Get the free Bulletin 174. Statistics of Churches. PresbyterianPresbyterian in the United States ...

Get, Create, Make and Sign bulletin 174 statistics of

Editing bulletin 174 statistics of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out bulletin 174 statistics of

How to fill out bulletin 174 statistics of

Who needs bulletin 174 statistics of?

Bulletin 174 Statistics of Form: A Comprehensive Guide

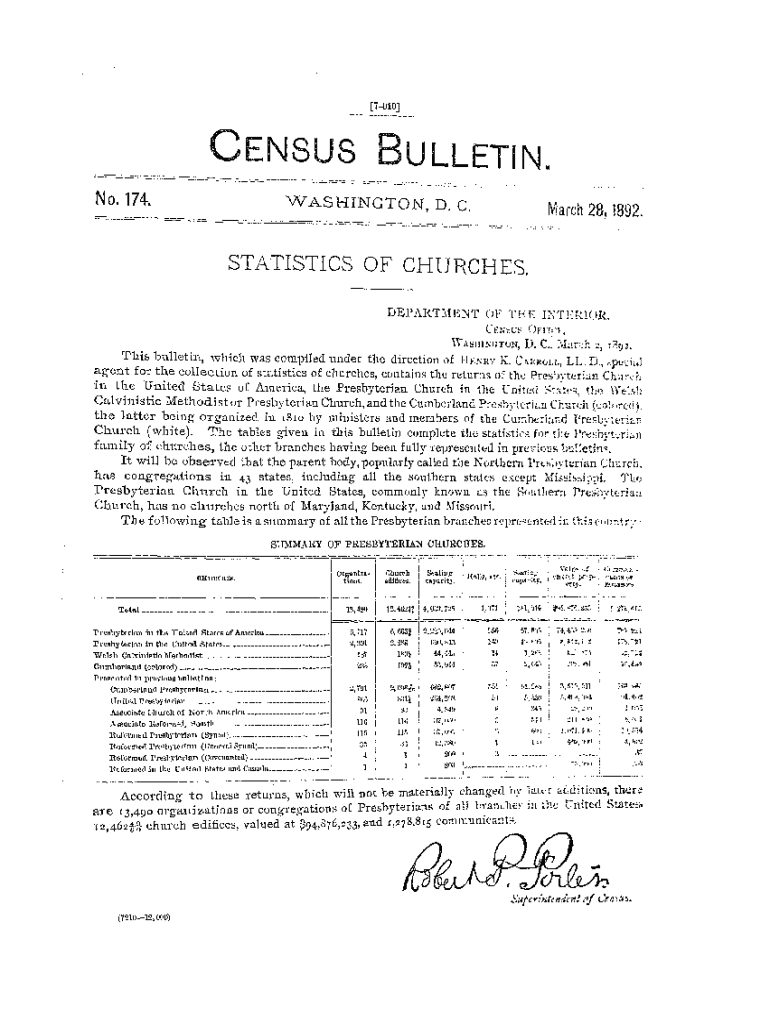

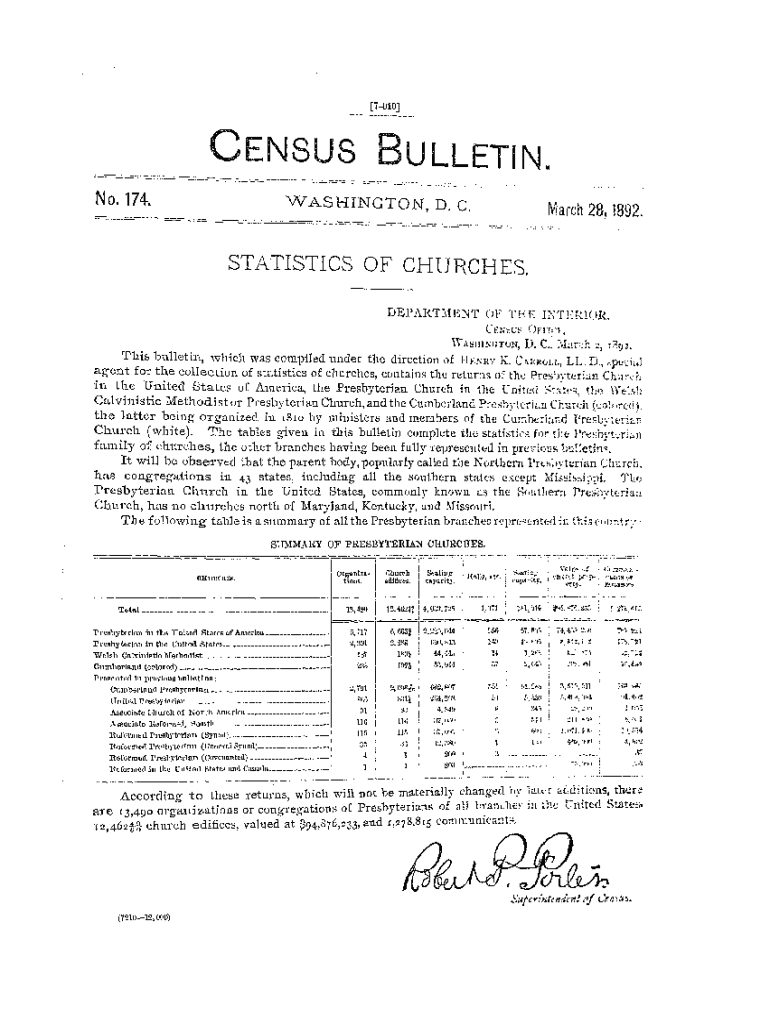

Overview of Bulletin 174

Bulletin 174 serves as a crucial regulatory framework defining how businesses and entities must report political contributions. Established to promote transparency and accountability in political financing, Bulletin 174 outlines essential definitions and guidelines that govern contributions from business entities to political subdivisions.

Accurate reporting in political contributions is vital for upholding democracy and ensuring that elections are not unduly influenced by undisclosed funding. Failure to report appropriately can lead to penalties, diminishing public trust in both political systems and businesses alike.

The target audience for Bulletin 174 insights primarily includes political parties, candidates, business entities involved in political contributions, and compliance officers. Understanding the intricacies of Bulletin 174 ensures informed decisions regarding financial contributions and adherence to legal obligations.

Key elements of Bulletin 174

Bulletin 174 encompasses several key elements that are critical for proper compliance. These elements include definitions of terms, specific reporting requirements, and submission timelines that all relevant entities must adhere to.

Detailed breakdown of sections

Each section of Bulletin 174 plays a distinct role in outlining the responsibilities of reporting entities.

§ 174.1: Business entity

Business entities are pivotal players in the political financing landscape. They can include corporations, partnerships, and limited liability companies. These entities regularly engage in political donations, which facilitate their influence in governmental decisions.

§ 174.2: Awarded nonbid contracts

Nonbid contracts often arise when a government entity directly awards a contract without opening it to competitive bidding. Understanding the relationship between these contracts and political contributions is essential, as it may create a perception of impropriety or favoritism.

§ 174.3: Commonwealth

This section addresses how contributions can impact state governance and overall transparency within the political environment. A robust understanding ensures that entities contribute ethically and responsibly.

§ 174.4: Political subdivision

Political subdivisions refer to local government entities, such as municipalities or counties. The definitions and implications outlined for these subdivisions confirm how they govern and manage contributions at a local level.

