Get the free Quotation Notice for Vat Series Dn63cf Uhv Gate Valve

Get, Create, Make and Sign quotation notice for vat

Editing quotation notice for vat online

Uncompromising security for your PDF editing and eSignature needs

How to fill out quotation notice for vat

How to fill out quotation notice for vat

Who needs quotation notice for vat?

Comprehensive Guide to Quotation Notice for VAT Form

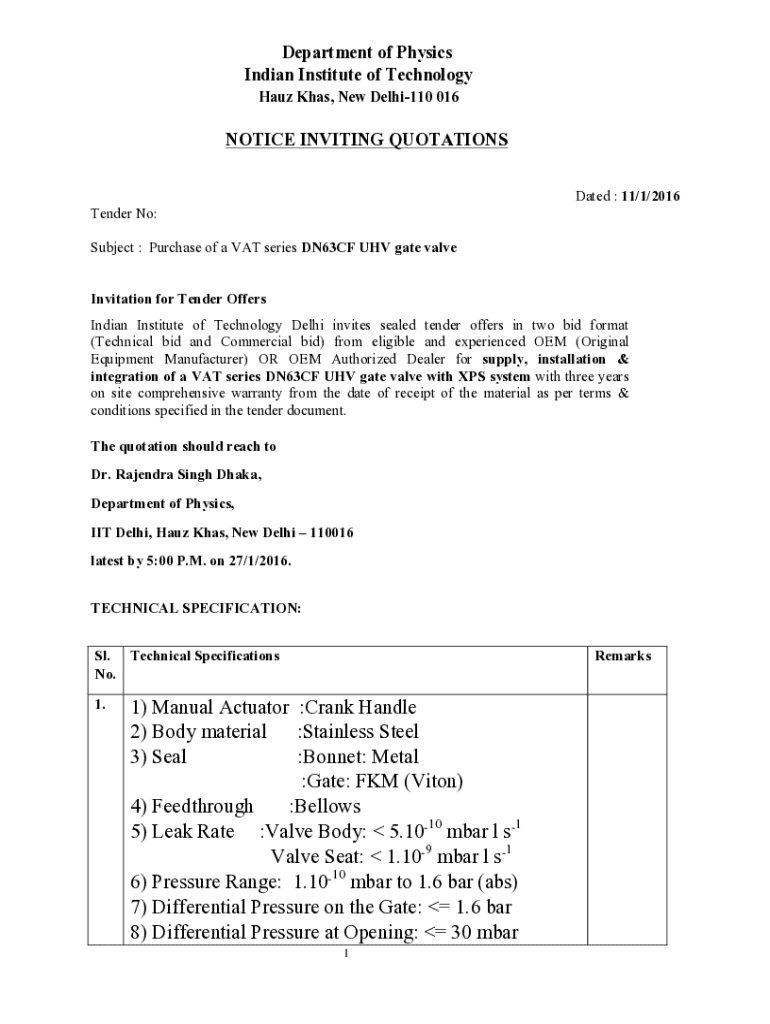

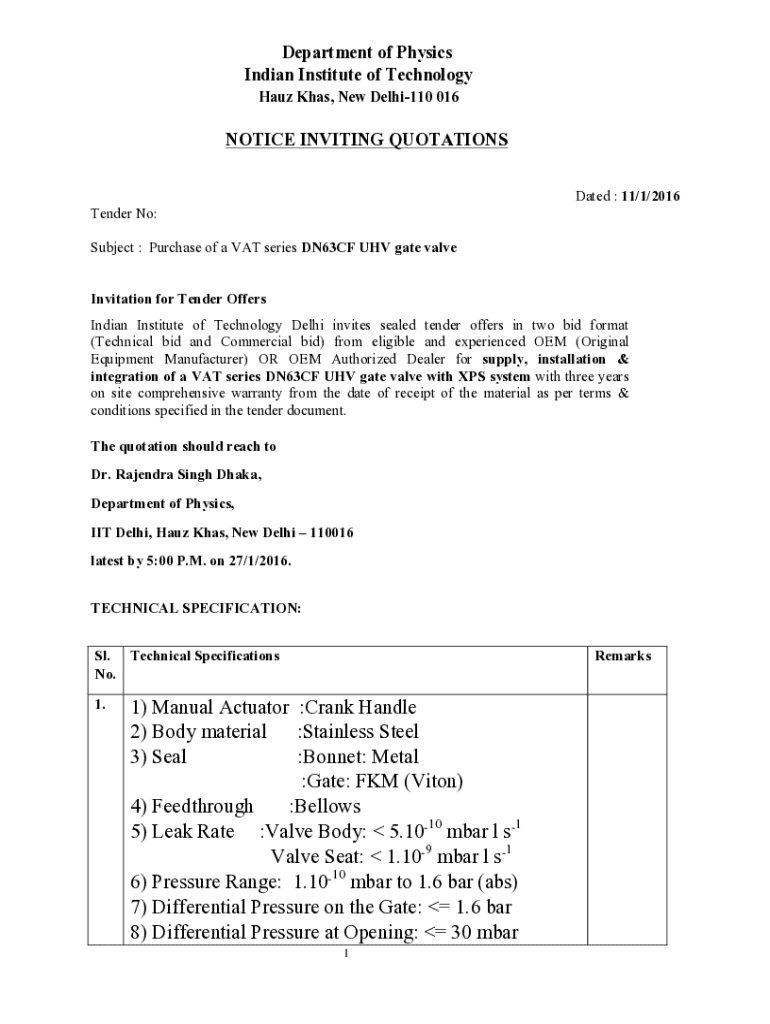

Understanding the quotation notice for VAT form

A quotation notice for VAT form serves as a formal document issued by businesses to specify the estimate of costs for goods or services, incorporating the applicable Value Added Tax (VAT). This document is crucial in the VAT framework, facilitating businesses in maintaining compliance with tax regulations while simultaneously providing clarity to clients regarding pricing.

For businesses, a quotation notice is not only a tool for sales communication but also an important aspect of tax documentation. Ensuring accuracy in VAT calculations and transparency in pricing contributes to smoother operations and trust with customers. The understanding of key terms is essential in this context: VAT refers to the tax levied on goods and services, a quotation notice is the formal estimate, and taxable persons denote the individuals or entities liable to pay VAT.

When is a quotation notice required?

A quotation notice for VAT form is required in several scenarios, particularly when businesses seek to provide potential customers with detailed price estimates prior to finalizing transactions. This is commonly seen in industries such as construction, wholesale, and professional services where total costs can vary based on specifications, materials, and labor.

In addition to industry-specific circumstances, a quotation notice becomes essential when there is a significant time lag between the price quote and the execution of the transaction. This requirement assures that both parties acknowledge the prices quoted, thus preventing future disputes. Ultimately, the impact of this quotation on cash flow is significant; accurate estimation and documentation assist businesses in planning their resources effectively, enhancing overall operational efficiency.

Essential components of a quotation notice for VAT

A well-structured quotation notice for a VAT form includes several crucial components, each contributing to clarity and compliance. These components consist of:

To ensure accuracy in each component, businesses should verify that all data is up-to-date and relevant, reducing the likelihood of miscommunication and tax-related issues in the future.

Step-by-step guide to filling out the quotation notice for VAT form

Properly filling out a quotation notice for VAT form involves a clear process. The preparation phase requires gathering necessary documents, such as previous invoices, VAT registration details, and client information.

Here's a detailed walkthrough of each field to complete:

Common pitfalls include neglecting to enter all relevant details or miscalculating VAT—being thorough in your review can prevent these issues.

Editing and customizing your quotation notice

