Get the free Beneficiary Designation Form

Get, Create, Make and Sign beneficiary designation form

How to edit beneficiary designation form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficiary designation form

How to fill out beneficiary designation form

Who needs beneficiary designation form?

Beneficiary Designation Form: A Comprehensive Guide

Understanding beneficiary designation

A beneficiary designation form is a crucial legal document that outlines who will receive your assets upon your passing. By specifying beneficiaries for your accounts and policies, you can bypass lengthy probate processes, ensuring a smoother transition of your resources. This form is fundamental in estate planning as it allows individuals to direct their assets according to their wishes, reducing disputes and confusion among family members.

The importance of a beneficiary designation form lies in its ability to provide clarity and ensure that your legacy is honored. Without a proper designation, your assets may unintentionally go to unintended recipients, which can lead to familial rifts. Therefore, understanding who needs a beneficiary designation form is essential — anyone with accounts such as retirement plans, life insurance, or investments should have one completed to safeguard their assets.

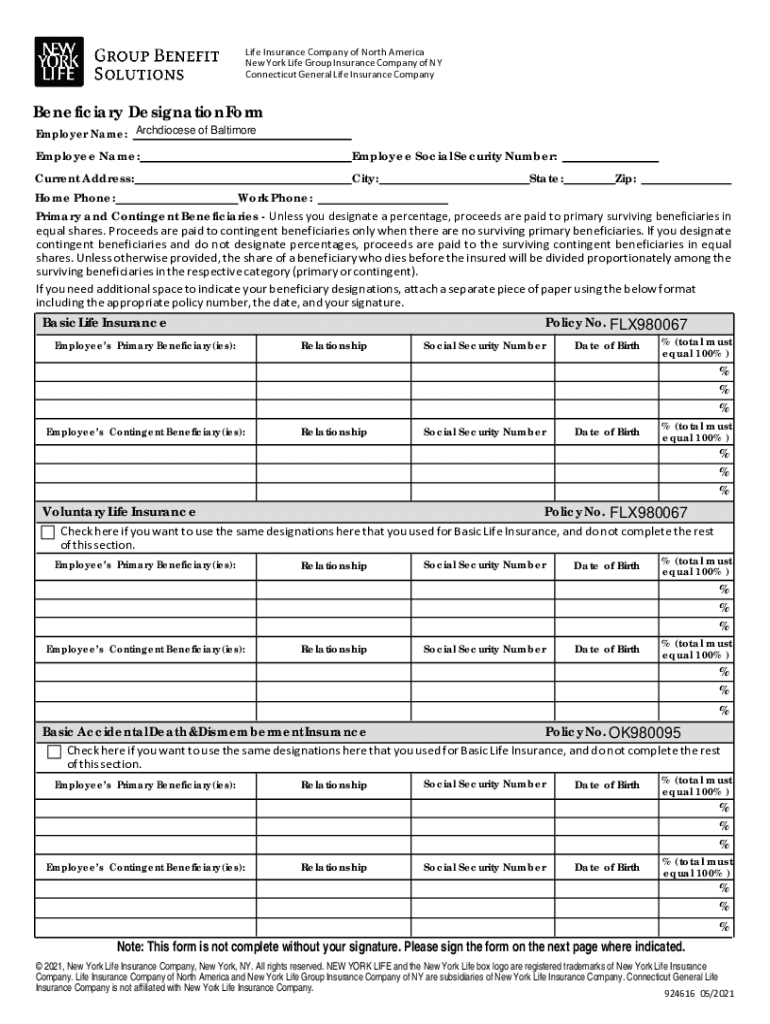

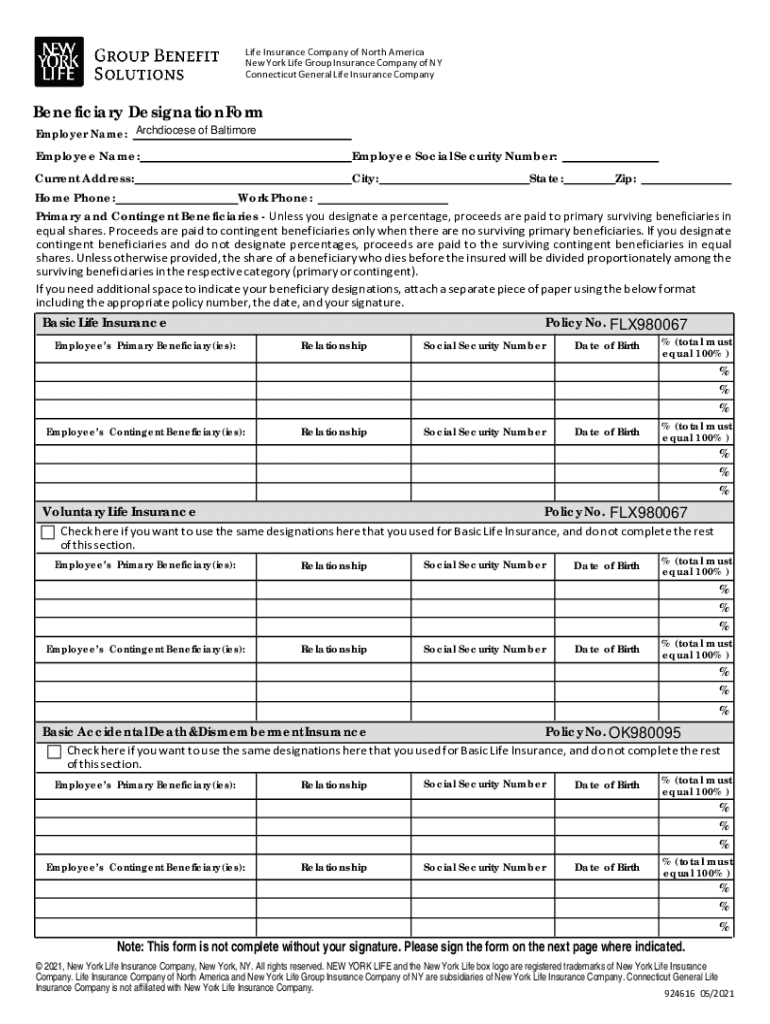

Key components of a beneficiary designation form

When filling out a beneficiary designation form, it is imperative to provide detailed personal information. This includes your name, address, and date of birth, alongside identification information of the account owner. Accurate information helps in verifying identities and ensuring that the assets are directed correctly.

Next, you must include beneficiary information. Beneficiaries can be categorized into primary and contingent. Primary beneficiaries are the first in line to receive assets, while contingent beneficiaries step in if the primary beneficiaries cannot. Listing beneficiaries involves providing their name, address, and relationship to you, which is essential for clarity and minimizing potential disputes over the designation.

Understanding which specific assets require coverage under the beneficiary designation form is crucial. Accounts might include retirement accounts, insurance policies, and various types of financial investments. Each category has its respective nuances, such as how retirement accounts often follow different rules than traditional wills.

Step-by-step instructions for completing the beneficiary designation form

To start the process, the first step is to obtain the correct form. You may find the beneficiary designation form through financial institutions, insurance agencies, or even online platforms like pdfFiller. It’s vital to ensure you have the most updated version of the form by checking your provider's website.

Once you have the form, follow these steps closely to complete it:

Be mindful of common mistakes that can arise during this process, such as leaving sections incomplete, not double-checking beneficiary details, or failing to review your designations periodically. Regular reviews can prevent outdated information that no longer reflects your current wishes.

Electronic vs. paper copies of the beneficiary designation form

