Get the free Form 990-pf

Get, Create, Make and Sign form 990-pf

How to edit form 990-pf online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990-pf

How to fill out form 990-pf

Who needs form 990-pf?

Comprehensive Guide to Form 990-PF Form

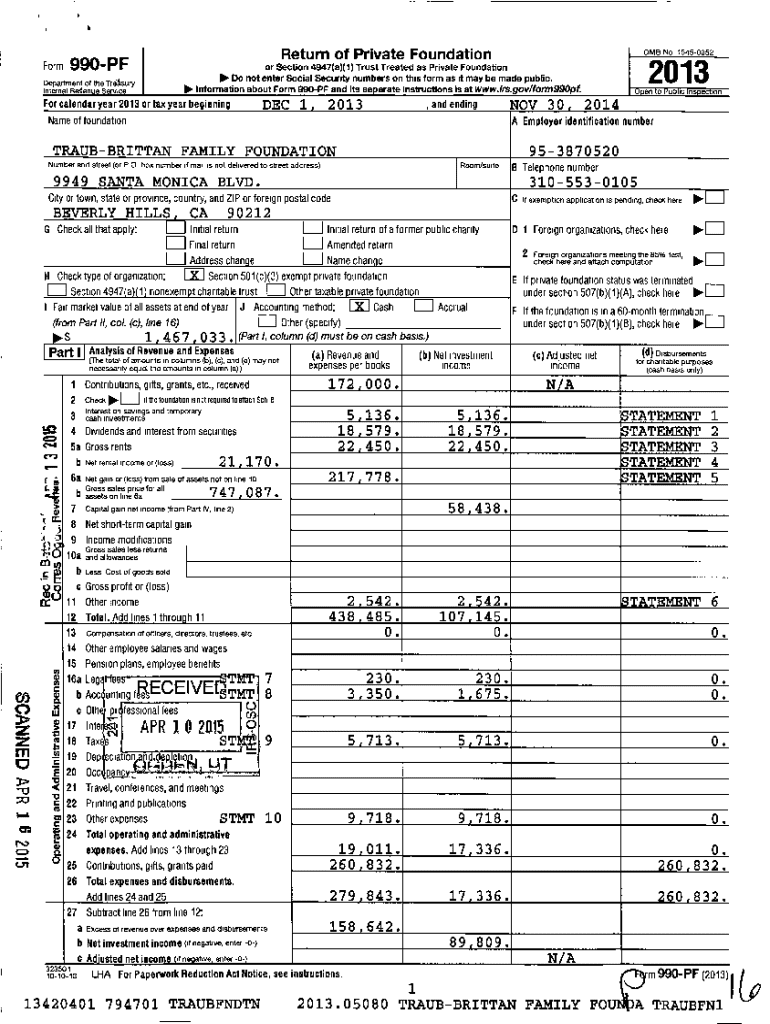

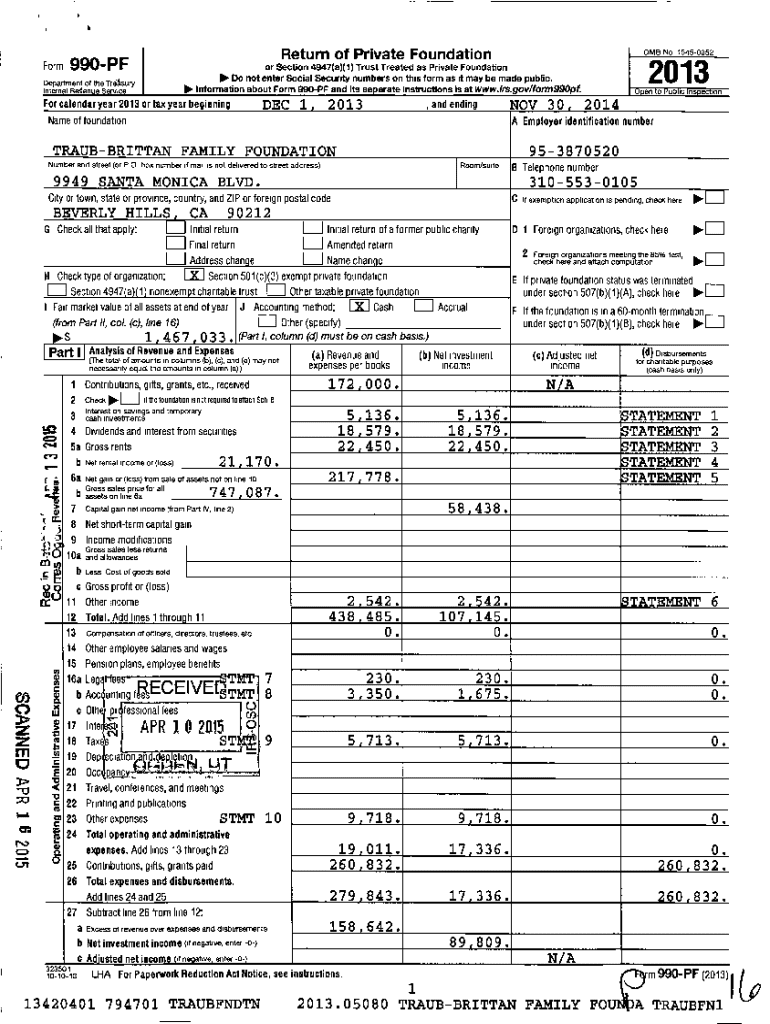

What is Form 990-PF?

Form 990-PF is a crucial document used by private foundations in the United States to report their financial activities and ensure compliance with IRS regulations. This form aids in maintaining transparency regarding the foundation's operations, funding sources, and distributions to charitable entities.

Filing Form 990-PF is not merely a formality; it serves several important purposes. Firstly, it allows the IRS to monitor that private foundations adhere to the required spending and investment practices. Secondly, it provides public insight into the financial health and charitable activities of these organizations, promoting accountability and trust.

Who must file Form 990-PF?

Any private foundation, regardless of revenue generation, must file Form 990-PF annually. This requirement applies to all foundations classified under Section 501(c)(3) of the Internal Revenue Code that primarily make grants for charitable purposes.

While most private foundations must adhere to this filing requirement, certain circumstances might exempt them. For instance, if a foundation is a new organization and has gross receipts of less than $50,000, it can file a simpler version called Form 990-N (e-Postcard) instead.

Key dates and deadlines

The deadline for filing Form 990-PF is typically the 15th day of the 5th month after the close of the foundation's accounting year. For most foundations operating on a calendar year, this means the deadline is May 15. If this date falls on a weekend or holiday, the due date is the next business day.

