VA Invoice Payment Processing System (IPPS) 2024-2026 free printable template

Get, Create, Make and Sign VA Invoice Payment Processing System IPPS

How to edit VA Invoice Payment Processing System IPPS online

Uncompromising security for your PDF editing and eSignature needs

VA Invoice Payment Processing System (IPPS) Form Versions

How to fill out VA Invoice Payment Processing System IPPS

How to fill out invoice payment processing system

Who needs invoice payment processing system?

A comprehensive guide to invoice payment processing system forms

Overview of invoice payment processing systems

An invoice payment processing system is a digital solution that allows businesses and individuals to manage their invoicing and payment transactions with efficiency and transparency. It serves as a bridge between invoice creation, approval, and payment execution, streamlining these processes to minimize errors and accelerate cash flow.

The importance of such systems cannot be overstated; they are crucial for maintaining financial accuracy and ensuring timely payments. For individuals and teams, using a robust invoice payment processing system enhances financial governance, helps track expenditures, and fosters better cash management practices.

Key components of an effective system typically include invoice creation tools, payment processing options, detailed reporting functionalities, and compliance checks, all of which support the complete invoice lifecycle from issuance to payment.

Benefits of using an invoice payment processing system

Implementing an invoice payment processing system offers numerous advantages, enhancing team productivity and improving overall efficiency. One of the primary benefits is time savings; automating repetitive tasks related to invoicing frees up valuable resources, allowing teams to focus on their core business activities.

Moreover, the improved accuracy in payment processing reduces the risk of human errors and discrepancies, which can often lead to costly issues. The simplified collaboration among team members facilitates transparent communication, enabling a straightforward approval process and reducing bottlenecks.

Key features of invoice payment processing systems

An effective invoice payment processing system is characterized by several essential features that enable smooth operations. Comprehensive document editing and management capabilities allow users to create, modify, and format invoices without extensive training.

