Get the free Campaign Finance Receipts & Expenditures Report

Get, Create, Make and Sign campaign finance receipts expenditures

Editing campaign finance receipts expenditures online

Uncompromising security for your PDF editing and eSignature needs

How to fill out campaign finance receipts expenditures

How to fill out campaign finance receipts expenditures

Who needs campaign finance receipts expenditures?

Understanding the Campaign Finance Receipts and Expenditures Form

Understanding the campaign finance receipts and expenditures form

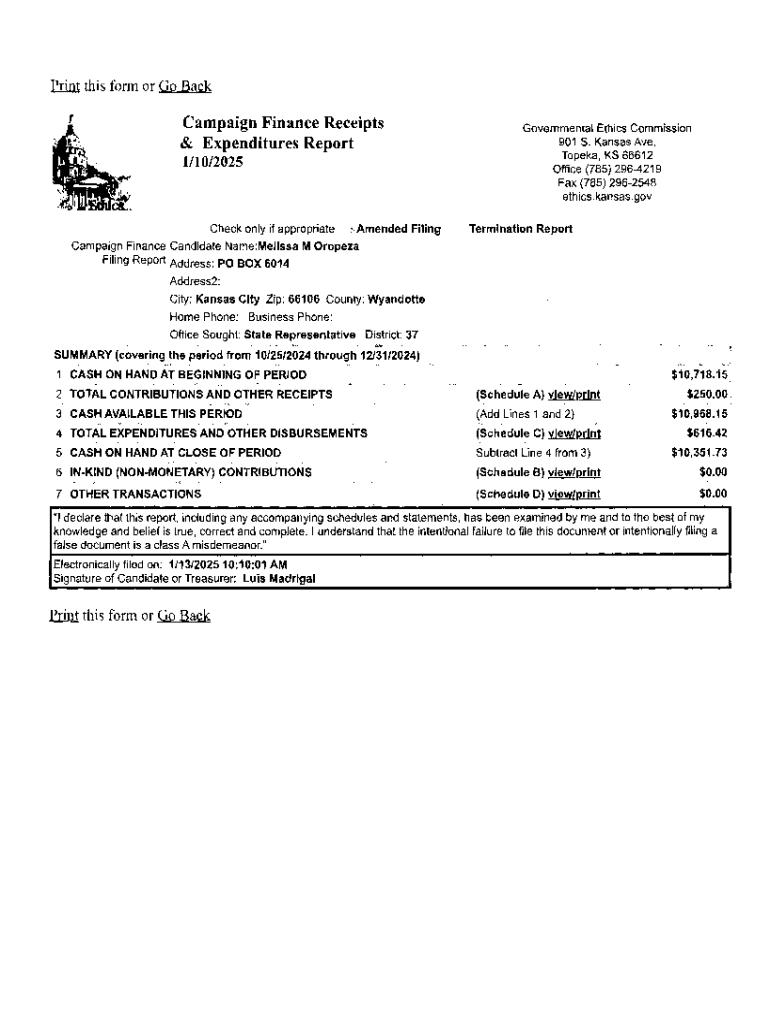

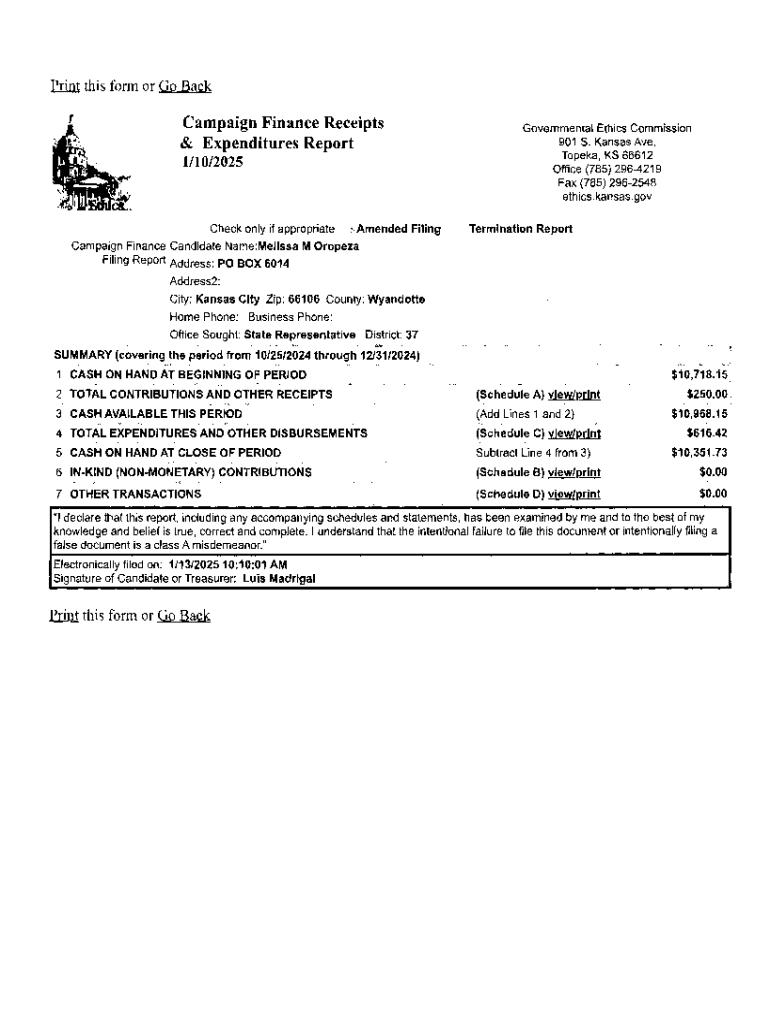

The campaign finance receipts and expenditures form is a crucial tool for political candidates and organizations to report their financial activities during an election cycle. This form tracks the money received (receipts) and spent (expenditures) to ensure transparency and compliance with legal obligations. With the increasing complexity of campaign finance laws, understanding how to accurately fill out this form is essential for anyone involved in a political campaign. Properly maintaining and reporting campaign finance data is not just about avoiding legal repercussions; it also builds trust with voters and supporters.

Legal requirements for campaign finance vary by state, but there are common federal regulations that candidates must abide by, such as the Federal Election Commission (FEC) rules. Key deadlines for submitting these reports can vary, and failure to comply can lead to severe penalties. Understanding these requirements is the first step towards effective campaign finance management.

Essential components of the form

The campaign finance receipts and expenditures form includes detailed sections for documenting both income and expenses. In the receipts section, candidates must report various types of contributions, including individual donations, corporate sponsorships, and in-kind contributions such as goods and services. It is vital to gather proper documentation for each contribution type — for instance, individual contributions often require donor information and contribution limits to be adhered to.

The expenditures section requires categorization of spending. Common categories include advertising, operational costs, staff payments, and event expenses. Accurate tracking of these expenditures includes gathering receipts, invoices, and contracts, as each must be documented to substantiate the claims made on the form. By doing so, candidates can provide a transparent overview of their financial activities to both regulators and the electorate.

Step-by-step guide to filling out the form

Filling out the campaign finance receipts and expenditures form may seem daunting, but breaking it down into manageable steps makes the process smoother. The first step is to gather all necessary documentation related to both receipts and expenditures. This may include bank statements, fund-raising reports, and invoices. Organizing this information in advance is vital for ensuring an efficient completion of the form.

Next, focus on the receipts section. Report each source of income clearly, starting with individual contributions. Record the donor’s name, address, the amount donated, and the date of contribution. For larger donations, it's wise to double-check the contribution limits enforced by your state or the FEC to avoid any regulatory issues. Finally, complete the expenditures section by itemizing each expense. Insert details such as the amount spent, the purpose of the expense, and the vendor if applicable to maintain transparency.

Tools for organizing and managing campaign finance data

