Get the free 990 ez form online

Get, Create, Make and Sign 990 ez form online

How to edit 990 ez form online online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 990 ez form online

How to fill out form 990-ez

Who needs form 990-ez?

How to Complete the Form 990-EZ

Understanding Form 990-EZ

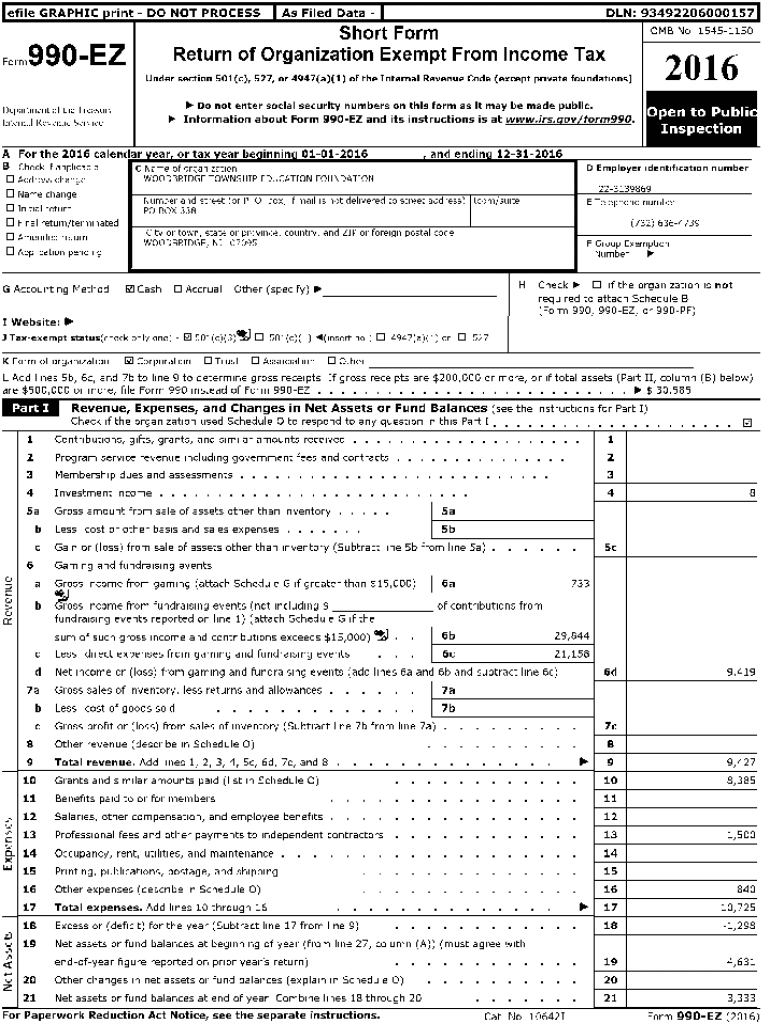

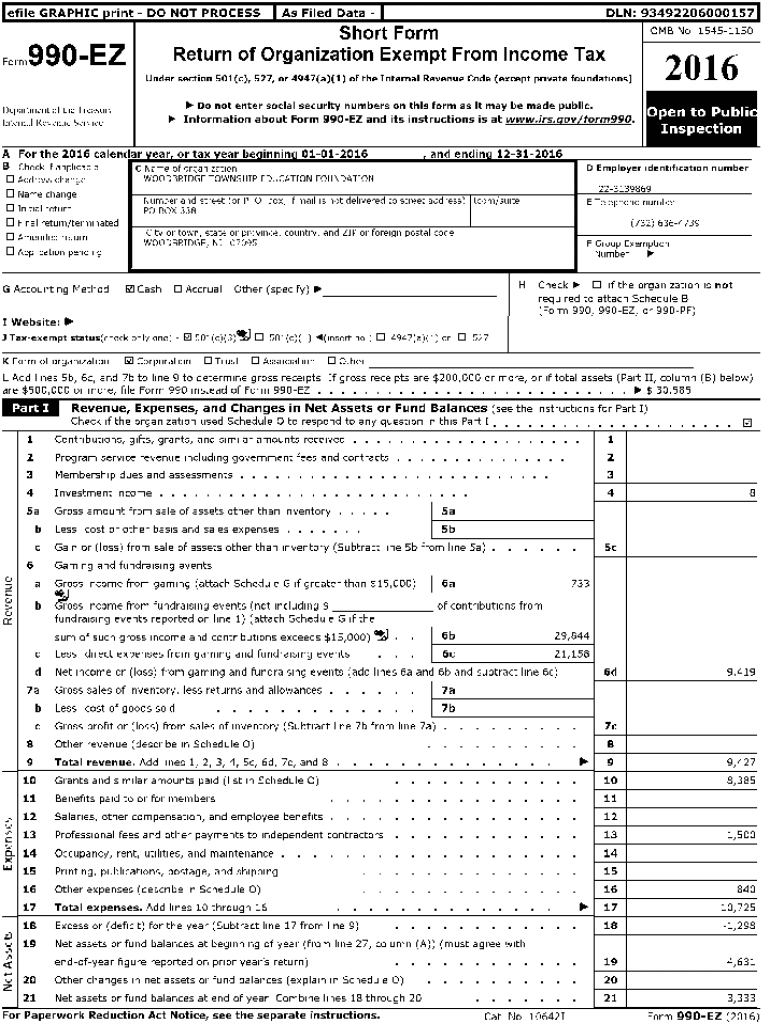

Form 990-EZ is a streamlined version of the Form 990 used by certain tax-exempt organizations, allowing them to report their financial information to the IRS. This form plays a critical role in assessing the public charity status and financial transparency of nonprofits. By providing essential information about revenue, expenses, and activities, Form 990-EZ informs both stakeholders and the IRS about the organization’s operations.

Form 990-EZ helps organizations maintain compliance with federal tax regulations, serving as a vital tool for transparency and accountability within the nonprofit sector. Filing this form is significant not just for legal compliance but also for cultivating public trust.

Who must file Form 990-EZ?

Eligibility to file Form 990-EZ is limited to tax-exempt organizations with total revenue under $200,000 and total assets under $500,000. This typically includes smaller nonprofits and certain charitable organizations. Understanding these thresholds helps organizations determine their filing obligations to the IRS.

Comparing Form 990 and Form 990-EZ

While both forms serve the purpose of reporting financial information for nonprofit organizations, they differ significantly in complexity and detail. Form 990 is designed for larger organizations with more complex operations that generate revenue exceeding the thresholds stipulated for Form 990-EZ. Therefore, the choice between these forms hinges on the organization’s financial size and operational complexity.

