Get the free Credit/debit Card Authorization Release Form

Get, Create, Make and Sign creditdebit card authorization release

Editing creditdebit card authorization release online

Uncompromising security for your PDF editing and eSignature needs

How to fill out creditdebit card authorization release

How to fill out creditdebit card authorization release

Who needs creditdebit card authorization release?

Credit Debit Card Authorization Release Form: A Comprehensive Guide

Understanding credit debit card authorization forms

A credit debit card authorization release form serves as a written agreement between a cardholder and a merchant, allowing the merchant to charge the cardholder's account for a specific transaction. This form is crucial in the modern payment ecosystem, ensuring that transactions are authorized and reducing the risk of fraud.

The significance of authorization forms in transactions cannot be overstated. They protect both the consumer and the merchant by clearly documenting consent for the transaction, which is particularly important in the event of disputes or chargebacks. Without such documentation, merchants face struggles in proving that they had permission to process the payment.

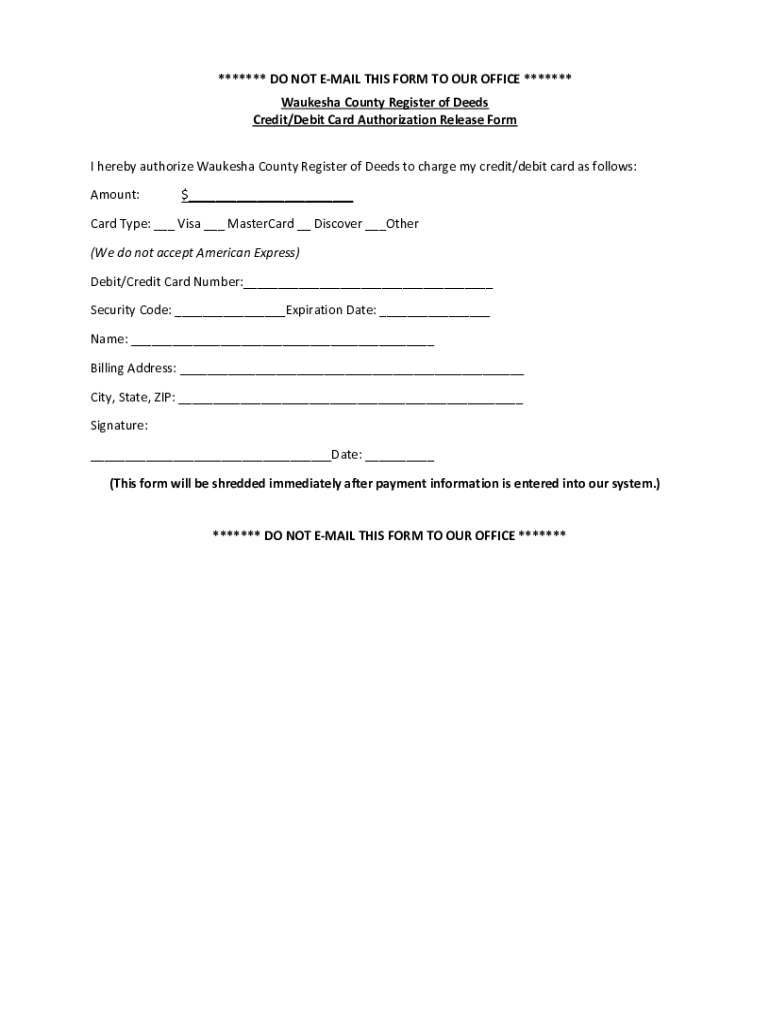

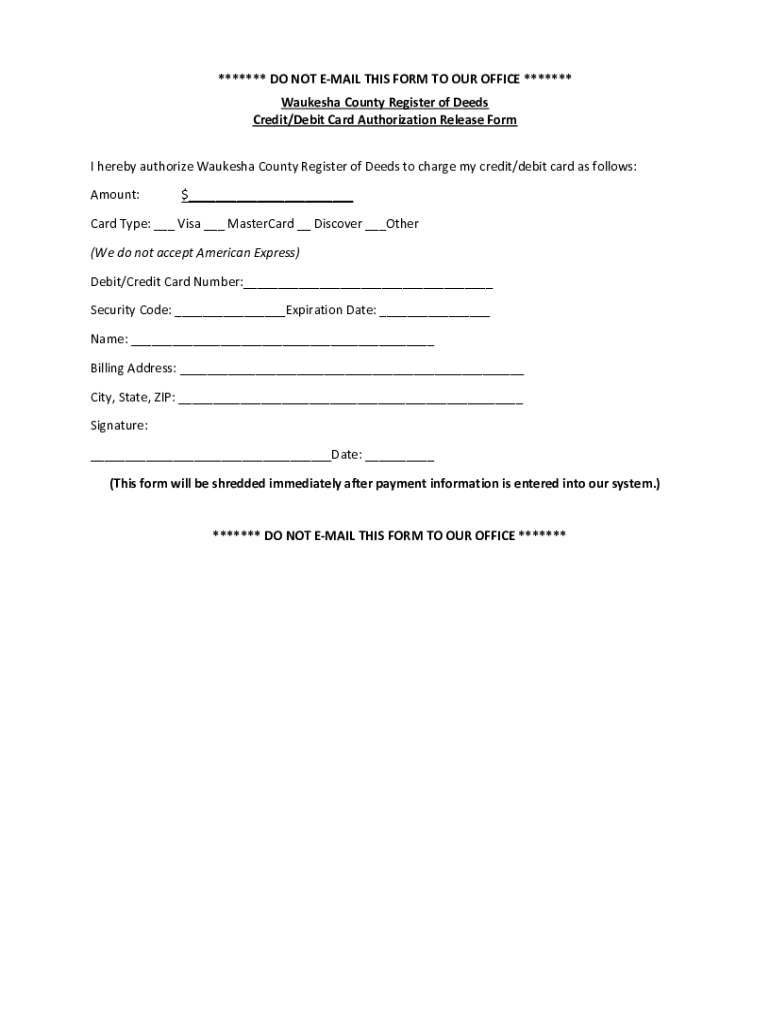

Key elements of a credit debit card authorization release form typically include the cardholder’s name, card number, expiration date, transaction amount, purpose, and a space for the cardholder's signature, authorizing the transaction. Including these elements ensures compliance with regulations and helps establish a secure foundation for financial interactions.

Benefits of using a credit debit card authorization release form

Implementing a credit debit card authorization release form provides numerous advantages for both consumers and businesses. One of the primary benefits is the prevention of chargeback abuse. Chargebacks can occur when customers dispute transactions, and without proper documentation, merchants find it challenging to defend against such disputes. By using a formal authorization form, they can effectively reduce the likelihood of unjustified chargebacks.

Enhanced security for transactions is another significant benefit. Authorization forms add an extra layer of verification, ensuring that transactions are legitimate, thus reducing the risk of credit card fraud. This added security is especially important for online businesses that cannot physically verify the identity of their customers before processing payments.

Moreover, these forms streamline payment processes. By having an authorization form on file, businesses can process payments more efficiently, as they do not need to repeatedly obtain verbal or written approval for ongoing transactions. This efficiency can improve customer satisfaction and speed up the payment process.

Finally, legal protections for sellers are a crucial benefit. In disputes where a seller can prove that they had authorization to charge the customer’s card, they have a stronger legal position, which can save significant time and money in potential litigation.

