Get the free De-310

Get, Create, Make and Sign de-310

How to edit de-310 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out de-310

How to fill out de-310

Who needs de-310?

DE-310 Form: A Comprehensive How-to Guide

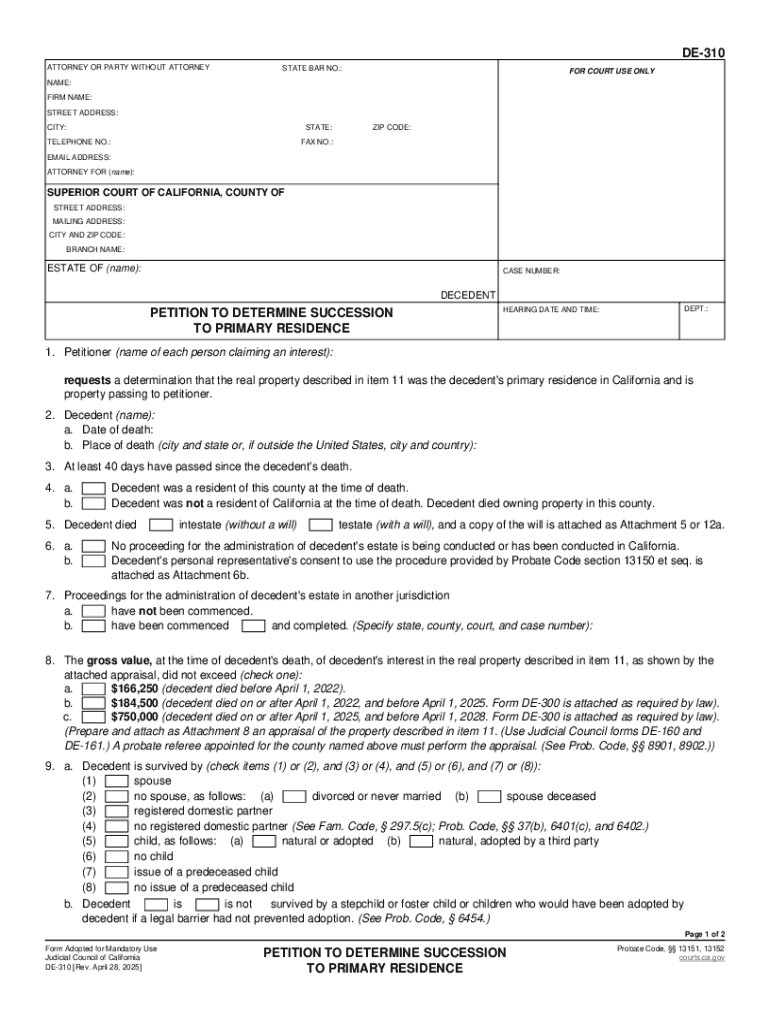

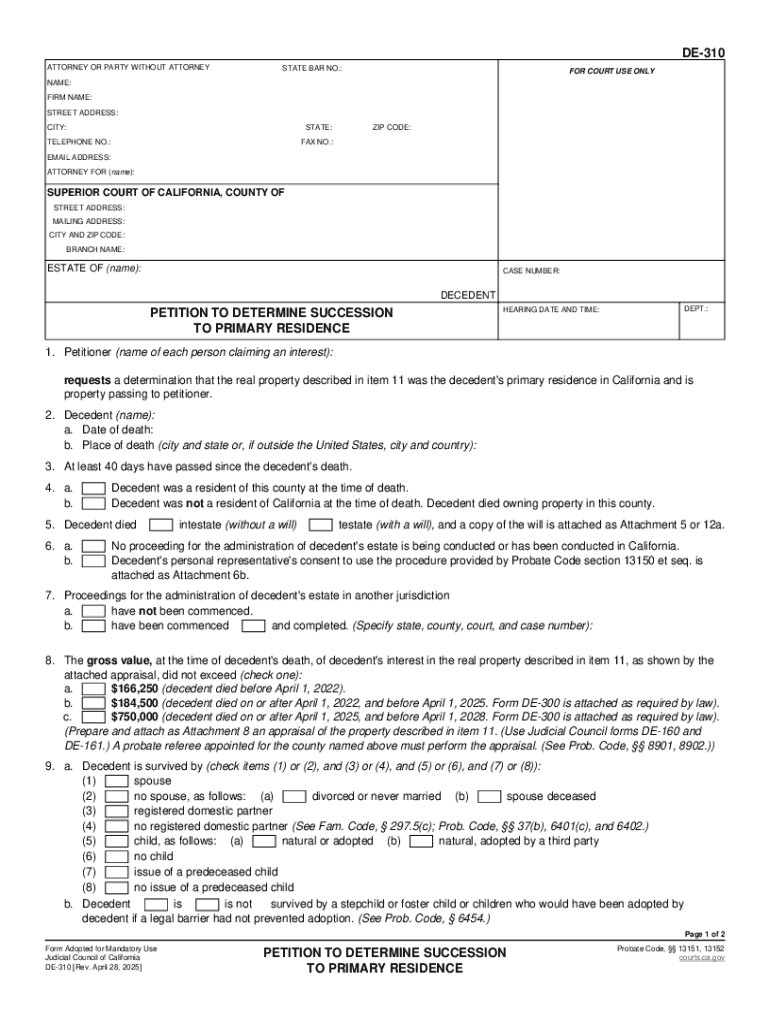

Understanding the DE-310 Form

The DE-310 form, also known as the 'Petition for Probate of Will and for Letters of Administration with Will Annexed,' plays a crucial role in the probate process. This form is essential when an individual needs to establish the succession rights to a primary residence after the death of a property owner. By filing this document, executors and administrators can gain the legal authority necessary to manage and distribute a deceased person's assets, ensuring a smoother transition for beneficiaries.

The DE-310 form is particularly important for those navigating the complexities of Probate Court, as it serves as the foundational legal document that initiates the probate process. It allows executors to perform their responsibilities efficiently and provides assurance to beneficiaries about their inheritance.

Who needs to use the DE-310 form?

Individuals who have recently been appointed as executors or administrators of a decedent's estate are typically required to use the DE-310 form. This includes persons identified in the decedent’s will, or those who take on these roles when no will exists. Additionally, beneficiaries seeking clarification on the title transfer of a property may find this form crucial in understanding how assets will be dispersed, particularly when dealing with multiple heirs.

Preparing to complete the DE-310 form

Before diving into the DE-310 form, it’s essential to gather all necessary information and documentation. This includes the decedent’s full legal name, date of birth, and date of death, as well as a description of the property involved in the succession. Having these details at hand will streamline the process, reducing the likelihood of errors.

