Get the free New Federal Reporting Requirement for Beneficial Ownership Information (boi)

Get, Create, Make and Sign new federal reporting requirement

Editing new federal reporting requirement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new federal reporting requirement

How to fill out new federal reporting requirement

Who needs new federal reporting requirement?

Comprehensive Guide to the New Federal Reporting Requirement Form

Overview of new federal reporting requirements

Understanding the latest federal reporting requirements is vital for businesses and organizations across the United States. The recent introduction of these regulations aims to enhance compliance, ensure transparency, and promote accountability in various sectors. These changes require businesses to adapt their reporting practices, which can significantly influence their operational procedures and financial reporting.

The implementation of these federal reporting requirements is designed to protect public resources and ensure fair play in the market. Companies must now prioritize understanding these requirements to avoid penalties and maintain their reputation. As organizations navigate these regulations, the need for accurate reporting cannot be overstated; a single misstep can lead to compliance issues, affecting financial stability and stakeholder trust.

Key federal reporting requirement forms

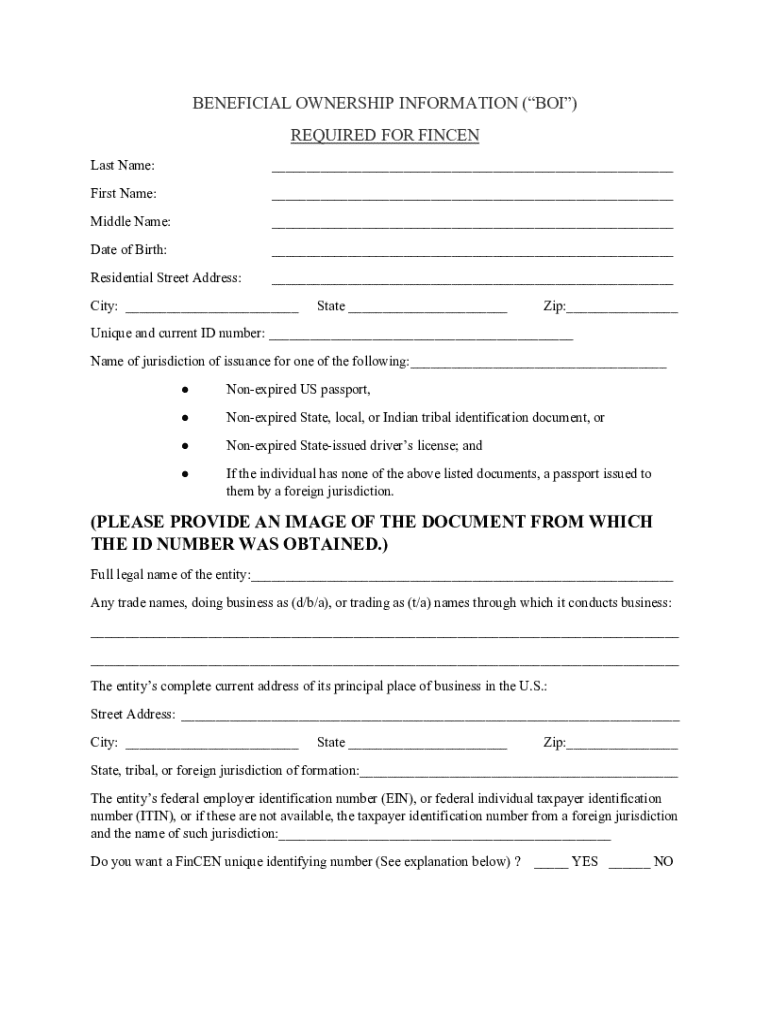

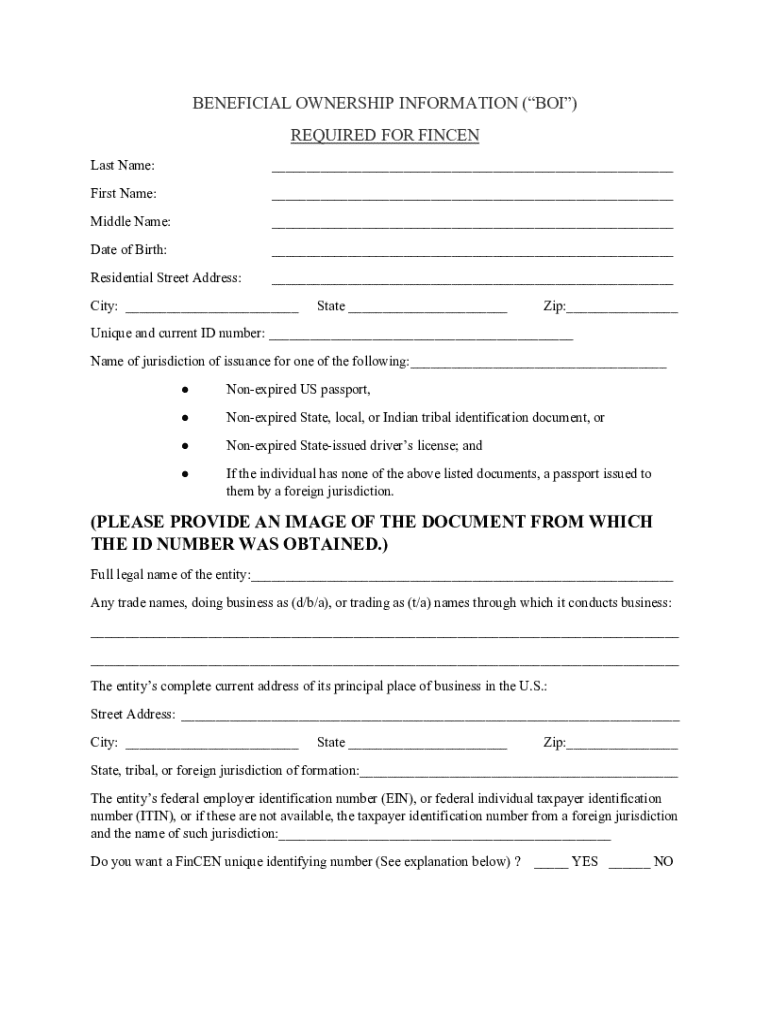

A comprehensive understanding of essential forms mandated by the new federal reporting requirements is the first step towards effective compliance. Below are significant forms that organizations must be familiar with:

Each form serves a distinct purpose and is applicable to specific entities. For instance, while for-profit businesses will primarily concern themselves with Forms 1 and 2, nonprofits need to prioritize Form 3 to comply with federal transparency expectations.

How to fill out the new federal reporting requirement form

Filling out the new federal reporting requirement form can be a straightforward process when broken down into manageable steps. Here's a detailed guide on how to complete these forms effectively.

Tools for effortless form management

Utilizing tools designed for efficient document management can alleviate much of the stress associated with the new federal reporting requirement form. pdfFiller provides various interactive features that cater to both individuals and teams, ensuring an organized approach to compliance.

By employing these tools, users can experience a smoother journey when navigating federal reporting requirements, thereby promoting better compliance outcomes.

Common challenges and solutions

