Get the free Campaign Finance Receipts & Expenditures Report

Get, Create, Make and Sign campaign finance receipts expenditures

Editing campaign finance receipts expenditures online

Uncompromising security for your PDF editing and eSignature needs

How to fill out campaign finance receipts expenditures

How to fill out campaign finance receipts expenditures

Who needs campaign finance receipts expenditures?

Comprehensive Guide to Campaign Finance Receipts and Expenditures Form

Understanding campaign finance basics

Campaign finance plays a vital role in the electoral process, influencing how political campaigns are funded and structured. It encompasses the collection and spending of money by candidates, political parties, and interest groups to support political engagement and election activities.

Understanding the distinction between receipts and expenditures is crucial for maintaining transparency. Receipts refer to the funds collected by a campaign, including donations and contributions, while expenditures are the costs incurred in running the campaign, including advertising, staff salaries, and event expenses. This differentiation impacts how stakeholders, regulators, and voters perceive a campaign's integrity.

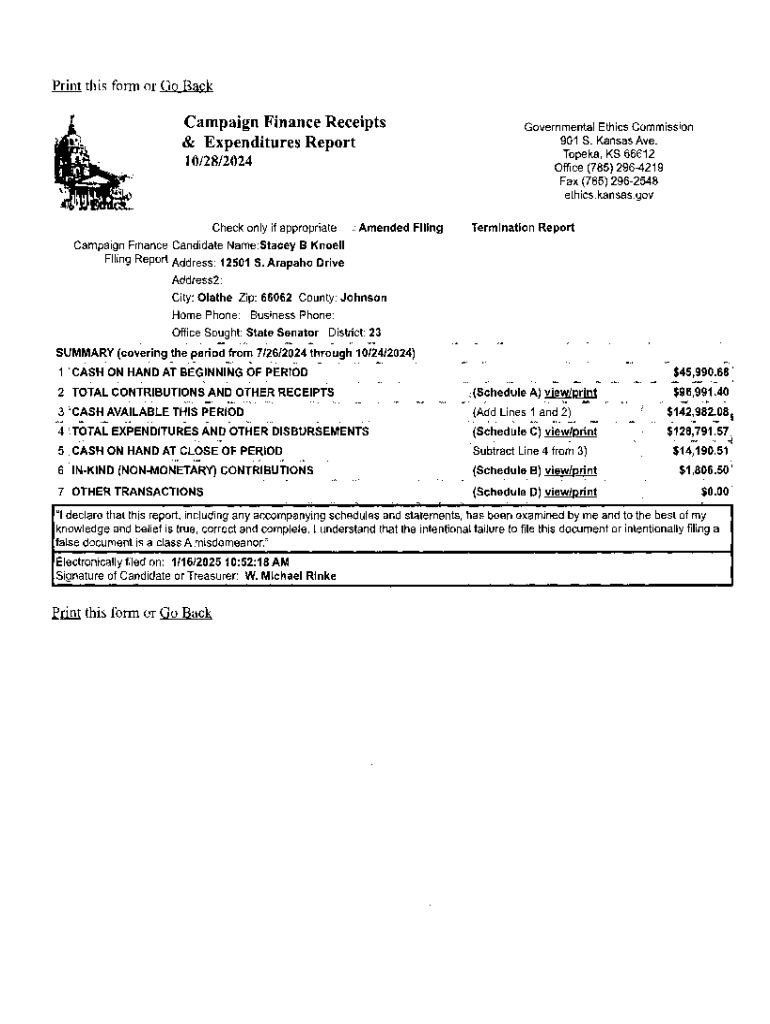

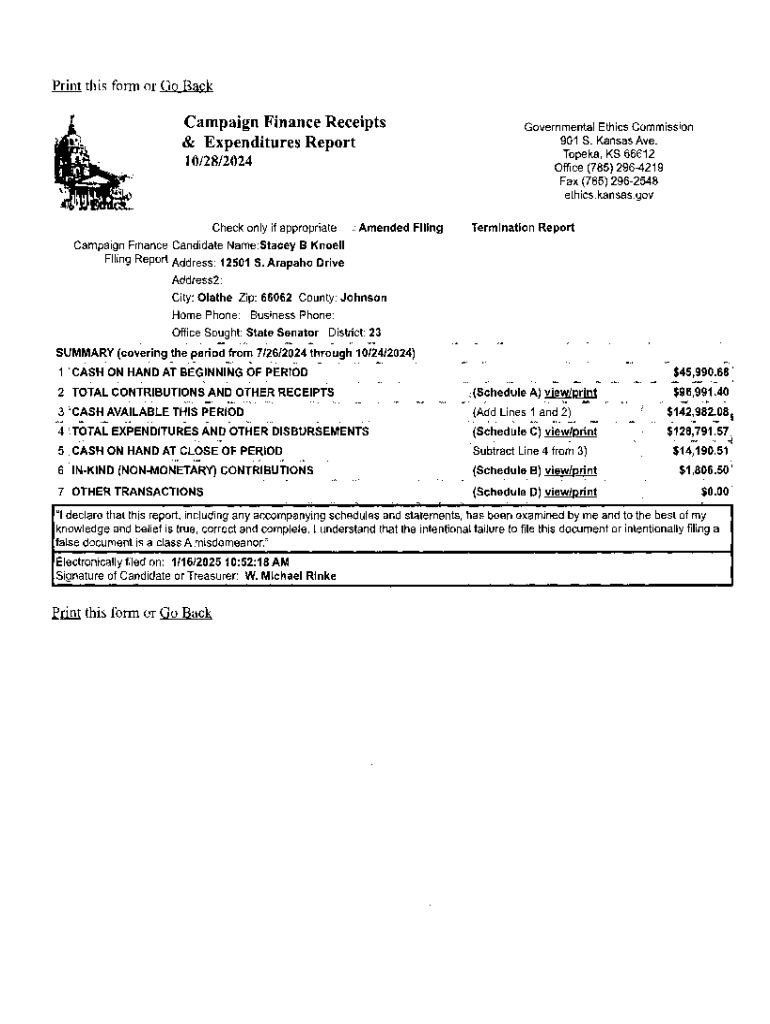

Overview of campaign finance receipts and expenditures form

The campaign finance receipts and expenditures form is a critical component of a campaign's financial documentation. This form enables campaigns to report their financial activities in a structured manner, providing transparency and accountability to the public and regulatory bodies.

This form includes various sections dedicated to detailing sources of contributions, loans received, and itemized expenditures. The clarity of these reports is essential for compliance with local and federal laws concerning campaign finance. Common terminologies used in this context include 'aggregate contributions,' 'itemized expenditures,' and 'non-itemized amounts,' all of which contribute to a complete financial picture of the campaign.

Who needs to file this form?

Entities required to file the campaign finance receipts and expenditures form typically include candidates running for office, political committees, and parties that participate in elections. Generally, any campaign that raises or spends above a certain threshold as determined by local regulations must adhere to these requirements.

However, there are exemptions to these rules. For instance, candidates engaging in races with minimal funding thresholds may not need to file if their total transactions fall below specified limits. Additionally, campaigns relying on self-financing or non-party funding may have different obligations, which should be clarified per state laws.

Step-by-step instructions for filling out the form

Before diving into filling out the form, proper preparation is critical. Campaign teams should gather all essential documentation, including bank statements, receipts for expenditures, and lists of contributions or loans. Streamlining this information beforehand will ease the filling process and minimize errors.

Filling out the receipts section involves identifying each source of campaign revenue. It requires detailed reporting of contributions from individuals, groups, and loan amounts. The expenditures section requires careful documentation of all campaign-related spending. This includes distinguishing between allowable expenses, such as marketing costs, and disallowed expenditures, which might include personal expenses not tied to the campaign.

Tips for accurate reporting

When it comes to filing the campaign finance receipts and expenditures form, vigilance is necessary. Common pitfalls include failing to report certain contributions or misclassifying expenses. Such errors can lead to compliance issues that may harm a campaign’s reputation.