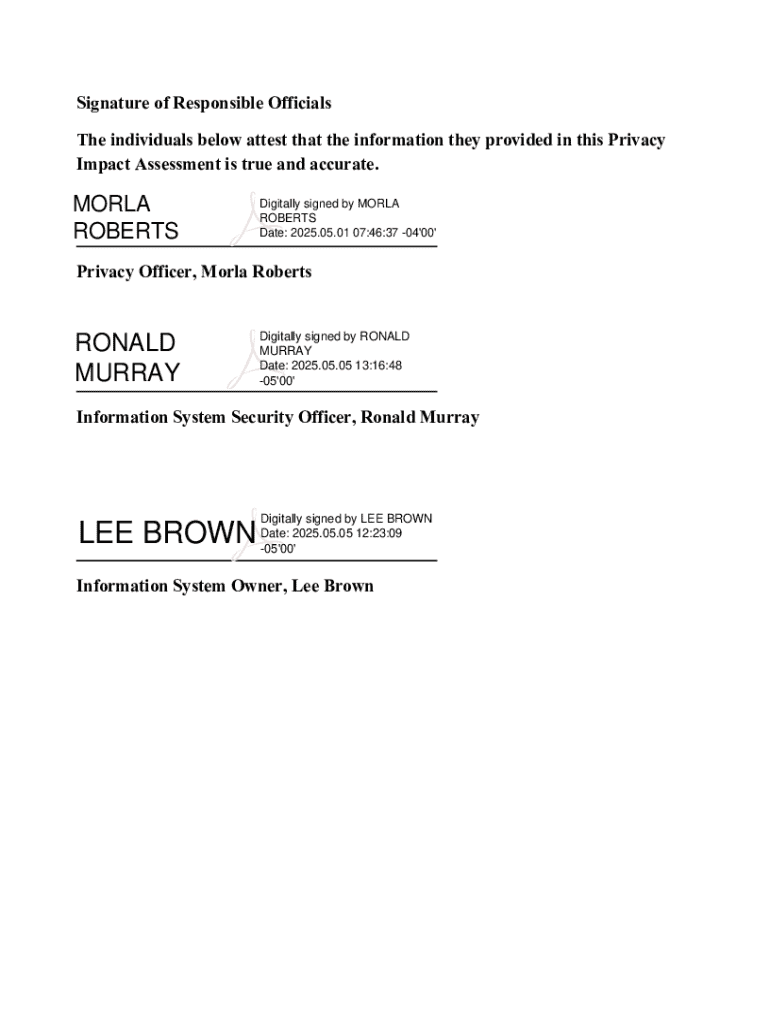

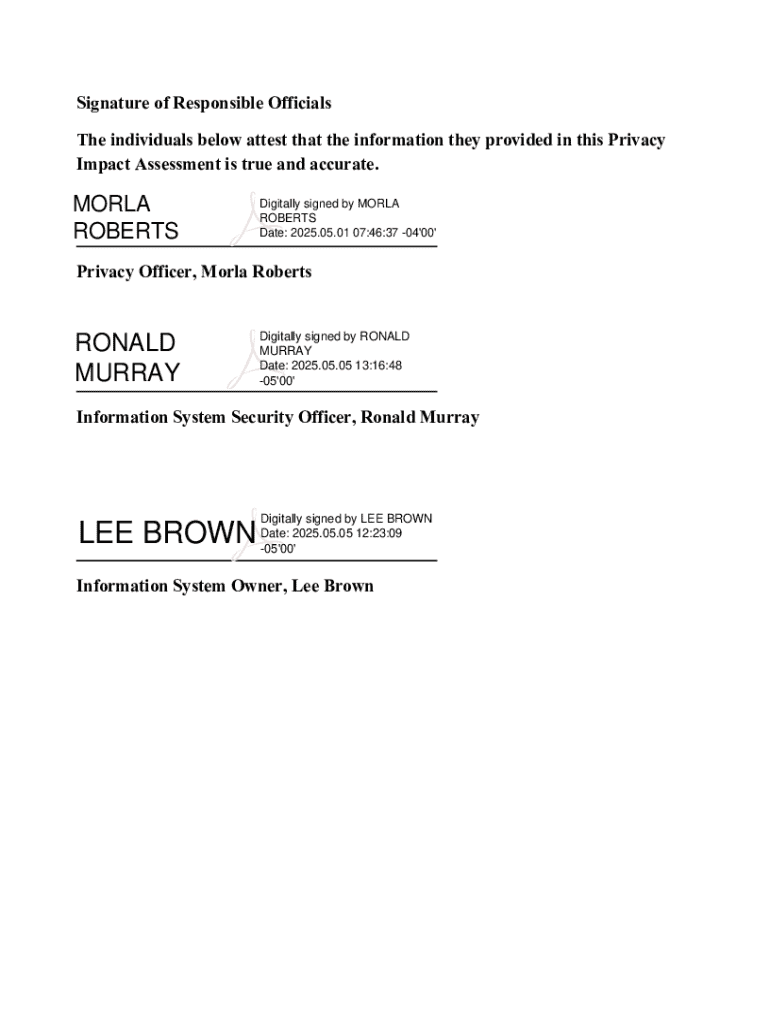

eSignature functionalities ensure that necessary approvals are secured seamlessly, while real-time tracking and visibility provide team members with up-to-date information on the status of payments. Furthermore, a centralized dashboard consolidates all invoice-related documents in one place, enhancing accessibility.

Understanding the invoice payment processing workflow

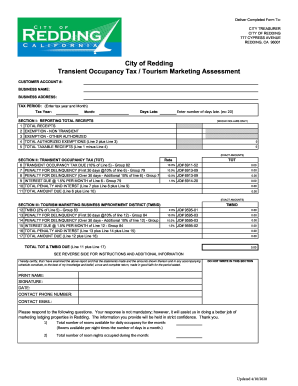

The workflow of invoice payment processing can be broken down into several critical steps, each pivotal for ensuring the accuracy and efficiency of the process. Step one involves the receipt of invoices, which can occur through a multitude of methods, including email submissions or direct uploads to the system.

Ensuring invoice compliance begins right at receipt; discrepancies or missing documentation can lead to significant delays. Step two focuses on data capture and verification, where essential information such as invoice amount, date, and vendor details are extracted using advanced technologies that automate this process.

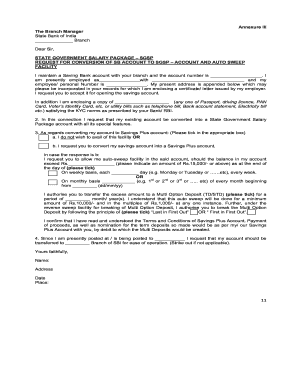

Approval routing, the third step, involves routing invoices through configurable workflows that facilitate quick approvals. Role-based access ensures the right individuals handle approvals, reducing turnaround times considerably. Finally, step four involves payment processing, where different payment methods like credit cards and ACH transfers are supported, and payment status can be tracked in real-time, offering complete transparency.

