Notice of Garnishment Tax Form: A Comprehensive Guide

Understanding notice of garnishment

A notice of garnishment is an essential document in the debt collection process. It is issued to inform a debtor that a creditor has obtained a court order to access their funds or earnings to settle an outstanding debt. This legal measure helps creditors recover what they are owed through direct deductions from the debtor's wages or bank account.

Wage garnishments: This involves deducting a portion of an employee's salary directly from their paycheck, as mandated by the court.

Bank account garnishments: This occurs when a creditor secures a court order to withdraw money directly from a debtor's bank account.

Tax garnishments: These involve the government seizing a portion of tax refunds or wages from the debtor to satisfy tax liabilities.

The purpose of a notice of garnishment is twofold: it serves as a legal warning to debtors about the impending deductions and allows creditors to assert their rights to recovery. This document is crucial in ensuring both parties are aware of the legal proceedings affecting the debtor's finances.

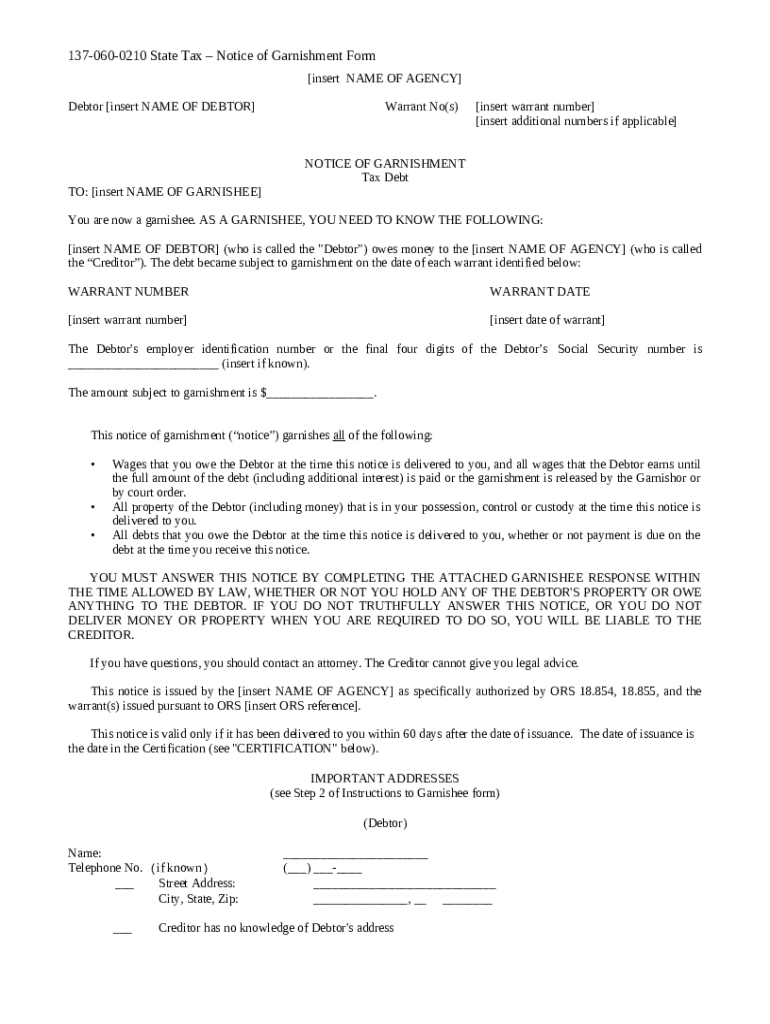

The tax form: An overview

The notice of garnishment tax form comprises key components that facilitate its purpose. These forms typically require essential information that identifies both the debtor and the creditor to ensure transparency and proper acknowledgment of the debt owed.

Required information: This includes personal details of the debtor, such as full name, address, and social security number, paired with the creditor’s details.

Relevant dates: The form must indicate the date the garnishment notice was issued and any applicable deadlines for responses.

Tax authorities generally issue the notice of garnishment. They play a pivotal role in ensuring compliance with tax obligations and enforcing payment mechanisms through garnishment for unpaid taxes. Understanding the origin of these forms is crucial in navigating the garnishment process.

Step-by-step guide to completing the notice of garnishment tax form

Filling out the notice of garnishment tax form can be straightforward if approached methodically. Begin by gathering all necessary information to ensure accuracy. This includes both personal details and specifics regarding the debt clearly stated.

Personal details required: Full name, address, and contact information of the debtor, as well as the creditor.

Debtor and creditor information: It’s crucial to verify names and addresses to avoid legal discrepancies.

