Get the free Application for Individual Life Insurance

Get, Create, Make and Sign application for individual life

How to edit application for individual life online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application for individual life

How to fill out application for individual life

Who needs application for individual life?

Application for Individual Life Form: A Complete Guide

Understanding individual life insurance: A key to financial security

Individual life insurance plays a pivotal role in financial planning by offering a safety net for your loved ones in case of untimely demise. It is a type of insurance that provides a cash payout, referred to as the death benefit, which can support your dependents in maintaining their lifestyle.

The primary types of individual life insurance are Term Life, Whole Life, and Universal Life. Term Life insurance is straightforward, covering specific time frames, while Whole Life insurance offers lifelong coverage and builds cash value over time. Universal Life introduces flexibility in premium payments and death benefit amounts, appealing to policyholders seeking adaptable coverage.

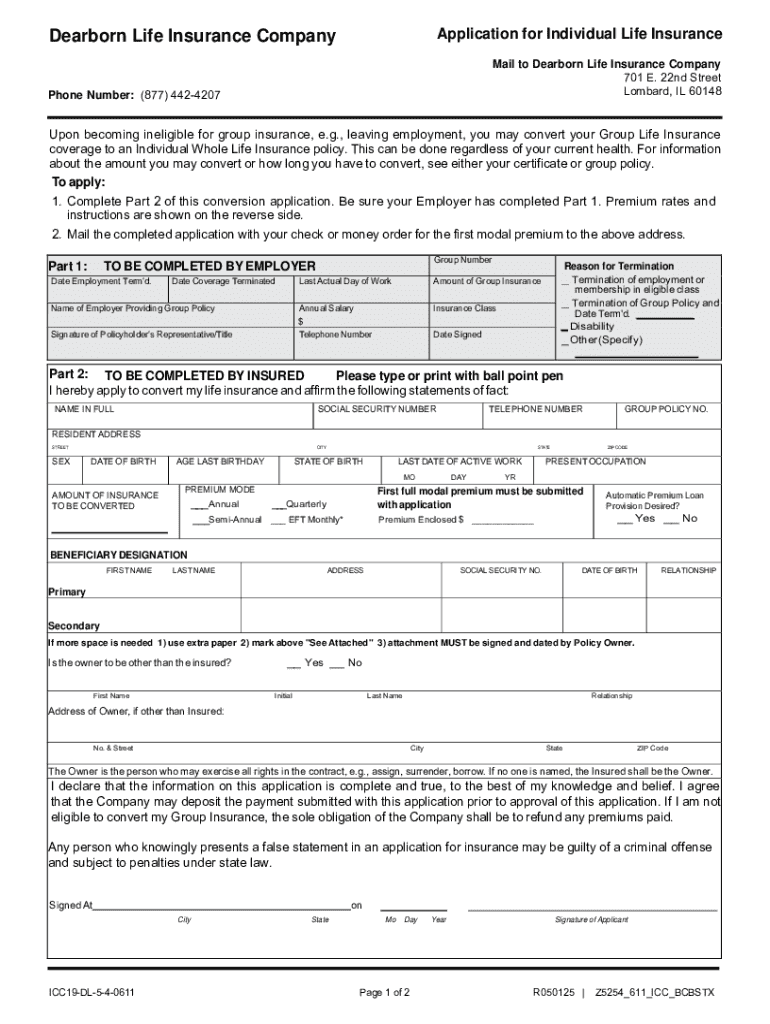

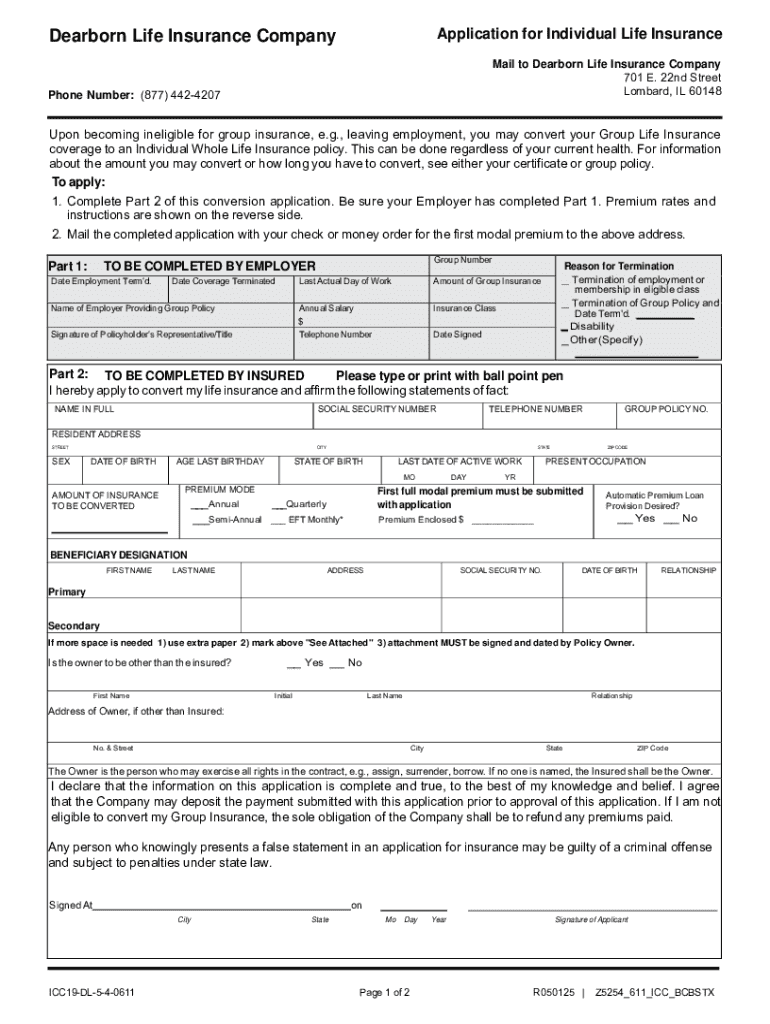

Detailed insights into the application for individual life form

The application for individual life form serves as the initial step in securing life insurance coverage. This document is essential for the insurer to assess your risk and determine the premium rates. By accurately filling out this form, you not only start the process of obtaining insurance but also streamline your coverage tailored to your needs.

Understanding the application process is crucial. It generally involves providing personal details, medical history, lifestyle choices, and financial information to enable insurers to make informed decisions about your coverage.

