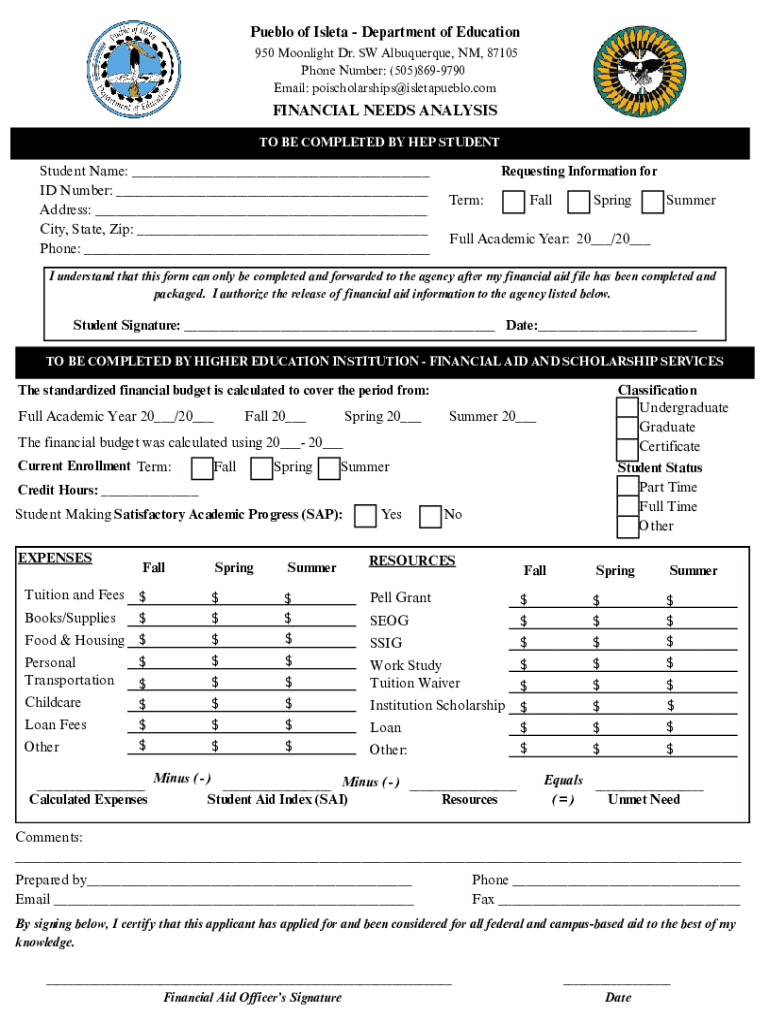

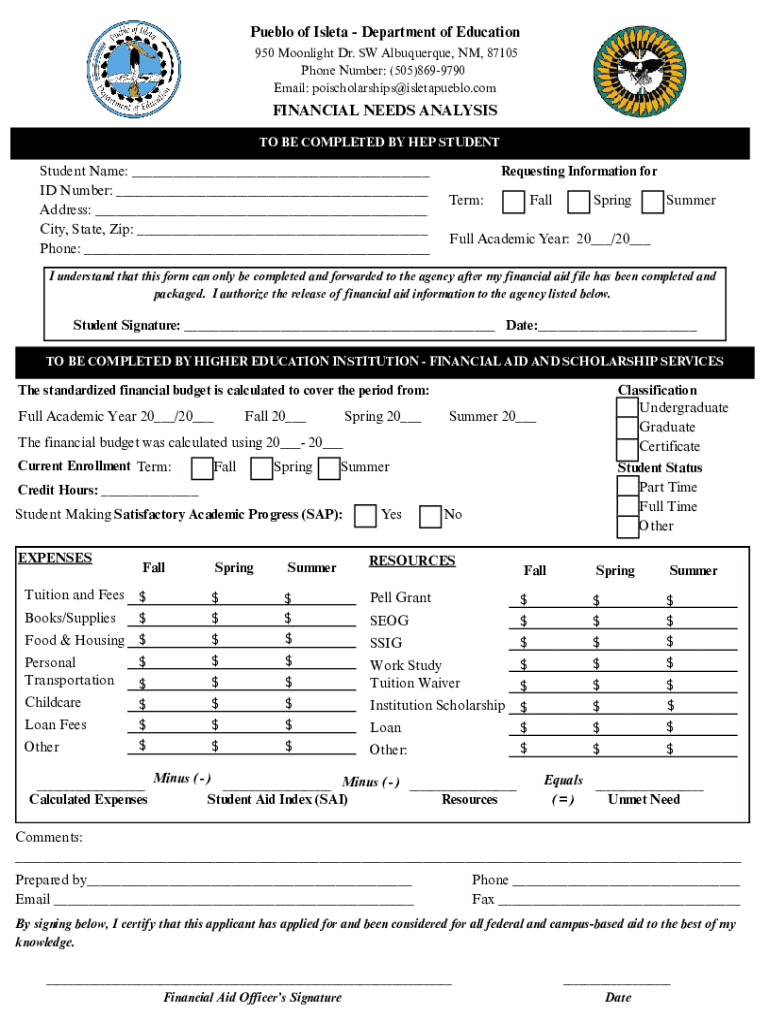

Get the free Financial Needs Analysis

Get, Create, Make and Sign financial needs analysis

Editing financial needs analysis online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial needs analysis

How to fill out financial needs analysis

Who needs financial needs analysis?