If additional time is needed, foundations can file for an extension using Form 8868, which grants an automatic six-month extension. However, it is important to note that this extension is merely for the form's submission and does not extend any payment deadlines.

Breakdown of Form 990-PF

Form 990-PF is divided into several key sections, each designed to provide detailed insights into the foundation's operations. From financial data to governance information, every section plays a critical role in depicting the organization's functioning.

The primary sections include an overview of financial data, governance details, program service accomplishments, and information related to contributions and grants. Additionally, the Schedule B is crucial as it outlines donor information, ensuring that valuable details are disclosed accurately.

Additional requirements for Form 990-PF

Beyond simply filling out Form 990-PF, foundations must also adhere to several additional requirements. These include providing supporting documentation that verifies the accuracy of reported figures, ensuring compliance with local and state regulations, and fulfilling federally mandated disclosures that may pertain to specific financial activities.

It's essential that foundations maintain accurate records and gather necessary documentation to support their filings, as failure to do so can lead to penalties and increased scrutiny from the IRS.

Common pitfalls and best practices

Filing Form 990-PF can be a complex process, and many foundations often encounter common pitfalls. Frequent errors include misreporting financial data, neglecting to disclose vital information, or failing to adhere to deadlines. To avoid these mistakes, it’s crucial to maintain thorough records and adhere to best practices in documenting every detail.

