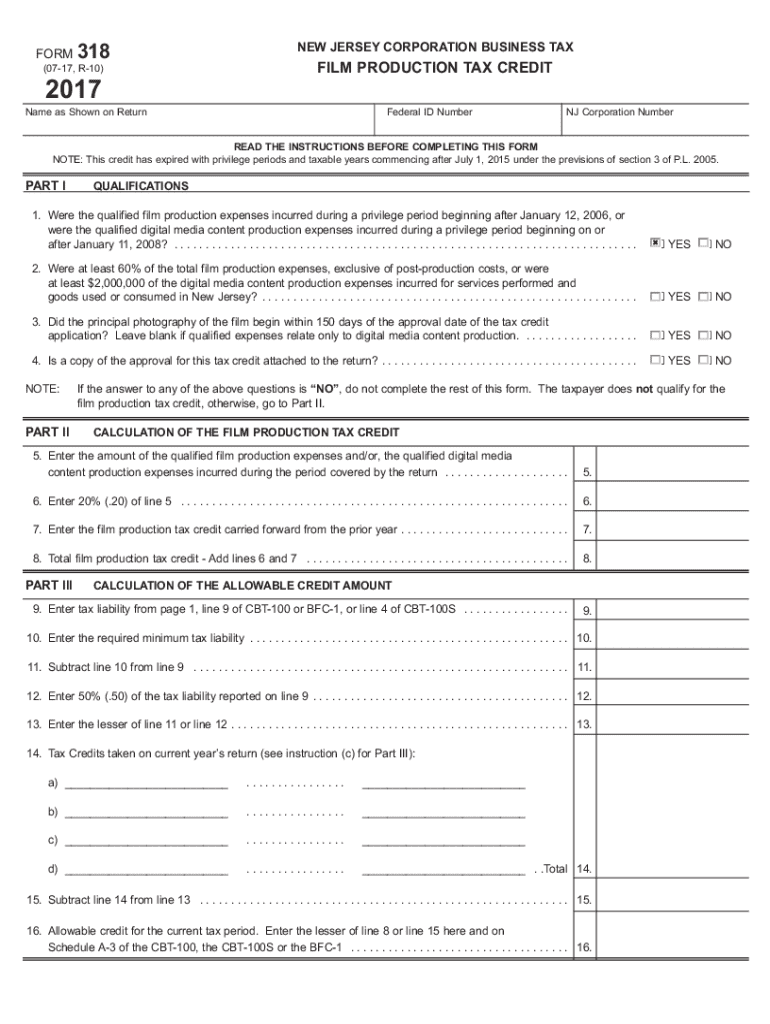

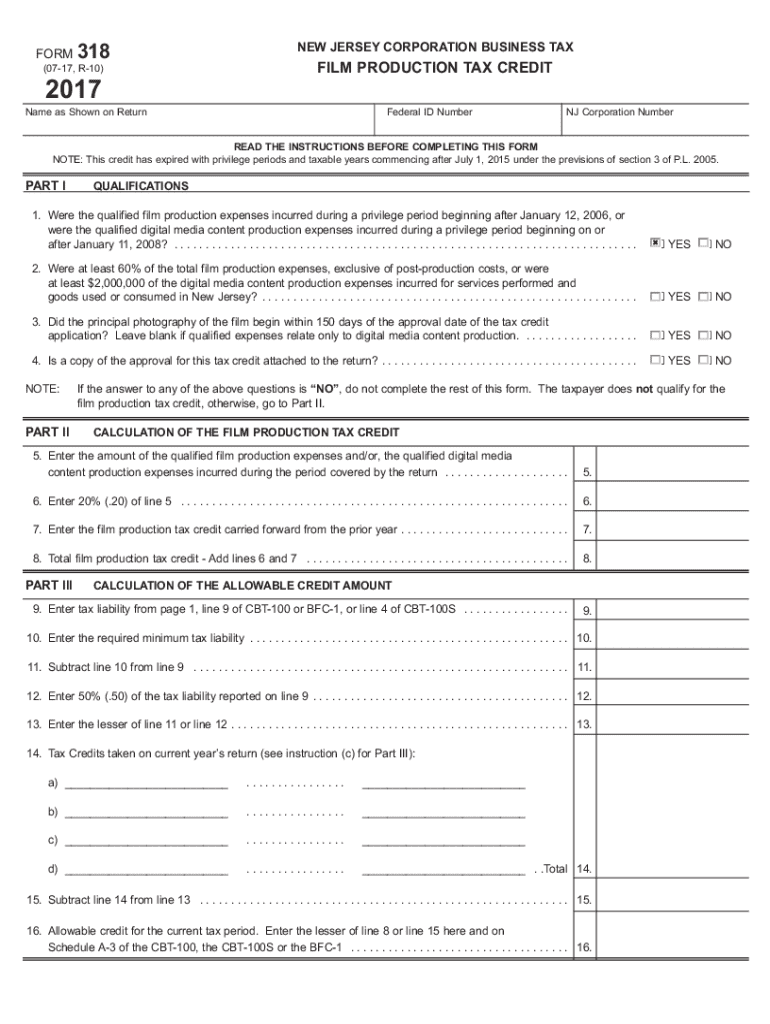

Get the free New Jersey Corporation Business Tax Film Production Tax Credit

Get, Create, Make and Sign new jersey corporation business

How to edit new jersey corporation business online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new jersey corporation business

How to fill out new jersey corporation business

Who needs new jersey corporation business?