Customization is key to ensuring your quotation notice for VAT form reflects your business branding. Using tools like pdfFiller allows for easy editing of the VAT form.

Interactive tools available to aid customization include:

Once customized, users can save and export the document in various formats, ensuring compatibility with client needs.

eSigning your quotation notice for VAT form

The use of electronic signatures offers numerous benefits, including enhanced convenience and efficiency in the signing process. eSigning can expedite transactions, allowing for quicker agreement on quotations and reducing the time lag often associated with traditional methods.

Using pdfFiller for eSigning is straightforward. Here’s a simple guide:

It's critical to be aware of legal considerations surrounding eSignatures, ensuring compliance with local regulations to maintain validity.

Collaborating with teams on quotation notices

Collaboration enhances the accuracy and effectiveness of the quotation notice process. Tools provided by pdfFiller facilitate team efforts through features like real-time editing and feedback loops.

Team collaboration can benefit from the following features:

These collaborative features streamline the quotation creation process, ensuring consistency and ease when finalizing documents.

Managing and storing your quotation notices

Organizing and filing VAT forms efficiently is essential for streamlined operations. Employing best practices helps in maintaining proper records and enhances accessibility for future references.

Benefits of utilizing digital platforms like pdfFiller for management include:

Implementing these practices fosters a well-organized system for managing VAT-related documents.

Frequently asked questions (FAQs)

Understanding the nuances of VAT form submission is vital for compliance. Users frequently inquire about aspects such as the required timeframe for submission and common troubleshooting issues.

Some common queries include:

For any unforeseen challenges during form completion or submission, it’s advisable to consult the appropriate tax authorities or utilize resources like pdfFiller for guidance.

Additional considerations

Staying updated with recent changes in VAT regulations is crucial for accurate quotation notice generation. These updates can significantly affect how businesses must prepare quotations.

Alternatives to quotation notices may sometimes be necessary, particularly for industries with unique specifications. Such adaptations ensure businesses remain agile and responsive to client needs.

It is beneficial to cross-link related forms and templates available on pdfFiller to present users with comprehensive solutions tailored to various needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute quotation notice for vat online?

Can I sign the quotation notice for vat electronically in Chrome?

How do I fill out quotation notice for vat using my mobile device?

What is quotation notice for vat?

Who is required to file quotation notice for vat?

How to fill out quotation notice for vat?

What is the purpose of quotation notice for vat?

What information must be reported on quotation notice for vat?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.