Get the free Financial Assistance Application

Get, Create, Make and Sign financial assistance application

How to edit financial assistance application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial assistance application

How to fill out financial assistance application

Who needs financial assistance application?

Financial Assistance Application Form - How-to Guide

Understanding financial assistance options

Financial assistance includes a variety of programs designed to provide monetary help to individuals and families in need. These programs can help with costs related to education, healthcare, and living expenses, fostering a supportive environment for those facing financial challenges.

There are several types of financial assistance programs available, each catering to specific needs and circumstances. Understanding these can significantly enhance your chances of securing help when needed.

Determining your eligibility for financial assistance

Determining your eligibility for financial assistance is crucial to applying successfully. Generally, the eligibility criteria vary depending on the type of program.

General eligibility criteria often include aspects such as income levels, family size, and sometimes demographic factors or special circumstances.

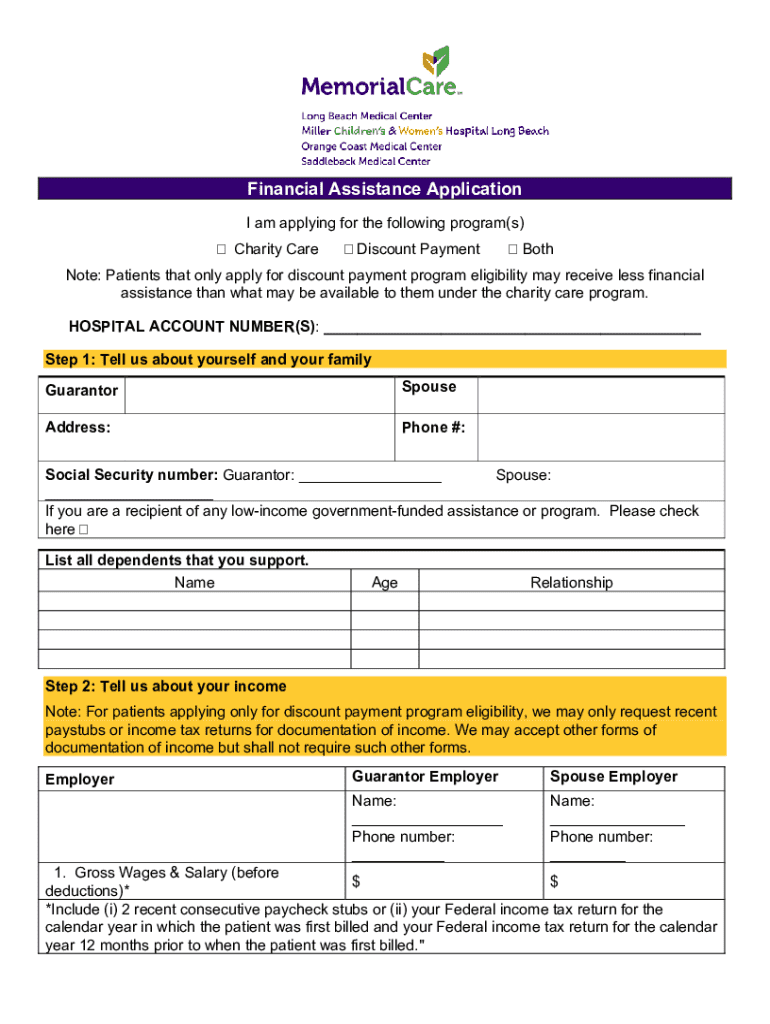

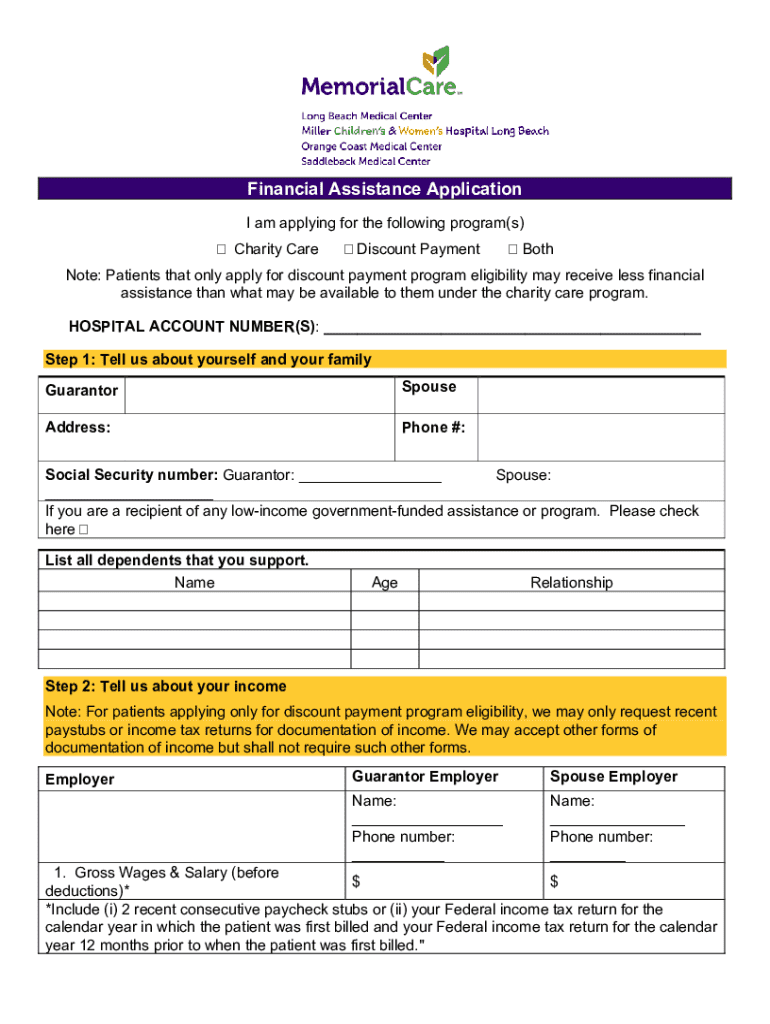

Gathering required documentation

Before you start filling out a financial assistance application form, gathering all the necessary documentation is critical. Proper preparation can drastically improve your chances of success.

Essential documents typically include proof of income, identification documents, and any additional supporting materials that may be relevant.

Once you have gathered your documents, it’s important to prepare them for submission. Here are some tips to help you organize and streamline your application.

Filling out the financial assistance application form

Successfully completing the financial assistance application form is one of the most critical steps in securing aid. It involves several sections that need your careful attention.

A standard application typically consists of personal information, financial details, and additional questions or statements that help clarify your situation.

While filling out the form, be mindful of common mistakes that can lead to delays in processing.

Utilizing tools like pdfFiller can streamline the filling process by providing interactive fields and auto-save features, ensuring you don’t lose progress.