In essence, if your organization meets the revenue and asset criteria, using Form 990-EZ can simplify the reporting process considerably, making compliance less burdensome.

Preparing to file Form 990-EZ

Before beginning to fill out Form 990-EZ, it’s beneficial to gather all necessary documentation to ensure a smooth process. Essential documents include financial statements, previous IRS tax returns, and records of contributions. Accurate data is crucial to comply with IRS mandates and enhance transparency.

Understanding the structure of Form 990-EZ is equally important. The form comprises several parts that collectively paint a comprehensive picture of your organization’s financial health, including revenue, expenses, and net assets. Familiarizing yourself with these sections beforehand can streamline the filling process.

Understanding the structure of Form 990-EZ

The form consists of three main parts that include information about revenue, expenses, and net assets, leading into supplementary schedules that capture specific details. Part I captures revenue, Part II expenses, and Part III asks for a statement of functional expenses.

Schedule overview

Form 990-EZ may require the completion of specific schedules that elaborate on certain financial aspects. For instance, Schedule A provides additional information on exemptions and public charity status. Each schedule serves to elaborate on core form sections, providing clarity and context for the IRS and public stakeholders.

Step-by-step guide to filling out Form 990-EZ

Filling out Form 990-EZ can be methodical. Here’s a step-by-step approach to effectively completing the form. First, ensure all necessary information is gathered, including your organization’s financial statements from the previous year.