§ 174.5: Preceding calendar year

Understanding contributions from the previous year is crucial for compliance, as audits often rely on historical data to verify the accuracy of disclosures.

§ 174.6: Political contribution

This section details the types of contributions covered under Bulletin 174, including cash donations, in-kind contributions, and any limitations or regulations that apply to them.

§ 174.7: Knowledge possessed

Entities must demonstrate a clear understanding of their reporting obligations and the significance of compliance. Knowledge is vital to avoid penalties and maintain public trust.

§ 174.8 and § 174.9: Clauses 1 and 2

These clauses set specific provisions that impact how reporting is conducted, including requirements for disclosures and the necessity of transparent operations within political finance.

§ 174.10: Unemancipated child

This unique clause details how contributions involving minors are treated, ensuring ethical considerations are prioritized in political finance.

Tools for compliance with Bulletin 174

Navigating the complexities of Bulletin 174 can be simplified with the use of digital tools that streamline compliance. Multiple interactive platforms like pdfFiller provide resources tailored specifically for completing and submitting required forms.

User experience with pdfFiller

Users of pdfFiller benefit from a seamless editing experience designed for efficiency and effectiveness. With features that cater to each user's needs, the platform facilitates effortless edits and collaboration on Bulletin 174 forms.

Advanced insights and customization options

Customizing Bulletin 174 forms ensures that reporting meets the specific needs of various users, which can significantly enhance compliance and strategic planning. Tailored data can yield insights into contribution patterns, which can be critical in understanding political influence.

Navigating challenges specific to Bulletin 174

Compliance with Bulletin 174 isn't without its challenges. Entities must be proactive in identifying potential pitfalls and understanding the complexities involved in reporting.

Future considerations and updates to Bulletin 174

As political financing continues to evolve, staying abreast of any updates or changes to Bulletin 174 is paramount. Regularly reviewing the regulatory environment ensures organizations remain compliant and informed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit bulletin 174 statistics of from Google Drive?

How can I send bulletin 174 statistics of to be eSigned by others?

How do I edit bulletin 174 statistics of online?

What is bulletin 174 statistics of?

Who is required to file bulletin 174 statistics of?

How to fill out bulletin 174 statistics of?

What is the purpose of bulletin 174 statistics of?

What information must be reported on bulletin 174 statistics of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.