Editing, signing, and submitting your application

After completing your application, you will need to sign and submit it. Using pdfFiller simplifies this process significantly.

To sign your application electronically with pdfFiller, follow the prompts to add your digital signature, making sure it complies with legal standards.

Tracking the status of your application

Once your application has been submitted, it is important to monitor its status. Many organizations provide ways to follow up on your application, which can vary from program to program.

You can typically expect a processing time of anywhere from a few weeks to several months, depending on the program.

Responding to financial assistance decisions

After you receive a notification regarding your financial assistance application, it’s imperative to respond appropriately, whether you are approved or denied.

If your application is approved, make sure to thoroughly understand your financial assistance package, including any terms and conditions.

Using pdfFiller tools and resources

pdfFiller offers an array of tools specifically designed to facilitate financial assistance applications. Leveraging these features can significantly simplify your experience.

With document templates tailored to various assistance programs, you can save time and ensure compliance.

Best practices for managing your financial documents

Managing your financial documents effectively can prevent disruptions when applying for assistance. Keeping well-organized records can make the whole process smoother.

Here are some best practices for ongoing financial document management.

Engaging with financial assistance organizations

Building relationships with financial assistance organizations can provide you with valuable resources and information. Connecting with local programs might open up further opportunities for support.

Finding local assistance programs requires proactive research and outreach.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send financial assistance application for eSignature?

How do I complete financial assistance application online?

Can I edit financial assistance application on an Android device?

What is financial assistance application?

Who is required to file financial assistance application?

How to fill out financial assistance application?

What is the purpose of financial assistance application?

What information must be reported on financial assistance application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.