Using digital tools can greatly enhance the efficiency of managing campaign finance data. Platforms like pdfFiller offer features that allow users to easily edit, sign, and collaborate on the campaign finance receipts and expenditures form. This level of accessibility means that multiple team members can work on the form simultaneously, leading to better organization and data accuracy. Moreover, cloud-based storage solutions enable seamless access to documents from anywhere, making it easier to stay up to date.

Additionally, interactive tools help track receipts and expenditures in real-time. Using integrated spreadsheets can simplify data entry and create easy-to-read summaries for stakeholders or campaign heads. Such tools foster collaboration within campaign teams, allowing for real-time updates and discussions.

Common challenges and solutions

Navigating the complexities of campaign finance regulations is a common challenge that candidates face. To address this, it's essential to familiarize yourself with both state and federal laws. Online resources, such as the FEC website, provide comprehensive guides and educational materials that clarify the reporting process. Furthermore, legal consultation should be considered for larger campaigns or those unfamiliar with compliance requirements.

Errors in submission can lead to severe consequences, including penalties or negative media attention. To mitigate this risk, create a checklist before submission to ensure all entries are thorough and correct. If an audit request arises, having well-maintained records will facilitate a smoother review. Best practices include periodically updating your documentation and ensuring continuous engagement with legal advisors.

Best practices for effective campaign finance management

For a successful campaign, maintaining transparency with donors and supporters is paramount. Clearly communicating how funds will be used builds trust and encourages further contributions. It’s recommended to provide regular updates through newsletters or social media about how finances are being managed and allocated.

Additionally, ethical considerations in campaign financing cannot be overlooked. Strategies should be in place to avoid conflicts of interest and adhere to regulations, ensuring that the values promoted align with campaign practices. Consistent documentation and record-keeping should be prioritized, keeping all financial activities in real-time to avoid scrambling before deadlines.

Frequently asked questions (FAQs)

Candidates often have questions about handling contributions and expenditures. For instance, if a late contribution is received, it’s essential to check the reporting cycle; any contributions made close to an election may need to be reported in the next cycle. When managing in-kind contributions, candidates must accurately assess and report the fair market value of these items or services.

Inaccurate reporting can lead to fines and legal issues. Understanding the implications of reporting both accurately and in a timely manner can save campaigns from unforeseen challenges. Regularly reviewing entries and maintaining clear records can go a long way in avoiding these pitfalls.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit campaign finance receipts expenditures online?

How do I fill out campaign finance receipts expenditures using my mobile device?

Can I edit campaign finance receipts expenditures on an Android device?

What is campaign finance receipts expenditures?

Who is required to file campaign finance receipts expenditures?

How to fill out campaign finance receipts expenditures?

What is the purpose of campaign finance receipts expenditures?

What information must be reported on campaign finance receipts expenditures?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.