Get the free pdffiller

Get, Create, Make and Sign pdffiller form

How to edit pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

How to fill out 2025 colorado estimated income

Who needs 2025 colorado estimated income?

A Complete Guide to the 2025 Colorado Estimated Income Form

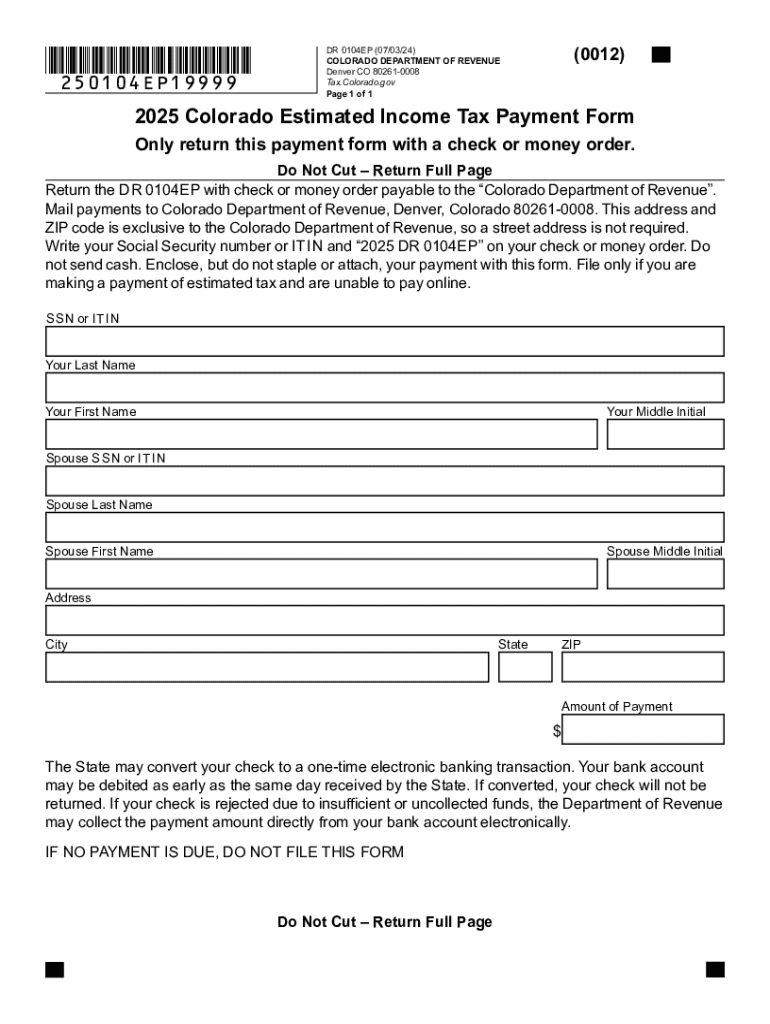

Overview of the 2025 Colorado Estimated Income Tax Form

The 2025 Colorado Estimated Income Tax Form is a crucial document for taxpayers who anticipate owing income tax throughout the fiscal year. This form serves a dual purpose: it enables individuals and businesses to report income taxes that will be paid quarterly and helps align cash flow management with anticipated earnings. Filing the estimated income tax form is essential to avoid substantial penalties and ensure compliance with state tax laws.

Key features of the 2025 Colorado Estimated Income Tax Form include spaces for personal identification, projected income, and deductions. The simplicity in not just filing but also in adjusting estimates is designed to help taxpayers maintain transparency with the Colorado Department of Revenue. Understanding this form’s nuances is critical for navigating Colorado’s tax landscape effectively.

Who needs to use the form?

Both individuals and businesses are required to complete the 2025 Colorado Estimated Income Tax Form if they expect to owe state income taxes of $1,000 or more. Individual taxpayers mainly include self-employed individuals and those with other substantial income sources, such as rental properties or investments. Corporations, partnerships, and other entities also file if expected income meets prescribed thresholds.