Best practices for financial reporting include maintaining a meticulous record of all transactions, using accounting software or spreadsheets for tracking, and regularly reviewing documentation against filed reports. This proactive approach reduces the likelihood of mistakes and enhances transparency throughout the campaign.

Electronic filing options

Embracing technology is essential for modern campaigns. Using resources like pdfFiller allows users to complete and submit the campaign finance receipts and expenditures form in a streamlined manner. pdfFiller’s features simplify the filing process by ensuring documents are easily accessible, editable, and shareable.

However, while electronic filing offers many conveniences, there are pros and cons to consider. Advantages include immediate submission tracking and reducing paper waste, while potential drawbacks involve compatibility issues with certain software or the learning curve associated with new technology.

Managing campaign finance documents

An organized approach to managing campaign finance documents significantly impacts compliance and operational efficiency. Creating a systematic filing system for all receipts, invoices, and completed forms ensures that everything is readily available should audits or inquiries arise.

Utilizing interactive tools for document management, such as those from pdfFiller, enhances collaboration among team members and streamlining the review process. Features like shared access and real-time edits elevate how campaigns manage their financial reporting tasks.

Legal obligations and compliance

Campaigns must understand the regulatory requirements imposed by local, state, and federal laws governing campaign finance. These regulations dictate how much can be contributed, the sources of funds, and the timing of disclosures. It is essential for candidates and their teams to remain informed of these guidelines to maintain compliance.

Failure to comply with campaign finance laws can lead to significant penalties, including fines and loss of candidacy. Organizations must prioritize accuracy and transparency to uphold the integrity of their campaign and foster trust among their supporters and the public.

Frequently asked questions (FAQs)

Many questions often arise concerning the campaign finance receipts and expenditures form. Common confusions include how to handle in-kind contributions, when to report, and how to rectify potential mistakes after submission.

For further assistance, candidates and their teams can reach out to local election offices or consult the Federal Election Commission's website for clarification on reporting requirements or to access resources designed to aid in completing the form accurately.

Staying updated on campaign finance laws

The landscape of campaign finance regulations is constantly evolving. It's crucial for campaign staff and candidates to stay informed about any changes that might affect their reporting requirements. Legislative updates can introduce new rules regarding donation limits or reporting timelines.

Subscribing to newsletters or alerts from organizations that specialize in campaign finance and political law can enhance understanding and ensure compliance. Keeping abreast of these developments will better equip campaigns to navigate the complex world of campaign finance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send campaign finance receipts expenditures to be eSigned by others?

How can I get campaign finance receipts expenditures?

Can I create an eSignature for the campaign finance receipts expenditures in Gmail?

What is campaign finance receipts expenditures?

Who is required to file campaign finance receipts expenditures?

How to fill out campaign finance receipts expenditures?

What is the purpose of campaign finance receipts expenditures?

What information must be reported on campaign finance receipts expenditures?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.