A comprehensive guide to understanding and utilizing a financial needs analysis form

Understanding financial needs analysis (FNA)

A financial needs analysis (FNA) serves as an essential tool for individuals and organizations aiming to assess their financial requirements comprehensively. It evaluates the current financial situation, future goals, and necessary steps to bridge the gap. By undertaking an FNA, users can identify areas for improvement, establish financial priorities, and create actionable plans for their financial future.

The importance of a financial needs analysis extends beyond mere assessment; it is a critical step in effective financial planning. For individuals, it helps clarify personal finance objectives — such as saving for retirement or buying a home. For teams and organizations, an FNA aids in strategic decisions regarding budget allocations and investments, ensuring all team members are aligned with common financial goals.

Components of a financial needs analysis

Several core components are typically included in a financial needs analysis. Understanding each of these elements is crucial for effective planning:

Preparing to fill out your financial needs analysis form

Before diving into completing a financial needs analysis form, gathering essential information is foundational to ensure accuracy. This involves collecting all relevant documents and data, including but not limited to income statements, an itemized breakdown of expenses, information about investment portfolios, and details on debt obligations. Having this information at hand will minimize errors and provide a clear picture of your financial landscape.

Assessing your current financial situation is the next critical step. Start by evaluating the sources of your income, distinguishing between straightforward fixed incomes like salaries and variable incomes such as freelance work or bonuses. Identifying both fixed and variable expenses will illuminate spending habits and areas where one might cut back. Ultimately, understanding existing financial obligations provides a framework for future financial planning.

Step-by-step instructions on filling out the financial needs analysis form

To effectively complete your financial needs analysis form on pdfFiller, start by accessing the platform. Here's how:

Accuracy is paramount during this process, so familiarize yourself with common mistakes and ensure that all data you input is correctly validated. Regularly double-check your figures to minimize the risk of errors that could skew results and ultimately affect your financial strategy.

Editing and customizing your financial needs analysis form

After filling out your financial needs analysis form, you may wish to edit or customize it further to better reflect your unique financial landscape. pdfFiller's wide range of editing tools can be instrumental here. With features such as text editing, annotations, and customizable form fields, you have the capability to adapt the form to your specific needs.

Additionally, managing the document efficiently is crucial for easy access and progress tracking. pdfFiller allows users to save their progress, ensuring you can revisit the form later without losing work. Furthermore, the feature permitting the handling of multiple document versions provides flexibility that is invaluable as your financial goals evolve.

eSigning and sharing your financial needs analysis

The digital age has streamlined the signing process through electronic signatures. With pdfFiller, eSigning your financial needs analysis form is a secure and straightforward process. After completing your form, simply follow the step-by-step breakdown provided by the platform to electronically sign your document.

In addition to personal use, sharing your financial needs analysis with advisors or family is crucial for constructive feedback and collaborative planning. pdfFiller offers various sharing options, including email and link-sharing, making it easy to invite others to review your analysis.

Leveraging your financial needs analysis for strategic planning

Once you have your financial needs analysis in hand, the next step involves translating that analysis into actionable financial goals. Identify which aspects of your financial situation require immediate attention and what can be planned for the long term. Setting clear priorities is the key to financial success.

Furthermore, reviewing and adjusting your financial needs analysis over time ensures that your financial strategy remains relevant as circumstances change. Utilizing the tools available on pdfFiller, you can continuously assess and adjust your financial plan, ensuring it reflects any new developments in your financial situation.

Case studies: Real-world applications of financial needs analysis

To better appreciate the application of a financial needs analysis, consider the following case studies. In an individual case, a professional utilized an FNA to define their path towards financial independence, which included strategic investments and expense management to significantly enhance their savings rate.

Conversely, organizations leverage financial needs analyses to develop comprehensive business financial strategies. In one instance, a team used an FNA to understand their financial health better, which helped them allocate resources effectively and pursue strategic investments that led to revenue growth.

Conclusion: Enhancing your financial future with a financial needs analysis

A financial needs analysis is not just a document; it is a roadmap for achieving financial stability and success. By embracing the importance of a detailed FNA, individuals and teams can equip themselves with the insights needed to navigate their financial journeys effectively.

Utilizing pdfFiller, with its robust features for document management, empowers users to create, edit, sign, and share their financial needs analysis seamlessly. This comprehensive platform not only streamlines the documentation process but also enhances collaborative financial planning, paving the way for a more secure financial future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in financial needs analysis?

How do I edit financial needs analysis on an iOS device?

How do I edit financial needs analysis on an Android device?

What is financial needs analysis?

Who is required to file financial needs analysis?

How to fill out financial needs analysis?

What is the purpose of financial needs analysis?

What information must be reported on financial needs analysis?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.