Step 1: Gather necessary information

Gather your organization’s key financial statements, such as the balance sheet, income statement, and significant event records that could impact your financial reporting. Ensuring the accuracy and completeness of this information is crucial for compliance.

Step 2: Fill out Part - Revenue

Part I requires detailed reporting of total revenues, distinguishing between contributions, program service revenue, and other income. Ensure all entries align with data from financial statements to maintain accuracy. Necessary detail in this section will alleviate potential issues during IRS reviews.

Step 3: Fill out Part - Expenses

In Part II, categorize expenses into program, management, and fundraising. Understanding these categories helps demonstrate the effectiveness and efficiency of fund usage, establishing confidence with stakeholders regarding the organization’s financial integrity.

Step 4: Fill out Part – Statement of Revenue

This section requires a detailed statement that outlines sources of revenue and any variations from previous years. It’s instrumental in providing transparency, showcasing changes in the revenue situation compared to prior filings.

Step 5: Complete additional required schedules

Once the main sections are completed, review specific schedules that may apply to your organization, such as Schedule B for contributions and Schedule A for public charity status. Completing these accurately is vital for full compliance.

E-filing Form 990-EZ

E-filing Form 990-EZ is an efficient alternative to traditional mailing. The process can be completed electronically through various authorized e-filing services, which streamline submission and provide confirmation of receipt.

How to file Form 990-EZ electronically

To begin e-filing, select an IRS-approved e-filing software platform. Next, set up an account, enter the necessary data from your organized documentation, and follow prompts to submit the form electronically. Consider electronically filing for quicker processing times.

Should you file Form 990-EZ electronically?

E-filing offers many advantages, such as instant confirmation of submission and reduced processing times. Additionally, it minimizes the risk of losing paper documents and allows for easy updates. If your organization is equipped for electronic processes, it's recommended to e-file.

Technical requirements for e-filing

Ensure that you have reliable internet access and a compatible device for e-filing. The IRS outlines specific formats that e-filing software must support, so choose a platform that aligns with these requirements for seamless submission.

Key considerations after submission

After submitting Form 990-EZ, it’s crucial to be mindful of deadlines and what follows. Ensuring timely filing helps maintain compliance with IRS regulations, while being prepared for potential follow-ups will ensure smooth operations.

When is the 990-EZ filing deadline?

The standard filing deadline for Form 990-EZ is the 15th day of the 5th month after the close of your organization’s tax year. Nonprofits can also apply for an automatic extension, but it’s essential to be aware of required timelines to avoid penalties.

What happens after you file Form 990-EZ?

After submission, the IRS reviews the form. This review process checks for compliance and accuracy. Depending on the information provided, further information may be requested, which leads to a follow-up action on the nonprofit's part.

How to amend a previously filed 990-EZ return

If you discover an error or need to make changes after filing, submit Form 990-X to amend any part of a previously filed return. This amendment process allows you to rectify inaccuracies and maintain transparency with the IRS.

Consequences of late filing

Filing Form 990-EZ late can result in severe repercussions for nonprofit organizations, including financial penalties that can add up quickly. It’s vital to understand these consequences to maintain operational integrity and compliance.

What are the penalties for filing Form 990-EZ late?

The penalty structure for respective late filings under IRS Section 6652 includes fines that increase the longer the form is overdue. Organizations can expect cumulative costs that make timely filing a necessity for nonprofit viability.

Is there an extension available for Form 990-EZ?

Nonprofits can file for an automatic extension using Form 8868. However, it’s important to recognize that an extension still requires the filing to be completed within a given period, and it does not relieve the organization from potential late penalties.

Tax considerations related to Form 990-EZ

Filing Form 990-T may become necessary under specific conditions, such as unrelated business income exceeding the threshold of $1,000. Understanding when to file Form 990-T in conjunction with Form 990-EZ is essential for compliance and accurate reporting.

