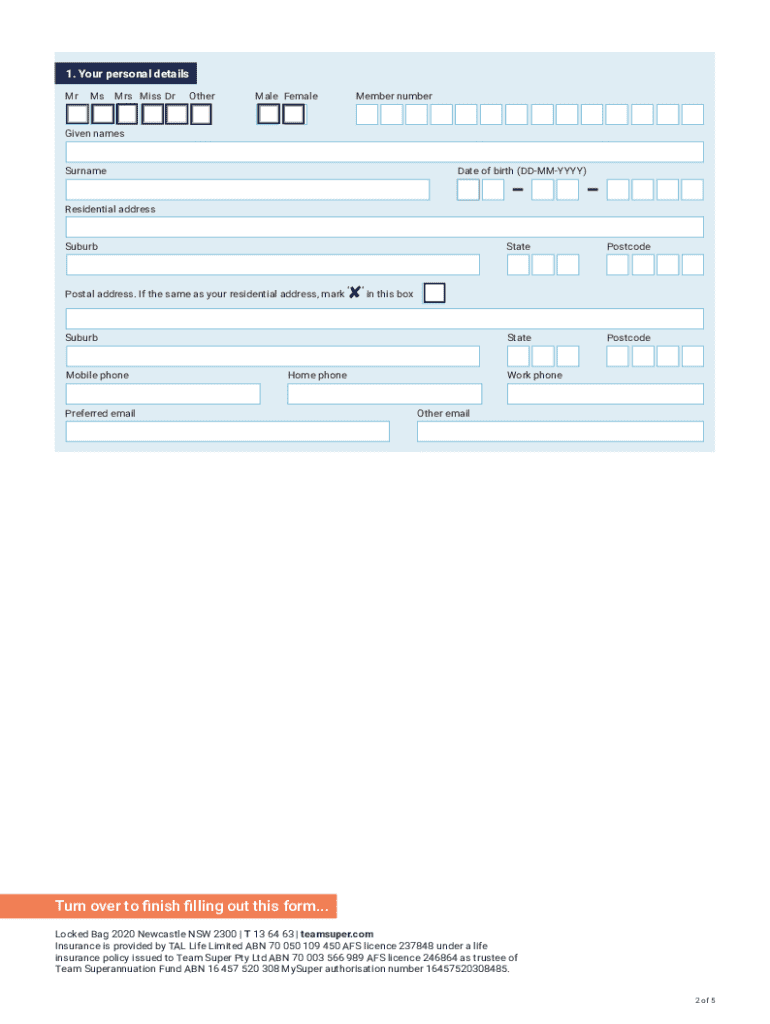

Before starting the insurance transfer process, it's essential to gather all necessary information and documents. Begin with the policyholder details such as name, address, and contact information. Gather information about the current insurance provider, including policy numbers and contact details, as well as similar information for the new provider. Additionally, collect the specific details of the policy being transferred, including coverage limits and any riders that may be attached.

Eligibility criteria may vary by insurance provider, but generally, certain conditions must be met to successfully use the transfer form. For example, the policy should be active and not in a grace period for payments. It's also crucial to avoid common pitfalls, such as failing to submit the form in the correct format or providing incomplete information.

Step-by-step guide to completing the insurance transfer form

Step 1 involves accessing the form. Users can find the insurance transfer form on pdfFiller, which offers a streamlined interface for downloading and filling out forms. Best practices include saving a copy of the form before beginning and ensuring all software is up to date to avoid issues during the process.

Step 2 covers details on filling out the form. Focus on the personal information section, which should include your name, data of birth, and contact information. Next, provide current policy details such as the insurance provider name, policy number, and coverage type. After that, fill in the new policy details, which often include provider name and policy terms.

In Step 3, reviewing the information is critical. Double-check for accuracy, particularly in contact numbers and policy numbers, as common errors can lead to delays. Step 4 requires signing the form, where users can utilize pdfFiller's eSigning feature, which provides a secure method for signing documents legally.

Step 5 involves submitting the form through various methods, including online submission via the insurance provider’s website or sending it via postal mail. Tracking the submission process is also advisable to confirm once the transfer is initiated.

Managing the insurance transfer

After submitting the insurance transfer form, it's important to know what to expect. Processing times for insurance transfers can vary widely; typically, it can take anywhere from a few days to several weeks. It's essential to communicate with both the current and new insurance providers to confirm the completion of the process.

Troubleshooting issues might arise, such as delayed processing times or missing documentation. Keeping thorough records of all communications and submissions can help in resolving these issues efficiently. Furthermore, pdfFiller’s document management tools are invaluable, allowing users to store, edit, and organize submitted forms easily.

Additional tips and best practices

Maintaining accurate records is essential during the insurance transfer process. Keeping copies of submitted forms not only provides a reference but can also serve as a safeguard in case disputes arise. pdfFiller's cloud storage allows users to keep all their documents organized and accessible from anywhere.

Understanding your rights as a policyholder during the transfer process is crucial. You have the right to contest delays or denials of your transfer request. Familiarize yourself with the terms of your policy and your rights, and explore resources for disputing potential issues that may arise during the transfer.

Frequently asked questions (FAQs)

What is the timeframe for an insurance transfer? Typically, the timeframe can vary significantly based on the providers involved. Many transfers take between seven to fourteen business days, but checking with your providers can offer a more specific timeline.

Can I transfer my insurance policy without using the form? In most cases, utilizing an insurance transfer form is necessary to formalize the process. However, speaking directly with your insurance agent may clarify if alternate methods exist.

What happens if my current provider does not approve the transfer? If the transfer is denied, the policyholder usually receives a notification detailing the reasons. It's advisable to address these issues directly with the provider to seek a resolution.

How does eSigning on pdfFiller ensure my document's security? pdfFiller employs advanced authentication procedures and encryption methods to secure all documents and signatures, ensuring that your sensitive information is protected throughout the process.

Real-life scenarios and examples

Consider a case study of a successful insurance transfer where a policyholder moved to a new city and found a better coverage plan. By utilizing pdfFiller to complete and submit their transfer form quickly, the policyholder ensured there were no lapses in coverage between the old and new policies.

On the other hand, common mistakes made during the process include failing to complete all the sections on the transfer form or submitting documents without proper review. One individual faced issues when their current insurance provider rejected the transfer due to missing information, highlighting the importance of attention to detail.

Conclusion and next steps

Starting the insurance transfer process can seem daunting, but with the right tools and guidance, it can be a seamless experience. pdfFiller empowers users to efficiently manage their documents while ensuring compliance with all necessary policies and regulations. By taking the first step today using pdfFiller’s user-friendly tools, you can simplify your insurance transfer and enjoy peace of mind.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify insurance transfer form without leaving Google Drive?

How do I edit insurance transfer form straight from my smartphone?

How do I complete insurance transfer form on an iOS device?

What is insurance transfer form?

Who is required to file insurance transfer form?

How to fill out insurance transfer form?

What is the purpose of insurance transfer form?

What information must be reported on insurance transfer form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.