When filling out the form, each section must be addressed carefully. A section-by-section breakdown includes identifying the debtor, specifying the type of garnishment, and detailing the amounts owed. Common mistakes to avoid include miswriting names, providing incorrect amounts, and missing signatures, which can delay the process and create legal complications.

Utilizing tools like pdfFiller can simplify this process significantly. With pdfFiller, you can conveniently fill, edit, and sign the notice of garnishment tax form digitally, ensuring that your documents are accurately completed without the hassle of physical paperwork.

Submitting the notice of garnishment tax form

After completing the notice of garnishment tax form, the next step is submission. The location for filing the form is pivotal—certain garnishment notices require local submission, while others may necessitate federal filing depending on the nature of the debt.

Local vs. federal submission: Understand the requirements applicable in your jurisdiction to prevent misfiling.

Deadlines and relevant timelines: Timeliness in submitting the garnishment form is imperative to avoid penalties or dismissal of the garnishment request.

Submitting electronically can expedite the process, with platforms like pdfFiller offering a streamlined method for instant filing. Digital submissions often track submission outcomes, adding another layer of reliability compared to traditional paper submissions.

Managing responses to the notice of garnishment

After submitting the notice of garnishment tax form, various outcomes may arise. One potential scenario is the acceptance of the garnishment by the creditor, which typically leads to immediate action on recovering the owed amounts from the debtor’s funds.

Acceptance of garnishment: This indicates that the court has allowed the garnishment, and the debtor’s funds will be accessed as per the order.

Objections from debtor: If a debtor contests the garnishment, they can file an objection, leading to a review process.

Handling objections effectively is crucial. Those managing garnishments should be prepared to respond swiftly, providing supporting documentation or clarification to help navigate potential disputes.

Understanding your rights and responsibilities

Both creditors and debtors should understand their rights and responsibilities under relevant laws. The Consumer Credit Protection Act provides significant legal protections, limiting how much of a debtor's wages can be garnished. Specifically, federal law limits wage garnishment to 25% of disposable earnings for most debts.

Limits on garnishment amounts: Understanding these limits helps creditors comply with legal requirements while protecting debtors from excessive deductions.

Additional consumer rights: Debtors have specific rights, such as receiving notice of garnishment and the option to challenge wrongful garnishments.

Fostering an awareness of these rights can empower debtors and help them seek resolution if they feel the garnishment is unfair or unjust.

Common questions about the garnishment process

The garnishment process often raises numerous questions. Common inquiries include what happens when the debtor is a minor and what limitations exist on garnishments. Addressing these questions can help demystify the garnishment process.

What if the debtor is a minor? Generally, a parent or guardian must handle a minor's garnishment issues.

What are the limitations on garnishments? Understanding maximum thresholds helps both parties comply with legal standards.

Employers and HR teams also have important roles during garnishment. Best practices for processing garnishment orders include timely response and ensuring accurate deductions from payroll in line with legal stipulations.

Additional tips for using pdfFiller effectively

Using pdfFiller can significantly streamline the process of managing the notice of garnishment tax form. The platform offers a range of features tailored for document management, making it easier to create and edit forms without the traditional hassle often associated with paper documentation.

Features for document management: Use tools for organizing and classifying your documents directly within pdfFiller.

Advanced editing tools available: Options to annotate, highlight, and comment directly on your documents improve collaboration.

Additionally, pdfFiller enables collaboration on document creation, allowing teams to work together seamlessly to generate accurate and compliant forms. Leveraging such capabilities can ensure that no detail is overlooked in the garnishment process.

Case studies and real-world scenarios

Real-world examples often illuminate the garnishment process. Case studies of businesses that successfully navigated garnishment can provide insight into best practices, showcasing how they efficiently complied with legal mandates and mitigated potential conflicts.

Examples of successful garnishment processes: Detail scenarios where creditors effectively recovered debts through garnishment.

Learning from mistakes: Pitfalls to avoid include failure to provide adequate notice or incorrect filings that can lead to legal challenges.

By analyzing these case studies, both creditors and debtors can understand the potential challenges and strategies for successful resolution in garnishment situations.

Continuing education and resources

Continued education on the garnishment process and related financial management practices can bolster knowledge and compliance for all parties involved. Upcoming workshops and webinars often address the complexities associated with garnishments, providing individuals and organizations with essential insights to navigate them effectively.

Upcoming workshops and webinars on garnishment: Pursue opportunities for learning to stay updated on the topic.

Online courses on tax compliance and document management: These resources empower users to adeptly manage garnishment-related documentation.

Fostering a culture of education around these topics can significantly enhance understanding and management of the notice of garnishment tax form, making processes smoother for everyone involved.