Optimizing your invoice payment processing for specific needs

Flexibility is key when it comes to invoice payment processing systems. Customizable options cater to various business models, ensuring that the system can adapt to unique operational requirements. Configuring alerts and notifications is an essential aspect that keeps team members informed about pending approvals or payment updates.

Additionally, tailoring workflows according to team size or organizational structure facilitates smoother operations. For larger teams, complex workflows may be needed to handle multiple approvals efficiently, while smaller teams might benefit from simplified processes.

Common challenges in invoice payment processing

Despite its advantages, several common challenges in invoice payment processing may hinder performance. One key issue is missing documentation, which can cause delays in approvals and payments. Implementing rigorous document-handling procedures can mitigate this risk.

Handling discrepancies in invoice amounts can pose another significant obstacle, often requiring additional communication between departments and vendors. Ineffective data capture mechanisms can exacerbate these issues, making it vital to utilize systems equipped with advanced data verification technologies.

Why automated invoice payment processing is essential

Automated invoice payment processing is essential to modern financial workflows, reducing manual effort and minimizing errors associated with traditional methods. Automation enhances operational efficiency, allowing businesses to scale seamlessly.

Leveraging analytics provided by these systems encourages better decision-making, enabling teams to identify trends and insights into spending patterns. Further, creating a paperless environment contributes to sustainability efforts, winning favor from environmentally conscientious stakeholders.

The integration of AI in invoice processing also signifies a revolutionary trend, as these technologies can predict discrepancies, manage risk, and increase the accuracy of data entry through machine learning algorithms.

Best practices for invoice payment processing

To ensure the maximum efficacy of your invoice payment processing system, employing best practices is paramount. Regularly reviewing and updating your workflows keeps them aligned with the evolving needs of your organization. Furthermore, training staff to make the most of the system’s capabilities is crucial for achieving optimal results.

Monitoring key performance indicators (KPIs) allows businesses to assess the efficiency of their invoice processing workflows, uncovering potential areas for improvement. Lastly, fostering continuous collaboration among teams ensures that everyone remains engaged and informed throughout the process.

Getting started with your invoice payment processing system

Selecting the right invoice payment processing system can be a daunting task given the plethora of options available in the market today. It’s essential to compare popular solutions based on your specific needs, considering factors like team size, budget, and unique business requirements.

Equally important are the tips for successful implementation; effective migration strategies from older systems will help ensure a smooth transition. Providing ongoing support and training opportunities for your team is vital to facilitate adoption and optimize the use of the new system.

Future trends in invoice payment processing

As technology continues its rapid evolution, future trends in invoice payment processing are poised to reshape the landscape. Developments in AI and machine learning promise enhanced predictive capabilities and further efficiencies in invoice processing.

Moreover, the potential for integration with other financial systems exposes new opportunities for creating seamless workflows. Organizations must also remain cognizant of expected regulatory changes and adapt their systems accordingly to ensure compliance and continued effectiveness.

Real-world applications and success stories

Examining real-world applications of invoice payment processing systems reveals how organizations have successfully optimized their invoicing. For instance, companies have reported significant reductions in the time taken to approve invoices and process payments, leading to improved cash flow.

One remarkable example is how pdfFiller has empowered users to streamline their document processes, allowing them to edit, eSign, and manage their invoices effortlessly on a cloud-based platform.

Tools and resources for effective invoice payment processing

To enhance efficiency in invoice payment processing, various tools are available that facilitate operations. pdfFiller offers unique features tailored to streamline invoice processing, such as customizable templates and automated workflows.

Additionally, users can access worksheets and templates that aid in maintaining organized financial documentation. Pairing these features with additional tools that integrate seamlessly with payment processing systems can significantly enhance operational efficiency.

Contact information for support and consultation

For individuals and teams looking to optimize their invoice payment processing systems, accessing support through pdfFiller is straightforward. Users are encouraged to explore additional products and services offered to further enhance their document management experiences.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my VA Invoice Payment Processing System IPPS in Gmail?

Can I create an eSignature for the VA Invoice Payment Processing System IPPS in Gmail?

How do I edit VA Invoice Payment Processing System IPPS on an iOS device?

What is invoice payment processing system?

Who is required to file invoice payment processing system?

How to fill out invoice payment processing system?

What is the purpose of invoice payment processing system?

What information must be reported on invoice payment processing system?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.