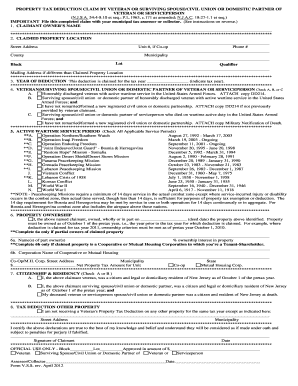

NJ Property Tax Deduction Claim by Veteran or Surviving Spouse/Civil Union or Domestic Partner of Veteran 2020-2026 free printable template

Get, Create, Make and Sign nj vss form

How to edit NJ Property Tax Deduction Claim by Veteran online

Uncompromising security for your PDF editing and eSignature needs

NJ Property Tax Deduction Claim by Veteran or Surviving Spouse/Civil Union or Domestic Partner of Veteran Form Versions

How to fill out NJ Property Tax Deduction Claim by Veteran

How to fill out property tax deduction claim

Who needs property tax deduction claim?

Property Tax Deduction Claim Form: A Comprehensive Guide

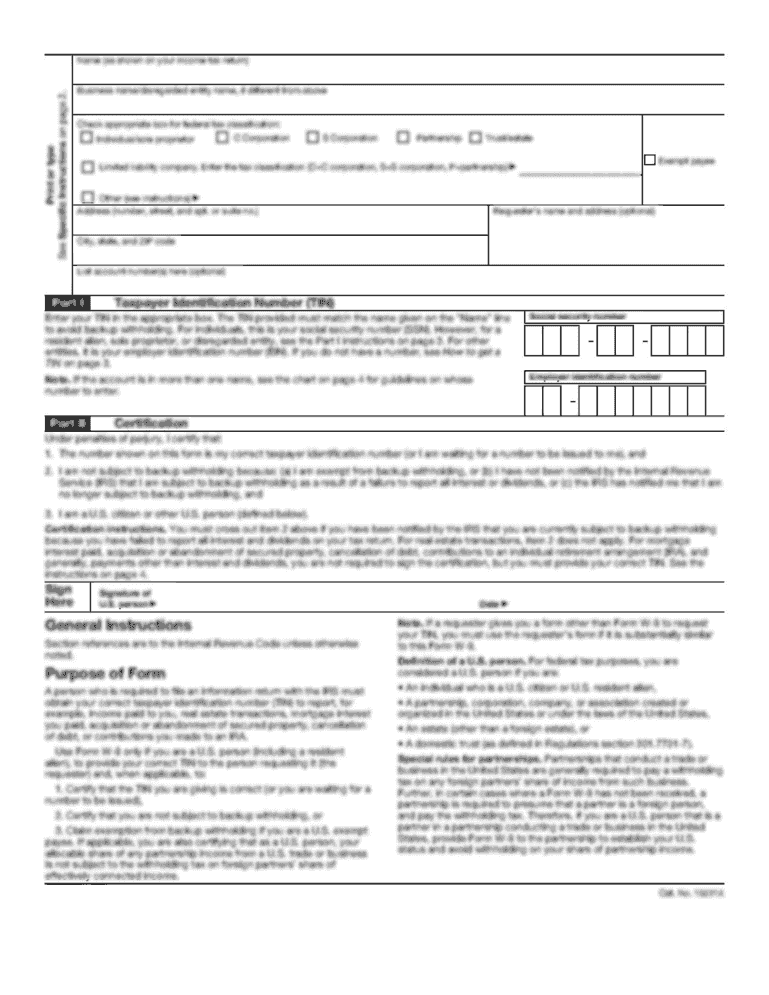

Understanding the property tax deduction

The property tax deduction allows homeowners and property investors to reduce their taxable income by claiming eligible property taxes paid during the tax year. This deduction is essential for easing financial burdens and making property ownership more affordable. By understanding the nuances of the property tax deduction claim form, you can maximize your savings and ensure you're taking full advantage of tax benefits available to you.

Eligibility criteria for claiming property tax deductions

To qualify for property tax deductions, you need to meet specific criteria based on the type of property you own. Knowing these eligibility guidelines ensures that you maximize your benefits. Homeowners cashing in on these deductions should start by assessing their property type and any special circumstances that might qualify them for additional benefits, such as age or military service.