You will also need specific documents, including the decedent’s will, if available, and a certified copy of the death certificate. These documents provide proof of death and the decedent’s intentions regarding their estate. Additionally, pdfFiller offers interactive tools to facilitate users throughout the form completion process.

Step-by-step instructions for filling out the DE-310 form

Filling out the DE-310 form can seem daunting, but breaking it down into manageable sections makes it easier. Here’s a detailed step-by-step guide to ensure a proper submission.

Section 1: Filing details

Begin by filling in the necessary filing details, including the court in which you are filing and relevant jurisdiction information. Pay attention to deadlines, as certain timelines must be adhered to so that your estate can begin processing in a timely manner.

Section 2: Decedent information

Accurately inputting the decedent’s information is critical. Include their full name, known aliases, and any identifying information that will help to clarify their identity.

Section 3: Property description

Use precise language to describe the property involved. Include the complete address and physical characteristics of the property, such as whether it is residential or commercial, and if there are any existing mortgages or liens.

Section 4: Successors and beneficiaries

Here, you will list all successors and beneficiaries. Be sure to provide their full names and relationship to the decedent. If applicable, detail any specific assets each beneficiary will receive, noting percentages if several individuals are sharing an asset.

Section 5: Signatures and verification

The final section requires signatures from appointed people, which may include your own signature as the executor and possibly a witness. Some jurisdictions also require notarization, so be prepared to have your document notarized if necessary.

