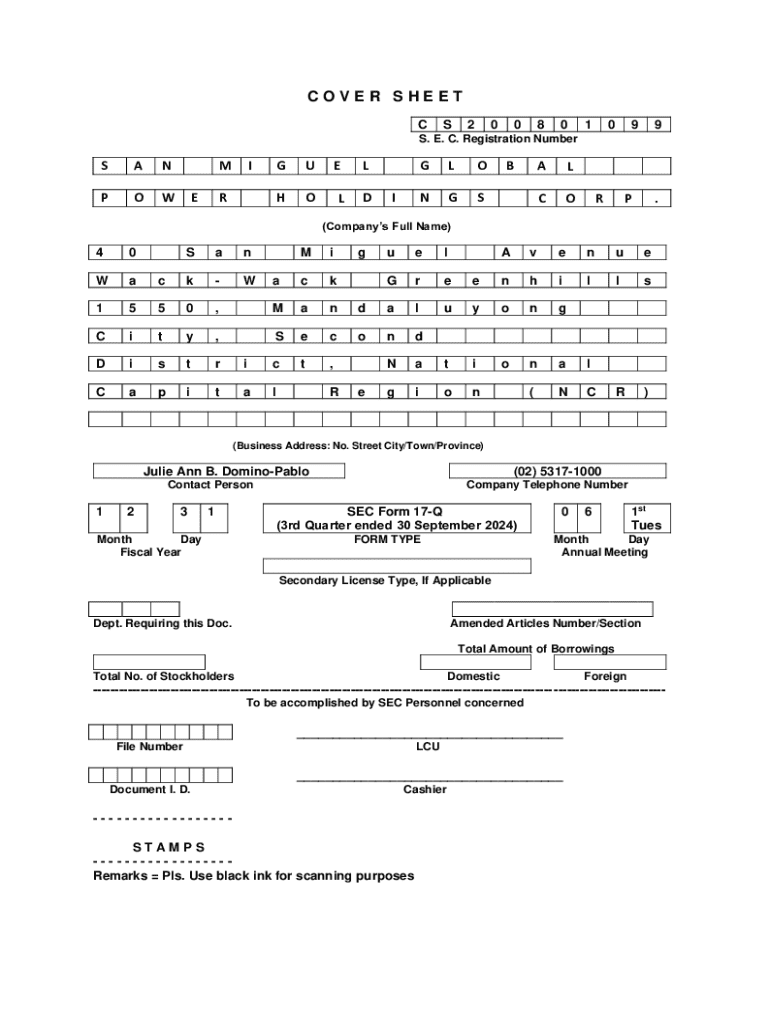

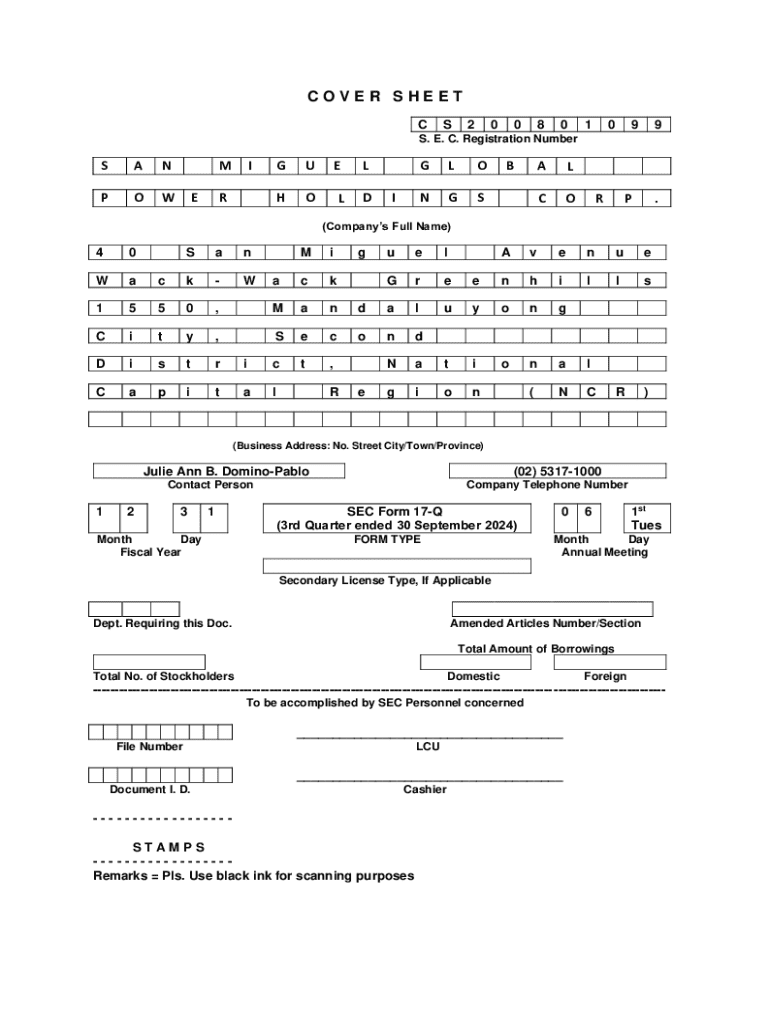

Get the free Sec Form 17-q

Get, Create, Make and Sign sec form 17-q

How to edit sec form 17-q online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 17-q

How to fill out sec form 17-q

Who needs sec form 17-q?