New Jersey Corporation Business Form: A Complete Guide to Incorporation

Understanding the basics of New Jersey corporation formation

Incorporating a business in New Jersey provides a unique opportunity for entrepreneurs. A corporation is a legal entity that is distinct from its owners, offering limited liability protection and various advantages. By forming a corporation, business owners can safeguard their personal assets against business debts and liabilities.

The advantages of incorporating in New Jersey are numerous and compelling. Limited liability protection shields personal assets from lawsuits and business debts, increasing business credibility, which can attract customers and investors. Furthermore, corporations often find it easier to raise capital through the sale of stock.

In New Jersey, common types of corporations include C corporations, S corporations, and limited liability companies (LLCs). Each type offers distinct benefits and tax implications, making it essential for business owners to choose the correct structure based on their specific goals.

Steps to form a corporation in New Jersey

Forming a corporation in New Jersey involves several critical steps. Begin by choosing a corporate name that fits your business vision, ensuring it adheres to state regulations by including designators like 'Inc.' or 'Corporation.' Conduct an availability check to confirm that your chosen name isn’t already in use, which can also be reserved if needed.

Next, designate a registered agent, who is responsible for receiving important correspondence. The registered agent must provide a physical address in New Jersey. Once that’s set, you can move onto filing the public records. This involves submitting the Certificate of Incorporation, which includes vital information about the corporation.

After successfully filing your public documents, obtain your Employer Identification Number (EIN) from the IRS, vital for tax identification and onboarding employees. Additionally, be sure to file a Beneficial Ownership Information Report to ensure compliance with federal regulations.

Further, create corporate bylaws that outline how your corporation will be governed, hold an organizational meeting to make essential decisions, and finally, open a corporate bank account to separate personal and business finances.

Ongoing compliance and maintenance for New Jersey corporations

After your corporation is formed, ongoing compliance is crucial. Every year, New Jersey corporations must file an annual report, which includes updated information about business addresses, officers, and financial data. Failure to file this can result in penalties or losing good standing with the state.

It's essential to understand situations that necessitate the amendment of corporate documents. Examples include changes in business ownership, structure, or registered agent. When dissolution becomes inevitable, follow specific procedures set by the state to avoid legal repercussions.

Specialized topics related to New Jersey corporations

Understanding the nuances of corporation names versus alternate or trade names is vital in maintaining brand integrity. Companies may wish to operate under a different name in New Jersey which requires filing a 'Doing Business As' (DBA).

Furthermore, corporations must be cautious regarding the privacy of personal information that appears in public records. Business owners may seek alternatives, such as using a registered agent's address, to keep their personal addresses confidential.

FAQ section: Common queries regarding New Jersey corporations

Several questions frequently arise for new and prospective corporations in New Jersey. One notable concern is whether individuals can serve as their own registered agents. While permissible, it may become cumbersome for someone managing several responsibilities.

It's also essential to confirm whether you need bylaws, which guide the governance of your corporation, or understand special procedures for conducting organizational meetings. Addressing these FAQs can significantly smooth the incorporation process.

Tools and resources for efficient document management

Utilizing tools such as pdfFiller can greatly enhance your experience when navigating corporate documentation. With features for document creation and editing, the platform empowers business owners to eSign, collaborate, and manage their documents efficiently.

By leveraging such a robust platform, individuals and teams can maintain documentation seamlessly while focusing on growing their New Jersey corporation.

Additional insights and guidance

Best practices for maintaining corporate compliance involve regularly scheduling reviews of documents and legal obligations. Corporations must proactively adapt to changes in law and regulations to sustain good standing.

For legal assistance in New Jersey, several resources are available. Engaging a legal advisor can be beneficial when navigating complicated regulations or drafting important documents. This ensures a corporation remains compliant while minimizing risks.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my new jersey corporation business directly from Gmail?

Can I sign the new jersey corporation business electronically in Chrome?

How can I fill out new jersey corporation business on an iOS device?

What is new jersey corporation business?

Who is required to file new jersey corporation business?

How to fill out new jersey corporation business?

What is the purpose of new jersey corporation business?

What information must be reported on new jersey corporation business?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.