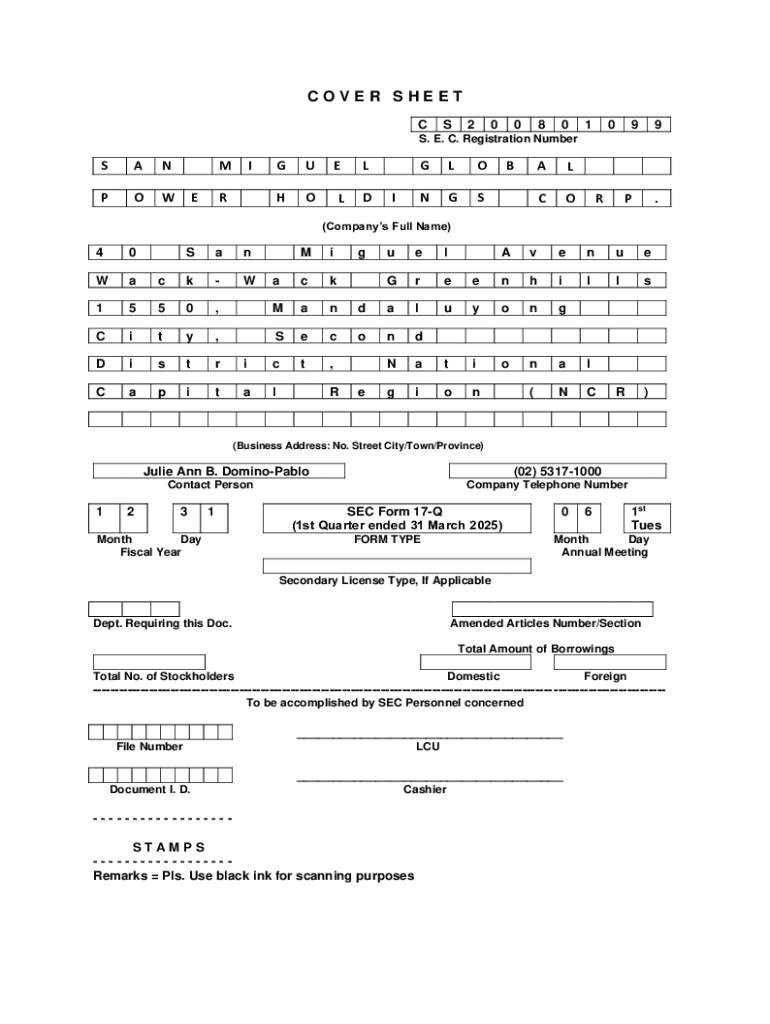

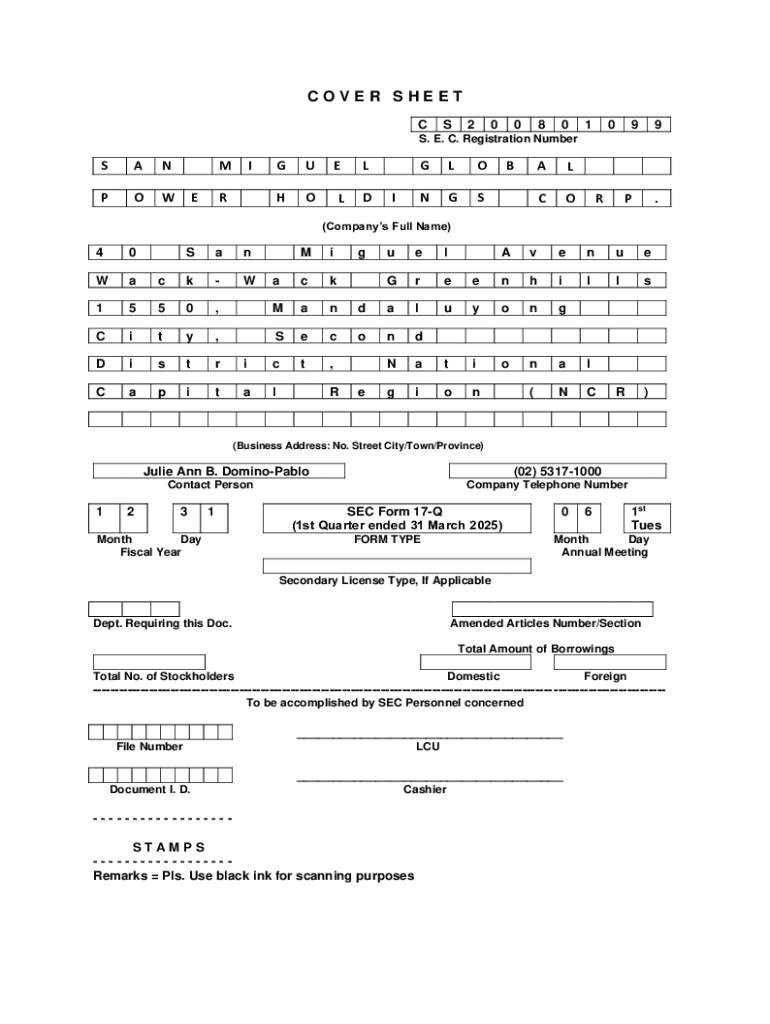

Get the free Sec Form 17-q

Get, Create, Make and Sign sec form 17-q

Editing sec form 17-q online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 17-q

How to fill out sec form 17-q

Who needs sec form 17-q?

Understanding SEC Form 17-Q: A Comprehensive Guide

Understanding SEC Form 17-Q: A Comprehensive Overview

SEC Form 17-Q is a critical report that public companies must file quarterly with the Securities and Exchange Commission (SEC) to provide a comprehensive overview of their financial health. This form serves to maintain transparency and consistency, allowing the SEC to oversee marketplace integrity. By mandating consistent reporting, the form ensures that investors have access to relevant financial data essential for making informed investment decisions.

The main purpose of SEC Form 17-Q is to furnish a summary of a company’s financial position and operational results over a specific period. It presents vital insights, including balance sheets, income statements, and cash flow statements, reflecting a company's performance and determining its operational viability which is crucial for both regulatory compliance and stakeholder communication.

Who needs to file SEC Form 17-Q?

The obligation to file SEC Form 17-Q applies primarily to publicly traded companies registered under the Securities Exchange Act of 1934. This encompasses various corporate structures, including corporations and limited partnerships that trade on public exchanges. These entities are required to file the form quarterly, highlighting the relevance of consistent financial reporting.

