Get the free Estimating Your Allowance - calpers ca

Show details

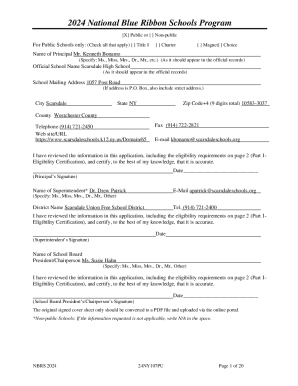

A Guide to Your CalPERSPartial Service Retirements page intentionally left blank to facilitate double-sided printing. TABLE OF CONTENTS

Introduction. . . . . . . . . . . . . . . . . . . . . . . .

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign estimating your allowance

Edit your estimating your allowance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your estimating your allowance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit estimating your allowance online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit estimating your allowance. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out estimating your allowance

How to Fill Out Estimating Your Allowance:

01

Gather all financial information: Start by collecting all relevant financial information, including your income, expenses, savings, and any additional sources of money. This will give you a clear picture of your overall financial situation.

02

Assess your regular income: Calculate your regular income, such as your salary, allowances, or any other consistent sources of money. Add up the amounts and note them down.

03

Determine your fixed expenses: Identify your fixed expenses, which are the recurring costs you need to pay every month, such as rent/mortgage, utilities, insurance, loan payments, and subscriptions. Write down these expenses and their corresponding amounts.

04

Calculate your variable expenses: Next, estimate your variable expenses, which are the costs that may fluctuate from month to month, such as groceries, entertainment, dining out, transportation, and other discretionary spending. Look at your past spending patterns to get an idea of these expenses and write them down.

05

Consider irregular or one-time expenses: Don't forget to account for irregular or one-time expenses that may occur throughout the year, such as annual subscriptions, vacations, gifts, or major purchases. Estimate the amounts and divide them by the number of months to determine their monthly impact.

06

Subtract your expenses from your income: Subtract your total expenses from your total income to determine your remaining allowance. This will give you an idea of how much money you have left after all the necessary expenses are taken care of.

07

Adjust your spending: If your remaining allowance is lower than expected or if you want to increase your savings, you may need to make adjustments to your spending. Look for areas where you can cut back without sacrificing your essential needs.

08

Monitor and review regularly: Estimating your allowance is an ongoing process. It's crucial to monitor your spending, track your expenses, and regularly review your financial situation to ensure you stay on track. Make adjustments as needed to meet your financial goals.

Who needs estimating your allowance?

01

Individuals looking to manage their personal finances: Estimating your allowance is essential for individuals who want to gain better control over their personal finances. It helps in understanding your financial standing, identifying areas of improvement, and making informed financial decisions.

02

Students and young adults: Estimating your allowance can be particularly beneficial for students and young adults who are starting to manage their own finances. It helps in budgeting, prioritizing spending, and preparing for financial independence.

03

Families and households: Families or households seeking to create a budget or improve their financial situation can greatly benefit from estimating their allowance. It promotes transparency, facilitates communication about money matters, and enables better financial planning.

04

Individuals with irregular income: People who have irregular income, such as freelancers, commission-based professionals, or entrepreneurs, can use estimating their allowance to ensure they meet their financial obligations and have a clear understanding of their financial stability.

Remember, estimating your allowance is a personalized process, and the steps may vary depending on individual circumstances and financial goals. It's important to adapt these guidelines to suit your specific needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit estimating your allowance from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your estimating your allowance into a dynamic fillable form that you can manage and eSign from anywhere.

How can I send estimating your allowance to be eSigned by others?

Once your estimating your allowance is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How can I fill out estimating your allowance on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your estimating your allowance from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is estimating your allowance?

Estimating your allowance is the process of predicting and calculating the amount of money allocated for a particular purpose.

Who is required to file estimating your allowance?

Individuals or organizations who need to plan and budget their finances may be required to file estimating their allowance.

How to fill out estimating your allowance?

To fill out estimating your allowance, you must gather financial information, make projections, and allocate funds accordingly.

What is the purpose of estimating your allowance?

The purpose of estimating your allowance is to plan and allocate financial resources effectively and efficiently.

What information must be reported on estimating your allowance?

Information such as income, expenses, goals, and timelines must be reported on estimating your allowance.

Fill out your estimating your allowance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Estimating Your Allowance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.