When to use a credit debit card authorization form

Certain scenarios necessitate the use of a credit debit card authorization release form. For instance, e-commerce transactions often require such forms to protect against fraud. When customers purchase goods online, merchants should obtain written authorization to charge their credit cards, allowing ease in electronic transaction processing.

Service-based businesses also benefit from these forms. Companies that offer services requiring upfront payment or deposits—such as cleaning services, repairs, or professional consulting—should have clients complete an authorization form to safeguard themselves from chargeback issues.

Additionally, event registrations and reservations warrant the use of authorization forms. When customers are reserving services, such as travel bookings or event attendance, having written authorization can prevent potential disputes regarding payment, especially for cancellations or no-shows.

Recognizing high-risk transactions is crucial as well. Transactions involving significant sums, international credit card payments, or repeat customers with a history of chargebacks should always have a robust authorization process in place.

What to include in a credit debit card authorization release form

The design of a credit debit card authorization release form must encompass essential information for it to be valid. First, it should contain the cardholder's details, including their full name, address, and contact information. This data allows for identity verification and communication if issues arise.

Next, the form must clearly state the transaction amount and purpose, providing transparency about what the cardholder is authorizing. Inclusion of expiration dates and the Card Verification Value (CVV) can enhance security, ensuring the card is valid and physically in the cardholder’s possession during the transaction.

The consent and signature areas are crucial for legal purposes. These sections not only confirm that the cardholder authorizes the transaction but also serve as proof of compliance with financial regulations. Variations may occur based on the context; for instance, individual use may have different requirements than business use. Recurring transactions will need additional terms outlining how often and for what duration the card will be charged.

How to fill out a credit debit card authorization release form

Filling out a credit debit card authorization release form accurately is crucial for both parties. Start by collecting the necessary information from the cardholder, ensuring you have details like their name, card number, and transaction specifics. Accurate data collection reduces errors that could lead to dispute or financial loss.

Next, carefully fill in the authorization details on the form. Ensure all relevant sections are completed, emphasizing clarity to avoid misunderstandings later. Once filled, review the document for accuracy before asking the cardholder to sign.