Understanding estimated taxes in Colorado

Estimated taxes refer to periodic payments made toward your anticipated tax liability for the year. Unlike traditional withholding adjustments from regular employment, estimated taxes cater to income sources that do not have automatic withholding, such as freelance earnings or rental income. Essentially, they are your proactive step towards fulfilling state obligations rather than waiting until tax season.

Paying estimated taxes helps taxpayers avoid underpayment penalties, which can add up significantly over the years. Moreover, managing estimated taxes effectively can enhance cash flow, allowing taxpayers to maintain a budget aligned with their expected income while meeting fiscal responsibilities. In doing so, they essentially smooth out the tax burden across the year, making planning easier.

How to calculate your estimated taxes

Calculating your estimated taxes involves several steps that assess your current financial situation and projected income. The following is a step-by-step process:

For convenience, online tax calculators are available to aid in accurately estimating your tax obligations. Various worksheet resources can also guide you throughout the calculation process, making the task less daunting.

Filing requirements for the 2025 form

Filing deadlines for the 2025 Colorado Estimated Income Tax Form are significant and require adherence to avoid penalties. The quarterly payment dates are usually structured as follows: January 15, April 15, June 15, and September 15 of the tax year.

In unique scenarios, such as for farmers or fishermen, extended deadlines are applicable. Special situations impacting one’s filing obligations—like self-employment or significant investment income—require close attention. If your taxable income exceeds certain thresholds (generally $1,000), you must file an estimated tax form.

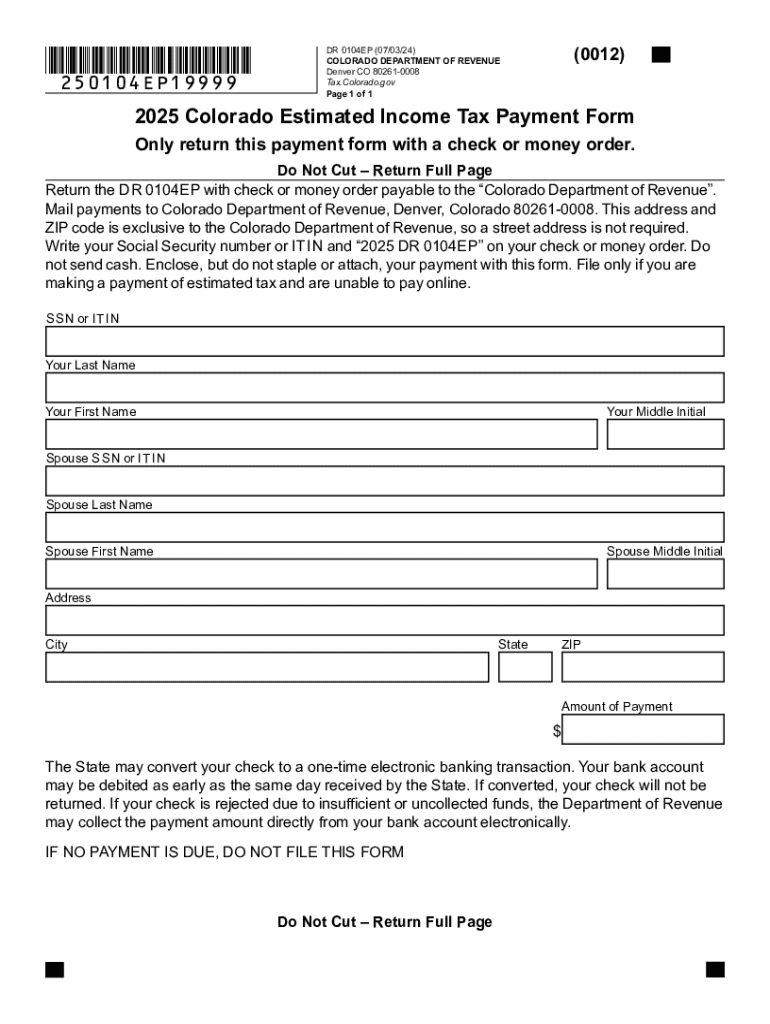

How to fill out the 2025 Colorado estimated income tax form

Filing out the 2025 Colorado Estimated Income Tax Form correctly is pivotal. Here’s a detailed walkthrough of each section:

Common mistakes include incorrect Social Security numbers, failing to report all income accurately, or miscalculating deductions. Diligently reviewing your entries can prevent these errors.

