Get the free Beneficiary Designation Form

Get, Create, Make and Sign beneficiary designation form

How to edit beneficiary designation form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficiary designation form

How to fill out beneficiary designation form

Who needs beneficiary designation form?

A Comprehensive Guide to the Beneficiary Designation Form

Understanding the beneficiary designation form

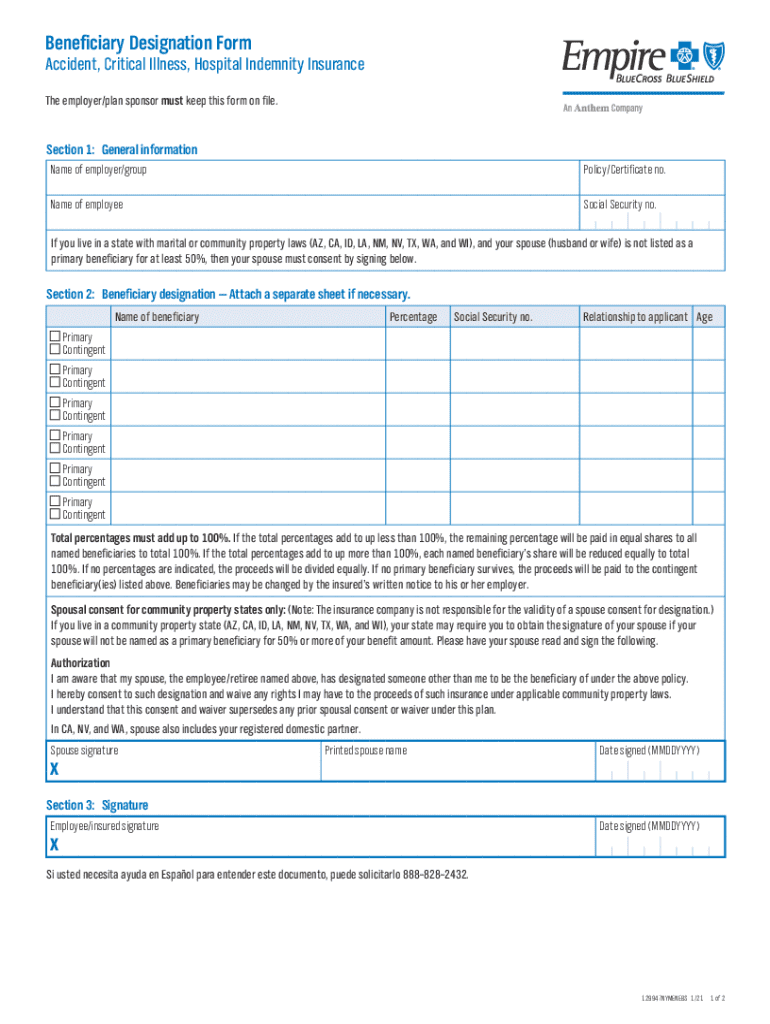

A beneficiary designation form is a legal document used to designate individuals or entities to receive assets upon the death of the account holder or policy owner. This form is essential for ensuring that your wishes are fulfilled regarding who inherits your assets, whether they are held in retirement accounts, insurance policies, or trusts.

The importance of beneficiary designation in estate planning cannot be overstated. It provides clarity and direction, significantly reducing the chances of disputes among heirs and ensuring a swift transfer of assets. By completing this form, you are actively participating in the management of your estate and safeguarding your loved ones from potential financial hardship.

Despite its significance, there are several common misconceptions associated with beneficiary designation. Many people believe that simply having a will is sufficient. However, assets designated through a beneficiary designation form typically bypass the probate process, making this form vital for effective estate planning.

Who needs a beneficiary designation form?

Anyone who possesses financial accounts, insurance policies, or retirement plans should consider filling out a beneficiary designation form. This includes individuals managing personal and joint accounts, as well as teams handling company policies and group benefits. Personal accounts require careful thought, especially in cases of joint ownership, where both parties need to agree on designations.

In addition to individuals, specific roles such as executors, trustees, and legal representatives must also be aware of these forms. They play pivotal roles in ensuring that the estate’s assets are distributed according to the deceased’s wishes, and having accurate and current beneficiary information is crucial to their duties.

Key components of the beneficiary designation form

A well-structured beneficiary designation form typically contains several key components. First, the personal information section requires details such as your name, address, and identification numbers, ensuring accurate identification of the account holder.