Understanding Form 990-T with 990-EZ

Form 990-T is specifically designed for reporting unrelated business income tax. Nonprofits generating such income must file this form alongside their 990-EZ, addressing the tax implications on that revenue, thus ensuring adherence to IRS regulations.

What is a no-cost amendment?

A no-cost amendment refers to correcting a previously filed form without incurring additional fees, provided it falls within a designated period after the initial submission. This option can alleviate financial burdens while allowing nonprofits to maintain accurate records.

Common questions and FAQs about Form 990-EZ

Navigating Form 990-EZ can raise several questions. Let’s address some common inquiries organizations have when dealing with this form.

When should you consider filing Form 990-EZ?

Consider filing Form 990-EZ if your nonprofit meets the revenue threshold and assets criteria that allow for simplified reporting while maintaining compliance. This form suits smaller organizations looking for a less complicated filing process.

How many parts are there in IRS Form 990-EZ?

IRS Form 990-EZ consists of three main parts, addressing revenue, expenses, and net assets along with supplementary schedules as necessary to provide a complete fiscal picture.

What is the Group Exemption Number (GEN)?

The Group Exemption Number signifies that an organization is part of a larger group of 501(c)(3) organizations. This unique identifier should be reported on Form 990-EZ where applicable, facilitating tracking and reporting within the group.

Can get a copy of my Form 990-EZ?

Yes, organizations can request a copy of their filed Form 990-EZ through the IRS directly or utilize provided corporate acts to retrieve copies from filing services.

Additional support and resources

Completing Form 990-EZ can be complex, but many resources are available to help organizations navigate this process effectively. Leveraging IRS resources can provide guidance, while platforms like pdfFiller offer additional tools for document management.

Helpful resources for completing Form 990-EZ

Utilizing the IRS’s website can provide essential information, updates, and helpful tips regarding Form 990-EZ requirements. Organizations should keep an eye on these resources to ensure compliance and accuracy.

Accessing the knowledge base

Accessing pdfFiller's knowledge base can equip users with the insights needed to create, edit, and manage Form 990-EZ efficiently. Leverage this resource for practical tips and troubleshooting guidance.

Client management tools

Effective document management is crucial for nonprofits dealing with Form 990-EZ. Utilizing client management tools can facilitate the tracking and organization of required documentation, which is essential for timely filings and compliance.

Tools and features offered by pdfFiller

pdfFiller provides a suite of interactive tools essential for nonprofit organizations in managing forms like 990-EZ seamlessly. These interactive features allow for straightforward completion and submission.

Interactive tools for filling out Form 990-EZ

The platform supports interactive form completion, allowing users to fill out, edit, and sign forms with ease. These tools simplify the user experience, promoting accuracy and confidence in submissions.

Easy signature process for document finalization

pdfFiller’s eSignature tools enable users to finalize documents seamlessly, ensuring compliance while enhancing efficiency. With digital signatures, organizations can expedite their filing process.

Volume-based pricing options

For nonprofits, understanding pricing structures can promote more effective budgeting. pdfFiller offers volume-based pricing options tailored to the needs of organizations in managing their documentation and filings.

Get started now with pdfFiller

Engaging with pdfFiller resources equips users with the knowledge and tools necessary to excel in filing Form 990-EZ. The platform's intuitive design ensures that users can navigate forms with minimal hurdles quickly.

Navigating pdfFiller's document creation solutions

Form 990-EZ can be completed swiftly through pdfFiller’s user-friendly platform, which provides resources and support every step of the way. Leverage the tools available to optimize your nonprofit's document workflow.

Unique value proposition of pdfFiller

Ultimately, pdfFiller empowers organizations to streamline document management, filling, and submission processes within a secure cloud-based platform, enhancing operational efficiency while ensuring compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 990 ez form online without leaving Google Drive?

How do I make edits in 990 ez form online without leaving Chrome?

Can I sign the 990 ez form online electronically in Chrome?

What is form 990-ez?

Who is required to file form 990-ez?

How to fill out form 990-ez?

What is the purpose of form 990-ez?

What information must be reported on form 990-ez?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.