A Comprehensive Guide to SEC Form 17-Q

Understanding SEC Form 17-Q

SEC Form 17-Q serves as a crucial element of the financial reporting framework for publicly listed companies in the United States. It is a quarterly report that companies file with the Securities and Exchange Commission (SEC) to provide stakeholders with timely updates about their financial performance, facilitating transparency and accountability. This form plays a vital role in ensuring that investors and analysts have consistent access to updated financial data, which in turn aids in informed decision-making.

Regular financial disclosures like those made in SEC Form 17-Q are not merely regulatory requirements; they symbolize a commitment by companies to uphold standards of integrity in financial reporting. Providing quarterly insights allows investors to gauge the ongoing performance of a company, thereby fostering trust and market confidence.

Key components of SEC Form 17-Q

SEC Form 17-Q includes several key components that comprise a comprehensive financial overview of the reporting entity.

Filing requirements and deadlines

Companies are mandated to file SEC Form 17-Q on a quarterly basis, specifically within 45 days following the end of each fiscal quarter. Adhering to this timeline is critical for compliance as it ensures that investors remain informed about the company's quarterly performance in a timely manner.

Key deadlines include:

Filing extensions may be sought in some circumstances, but it’s essential to note that late submissions can result in penalties and damage to the company’s credibility with investors.

Preparing your SEC Form 17-Q

The preparation of SEC Form 17-Q begins with meticulous data collection, involving the gathering of all necessary financial data to encapsulate the company’s performance. This includes pulling figures from accounting statements and preparing them for review.

pdfFiller serves as an excellent platform for creating and managing your SEC Form 17-Q. Here’s a step-by-step guide for using pdfFiller:

Collaborating with team members is crucial in this stage. With pdfFiller, multiple team members can edit the document in real-time, ensuring everyone is aligned on the information presented.

Editing and formatting your SEC Form 17-Q

Proper formatting is paramount when completing the SEC Form 17-Q. Adequate spacing, consistent font styles, and headings enhance readability and make the document appear professional.

Avoid common mistakes like failing to include required disclosures or misrepresenting financial data. Revision tools in pdfFiller offer features to enhance the document, including:

Signing and submitting your form

Once your SEC Form 17-Q is complete, it needs to be signed before submission. Several e-signature options are available through pdfFiller, providing safe and secure methods to obtain necessary approvals.

Submission typically occurs via the SEC’s EDGAR (Electronic Data Gathering, Analysis, and Retrieval) system. Keeping compliance with submission guidelines is critical to avoid issues. Here are some tips for ensuring compliance:

Managing & storing SEC Form 17-Qs

Post-submission, effective document management is vital. Companies should adopt best practices to ensure both compliance and easy access to past filings. Secure cloud storage solutions enable teams to store and retrieve past SEC Form 17-Qs without hassle.

Utilizing a platform like pdfFiller can enhance collaboration for future amendments, ensuring easy access to previous versions. Best practices for management include:

Frequently asked questions (FAQs)

Many individuals have questions about the specifics of SEC Form 17-Q, primarily around its filing process and content requirements. Addressing common confusions helps demystify the process.

Real-world examples and case studies

Real-world examples offer insights into effective practices and mistakes to avoid regarding SEC Form 17-Q. Notably, companies like Apple and Microsoft consistently file comprehensive and accurate forms, setting a strong precedent for others.

On the other hand, some companies have faced repercussions for neglecting accurate reporting, which can lead to legal concerns and loss of investor trust. These case studies highlight the importance of diligence in form preparation.

Tailoring your SEC Form 17-Q for stakeholders

It's essential to customize SEC Form 17-Q reports to cater to the needs of various stakeholders, including investors and analysts. Clear presentation of data alongside insightful analysis can greatly enhance understanding and trust.

Investors appreciate transparency in financial reporting. Hence, providing a straightforward and understandable format can translate to strong support from the investment community.

Conclusion: Ensuring compliance and accuracy

Navigating the intricacies of SEC Form 17-Q can be daunting, but by following proper procedures and leveraging tools like pdfFiller, individuals and teams can simplify complex document management tasks. Key takeaways emphasize that timely and accurate disclosures are crucial in maintaining compliance and fostering trust among stakeholders.

pdfFiller empowers users by creating an efficient pathway for editing, signing, and managing the SEC Form 17-Q, all within a secure cloud framework. By adopting this document management approach, companies can ensure their filings remain organized and up-to-date, ensuring a robust financial reporting practice.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my sec form 17-q directly from Gmail?

How do I fill out sec form 17-q using my mobile device?

How do I fill out sec form 17-q on an Android device?

What is sec form 17-q?

Who is required to file sec form 17-q?

How to fill out sec form 17-q?

What is the purpose of sec form 17-q?

What information must be reported on sec form 17-q?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.