The next crucial component is the beneficiary information section, where you’ll specify primary and contingent beneficiaries. Primary beneficiaries are your first choice for receiving the assets, while contingent beneficiaries are designated to receive benefits only if the primary beneficiaries are unable to do so. Beneficiaries can also include individuals, trusts, or organizations.

Finally, the form requires your signature and the date, confirming that you understand and agree to the designations outlined in the document.

Step-by-step instructions for completing the form

Completing a beneficiary designation form may seem daunting, but following a systematic process can simplify it. Step one involves gathering all necessary information, including your identification details and your beneficiaries' names and contact information.

Step two is to fill out the form diligently. Each field should be completed carefully, ensuring all requested information is legible and accurate. Pay special attention to the spelling of names and the correctness of identification numbers, as errors can lead to complications.

Next, in step three, review your completed form thoroughly. Double-check for completeness and accuracy, confirming that all beneficiaries are listed correctly. Step four involves signing and dating the form; this step not only authenticates the document but also signifies your understanding of its contents.

Finally, step five is submitting the form. Depending on the institution or entity, submission options may include online platforms, traditional mail, or in-person delivery. Ensure you follow the specific instructions provided by the institution to ensure seamless processing.

Managing your beneficiary designation

Managing your beneficiary designation is essential to ensure it remains up-to-date. Significant life changes such as marriage, divorce, birth, or death can necessitate updates to your form. Regularly reviewing your designations allows you to align them with your current wishes and family dynamics.

Making changes to your designation form can be done easily through pdfFiller, which offers user-friendly options for editing and resubmitting the form online. Another critical aspect is managing multiple beneficiaries. Whether you choose to distribute assets equally or unevenly, clarity in how you designate each beneficiary is vital to prevent misunderstandings.

Frequently asked questions about beneficiary designation forms

A common question regarding beneficiary designation forms is, 'What if I forget to designate a beneficiary?' In such cases, the assets may be directed according to the laws of intestacy, which could lead to results not aligned with your wishes. This highlights the importance of timely completion of these forms.

Another frequent inquiry is, 'How does a court handle unclaimed benefits?' Typically, unclaimed benefits revert to the estate and will be distributed according to the will or state laws, emphasizing the necessity of clear and up-to-date beneficiary designations.

Lastly, some individuals wonder, 'Can I designate a minor as a beneficiary?' While you can technically name a minor as a beneficiary, it is often advisable to establish a trust or a custodian account to manage those funds until the child reaches adulthood.

Resources for further assistance

When seeking assistance with beneficiary designation forms, pdfFiller provides a wealth of resources. Users can access interactive tools designed to simplify the designation process, ensuring all forms are completed accurately and efficiently.

Additionally, downloadable templates and samples are available, guiding users as they prepare their forms. If personalized help is required, pdfFiller offers various contact options, including live chat support, to address any specific queries or concerns.

Specific use cases of beneficiary designation forms

Beneficiary designation forms can be applied in a variety of contexts. For instance, in insurance policies, the form determines who will receive death benefits, providing financial support during difficult times. Retirement account and 401(k) plans also require these forms to ensure that assets are passed on to the intended beneficiaries without unnecessary delays or complications.

Furthermore, trusts and estate accounts benefit from beneficiary designation forms. By specifying beneficiaries in these contexts, individuals can avoid probate, streamline the distribution process, and maintain confidentiality regarding their estate.

Breadcrumb navigation

To enhance user experience, implementing breadcrumb navigation on pdfFiller ensures quick access to related topics and forms. This feature allows users to effortlessly navigate back to primary categories, locating essential tools and resources tailored for effective document management.

Contact information for additional support

For users seeking further assistance regarding their beneficiary designation form, pdfFiller provides comprehensive customer service options. Detailed contact information allows users to reach out with questions, whether through email or direct phone contact.

Additionally, live chat support is available during business hours, ensuring that users can receive quick and accurate answers to any inquiries, facilitating a seamless experience with their beneficiary designation forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit beneficiary designation form on a smartphone?

How do I complete beneficiary designation form on an iOS device?

How do I complete beneficiary designation form on an Android device?

What is beneficiary designation form?

Who is required to file beneficiary designation form?

How to fill out beneficiary designation form?

What is the purpose of beneficiary designation form?

What information must be reported on beneficiary designation form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.