Get the free Brokerage-to-brokerage Referral Agreement

Get, Create, Make and Sign brokerage-to-brokerage referral agreement

How to edit brokerage-to-brokerage referral agreement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out brokerage-to-brokerage referral agreement

How to fill out brokerage-to-brokerage referral agreement

Who needs brokerage-to-brokerage referral agreement?

Brokerage-to-brokerage referral agreement form: A how-to guide

Overview of brokerage-to-brokerage referral agreements

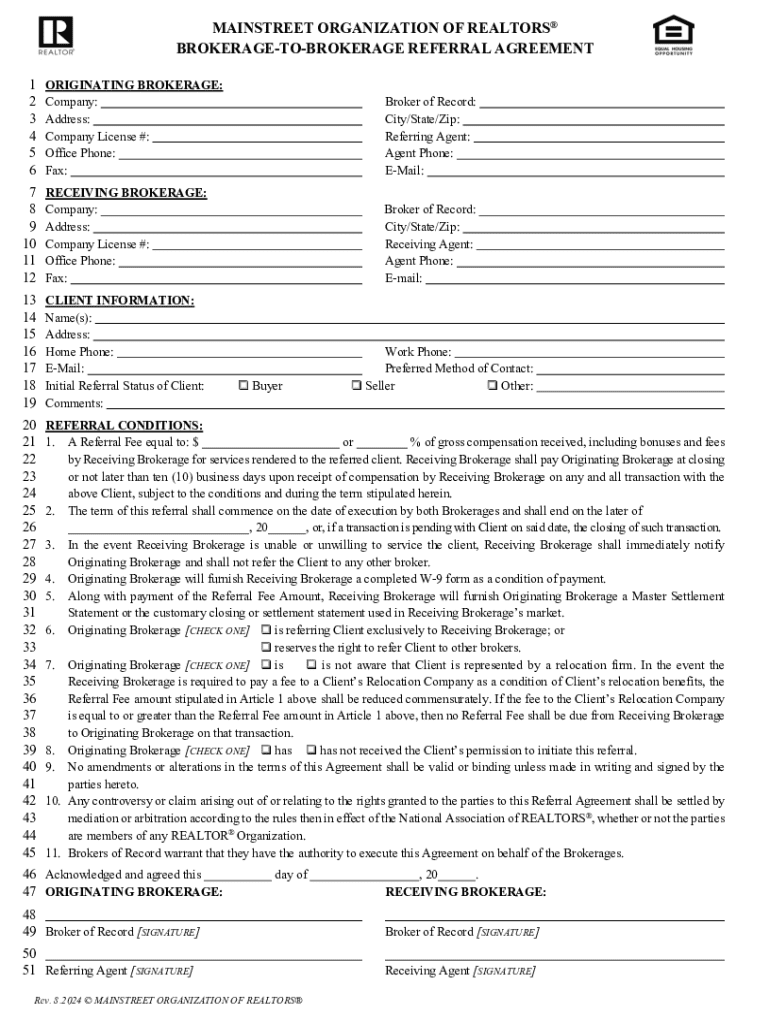

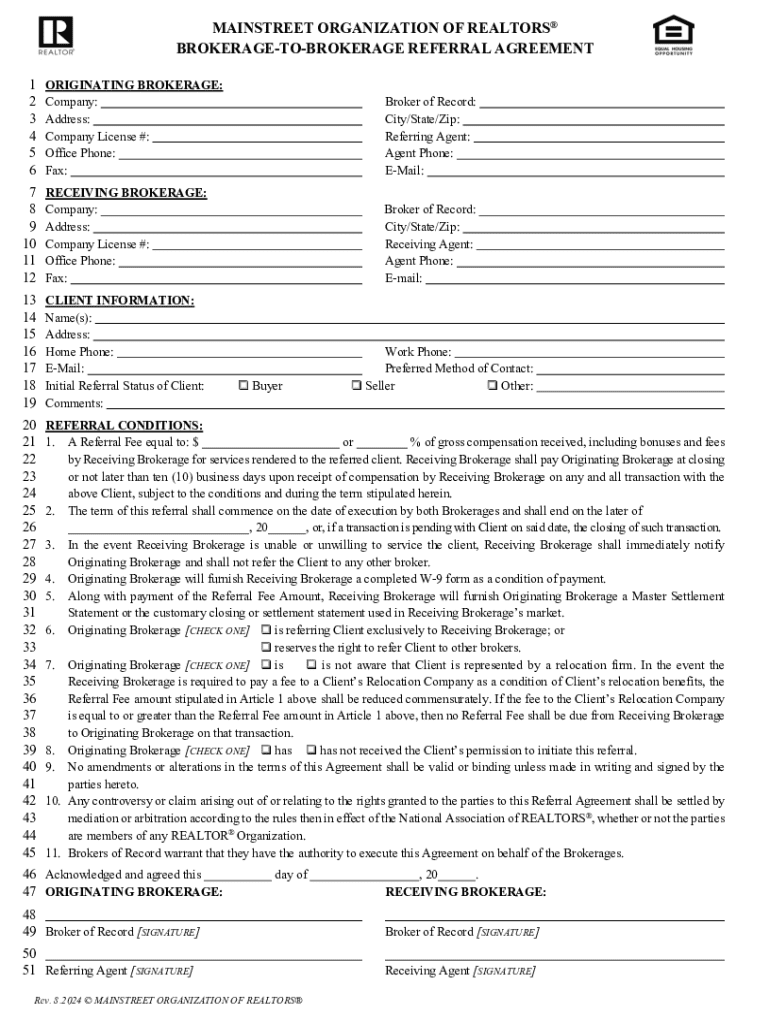

A brokerage-to-brokerage referral agreement is a formalized document that outlines the terms under which one brokerage refers a client to another. This agreement establishes the basis for the relationship between the two brokers, ensuring transparency and mutual understanding about the commission structure and services provided. Referral agreements are crucial in the real estate industry, as they facilitate partnerships and enable brokers to collaboratively serve clients. Brokers often opt for these agreements to expand their network without having to manage each transaction from start to finish.

The primary purpose of a brokerage-to-brokerage referral agreement is to create a win-win situation for both parties involved. By using these agreements, brokers can tap into each other's client bases and expertise, enriching service offerings and enhancing customer satisfaction. With the right referral agreement in place, the process of referring clients becomes streamlined, reducing the complexities that often accompany broker collaborations.

Essential elements of a brokerage-to-brokerage referral agreement form

A well-structured brokerage-to-brokerage referral agreement form contains several key elements that ensure clarity and protection for all parties involved. Understanding these essential components can help brokers draft effective agreements that meet their specific needs. The first element is the identification of the parties involved, where both brokers and the referred client are clearly detailed. This step is vital to confirm who is responsible for the services and to avoid any confusion later on.

Another critical element is the scope of services, which should explicitly outline what each broker will provide. This may include everything from client communication to property showings or negotiations. Furthermore, the referral fee structure is significant; here, brokers need to decide between a percentage-based commission or flat fee, along with clear payment terms. The duration of the agreement is also essential, specifying how long the agreement will remain in effect and under what conditions termination can occur. Clearly addressing these aspects can prevent disputes and misunderstandings between the involved parties.

