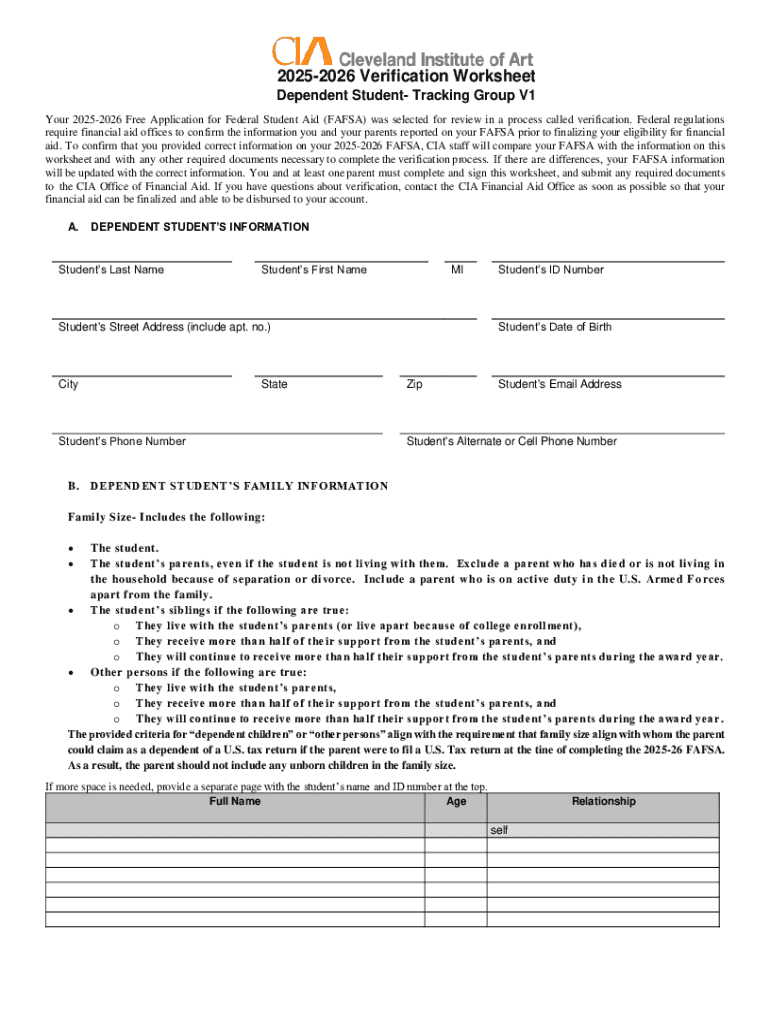

Get the free 2025-2026 Verification Worksheet

Get, Create, Make and Sign 2025-2026 verification worksheet

How to edit 2025-2026 verification worksheet online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025-2026 verification worksheet

How to fill out 2025-2026 verification worksheet

Who needs 2025-2026 verification worksheet?

A Comprehensive Guide to the 2 Verification Worksheet Form

Understanding the verification process

Verification is a critical aspect of the financial aid landscape, essential for both students and educational institutions. In this context, verification refers to the process by which schools confirm the accuracy of data provided on the Free Application for Federal Student Aid (FAFSA). When selected for verification, students must provide additional documentation to ensure that their financial aid packages are based on correct and current information.

The importance of verification cannot be overstated. It safeguards the integrity of federal and state financial aid programs, helping to prevent fraud and ensuring that funds are allocated to eligible students. For students, understanding this process and the requirements involved is crucial, as it directly impacts their financial aid eligibility and the ability to fund their education.

Key updates for the 2 verification worksheet

The 2 verification process has seen several changes to streamline the procedures and enhance transparency. One significant update is the increase in the types of acceptable documentation now accepted, which includes more diverse income verification methods to cater to various student circumstances. Institutions are now encouraged to adopt flexible guidelines that accommodate unique financial situations, thereby making it easier for students to comply.

Additionally, the U.S. Department of Education has issued new requirements to improve the efficiency of the verification process. These changes emphasize the need for schools to provide clear instructions regarding documentation and timelines, ultimately aiming to facilitate a smoother verification experience for students. It is essential for students to stay informed about these changes and prepare their documents accordingly to meet these new requirements.

Types of verification requests

There are primarily two types of verification requests: Standard verification and additional documentation requests. Standard verification is determined based on the data provided in the FAFSA; students selected for this type need to submit specific documents confirming their reported information.

On the other hand, additional documentation requests occur when a financial aid office determines that further information is required to make proper evaluations. Common triggers for these requests include inconsistencies within the data submitted, incomplete FAFSA submissions, or any significant changes in the student's financial situation. It's critical for students to consult their financial aid offices promptly as soon as they receive such requests to avoid unnecessary delays.

Essential documents for verification

When preparing for verification, students should gather necessary documentation to support their financial information. Acceptable documentation types include IRS Tax Transcripts, W-2 forms, and other income verification documents. Each type of document serves a specific purpose and must be accurate to prevent processing delays.

To collect these necessary documents, students should follow a systematic approach. This includes: organizing paperwork by category, ensuring that all documents are complete before submission, and checking for up-to-date forms based on the recent tax year. Common mistakes to avoid include submitting incorrect or outdated documents, which can lead to rejection or additional verification steps.

Step-by-step instructions for completing the verification worksheet

Completing the verification worksheet involves several key steps designed to ensure all information is accurate and timely submitted. Step 1 is to perform an initial assessment. Students should first determine if they have been selected for verification and understand the specific requirements outlined by their institution.

Step 2 involves gathering required information, such as family size and income details, making sure the information aligns with what was submitted in the FAFSA. In Step 3, students will fill out the worksheet by carefully following the instructions for each section. Finally, in Step 4, submission methods should be chosen cautiously, ensuring secure and timely submission to avoid delays in the financial aid process.