Tips for ensuring accuracy before submission

To avoid common pitfalls, take the time to double-check all entries on the DE-310 form. Mistakes or omissions may cause delays in the probate process. Ensure all required signatures are in place and all relevant documentation is attached, maintaining a clear and organized submission.

Editing and managing the DE-310 form with pdfFiller

pdfFiller provides an efficient platform for making edits and updates to the DE-310 form. If you discover any mistakes post-completion, or if new information arises, you can easily access your form online and make necessary adjustments.

Utilizing the pdfFiller tools allows you to have a versatile document management experience. It enables you to save multiple versions of your forms and track changes over time, ensuring that your work is always current.

eSignature features

pdfFiller includes eSignature capabilities that simplify the signing process. Once edits are complete, documents can be signed electronically, saving time and ensuring compliance with legal requirements. This feature is particularly beneficial when multiple parties need to sign, providing an efficient way for everyone involved to approve the document without mailing back and forth.

Submitting the DE-310 form

Once your DE-310 form is completed and reviewed, it's time for submission. There are various methods for submitting the form, depending on your court's requirements.

Methods for submitting the form:

After submission, it’s vital to verify receipt. You can contact the court to confirm they received your DE-310 form, ensuring there are no delays in the probate process.

Understanding the aftermath: what happens next?

Once your DE-310 form has been submitted, the court will begin processing the probate. This phase includes notifying beneficiaries and allowing any interested parties to contest the will or the probate decision.

The timeline can vary depending on the complexity of the estate, but it usually takes several months. Following submission, expect to receive notices from the court regarding hearings or additional required filings. Patience is key, as legal processes can often face unexpected delays.

Responding to potential legal challenges

It’s not uncommon for disputes to arise during the probate process. Common issues include claims against the estate, disagreements among beneficiaries, or challenges regarding the validity of the will itself. Being prepared to respond to these challenges is important — consulting with a probate attorney can provide valuable guidance and ensure that you’re equipped to handle unforeseen situations effectively.

Frequently asked questions (FAQs) regarding the DE-310 form

Below are some frequently asked questions surrounding the DE-310 form, aimed to clarify common concerns.

General questions

How long does it take for the DE-310 form to be processed? This can vary based on jurisdiction, but it typically takes several weeks to receive a response from the court following submission.

Specific legal queries

What happens if someone contests the will? If a will is contested, the probate process may pause as the court resolves the dispute, often requiring hearings and additional documentation.

Technical troubleshooting for pdfFiller users

If you face issues with pdfFiller, common solutions include ensuring your browser is up to date and checking your internet connection. Additionally, pdfFiller’s support staff can assist with any technical difficulties encountered during form management.

Related topics and resources

Navigating the world of probate doesn’t end with the DE-310 form. There are several additional forms and resources that individuals may find beneficial.

Exploring additional probate forms

Other essential probate forms include the DE-111, which is used for preliminary hearings, and the DE-120 to appoint an executor. Understanding these forms can equip you better for the probate process.

Connecting with legal resources

Finding a probate lawyer or legal aid services in your area can facilitate a smoother transition through the process. Websites like the American Bar Association's directory can help locate experienced professionals.

Learning more about real estate succession

For further insights into real estate succession, consider reviewing detailed articles on various topics such as estate planning, estate taxes, and property law. These resources will provide critical knowledge to better navigate the complexities involved.

Best practices for document management in probate

Managing documents during probate is crucial in ensuring that no relevant information is lost. Establish a filing system that categorizes documents related to the estate, such as identification, property records, and correspondence with the court.

Leveraging technology can enhance collaboration. pdfFiller's features, including shared access to documents and collaborative editing tools, enable multiple parties to work together seamlessly. This ensures everyone involved stays updated and informed.

Tips for effective document management

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in de-310 without leaving Chrome?

Can I sign the de-310 electronically in Chrome?

How do I fill out the de-310 form on my smartphone?

What is de-310?

Who is required to file de-310?

How to fill out de-310?

What is the purpose of de-310?

What information must be reported on de-310?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.