Specific thresholds define who must file. Generally, any entity with a public float of $10 million or more, or that meets specific revenue requirements, is mandated to submit SEC Form 17-Q. The requirements can vary based on the entity's market capitalization and listing status, ensuring that all significant public companies maintain transparency.

Key sections of SEC Form 17-Q

SEC Form 17-Q consists of key sections that contribute to a holistic view of a company's financial standing. The principal components of this report include the balance sheet, income statement, and cash flow statement, which all offer unique insights into the company's financial activities.

The balance sheet outlines the company’s assets, liabilities, and shareholders’ equity at a specific point, reflecting its net worth. The income statement details revenues, expenses, and profits over the reporting period, while the cash flow statement provides an overview of cash inflow and outflow, indicating liquidity. Each of these components is vital for assessing the company’s operational strength and strategic viability.

In addition to these financial statements, notes and disclosures accompanying SEC Form 17-Q are fundamental for transparency. These notes elaborate on specific entries and can include accounting policies, legal proceedings, and risk factors. The transparency afforded by these disclosures helps mitigate the risks of misinformation and enhances investor confidence.

Step-by-step guide to completing SEC Form 17-Q

Filing SEC Form 17-Q can be a daunting task, but following a clear step-by-step guide can simplify the process. Start by gathering necessary financial information, including data from previous quarterly reports, which will provide a foundation for your new filing.

When compiling your data, focus on key financial metrics, such as total revenues, operating income, and net earnings. Ensure you have reviewed your previous quarterly filing to maintain consistency in reporting.

