Get the free Form 3 - Initial Statement of Beneficial Ownership of Securities

Get, Create, Make and Sign form 3 - initial

Editing form 3 - initial online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 3 - initial

How to fill out form 3 - initial

Who needs form 3 - initial?

Form 3 - Initial Form: Your Essential Guide

Overview of Form 3 - Initial Form

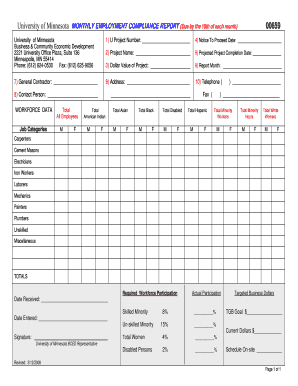

Form 3, often referred to as the Initial Form, serves a critical role in regulatory compliance within various industries. This document is designed to provide a foundational framework for reporting significant ownership information. Its primary purpose is to ensure transparency and adherence to financial regulations by capturing necessary data about ownership interests.

Accurate submission of Form 3 is paramount. Errors or omissions can lead to compliance issues or delays in processing, which may have ramifications for the individuals or entities involved. Stakeholders such as corporate owners, executives, and various regulatory bodies must prioritize filling out this form to maintain proper governance and accountability.

Details of Form 3

The OMB Control Number is a unique identifier assigned to Form 3, critical for tracking and managing data across multiple federal agencies. It signifies that the form adheres to standardized procedures outlined by the Office of Management and Budget. Knowing this number is essential for anyone involved in this process.

Historically, Form 3 has evolved with regulatory frameworks to enhance transparency in ownership disclosures. The regulations surrounding this form have been shaped by significant legislative developments aimed at combating issues like insider trading and ensuring fair financial markets. Related forms, such as Form 4 and Form 5, continue this trend by requiring further disclosures from owners.

Who should fill out Form 3

The target audience for Form 3 encompasses individuals and groups that have a substantial ownership interest in publicly traded companies. This includes board members, major shareholders, and any entity that acquires significant voting power or equity. Understanding the eligibility criteria is essential for compliance.

Common scenarios requiring submission of Form 3 include acquisitions of stock by insiders, changes in ownership percentages, and other significant financial transactions. To ensure compliance, it’s crucial for these stakeholders to understand when and why they need to submit Form 3.

Step-by-step instructions for completing Form 3

Section 1: Basic information

The first section requires fundamental details such as name, address, and the nature of ownership. Always ensure that the information matches your official identification to prevent any discrepancies.

Accurate completion is vital; double-check each field and consider using presets where possible to minimize errors.

Section 2: Detailed ownership reporting

In this section, you’ll need to report your ownership context—whether it’s direct or indirect ownership. Be precise in detailing the amount of shares owned and the value of those shares. Remember, certain exempt transactions may not require inclusion.

Special considerations include understanding how ownership through derivatives works and how it should be reported.

Section 3: Additional comments (if applicable)

If your ownership structure is complex, you can articulate that in the comments section to provide further clarity. Use straightforward language and be as concise as possible to aid in the review process.

Tools for filling out Form 3

Using pdfFiller for enhanced efficiency

pdfFiller offers a user-friendly platform to streamline the process of filling out Form 3. You can easily edit, sign, and share documents from any device, enhancing workflow efficiency. The platform also enables users to collaborate effectively, ensuring that multiple stakeholders can review the form before submission.

Features of pdfFiller applicable to Form 3

pdfFiller includes features tailored for Form 3, such as fillable fields that automatically guide you through each required entry. These templates not only save time but also reduce the risk of errors. Additionally, electronic signature capabilities allow for a streamlined submission process—no need for printing or scanning.

Review and submission process

After completing Form 3, it’s crucial to review your submission for completeness. Use a checklist to ensure all sections are filled accurately, and provide all required documentation to avoid unnecessary delays.

Common mistakes include omitting essential data, providing incorrect contact information, or failing to sign the form. Double-check each field and consider having a colleague review it to catch any potential errors before submitting.

Submission can occur both online via electronic means and offline through postal services. Be mindful of deadlines, especially for online submissions, to ensure compliance with regulations.

Post-submission: What happens next?

Once Form 3 is submitted, the reviewing authority will process it, which typically involves assessing the accuracy and completeness of the information provided. Expect a review timeline which may vary based on the volume of submissions and the specific agency involved.

Communication from authorities may involve acknowledgments of receipt or requests for additional information. Be prepared for potential follow-ups, and maintain organization of all submitted documents in case further clarification is needed.

Frequently asked questions (FAQs)

Common inquiries regarding Form 3 include issues about the submission process, deadlines, and acceptable recording methods. Accurate information regarding common issues is essential for all stakeholders.

For support or clarification, you can reach out to the regulatory body responsible for your submission, as they can provide specific guidance tailored to your situation.

Interactive tools and additional features

To enhance user understanding, it is beneficial to compare Form 3 with similar documentation such as Form 4. Differences in reporting requirements and timelines can impact stakeholders' obligations.

Interactive calculators offered by pdfFiller can further assist users in determining potential ownership influences and implications, providing a clearer understanding of how various scenarios may affect compliance.

Stay updated

Changes to Form 3 and related regulations can occur, so it is essential to stay informed. Signing up for updates ensures that you receive timely notifications regarding these changes.

Follow pdfFiller on social media to access the latest developments and continuously improve your document management strategies in compliance with current laws.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute form 3 - initial online?

How do I edit form 3 - initial in Chrome?

How do I fill out form 3 - initial using my mobile device?

What is form 3 - initial?

Who is required to file form 3 - initial?

How to fill out form 3 - initial?

What is the purpose of form 3 - initial?

What information must be reported on form 3 - initial?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.