Preparing to complete the application

Before filling out the application for individual life, it's vital to gather essential information. You'll need to prepare personal details like your name, age, and address. Additionally, your medical history, including previous illnesses and current medications, will play a significant role in the underwriting process. Lifestyle factors, such as your occupation and income, also contribute to how the insurer evaluates your risk.

Consider collecting the following documents to streamline your application process:

Step-by-step guide to filling out the form

Filling out the application for individual life insurance can seem daunting, but following a systematic approach will help ease the process. Begin with Section 1, where you provide personal information. Provide accurate details as errors can lead to delays or denial of coverage.

Moving on to Section 2, you will encounter medical history questions. Be thorough, as this information will assist insurers in assessing your health risks. For Section 3, lifestyle questions are crucial; honesty here is paramount. For instance, disclosing smoking or drinking habits affects your premium rates significantly.

In Section 4, financial information will likely include questions about your income and financial needs. It's important to understand why insurers ask about your finances, as it helps them gauge the necessary coverage amount. Double-check each section to ensure accuracy and completeness to avoid complications later on.

Editing and modifying your application

Once you have completed the application, reviewing and editing your information is essential to ensure its accuracy. Utilizing tools like pdfFiller allows you to effortlessly make modifications directly on your submitted form. With its intuitive editing features, you can easily adjust your information as needed.