Payment options for estimated taxes

Colorado offers multiple payment options for remitting estimated taxes. Online payment methods, such as using tax software or making a direct payment through the Colorado Department of Revenue Portal, provide convenience and efficiency.

For those who prefer traditional methods, mailing in payments is also an option. Payments should ideally be sent via checks or money orders to ensure proper transaction tracking. Make sure to send them to the correct address provided by the Colorado Department of Revenue in order to avoid processing delays.

Adjusting or amending your estimated tax payments

Life is unpredictable, and income fluctuates; thus, adjustments to your estimated tax payments may be necessary. If you find that your income increases or decreases significantly, it's essential to adjust your payments accordingly. You can estimate new payments using the same method you initially calculated.

In cases of overpaying or underpaying, you might receive a refund or will need to make additional payments. Filing an amended estimated tax form can help correct any discrepancies and align your tax obligations more accurately with actual earnings.

Penalties for late or insufficient payments

Understanding penalties associated with late or insufficient payments can save you money and headaches down the line. If you fail to pay your estimated taxes on time, a penalty may be assessed, typically calculated as a percentage of the unpaid tax. The longer you wait to rectify missed payments, the more you may incur.

Common scenarios leading to penalties include underestimating your income substantially or failing to meet quarterly payment deadlines. To avoid such penalties, it's paramount to stay compliant with your estimated tax responsibilities and address any discrepancies promptly.

Interactive tools and resources available on pdfFiller

pdfFiller offers a suite of interactive tools for the 2025 Colorado Estimated Income Tax Form. Users can access editable PDF features that allow for quick revisions and corrections. The platform’s eSignature options expedite the signing process, paving the way for streamlined submission.

Additionally, pdfFiller helps track and manage your documents conveniently from any location. With these user-centric features, managing your tax paperwork becomes more efficient, ensuring that you are always organized and ready for tax season.

FAQs about the 2025 Colorado estimated income tax form

As taxpayers approach the 2025 tax season, questions often arise concerning the Estimated Income Tax Form. Common concerns include, 'What if I don't owe taxes?' or 'How do I amend my previous estimates?'. It's essential to clarify these issues to enhance understanding of the state tax system.

Addressing myths versus facts surrounding estimated taxes can provide peace of mind. Misunderstandings often lead to unnecessary worry or miscalculated payments. For personalized support, taxpayers are encouraged to seek guidance directly from tax professionals or the Colorado Department of Revenue.

Additional implications of Colorado tax laws

In 2025, several tax law changes may affect estimated tax payments in Colorado. Understanding these updates and their implications becomes central to effective tax planning. Tax legislation is subject to change based on economic fluctuations or shifts in governance, resulting in alterations to income thresholds or deducible items.

Being proactive in understanding these changes can help taxpayers forecast their future estimated tax fees more accurately while ensuring compliance with the law. Awareness of potential legislative shifts also creates room for strategic tax planning, which can greatly benefit your overall financial health.

Exploring your tax planning strategies with pdfFiller

With pdfFiller, interactive tools enhance your ability to optimize tax outcomes effectively. You can collaborate with team members for seamless tax preparation and document management, ensuring that everyone stays on the same page. By leveraging these features, you can work smarter, streamline the filing process, and reduce errors significantly.

Engaging in proactive tax planning, particularly when utilizing pdfFiller’s extensive capabilities, positions you toward financial success and clarity during tax season. Rather than feeling overwhelmed, you can approach the filing process with confidence and accuracy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit pdffiller form from Google Drive?

Can I edit pdffiller form on an Android device?

How do I fill out pdffiller form on an Android device?

What is 2025 colorado estimated income?

Who is required to file 2025 colorado estimated income?

How to fill out 2025 colorado estimated income?

What is the purpose of 2025 colorado estimated income?

What information must be reported on 2025 colorado estimated income?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.