Special circumstances in verification

Special circumstances may necessitate additional considerations during the verification process. For instance, verification for confined or incarcerated individuals may require unique documentation and adherence to specific institutional policies. Updates also include provisions for students facing economic hardships, ensuring that they are not unduly penalized when providing documentation.

Another aspect to consider is interim disbursements. In some instances, institutions may allow students to receive a portion of their financial aid disbursement before completing the verification process. Understanding these nuances can help students navigate their financial aid options more effectively.

Common issues and solutions

Failure to submit documentation on time is a common issue that can severely impact a student's financial aid. Potential consequences include delayed disbursement or loss of eligibility altogether. To avoid these scenarios, students must keep track of deadlines and ensure timely submissions.

In cases where revisions or corrections are needed post-submission, it's crucial to communicate promptly with the financial aid office. This includes seeking guidance on how to address requests for additional information, ensuring that any new submissions are accurate and appropriately documented.

Policies and procedures surrounding verification

Each educational institution will have its policies regarding verification. A comprehensive understanding of these policies is essential for students to navigate their rights and responsibilities. This may involve familiarizing themselves with institutional deadlines, documentation requirements, and any additional steps necessary for successful verification.

Students should also be aware of their rights during the verification process, including the right to appeal if they believe their verification outcome is not justified. Being proactive and informed can pave the way for a smoother verification experience.

Understanding appeal processes

Should a student's verification be denied, it is essential to know the steps for submitting a formal appeal. This process generally involves gathering relevant documentation that supports the student's case and submitting it to the financial aid office within a specified deadline.

Staying organized throughout this process is vital. Maintaining a checklist of important deadlines and required documents can significantly improve the chances of a successful appeal. Students must remain knowledgeable about their institution's policies to effectively address any verification denials.

Conclusion: The importance of being proactive

Being proactive in managing the 2 verification worksheet form is crucial for prospective and current students seeking financial aid. Early preparation and thorough research can alleviate stress and ensure compliance with all necessary requirements ahead of deadlines.

Ultimately, understanding the verification process, staying informed of the latest updates, and following the outlined procedures can significantly influence a student's ability to secure financial aid and successfully navigate the complexities of their educational journey.

Interactive tools and resources

pdfFiller offers a suite of tools that facilitate seamless document management throughout the verification process. Users can access easy-to-use PDF editing and eSigning solutions, making gathering and submitting the necessary documents efficient and manageable.

In addition, interactive checklists for document submission and templates for financial documentation are available, helping applicants stay organized and compliant with the verification guidelines.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 2025-2026 verification worksheet without leaving Google Drive?

How do I complete 2025-2026 verification worksheet online?

Can I edit 2025-2026 verification worksheet on an iOS device?

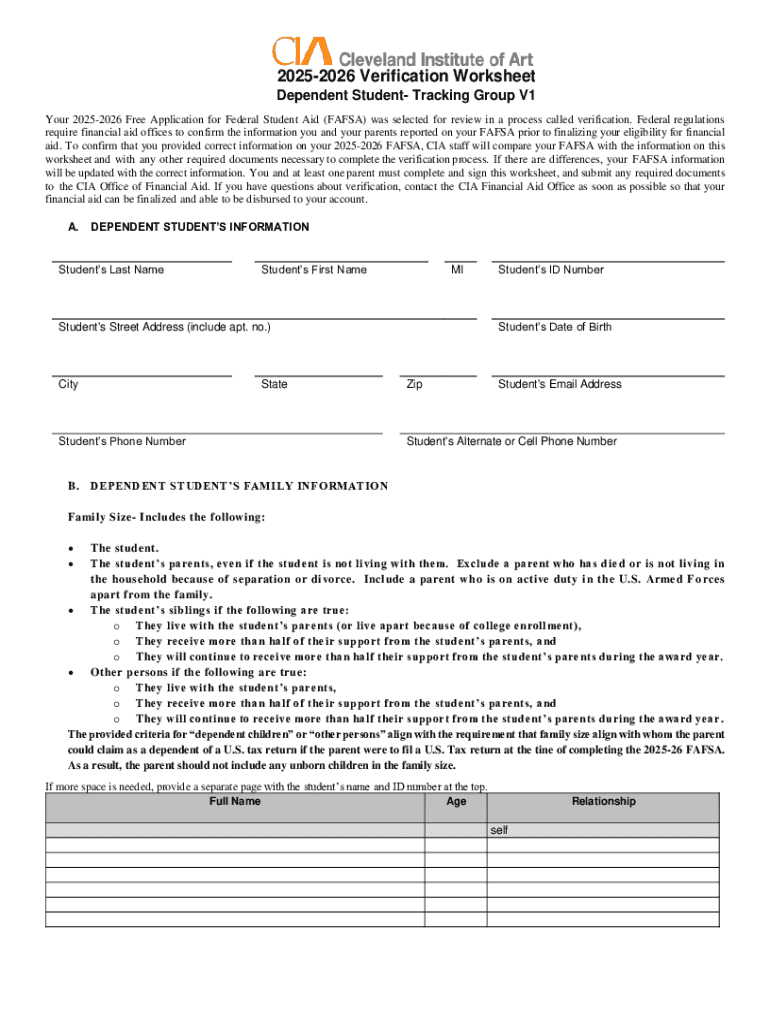

What is 2025-2026 verification worksheet?

Who is required to file 2025-2026 verification worksheet?

How to fill out 2025-2026 verification worksheet?

What is the purpose of 2025-2026 verification worksheet?

What information must be reported on 2025-2026 verification worksheet?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.