Additionally, developing a timeline can significantly improve the accuracy of your filings. Start preparing earlier in the year to collect the necessary data, and allow ample time for reviews and adjustments to ensure compliance with IRS regulations.

E-filing vs. paper filing: What you need to know

When considering how to submit Form 990-PF, one must weigh the benefits of e-filing versus traditional paper filing. E-filing has several advantages, including faster processing times, automatic calculations that minimize the risk of errors, and confirmation of submission from the IRS, which is essential for keeping your records up to date.

For those opting to e-file, platforms like pdfFiller provide user-friendly tools for seamless electronic submission. Understanding these tools can greatly enhance the filing experience, making it easier for users to manage their form efficiently.

FAQs about Form 990-PF

Knowing the intricacies of Form 990-PF is essential for any private foundation. Common questions often arise regarding the filing process. For instance, many might wonder, 'What information is required to file Form 990-PF?' A comprehensive understanding is key, as the data needed goes beyond basic financials, encompassing governance and operational insights as well.

Another frequently asked question is whether Form 990 or 990-EZ can be used instead of Form 990-PF. Given that they serve distinct purposes for different entity types, it's paramount for private foundations to file the correct form to adhere to IRS expectations and regulations.

Interactive tools and resources

Modern technology offers various interactive tools that can greatly assist private foundations in navigating the complexities of Form 990-PF filing. For instance, a tax year and form selection tool can help identify the correct forms based on specific circumstances, while an estimated cost calculator can provide insights into potential expenses associated with e-filing.

Moreover, built-in audit check features can help ensure that all requirements are met, thus reducing the likelihood of mistakes in your submission. For those seeking further assistance, smart AI tools can guide users through filling out forms, simplifying the process significantly.

How to get started with pdfFiller for filing Form 990-PF

Getting started with pdfFiller to file Form 990-PF is straightforward. First, set up an account on the platform, ensuring that you have access to all necessary tools for document management and e-filing. With an intuitive interface, users can quickly navigate to the Form 990-PF template, allowing for seamless preparation and submission.

Once your account is set up, follow step-by-step instructions to utilize pdfFiller's features effectively. This includes collaborating with your team by sharing documents and assigning tasks. Additionally, secure e-signing processes are integrated within the platform, ensuring that all signatures are authenticated and reliable.

Client management and support

For foundations tackling the complexities of Form 990-PF, accessible support is vital. pdfFiller offers robust client management solutions that help organizations streamline their filing process. Support teams are available to assist users with questions and issues that may arise during the submission process.

Furthermore, pdfFiller enhances foundation management through its elegant design and user-friendly interface. Many organizations have shared positive testimonials about their experiences, highlighting efficiency improvements and ease of use for nonprofit management.

Enhancing your tax practice with pdfFiller

For tax practitioners serving private foundations, pdfFiller equips you with features designed specifically for nonprofit organizations. By utilizing the platform, practitioners can facilitate faster and more efficient filings of Form 990-PF, allowing their clients to maintain compliance with IRS obligations.

In addition, the software's capabilities can help tax professionals maximize savings through repeat filings, making it a cost-effective solution for managing multiple client forms. This software not only optimizes the filing process but also enhances the overall client experience.

Related forms and resources

Understanding the landscape of IRS forms related to nonprofits is crucial. While Form 990-PF serves private foundations, other IRS forms like Form 990, Form 990-EZ, and Form 990-T are also essential for different organization types. Each serves a distinct purpose and must be filed according to the organization’s structure and revenue.

Additionally, supporting schedules such as Schedule A, Schedule B, Schedule C, and Schedule D can provide supplementary information that enhances the primary form, ensuring full compliance with filing requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 990-pf from Google Drive?

Can I create an electronic signature for the form 990-pf in Chrome?

Can I create an eSignature for the form 990-pf in Gmail?

What is form 990-pf?

Who is required to file form 990-pf?

How to fill out form 990-pf?

What is the purpose of form 990-pf?

What information must be reported on form 990-pf?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.