Common mistakes to avoid during completion include skipping required fields, using illegible handwriting, or failing to clarify the payment purpose. Such oversights can create challenges during payment processing and may affect the legality of the authorization.

Best practices for managing credit debit card authorization release forms

Secure storage requirements for credit debit card authorization release forms are paramount to maintain consumer privacy and adhere to regulatory standards. For digital formats, utilizing compliant storage solutions ensures that sensitive information is protected against breaches and unauthorized access.

Retention period laws and recommendations vary by jurisdiction; however, it is generally advisable to keep signed forms for a minimum of three to five years. This longevity ensures that businesses can defend against chargebacks or disputes that may arise well after the transaction has taken place.

Compliance with PCI-DSS (Payment Card Industry Data Security Standards) is essential for all entities handling credit card transactions. These guidelines outline necessary security measures to protect cardholder data. Additionally, utilizing PDF solutions for editing and signing forms can simplify the documentation process, confirm legality, and enhance collaborative efforts across teams.

FAQs about credit debit card authorization forms

Am I legally required to use an authorization form? While not every transaction mandates a formal authorization, using one is highly advisable for protecting your business from chargebacks and disputes. It provides a clear record of consent that can be invaluable in case of conflicts.

How long should I keep signed forms? Businesses should maintain signed forms for a minimum of three years, but it's always better to check the specific laws applicable in your region. Are electronic signatures valid? Yes, electronic signatures are legally recognized as valid in many jurisdictions, provided they meet specific requirements, such as ensuring that the signer’s identity can be verified.

What are the risks of not using authorization forms? Failing to use them can expose businesses to fraudulent transactions, resulting in financial loss without recourse to reclaim funds. Lastly, if a dispute arises, having an authorization form significantly improves the chances of resolving it favorably.

Downloadable templates for credit debit card authorization release forms

Accessing pre-designed templates for credit debit card authorization release forms can be a great way to ensure compliance and efficiency in your transaction processes. These templates can be customized to suit your business needs, making it easier to implement a robust payment authorization system.

Customization options allow businesses to tailor forms based on specific transaction requirements, whether they be for one-time payments or recurring charges. The convenience of using templates not only saves time but also enhances accuracy, ensuring that all necessary information is captured correctly.

Related tools and resources

Utilizing document creation and management tools such as those offered on pdfFiller enhances the efficiency of handling credit debit card authorization release forms. Interactive tools for editing and signing forms allow for seamless collaboration between team members and clients, enabling a smoother transaction process.

Exploring pdfFiller’s features for document and forms management can significantly improve the way businesses handle their authorization needs. From cloud-based editing to e-signatures, these features promote a flexible and secure environment for all document-related tasks.

Exploring advanced techniques in credit card security

The role of AI in fraud detection is becoming increasingly critical. Advanced algorithms can analyze transaction patterns and behaviors to flag suspicious activities in real-time, thereby enhancing the overall security of card transactions.

Future trends in credit card processing security will likely focus on integrating biometric verification methods, which could further reduce fraud risks. These innovations aim to create a more secure environment for consumers and businesses alike.

To stay updated on regulatory changes, it's crucial for businesses to regularly consult financial news sources and trade organizations, ensuring they remain compliant with evolving standards and best practices in the industry.

Real-life case studies of effective use

Several businesses have successfully implemented credit debit card authorization release forms to protect against fraud. For instance, an online retailer that introduced these forms noted a significant decrease in chargeback disputes and improved cash flow due to timely payments.

Additionally, a service-based company was able to recover funds swiftly during a dispute involving a chargeback, thanks to their well-documented authorization process. The lessons learned from chargeback disputes highlight the necessity of having stringent authorization practices in place to avoid financial setbacks.

Innovations in payment solutions across different industries showcase a shift towards more secure methods of transaction processing. As more businesses adopt digital solutions for managing their payment authorizations, the overall integrity of financial exchanges improves.

Conclusion: Empowering your transaction security

Using a credit debit card authorization release form is essential for both consumers and businesses to establish secure transaction processes. These forms not only protect against unauthorized transactions but also help maintain trust in financial interactions.

pdfFiller is transforming document management by providing users with the tools they need to seamlessly edit PDFs, e-sign, collaborate, and manage documents from a single, cloud-based platform. Embracing such technology can simplify your transaction processes, ensuring that your documentation is efficient and secure.

Stay ahead by keeping your cloud-based documents secure and organized. By utilizing a credit debit card authorization release form, you're taking an important step towards safeguarding your financial transactions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit creditdebit card authorization release from Google Drive?

How can I send creditdebit card authorization release to be eSigned by others?

How do I fill out creditdebit card authorization release on an Android device?

What is creditdebit card authorization release?

Who is required to file creditdebit card authorization release?

How to fill out creditdebit card authorization release?

What is the purpose of creditdebit card authorization release?

What information must be reported on creditdebit card authorization release?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.