Step-by-step guide to filling out the referral agreement form

Filling out a brokerage-to-brokerage referral agreement form involves several important steps. First, gather all the required information from both brokers, ensuring that you have accurate details about identities, addresses, and any particular nuances of the transaction. Once the required information is ready, the actual filling out of the form can begin.

Start by identifying the brokers involved, providing full names, contact details, and brokerage affiliations. Next, include all pertinent client and property details, such as the client's name, contact information, and the property address. After that, outline the services each broker will provide, making it clear who handles which responsibilities. Following this, specify the referral fee terms, including the percentages or flat fees involved and any payment conditions. Finally, articulate the duration of the agreement and specify any termination clauses. After filling out the form, review it carefully using a checklist to ensure accuracy and completeness.

Tips for editing and customizing your referral agreement

Editing and customizing your brokerage-to-brokerage referral agreement form can significantly enhance its effectiveness. One useful approach is to utilize PDF editing tools, which allow for straightforward customization of templates. pdfFiller offers a range of editing features that enable brokers to modify agreements easily, ensuring that all relevant information is accurately reflected. These tools are vital in creating a document that aligns with the unique nuances of each referral.

When customizing your agreement, consider tailoring the language to fit the specific transaction closely. Depending on the context of the deal, you may want to include additional clauses that address unique scenarios. Best practices also suggest reviewing similar agreements for inspiration or legal verification to ensure compliance with local regulations. This practice not only strengthens your agreement but also minimizes potential conflicts down the line.

Signing and finalizing the referral agreement

Finalizing a brokerage-to-brokerage referral agreement requires careful attention to the signing process. E-signatures are now a popular choice for many brokers because of their convenience and the security features they offer. Within the pdfFiller platform, brokers can eSign documents securely, ensuring authenticity and legal compliance. The use of electronic signatures not only simplifies the signing process but also speeds up the overall referral transaction.