The next step involves completing the individual sections of the form. Each segment should be filled out accurately, ensuring that figures correlate correctly across the documents. Pay special attention to calculations and data entry, as inaccuracies can lead to compliance issues.

Upon completing the form, it's crucial to review and revise your submission meticulously. Engage your finance team to double-check all figures and assumptions. Utilizing tools like financial software can help identify discrepancies and enhance accuracy.

After thorough revisions, submit the file electronically through the SEC's EDGAR system, adhering to deadlines to avoid penalties. Be mindful of important filing dates, typically occurring within 40 days after the end of a fiscal quarter.

Common mistakes to avoid when filing SEC Form 17-Q

While filing SEC Form 17-Q is essential for compliance, many filers encounter common pitfalls that can lead to headaches. One of the most prevalent errors is the misreporting of figures, particularly in the balance sheet and cash flow sections. Such inaccuracies not only breach compliance but can significantly harm investor relations.

Another frequent mistake involves failing to disclose necessary notes, leaving investors under-informed about critical operational risks or changes. It's also important to watch for inconsistencies between sections, which can raise red flags with regulatory bodies.

To mitigate these risks, best practices should be implemented, such as conducting audits of financial statements and ensuring multi-tier reviews within finance teams. Engaging external auditors can also provide an additional layer of assurance, thus enhancing the reliability of the filings.

Utilizing pdfFiller for SEC Form 17-Q

To streamline the process of completing and submitting SEC Form 17-Q, utilizing pdfFiller offers a range of interactive features. The platform allows users to edit PDFs directly, which is invaluable when ensuring that financial documents are accurate and up-to-date. With templates specific to SEC Form 17-Q available, users can be confident they’re starting with the right structure.

Collaboration is key in completing these complex filings, and pdfFiller enables teams to work together in real-time. Users can share documents securely and track changes, making it easier to manage feedback from various stakeholders. This feature is essential in ensuring all team members have the latest version and can contribute effectively.

Lastly, pdfFiller’s integrated eSignature features facilitate quick approvals, allowing teams to finalize and submit documents without unnecessary delays. The platform also provides robust document management tools, ensuring that forms are organized and easily accessible for future reference. These tools together enhance the filing experience while ensuring compliance and accuracy.

Additional considerations and strategic insights

Filing SEC Form 17-Q is not just a regulatory obligation, but it also offers insights into market trends and the financial health of companies. Understanding how economic factors like inflation, interest rates, and market volatility affect quarterly reporting is crucial for both corporate leaders and investors. Companies that stay ahead of these trends can leverage their knowledge to enhance decision-making processes and investor communication.

Looking forward, potential changes in SEC reporting requirements could reshape how businesses prepare their financial disclosures. Stakeholders should stay informed about predicted regulatory shifts and consider how to strategize compliance approaching these standards. Adopting an agile approach to financial reporting will help mitigate the risks posed by new compliance challenges.

Post-submission engagement with stakeholders is equally essential. Effective communication with investors about filings allows companies to highlight strategic initiatives and financial health thoroughly. Utilizing data drawn from SEC Form 17-Q is beneficial for presentations, enabling companies to approach investor relations proactively.

Community and support for SEC Form 17-Q filers

For those navigating the complexities of SEC Form 17-Q filings, engaging with community forums and online groups can be instrumental. These platforms offer a wealth of knowledge, support, and the opportunity to share experiences with other filers facing similar challenges.

Additionally, educational resources, including webinars and workshops, are invaluable in enhancing understanding of best practices related to the filing process. Companies can take advantage of these offerings to bolster their filing strategies, helping them stay compliant and competitive in a rapidly changing regulatory landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send sec form 17-q to be eSigned by others?

How do I edit sec form 17-q in Chrome?

Can I create an electronic signature for the sec form 17-q in Chrome?

What is sec form 17-q?

Who is required to file sec form 17-q?

How to fill out sec form 17-q?

What is the purpose of sec form 17-q?

What information must be reported on sec form 17-q?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.