Essential documents for filing a property tax deduction claim

Gathering all necessary documentation is crucial when filing your property tax deduction claim. Properly compiling your tax records and understanding any associated escrow accounts will streamline the process, help avoid delays, and ensure a smooth filing experience.

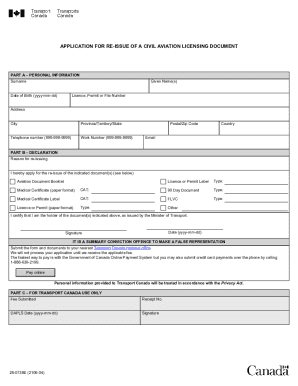

How to fill out the property tax deduction claim form

Completing the property tax deduction claim form, specifically Schedule A, is straightforward if you follow a step-by-step approach. Begin by obtaining the correct form from the IRS website or your tax preparation service. Fill in your personal information, ensure all details are accurate, and don’t forget to double-check your entries to avoid common pitfalls that can lead to delays.

Filing your claim: What comes next?

Once you've completed your property tax deduction claim form, it's time to choose the best filing method for you. E-filing is increasingly popular due to its convenience and speed, while paper filing remains an excellent option for those who prefer traditional methods. Keep in mind filing deadlines and tracking your claim status to ensure everything is processed smoothly.

Maximizing your property tax deductions

Maximizing your property tax deductions can make a significant difference in your overall tax liability. Strategies such as prepaying property taxes or exploring federal energy incentives can yield additional benefits. Understanding deduction limits and applying these strategies can help maximize your financial advantages when filing.

Common questions and scenarios surrounding property tax deductions

Navigating property tax deductions involves various scenarios that may confuse taxpayers. For instance, not all properties qualify for deductions, and peculiar situations arise when buying or selling homes that can affect claims. Being informed about non-deductible properties and how to handle adjustments for previous tax years can prepare you for potential challenges.

Utilizing pdfFiller for your property tax deduction claim form

pdfFiller streamlines the process of filling out your property tax deduction claim form, enabling users to easily edit and manage their documents in the cloud. With features like eSigning and collaboration, individuals and teams can efficiently handle multiple claims without the typical hassles associated with traditional paperwork, making it an ideal solution for modern tax preparation.

Interpreting state and local variations in property tax deductions

Property tax deductions can vary significantly between states and local jurisdictions. Whether you’re residing in California, Texas, or New York, it’s essential to navigate the specific regulations affecting deductions in your area. Utilizing available resources helps ensure you’re compliant and fully informed about the deductions you qualify for at the state and local level.

Additional tax deductions for homeowners

Homeownership often provides additional opportunities for tax deductions beyond property tax deductions. Home insurance may be deductible in some cases, and state tax credits can further reduce your liability. Understanding these additional options enables homeowners to maximize financial benefits. Researching available local incentives may uncover additional deductions that align with your financial strategies.

Best practices for future claims

Establishing best practices in record-keeping can simplify future property tax deduction claims. Staying organized throughout the year ensures you can quickly gather necessary documents and helps maintain awareness of your eligibility status for ongoing deductions. Utilizing interactive tools for continuous management of property taxes will pave the way for seamless claims in subsequent years.

People Also Ask about

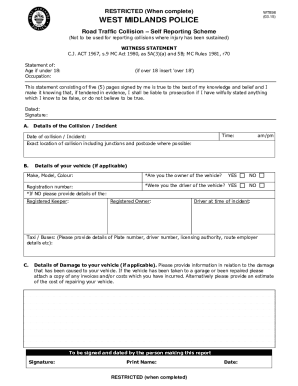

How long can your car stay in impound in Texas?

What is a Texas VSF form?

How long does a car have to be parked before it can be towed Texas?

How do I get my impound fee waived in Texas?

How much does it cost to get a car out of impound in Texas?

Can someone else get my car out of impound Texas?

What do you need to get a vehicle out of impound in Texas?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the NJ Property Tax Deduction Claim by Veteran in Gmail?

How can I edit NJ Property Tax Deduction Claim by Veteran on a smartphone?

How do I fill out the NJ Property Tax Deduction Claim by Veteran form on my smartphone?

What is property tax deduction claim?

Who is required to file property tax deduction claim?

How to fill out property tax deduction claim?

What is the purpose of property tax deduction claim?

What information must be reported on property tax deduction claim?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.