Furthermore, managing version control is essential in the document lifecycle. By tracking changes made during negotiations or edits, brokers can maintain document integrity and ensure that all parties are on the same page. This practice not only enhances professionalism but also builds trust among brokers involved in the referral agreement.

Common mistakes to avoid when creating a referral agreement

Creating a brokerage-to-brokerage referral agreement can seem straightforward, but there are potential pitfalls. One such mistake is providing incomplete information, which can lead to vague or ambiguous terms that later cause disputes between brokers. It's essential to be thorough in identifying the parties involved and specifying their respective roles to mitigate any potential misunderstandings.

Another common error is misunderstandings regarding fee structures. Brokers must clarify expectations surrounding payment to avoid any unexpected disagreements. Additionally, ignoring local regulations is a frequent misstep. Each state may have unique laws governing brokerage practices, and it is crucial to remain compliant with these regulations to ensure the legality of the referral agreement.

Frequently asked questions (FAQs)

When dealing with brokerage-to-brokerage referral agreements, questions often arise. One typical query is what happens if the agreement is violated. Depending on the specific terms outlined in the agreement, violations usually lead to discussions between parties, and in severe cases, legal actions may be pursued. Another question is whether referral agreements can be modified after they have been signed; the answer is typically yes, provided both parties agree and document the changes appropriately.

Understanding the legal implications of a referral agreement is also vital. These agreements are legally binding contracts, and failing to adhere to the terms can result in financial repercussions or legal disputes. Due diligence in drafting and executing these agreements can help prevent issues and uphold a healthy working relationship between brokers.

Case studies: Successful brokerage referrals

Examining case studies of successful brokerage referrals highlights the effectiveness of well-crafted agreements. For instance, several brokerages have successfully partnered, allowing one to refer clients needing specific services to a niche broker while retaining part of the commission. This mutually beneficial relationship not only expanded their client base but also enhanced overall service quality. Through these partnerships, the brokers have managed to create win-win scenarios where both parties thrive, demonstrating the power and potential of referral agreements.

Learning from these real-world examples offers valuable lessons. Each successful referral story emphasizes the importance of clear communication and thorough understanding of each broker's roles and responsibilities. Notably, having documented agreements in place allowed brokers to build trust and confidence, paving the way for future referrals. These cases illustrate how establishing and maintaining strong relationships among brokers can lead to increased productivity and profitability.

Related forms and templates on pdfFiller

In addition to the brokerage-to-brokerage referral agreement form, brokers may benefit from a variety of other related forms and templates available on pdfFiller. Examples include buyer representation agreements and seller listing contracts, each tailored to the specific needs of real estate transactions. With access to these comparative forms, brokers can efficiently manage their documentation and ensure their agreements are consistent and well-structured.

Finding and accessing these forms on pdfFiller is easy, providing a centralized location for all necessary documentation. Utilizing templates not only saves time but also ensures compliance with industry standards, facilitating a smooth experience for both brokers and clients alike.

Stay informed: Latest updates in brokerage regulations

Staying updated on the latest brokerage regulations is essential for brokers utilizing referral agreements. Ongoing changes in the industry can impact how agreements are structured and enforced, making continuous learning crucial. Brokers should regularly review industry news, trends, and regulations in their regions to remain compliant and effective in their strategies.

Resources such as articles, videos, and webinars are available to help brokers keep informed. By investing time in education and awareness, brokers can navigate the complexities of referral agreements and maintain their competitive edge in a rapidly evolving marketplace.

Feedback section

Engaging with readers through feedback encourages a collaborative spirit among brokers. Comments and suggestions on the guide provide valuable insights and foster a community where knowledge and experience are exchanged.

Additionally, readers are encouraged to share their own experiences related to successful implementations of brokerage-to-brokerage referral agreements. Personal stories can offer unique perspectives, and through sharing, the community grows stronger.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send brokerage-to-brokerage referral agreement for eSignature?

How can I get brokerage-to-brokerage referral agreement?

How do I edit brokerage-to-brokerage referral agreement online?

What is brokerage-to-brokerage referral agreement?

Who is required to file brokerage-to-brokerage referral agreement?

How to fill out brokerage-to-brokerage referral agreement?

What is the purpose of brokerage-to-brokerage referral agreement?

What information must be reported on brokerage-to-brokerage referral agreement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.