Using comments and annotations during this stage can be beneficial. Collaborating with family members or financial advisors enables you to gather their insights and ultimately submit a stronger application.

Signing your application

The electronic signature has transformed the signing process, adding layers of convenience and security. Understanding why eSignatures matter is key—they hold legal validity and can expedite the submission of your application. Utilizing pdfFiller, you can securely eSign documents, bypassing the need for printing and scanning.

To eSign your application using pdfFiller, follow these simple steps: select the signature option, draw or upload your signature, and finalize the signing process. This method not only saves time but also enhances the security of your sensitive information.

Submitting your application

After completing and signing your application, the next step is submission. Depending on your preference, you can submit the form online through the insurer's website or mail a physical copy. Each method has its benefits; online submission is generally faster, while mailing may suit those who prefer traditional methods.

Once submitted, be aware that you should expect follow-up communications from the insurer. Understand the typical timelines for application processing, which can vary by provider, and stay proactive in checking for any updates.

Managing your life insurance application

Keeping track of your life insurance application is essential for peace of mind. Tools available on pdfFiller allow you to monitor the status of your submitted application easily. By accessing your account, you can quickly see updates and communications from the insurer.

In case you need to make updates or changes post-submission, utilizing pdfFiller's features provides a seamless way to amend your application without hassle. Familiarizing yourself with these tools can significantly ease the management process.

Frequently asked questions

Navigating the world of individual life insurance applications can produce common queries among prospective policyholders. One frequent concern is about application processing times. Policies vary greatly by provider, but understanding what to expect helps manage expectations.

Another important question is what to do if you get denied. Emphasizing transparency in your initial application can reduce the chances of denial. If denied, reviewing the reason given by the insurer can guide you in improving your application for future submissions.

Additionally, addressing common misconceptions, such as the belief that only healthy individuals can secure coverage, aids in spreading awareness of the eligibility options available to a broader audience.

Related tasks and next steps

Once you've submitted your application, the next phase is preparation for underwriting. Understanding what to expect during this process is beneficial as insurers evaluate your application information, including medical history and lifestyle details, to assess risks accurately.

After approval, you’ll be presented with policy options. This is the time to thoroughly compare coverage amounts, premiums, and terms before committing to a policy that best meets your financial security needs.

Important considerations for specific demographics

Different demographics encounter unique challenges when it comes to individual life insurance applications. For example, seniors may face higher premiums or restrictions based on their health status. On the other hand, young adults may benefit from lower rates but need to account for potentially changing health conditions.

Individuals with pre-existing conditions must pay close attention to how these factors may affect their eligibility and premiums. Being prepared to provide comprehensive details about your health can lead to better coverage options.

Interactive tools to help you along the way

Utilizing calculators and quote tools available on pdfFiller can greatly assist those navigating the application for individual life form. These resources provide valuable insights into potential premiums and coverage amounts, aiding in informed decision-making.

Planning with interactive resources helps demystify the insurance process. By understanding what coverage fits your needs and budget from the start, you pave the way for a seamless application experience.

Real-life application stories

Personal testimonials and case studies from individuals who have successfully secured life insurance highlight the effectiveness of the application process. These real-life experiences demonstrate how applying for individual life insurance can provide financial security and peace of mind.

Hearing success stories can motivate prospective applicants, encouraging them to take the next step in protecting their family’s financial future through life insurance.

Insights on policy management

Keeping your life insurance policy updated is key to ensuring that it continues to meet your changing needs. Regularly reviewing your coverage as life circumstances evolve—such as changes in family status, income, or health—is essential.

Staying proactive about managing your policy not only guarantees that your coverage remains relevant but also reinforces the financial security provided by your individual life insurance plan.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the application for individual life electronically in Chrome?

Can I create an eSignature for the application for individual life in Gmail?

Can I edit application for individual life on an Android device?

What is application for individual life?

Who is required to file application for individual life?

How to fill out application for individual life?

What is the purpose of application for individual life?

What information must be reported on application for individual life?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.