Choosing between electronic and paper copies of the beneficiary designation form comes down to personal preference and specific needs. Electronic copies have significant benefits, including flexibility and accessibility, especially when created through platforms like pdfFiller. Here, you can easily access your forms wherever you are and utilize eSignature capabilities for convenience.

On the other hand, there are situations where you may prefer paper copies, particularly when dealing with institutions that require them. When using paper forms, consider best practices for managing and storing these documents. Keep them in a secure location while ensuring that trusted family members are aware of their existence and accessibility.

Managing changes to the beneficiary designation

Life events can prompt the need to review and possibly update your beneficiary designation. Major milestones such as marriage, divorce, or the birth of a child should trigger a review of your designations to ensure they align with your current situation. Additionally, significant financial changes, such as acquiring new assets or changes in income levels, may also necessitate adjustments.

Updating your beneficiary designation can involve amending or revoking an existing form. Using tools like pdfFiller can simplify the update process, allowing you to make necessary changes promptly. Regular check-ins on your designations can help maintain clarity and ensure that your assets are directed according to your current wishes.

Frequently asked questions about beneficiary designation forms

A common question revolves around what happens if you don’t complete a beneficiary designation. In such cases, assets may be distributed according to state laws instead of your personal wishes, potentially leading to undesired outcomes. It’s recommended to fill out a designation form to ensure your intentions are upheld.

Many also inquire about having multiple beneficiaries. Yes, you can list multiple primary and contingent beneficiaries. However, it's essential to clearly specify the distribution percentages or shares to prevent any ambiguity over asset division. Furthermore, understanding how your beneficiary designation will be enforced through the legal system can help ensure all parties adhere to your directives.

Resources for further assistance

When it comes to completing and managing beneficiary designation forms, seeking professional guidance can be invaluable. Consulting with financial advisors or estate planners can provide clarity on your individual needs and the implications of your designations. They can help you navigate complex situations, ensuring your choices align with your overall estate planning strategy.

Beyond expert help, leveraging useful tools and software, such as those available on pdfFiller, can enhance your experience. Interactive tools for creating and managing forms provide a simplified, efficient approach to handling your estate planning documents. Access to a range of additional templates can also assist users in staying organized and thorough in their planning.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my beneficiary designation form in Gmail?

How do I make changes in beneficiary designation form?

How can I edit beneficiary designation form on a smartphone?

What is beneficiary designation form?

Who is required to file beneficiary designation form?

How to fill out beneficiary designation form?

What is the purpose of beneficiary designation form?

What information must be reported on beneficiary designation form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.