Despite clear guidelines, many users encounter challenges when filling out the new federal reporting requirement forms. Understanding these common pitfalls can help organizations avoid errors and enhance their reporting accuracy.

Moreover, users may have inquiries regarding the new reporting requirements. Addressing frequently asked questions can clarify complex aspects of these regulations, promoting greater compliance.

Additional insights on federal reporting compliance

The role of technology plays a crucial part in meeting the new federal reporting requirements. Cloud-based solutions like pdfFiller not only simplify the process of filling out forms but also provide an efficient, centralized approach to managing documents.

In the coming years, we can expect continuous changes in reporting requirements as regulations evolve. Keeping up-to-date with these changes is essential for compliance and to navigate potential shifts in regulatory landscapes effectively.

User support and resources

pdfFiller understands the importance of reliable customer support. Users can easily access guidance for immediate assistance, resolving any issues they encounter while filling out the federal reporting requirement form.

Moreover, the platform offers a slew of learning resources and guides. These tools are instrumental for users who need further clarification on procedures related to federal reporting compliance.

Stay informed

To stay ahead of the curve regarding federal reporting requirements, subscribing to alerts and updates becomes a key strategy. This ensures that organizations are consistently informed about compliance changes and best practices.

Continual education about federal regulations not only enhances compliance but also arms organizations with the knowledge necessary to adapt their practices as regulations evolve.

Contact and connect with pdfFiller

Engaging with pdfFiller’s community is essential for receiving feedback and suggestions for improvements. Users are encouraged to connect through social media for real-time updates and access to resources that simplify the form-filling process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the new federal reporting requirement form on my smartphone?

Can I edit new federal reporting requirement on an iOS device?

How do I fill out new federal reporting requirement on an Android device?

What is new federal reporting requirement?

Who is required to file new federal reporting requirement?

How to fill out new federal reporting requirement?

What is the purpose of new federal reporting requirement?

What information must be reported on new federal reporting requirement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.